Soda Consumption Falls After Special Tax in California City

August 23 2016 - 6:24PM

Dow Jones News

By Mike Esterl

Consumption of soda and other sugary drinks fell by more than a

fifth in low-income neighborhoods of Berkeley after the California

city became the first in the U.S. to introduce a special tax last

year, according to a study published Tuesday.

The peer-reviewed research is the first to measure the impact of

the penny-per-ounce tax. It found that consumption declined 21% and

many residents switched to water after the tax went into effect in

March 2015, according to the study published online in the American

Journal of Public Health.

The study states that the results "suggest" that the tax lowered

consumption but acknowledged other factors also could have been at

play, including increased awareness about the health impact of

sugary drinks.

The American Beverage Association, an industry group, said the

Berkeley study has flaws and there is no indication the tax has had

a measurable impact on public health. Street surveys relying on

people's recollections are "inherently unreliable," said Brad

Williams, an economist who does consulting work for the

association.

Even so, the study is likely to provide ammunition to

public-health officials pushing for similar levies in other parts

of the country.

The work focused on low-income neighborhoods because the

researchers at the University of California, Berkeley say obesity

and diabetes rates are higher, and price increases have a bigger

impact on purchasing patterns.

The findings were based on comparisons of interviews with

Berkeley residents in 2014 and then between April and August 2015.

At the same time, soft and sugary drink consumption in low-income

neighborhoods of San Francisco and Oakland rose 4%, according to

similar interviews conducted in those cities.

Consumption of bottled water or tap water rose 63% in Berkeley

during the period but a more modest 19% in San Francisco and

Oakland, according to the study, which asked residents how

frequently they drank different types of beverages.

The larger neighboring cities of San Francisco and Oakland are

expected to vote on a penny-per-ounce levy on sugary drinks in

November ballot initiatives, while Boulder, Colo., is weighing a

2-cent-per-ounce tax. Philadelphia's city council in June approved

a tax of 1.5 cents per ounce on sweetened drinks, becoming the

second U.S. city to pass such a measure.

Beverage giants Coca-Cola Co., PepsiCo Inc. and Dr Pepper

Snapple Group Inc. have argued that it is unfair to single out

sugary drinks because they represent less than 10% of caloric

intake. The companies have spent more than $100 million to defeat

proposed taxes in more than two dozen cities and states since 2009

and plan to challenge Philadelphia's planned tax in court before it

takes effect in January.

U.S. regulators also increasingly are taking aim at sugar. The

Food and Drug Administration announced new rules in May requiring

nutrition-facts panels to list how much sugar has been added and

the daily recommended maximum, which is about 30% less than in a

20-ounce bottle of Coke.

The long-term impact of special taxes on sugary drinks remains

unclear. In Mexico, which introduced a roughly 10% tax in January

2014, purchases dropped 6% the first year from the average of the

previous two years, according to a peer-reviewed study by Mexican

health officials and the University of North Carolina. But soda

volumes in the country began rising again in 2015.

Even without special taxes, U.S. soda sales volumes have

declined 11 straight years and per-capita consumption is at a

three-decade low, according to industry tracker Beverage

Digest.

Residents might understate their consumption of sugary drinks in

interviews because such drinks are seen as unhealthy, acknowledged

Kristine Madsen, an associate professor at UC Berkeley's School of

Public Health who co-wrote the study. But she noted 2015 was hotter

than usual, which typically would increase consumption.

Consumption of regular soda dropped 26% in Berkeley's low-income

neighborhoods after the tax, while energy drinks and sports drinks

fell 29% and 36%, respectively. Sweetened fruit drinks, coffee and

tea declined 13%.

The household median income in surveyed Berkeley neighborhoods

was $59,000, compared with $65,000 citywide. The neighborhoods also

skewed more heavily toward African-Americans and Latinos, who are

bigger drinkers of sugar-sweetened beverages, according to previous

studies.

Berkeley, a city of about 115,000 people, collected $1.4 million

from the sugary drink tax in the first 12 months. Residents voted

75% in favor of the tax in a November 2014 ballot measure.

A bit more than half of San Francisco residents in 2014 backed a

2-cents-per-ounce tax on sugary drinks, but the ballot measure fell

short of the required two-thirds support. This June, a federal

judge put on hold a city plan requiring health warnings for sugary

drink advertisements after the beverage industry argued the

requirement violated free-speech rights.

Write to Mike Esterl at mike.esterl@wsj.com

(END) Dow Jones Newswires

August 23, 2016 18:09 ET (22:09 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

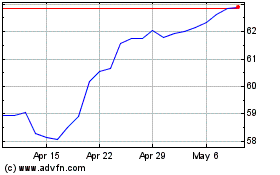

Coca Cola (NYSE:KO)

Historical Stock Chart

From Mar 2024 to Apr 2024

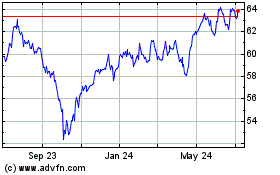

Coca Cola (NYSE:KO)

Historical Stock Chart

From Apr 2023 to Apr 2024