Coke Profit and Revenue Fall as Volume Is Flat--3rd Update

April 20 2016 - 3:43PM

Dow Jones News

By Mike Esterl

Coca-Cola Co.'s growth slowed in the first quarter as it was

dragged down by its namesake cola, renewing questions of whether

the beverage giant can return to promised revenue increases in the

mid-single digits.

Soda volumes were flat after five straight quarters of increases

as flagship Coke declined in every region but Asia, weighed down by

a weakening global economy and rising health concerns over sugary

drinks.

Coke's share price was down 4% at $44.72 in midafternoon trading

Wednesday, wiping out nearly half of this year's 8.5% gain. The

selloff came even as the company reported 7% volume growth in

noncarbonated drinks and as it speeds up sales of less profitable

bottling assets.

Management faced tough questions from Wall Street analysts on an

earnings call, with Sanford Bernstein analyst Ali Dibadj noting "a

lot of skepticism" among investors that Coke can reach its 2016

target of 4% to 5% organic revenue growth.

Chief Executive Muhtar Kent said Coke expects to reach its

growth projection and believes that soda, which represents nearly

three-quarters of company sales, will grow this year as a new cola

marketing campaign kicks in and the global economic slowdown

bottoms out.

"We feel confident that we will still achieve what we have

said," Mr. Kent told analysts, adding that Coke anticipates "a

certain degree of improvement" in hard-hit economies during the

second half of the year.

Net profit fell 4.8% to $1.48 billion and revenue dropped 4% to

$10.28 billion in the first quarter from a year earlier. Weakening

foreign currencies had a negative impact of 12 percentage points on

earnings. Restructuring charges tied to divestments also weighed on

results.

Beverage volumes rose 2%, down from 3% growth in the second half

of last year. Organic revenue also rose just 2%, half of the

company's 2015 growth rate.

Coke said the numbers were affected by one fewer calendar day in

the quarter and ongoing bottling divestments. It said the revenue

growth rate was 4% in the first quarter after stripping out those

factors and foreign-exchange losses.

The company posted another quarter of solid growth in North

America, where still-beverage volumes rose 5%, including

double-digit growth in its Smartwater and Gold Peak tea brands.

Coke also has been steering consumers to smaller soda packages like

7.5-ounce cans, charging more per ounce. Overall, it raised prices

by 3% in its home market in the most recent quarter, even as

carbonated volumes were flat.

But management said it faces big economic challenges in several

erstwhile growth markets, including Brazil, Russia and China, even

as the company continues to swipe market share from beverage

rivals.

There are also growing signs that consumers in many parts of the

world are cutting back on soda in response to rising obesity and

diabetes rates. The U.K. plans to implement a special tax on

sugar-added drinks in 2018 and several other countries, including

India and South Africa, are weighing similar measures.

Coke reiterated Wednesday it has high hopes for its new global

marketing campaign, "Taste the Feeling." The campaign, launched in

January, plays up the company's zero-calorie cola brands including

Diet Coke and Coca-Cola Zero. Earlier this week it announced a

global packaging overhaul in which the front of diet cola cans and

bottles carry the phrase "Zero Sugar" or "No Calories."

Coke has stepped up its soda marketing as it redirects savings

from its $3 billion cost-cutting program and hopes to benefit from

this year's Olympics, which it sponsors. The company said it's on

track to cut costs by $600 million this year.

But Coke also will "continue to look for bolt-on acquisitions to

accelerate our growth" in noncarbonated beverages, Chief Operating

Officer James Quincey told analysts.

Coke agreed in January to buy a 40% stake in Nigeria's largest

juice maker, TGI Group's Chi Ltd., with an option to buy the rest

in a deal that valued the company at a little less than $1 billion.

Last year, Coke agreed to acquire China Culiangwang Beverages

Holdings Ltd., which specializes in multigrain drinks, for about

$400 million including debt.

The company also said Wednesday it had reached a new round of

refranchising deals with four companies in the U.S. It announced in

February it would sell its North American manufacturing and

distribution assets by the end of 2017 to focus on its more

profitable concentrate business. With the latest deals, Coke has

agreed to refranchise nearly two-thirds of the U.S. territory it

acquired in 2010, when it bought its biggest soda bottler.

Coke reiterated it expects earnings per share to rise 4% to 6%

in 2016, but that's after stripping out a negative impact of 8 to 9

percentage points on profit from weaker foreign currencies.

Write to Mike Esterl at mike.esterl@wsj.com

(END) Dow Jones Newswires

April 20, 2016 15:28 ET (19:28 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

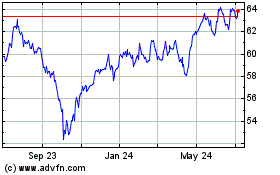

Coca Cola (NYSE:KO)

Historical Stock Chart

From Mar 2024 to Apr 2024

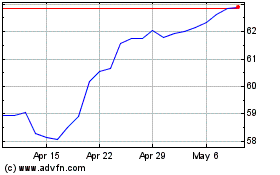

Coca Cola (NYSE:KO)

Historical Stock Chart

From Apr 2023 to Apr 2024