Kimberly-Clark Revenue Falls -- Update

January 25 2016 - 5:26PM

Dow Jones News

By Austen Hufford and Paul Ziobro

Kimberly-Clark Corp. said resilience among U.S. shoppers helped

offset weakness in its businesses in Brazil, China and Russia that

dragged on quarterly sales.

The maker of Huggies diapers and Kleenex tissue said shoppers in

the U.S. are willing to spend more on new products, such as

improved diapers, feeling the benefits of a falling unemployment

rate and lower gas prices. In addition, store brands have stopped

gaining market share in most of the categories Kimberly-Clark sells

in, Chief Executive Thomas Falk said.

"It's another signal that you're not seeing as much trade down

at this level," Mr. Falk said in an interview on Monday. "The U.S.

consumer is in a pretty good place."

Mr. Falk's comments come as Kimberly-Clark saw the stronger

dollar wipe out much of the growth elsewhere in the world. The

company's fourth-quarter sales fell 6% to $4.5 billion, though they

would have been 5% higher without currency fluctuations.

Kimberly-Clark reported gains in organic sales of its adult

incontinence and baby diaper businesses.

Shares of the company fell 3% on Monday, but are up about 10%

over the past 12 months.

Overall, Kimberly-Clark reported a profit of $333 million in the

fourth quarter, up sharply from a loss of $83 million a year

earlier when the company took a charge related to the revaluation

of the Venezuelan currency.

Sales in emerging markets were up 9% on an organic basis, though

that includes slowdowns in some important markets. Mr. Falk said

Kimberly-Clark's business-to-business division experienced a

slowdown in China. It is still opening factories and expanding to

more cities to capitalize on the growing birthrate, which could get

a boost this coming year. he said. Chinese families may have put

off new babies last year, so they could be born during the coming,

more auspicious Year of Monkey.

"Our team views it as a very good year," he said, adding that

the number of births could rise as much as 7%.

Other emerging countries Kimberly-Clark has targeted, such as

Brazil and Russia, are more problematic as higher inflation is

hurting demand and slowing down economic growth.

Kimberly-Clark forecast per-share earnings would rise to between

$5.95 and $6.15 a share this quarter, compared with the average

analyst estimate of $6.14 a share. Sales are expected to either

fall 3% or be flat, owing largely to the stronger dollar.

Write to Austen Hufford at austen.hufford@wsj.com and Paul

Ziobro at paul.ziobro@wsj.com

(END) Dow Jones Newswires

January 25, 2016 17:11 ET (22:11 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

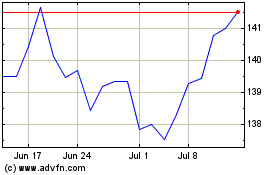

Kimberly Clark (NYSE:KMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kimberly Clark (NYSE:KMB)

Historical Stock Chart

From Apr 2023 to Apr 2024