Bill Ackman Takes on Charlie Munger in Moral Debate

November 11 2015 - 8:08PM

Dow Jones News

By Monica Langley and Erik Holm

William Ackman has long looked up to Warren Buffett. It took a

massive, money-losing position -- and an obsessive aversion to

sugar -- to cause some friction.

The hedge-fund manager took a shot at Mr. Buffett's longtime

investment in Coca-Cola Co. on Wednesday, saying the soda company

has "caused enormous damage to society."

The broadside came at a New York conference celebrating the

Oracle of Omaha's half-century running Berkshire Hathaway Inc. And

it reflected growing frustration with repeated criticism from Mr.

Buffett's longtime sidekick against one of Mr. Ackman's most

prominent investments, Valeant Pharmaceuticals International

Inc.

That criticism by Berkshire Vice Chairman Charles Munger against

Valeant included comments in an interview with The Wall Street

Journal last week: "It's just a company that was too aggressive in

ignoring moral considerations in the way it did business."

Valeant has defended its ethics and says it is trying to do a

better job of listening to its critics. Its stock, however, has

tumbled amid questions about its relationship with specialty

pharmacies that distribute its drugs and its growth prospects,

producing losses on paper of more than $2 billion for Mr. Ackman's

Pershing Square Capital Management LP.

Valeant's shares fell another 5.7% Wednesday to $78.90, leaving

them well below the $186 that Pershing Square paid for them on

average. The decline means that Mr. Ackman, who makes concentrated

bets, is on track to post the hedge fund's worst year since it was

founded in 2004.

At the event at the Museum of American Finance on Wednesday, Mr.

Ackman was speaking as an investor "inspired by Berkshire

Hathaway," and he considers himself a value investor in the Buffett

mold. He has studied Mr. Buffett's investment history in great

detail, and was even lauded on the cover of Forbes magazine earlier

this year as the "Baby Buffett."

They part ways at Coke.

Mr. Buffett famously drinks several Cherry Cokes a day, and the

company is one of the largest and longest-held positions in

Berkshire's portfolio. Wednesday's event honoring him began serving

Coke to attendees before 8 a.m.

Mr. Ackman, meanwhile, is a health and fitness devotee who

contends that "sugar is poison." Meals with him are a lesson in

abstinence, with bread baskets going untouched and fruit the only

acceptable dessert. Nearly every employee who started at Pershing

Square with extra weight has lost it.

"Coca-Cola has probably done more to create obesity and diabetes

on a global basis than any other company in the world," Mr. Ackman

said at the conference.

"I have a problem with Berkshire's ownership of Coke," he said

in response to a question about whether he'd found himself on the

opposite side of a trade from Berkshire. "Coca-Cola is a company

that I wouldn't own."

Coke defended its products, saying it sells more than 200 low-

and no-calorie drinks in North America, including bottled water.

Soft drink makers like Coke also say it's unfair to single out soda

and other sugary drinks for causing obesity and other health

problems.

"These comments are irresponsible and do not recognize the

current breadth of our business," a Coke spokesman said

Wednesday.

Mr. Ackman's absolutism does have its limits. Earlier in the

year when Pershing Square weighed whether to take a position in

Oreo cookie maker Mondelez International Inc., the firm was

satisfied that the company in its view met a couple of key

criteria: It presented an opportunity for further cost cutting and

could be a potential takeover target.

But Pershing Square's staff worried about Mr. Ackman's hard line

on sugar. A colleague brought Mondelez products to the investment

committee and waited to see if Mr. Ackman would eat an Oreo. He ate

two. That was the go-ahead to start buying.

"Everything in moderation," Mr. Ackman said Wednesday. "It's

complicated."

He pointed out that Mondelez products such as cookies and candy

bars can be treats after a healthy meal, not outright replacements

as Coke products can be for water.

Other comments about Berkshire and its leaders by the hedge-fund

manager Wednesday were positive. He argued at points during the

event that Mr. Buffett was deserving of admiration and deeply

ethical -- not to mention "genetically interesting" given his

apparent ability to survive his Cherry Coke habit.

And without mentioning his now-unprofitable Valeant stake by

name, Mr. Ackman joked that he'd been learning new investment

lessons lately. While Mr. Buffett often tells investors to "be

fearful when others are greedy and to be greedy only when others

are fearful," Mr. Ackman says he's lately learned to "be fearful

when others are fearful."

Anupreeta Das contributed to this article.

Write to Monica Langley at monica.langley@wsj.com and Erik Holm

at erik.holm@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 11, 2015 19:53 ET (00:53 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

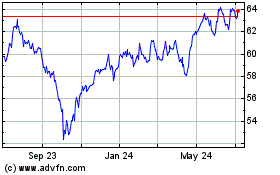

Coca Cola (NYSE:KO)

Historical Stock Chart

From Mar 2024 to Apr 2024

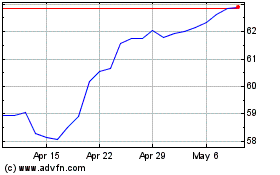

Coca Cola (NYSE:KO)

Historical Stock Chart

From Apr 2023 to Apr 2024