KIMBERLY-CLARK

Currency Fluctuation Weighs on Results

Kimberly-Clark Corp. took a hit from currency fluctuations,

which weighed on its quarterly results, but Chief Executive Thomas

Falk said that the worst has past.

The maker of Kleenex tissues and Huggies diapers reported lower

sales across its divisions with currency moves shaving 4% from its

top line. Total sales slipped 1.2% from a year earlier to $4.59

billion while organic sales -- which excludes currency rates --

rose 3%.

The company said the negative impact of weak currencies outside

the U.S. should be less severe than initially forecast for the rest

of 2016.

"I don't know if I can call the top or the bottom, but we are

encouraged to see that it appears to be less negative," Mr. Falk

said in an interview, noting that Russia and Brazil in particular

have been improving.

Shares of the company fell 1.8% in morning trading to

$132.26.

Kimberly-Clark, like other consumer product rivals, had targeted

emerging markets, such as Brazil and Russia, to help it counter

sluggish growth in developed markets. But higher inflation and

political turmoil has hurt demand. About half of Kimberly-Clark's

sales are outside the U.S.

The Dallas personal-care company now expects full-year organic

sales growth at the low end of its previously released range of 3%

to 5% because of lower-than-expected benefits from price

increases.

The company now says fallout from currency fluctuations will

have a 4%-to-5% negative effect on sales and operating product,

instead of the previously forecast 5% to 6%.

The company swung to a profit of $566 million from a loss of

$305 million in the same quarter a year ago. Profit was helped by

organic sales growth, lower expenses and a lower effective tax

rate. In addition, the prior-year quarter included

pension-settlement charges.

The company cut marketing, research and general expenses by

2.5%.

In its personal-care unit, the company's largest, sales fell

1.2% to $2.28 billion as changes in currency rates cut sales by 6%.

Volumes increased 6%. In consumer tissue, sales were down just 0.3%

to $1.49 billion on currency rates and unfavorable product mix

changes. Volumes increased 3%.

--Sharon Terlep and Austen Hufford

HUAWEI TECHNOLOGIES

Margin Shrinks As Investment Rises

HONG KONG -- Huawei Technologies Co. said Monday that its

revenue rose 40% in the first half of the year, but its operating

margin shrank as the Chinese technology company increased

investment on its smartphone business.

The world's third-largest smartphone maker by sales, behind

Samsung Electronics Co. and Apple Inc. , is trying to challenge the

two companies not only in China but increasingly in overseas

markets such as Europe and the Middle East.

Huawei, which makes handsets as well as networking equipment

such as base stations, said its revenue rose to 245.5 billion yuan

($36.7 billion) for the six months through June from 175.9 billion

yuan a year earlier, while its operating margin shrank to 12% from

18% in the first six months of 2015. Huawei didn't disclose its net

profit.

"The modest reduction in operating margin during the period is

mostly the result of increased investment to support future

growth," a spokesman for Huawei said.

Still, Huawei grew at a faster pace than last year: Its revenue

growth in the first half of 2015 was up 30% from the same period in

2014.

"We are confident that Huawei will maintain its current

momentum, and round out the full year in a positive financial

position backed by sound ongoing operations," Huawei Chief

Financial Officer Sabrina Meng said in a news release.

The results came as demand for network upgrades at

telecommunications carriers are slowing, with more clients already

using fourth-generation wireless networks. Still, Huawei has been

trying to sell more software and services to carriers that have

already installed base stations and other hardware equipment. Such

efforts appear to be paying off as Huawei's revenue from its

business for carriers continues to grow, analysts said.

Huawei didn't disclose a revenue breakdown by business segment.

The company's smartphone business has been growing rapidly over the

past few years as it expands in European markets such as Italy and

Spain as well as the Middle East, Africa and Latin America.

In the first quarter, Huawei's smartphone sales rose 59% to more

than 28 million units, while its global market share increased to

8.3% from 5.4% a year earlier, according to data from research firm

Gartner. Samsung's market share in the quarter was 23%, followed by

Apple's 15%.

Despite its expansion in many parts of the world, Huawei has

struggled to build a foothold in the U.S., where its

networking-equipment business has effectively been banned after a

2012 congressional report recommended that U.S. carriers avoid

using the Chinese company's gear amid concerns it could be used by

Beijing to spy on Americans.

Huawei has denied the allegations.

Huawei's smartphone business also has only a minor presence in

the U.S., where it has sold some handsets online.

--Wayne Ma and Juro Osawa

ANGLO AMERICAN PLATINUM

Low Metals Prices Slam Earnings

JOHANNESBURG -- Anglo American Platinum Ltd., the world's top

producer of the precious metal, said Monday that low metals prices

and a tax adjustment hit its earnings hard in the first half of

2016.

The Johannesburg-listed miner reported a profit of 938 million

South African rand ($65.4 million) for the six months ended June

30, down 62% from the same period a year earlier.

Like other South African platinum producers, Amplats -- a

majority-owned unit of globally diversified miner Anglo American

PLC -- has been hammered by labor issues and low prices, which have

driven away investment. And the industry now faces another round of

wage negotiations, set to begin any day. A wage battle between

platinum companies and miners' unions led to a five-month strike in

2014, the country's longest-ever. Platinum output plummeted 15%,

hitting miners' bottom lines and slowing broad economic growth,

which is expected to be flat this year.

"The only thing we do know is our business is cyclical," Chief

Executive Chris Griffith told The Wall Street Journal in an

interview on Monday . "We've addressed some of the fundamental

issues. I think we're going to be very well placed [when the cycle

turns up]. We're going to make a lot of money."

