Coke Revenue Slides as Volumes Flat

July 27 2016 - 8:20AM

Dow Jones News

Coca-Cola Co. posted said revenue slid more than expected in the

latest quarter on flat soda volume amid continued weakness abroad,

particularly in developing markets.

Shares, which have risen 4.5% this year, lost 1.2% premarket to

$44.34.

Overseas weakness has damped Coke's results recently, with key

countries such as Russia and Brazil in recession, lower consumer

demand in Europe and China's economy slowing. The stronger U.S.

dollar has also hurt the company, which generates about half its

sales abroad but translates results into dollars.

Higher prices and smaller packaging in the U.S. that costs

consumers more per ounce has helped Coke offset those declines. In

the June quarter, Coke reported that its beverage volumes were flat

world-wide but grew 1% in its key North American market.

On Wednesday, Chief Executive Muhtar Kent said "challenging

macroeconomic conditions, structural changes and foreign-exchange

headwinds" dragged on the top line, but he pointed to 3% organic

revenue growth.

He said strong performance in the company's largest and most

developed markets, including the U.S., Mexico and Japan, was offset

by difficult external conditions in emerging and developing

markets, including China and Argentina.

"These factors combined to put pressure on our volume and

top-line performance in the quarter, especially where we own

bottling businesses," Mr. Kent said. "In these international

operations where external headwinds have proven to be more severe

than originally forecast, we are taking action by reassessing local

market initiatives where needed."

During the quarter, noncarbonated drinks, which include tea,

packaged water and sports drinks, grew 2%, driven by strong

performance across most categories except for juice and juice

drinks which declined due to industry weakness in China.

Soda volumes declined 1% in the quarter globally—on weakness in

certain emerging markets—and in North America, where growth in

Sprite, Fanta and energy drinks was offset by a decline in the

namesake Coca-Cola brand.

In all for the quarter, Coke posted a profit of $3.45 billion,

or 79 cents a share, up from $3.12 billion, or 71 cents a share, a

year earlier. Excluding certain items, per-share earnings were 60

cents, topping the 58 cents analysts polled by Thomson Reuters had

forecast. The company said foreign exchange shaved 10 percentage

points off its per-share earnings in the quarter.

Revenue slipped 5.1% to $11.54 billion, below analysts'

prediction for $11.64 billion.

Write to Anne Steele at Anne.Steele@wsj.com

(END) Dow Jones Newswires

July 27, 2016 08:05 ET (12:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

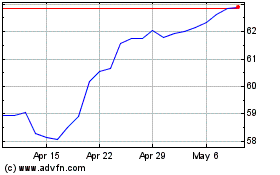

Coca Cola (NYSE:KO)

Historical Stock Chart

From Mar 2024 to Apr 2024

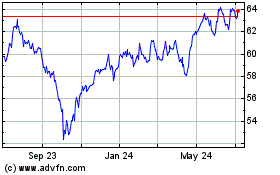

Coca Cola (NYSE:KO)

Historical Stock Chart

From Apr 2023 to Apr 2024