Amplats shares on the Johannesburg Stock Exchange were down 1%

at 385.25 rand a share in early trade Monday. Still, the stock has

gained 51% over the last 12 months, on the back of rising platinum

futures prices, a weak South African rand and off a very low

base.

The company reported headline earnings, which strip out certain

exceptional and one-off items, of 1.04 billion rand for the first

half of 2016, down 58% from the same period in 2015, in line with

the company's previously announced guidance.

Amplats has previously said that the decrease in profit is

primarily due to an after-tax gain of 1.6 billion rand booked

during the first half of 2015, thanks to an adjustment to metal

inventory levels, as well as low metal prices during the first half

of 2016. The company's average U.S. dollar basket price per

platinum ounce sold fell 24% in the first half of 2016 to $1,632

from $2,157 in the first half of 2015.

Still, all mining operations continued to be cash flow positive,

and during the first half of 2016, Amplats reduced net debt 23% to

9.92 billion rand. Amplats also reaffirmed its production guidance

for the year, and said it expects platinum production to come in at

the upper end of the guided range of 2.3 million to 2.4 million

ounces.

Refined platinum production fell 8.2% to 1.01 million ounces in

the first six months of the year, while total platinum production

rose 1.8% to 1.15 million ounces, the company said. However,

overall metal prices continue to present a challenge for the

company.

Platinum futures are up 21% since the start of the year, but

prices are still far lower than they were during the first half of

2015. If prices stay where they are in the second half of 2016,

though, the company's full-year prices should be up on 2015, Mr.

Griffith said. But, "it's still not shooting the lights out," he

added, and that dollar price increase for platinum could be offset

by a stronger local rand currency.

As a result, Amplats is continuing to restructure its operations

and is in the process of selling its Rustenburg assets, and

continues to look for a buyer for its Union mine, as well as an

exit from its joint ventures at the Bokoni, Pandora and Kroondal

mines. The company's Twickenham project was also put on care and

maintenance in the first half of the year.

"We've advanced disposals of noncore assets," Mr. Griffith said

on a call Monday. The sale of the company's Rustenburg assets to

Sibanye Gold Ltd. is expected to close by the end of 2016, Mr.

Griffith said. In addition, a party interested in the company's

Union mine is currently completing due diligence on the assets, he

said.

After cutting about 15,000 jobs since 2013, Amplats plans to

shed about another 20,000 of its remaining 44,000 jobs through its

sales of Rustenburg and Union, leaving it with leaner, more

mechanized operations. An underground mechanized operation uses

about one third the labor of a traditional platinum mining

operation, Mr. Griffith said.

"We are absolutely adamant that we are not going to have

unprofitable ounces going to the market," Mr. Griffith said.

--Alexandra Wexler

AMSTERDAM -- ROYAL PHILIPS

Savings and Sales Contribute a Boost

AMSTERDAM -- Royal Philips NV said Monday that cost-savings and

strong sales delivered a boost to second-quarter earnings as the

Dutch firm seeks to reposition itself as medical technology

company,

Adjusted earnings before interest, taxes and amortization were

EUR544 million ($597 million), up 9% from the same period last

year, beating market expectations.

Comparable sales, which are corrected for currency swings, rose

3% to EUR5.9 billion, while the adjusted Ebita margin rose to 9.3%

from 8.4%.

Shares of Philips rose by 2.8% in Amsterdam, having gained 3.8%

so far this year.

It was Philips' first earnings report since the May initial

public offering of its lighting division, in which it still owns a

stake of roughly 70%. The company has shifted to selling

health-care products and technology, which it believes offer better

long-term growth prospects. It competes with corporate giants like

Siemens AG and General Electric Co.

Philips said the health-care technology operations, made up of

three divisions, recorded a 5% rise in comparable sales in the

quarter.

Growth was strongest at the consumer-oriented Personal Health

unit, where comparable sales increased by 9%, driven by strong

sales of electric toothbrushes and interactive sleep-therapy

devices.

Order intake of medical-equipment like ultrasound scanners fell

1% in the quarter, which the company largely blamed on the

lumpiness of its order book.

In an interview, Chief Executive Frans van Houten said the

results provided fresh evidence that Philips' strategy to contain

costs and market innovations at a greater speed is paying off.

He said he expects the positive trends to continue and that

innovations in both the consumer and hospital segment could further

boost sales and order intake in the remainder of the year.

An example of a successful innovation is the OneBlade, a

beard-styler that looks to tap into the popularity of facial hair,

Mr. van Houten said.

Mr. van Houten maintained his profit guidance for the year but

expressed concerns of growing uncertainties caused by Britain's

vote to leave the European Union and the recent wave of terror

attacks. He also described the coming U.S. presidential election as

"a risk" that is being closely monitored.

"It looks like the election will become a tight race," he said.

"There are significant differences on policies [between the

candidates] which could influence health-care, trade treaties and

the wider U.S. economy," he said.

Any changes to U.S. health-care policies would have a

significant impact on Philips. The Dutch company generates roughly

one-third of sales in North America, making the region its most

important market.

--Maarten van Tartwijk

(END) Dow Jones Newswires

July 26, 2016 02:49 ET (06:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

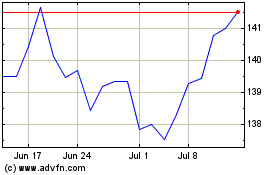

Kimberly Clark (NYSE:KMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kimberly Clark (NYSE:KMB)

Historical Stock Chart

From Apr 2023 to Apr 2024