UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 11-K

|

| |

[X] | ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE |

SECURITIES EXCHANGE ACT OF 1934

For the period from January 1, 2015 to March 20, 2015 (Date of Merger)

OR

|

| |

[ ] | TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE |

SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____________ to _________________

Commission file number 1-225

| |

A. | Full title of the plan and the address of the plan, if different from that of the issuer named below: |

Kimberly-Clark Corporation 401(k) and Retirement Contribution Plan

401 North Lake Street

Neenah, Wisconsin 54956

| |

B. | Name of issuer of the securities held pursuant to the plan and the address of its principal executive office: |

Kimberly-Clark Corporation

P. O. Box 619100

Dallas, Texas 75261-9100

The financial statements included with this Form 11-K have been prepared in accordance with the Employee Retirement Income Security Act of 1974.

| |

2. | Kimberly-Clark Corporation 401(k) and Retirement Contribution Plan |

The Report of Independent Registered Public Accounting Firm with respect to the financial statements of the Kimberly-Clark Corporation 401(k) and Retirement Contribution Plan is set forth in the financial statements filed as Exhibit 99.1.

|

| |

No. | Description |

23.1 | Consent of Deloitte & Touche LLP, Independent Registered Public Accounting Firm dated September 9, 2015 |

99.1 | Kimberly-Clark Corporation 401(k) and Retirement Contribution Plan Financial Statements as of March 20, 2015 (Date of Merger) and December 31, 2014 and for the Period From January 1, 2015 to March 20, 2015 (Date of Merger) and for the Year Ended December 31, 2014 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, Kimberly-Clark Corporation, as Plan Administrator of the Kimberly-Clark Corporation 401(k) and Retirement Contribution Plan, has duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

KIMBERLY-CLARK CORPORATION 401(k) AND RETIREMENT CONTRIBUTION PLAN

| |

Date: September 9, 2015 | By: Kimberly-Clark Corporation |

Plan Administrator

By: /s/ Wesley E. Wada

Wesley E. Wada

Vice President, Compensation, Benefits and

Health Services

EXHIBIT INDEX

|

| |

Exhibit | Description |

23.1 | Consent of Deloitte & Touche LLP, Independent Registered Public Accounting Firm dated September 9, 2015 |

99.1 | Kimberly-Clark Corporation 401(k) and Retirement Contribution Plan Financial Statements as of March 20, 2015 (Date of Merger) and December 31, 2014 and for the Period From January 1, 2015 to March 20, 2015 (Date of Merger) and for the Year Ended December 31, 2014

|

EXHIBIT NO. 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in Registration Statements No. 333-104099 and 333-155380 of Kimberly-Clark Corporation on Form S-8 of our report dated September 9, 2015 relating to the financial statements of Kimberly Clark-Corporation 401(k) and Retirement Contribution Plan, appearing in this Annual Report on Form 11-K of the Kimberly-Clark Corporation 401(k) and Retirement Contribution Plan for the period from January 1, 2015 to March 20, 2015 (Date of Merger).

/s/ DELOITTE & TOUCHE LLP

Dallas, Texas

September 9, 2015

EXHIBIT NO. 99.1

KIMBERLY-CLARK CORPORATION 401(K) AND

RETIREMENT CONTRIBUTION PLAN

Employer ID 39-0394230

Plan ID 010

Financial Statements As of March 20, 2015 (Date of Merger) and

December 31, 2014 and for the Period From January 1, 2015 to March 20, 2015 (Date of Merger) and for the Year Ended December 31, 2014

(With Report of Independent Registered Public Accounting Firm Thereon)

Table of Contents

|

| |

FINANCIAL INFORMATION | |

| |

Report of Independent Registered Public Accounting Firm | |

Statements of Net Assets Available for Benefits as of March 20, 2015 (Date of Merger) and December 31, 2014 | |

Statements of Changes in Net Assets Available for Benefits for the Period From January 1, 2015 to March 20, 2015 (Date of Merger) and for the Year Ended December 31, 2014 | |

Notes to Financial Statements | |

| |

| |

| |

| |

NOTE: The accompanying financial statements have been prepared in part for the purpose of filing with the Department of Labor's Form 5500. Supplemental schedules required by Section 2520.103-10 of the Department of Labor's Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974 are omitted because of the absence of the conditions under which they are required.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Plan Administrator and Participants of

Kimberly-Clark Corporation 401(k) and Retirement Contribution Plan:

We have audited the accompanying statements of net assets available for benefits of the Kimberly-Clark Corporation 401(k) and Retirement Contribution Plan (the “Plan”) as of March 20, 2015 (Date of Merger) and December 31, 2014, and the related statements of changes in net assets available for benefits for the period from January 1, 2015 to March 20, 2015 (Date of Merger) and for the year ended December 31, 2014. These financial statements are the responsibility of the Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, such financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of March 20, 2015 (Date of Merger) and December 31, 2014, and the changes in net assets available for benefits for the period from January 1, 2015 to March 20, 2015 (Date of Merger) and for the year ended December 31, 2014, in conformity with accounting principles generally accepted in the United States of America.

As discussed in Note 1, effective March 20, 2015, the Plan was merged into the Kimberly-Clark Corporation 401(k) and Profit Sharing Plan. Participants ceased participation in the Plan and their balances were transferred.

/s/ DELOITTE & TOUCHE LLP

Dallas, Texas

September 9, 2015

KIMBERLY-CLARK CORPORATION

401(K) AND RETIREMENT CONTRIBUTION PLAN

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

|

| | | | | | | | |

| | March 20 2015 | | December 31 2014 |

(Thousands of dollars) | | |

| | | | |

Assets | | | | |

Investments at Fair Value: | | | | |

Cash equivalents | | $ | — |

| | $ | 880 |

|

Kimberly-Clark Corporation stock fund | | — |

| | 2,619 |

|

Collective funds | | — |

| | 27,012 |

|

Self-Directed Brokerage Account ("SDBA") | | — |

| | 2,294 |

|

Total Investments | | — |

| | 32,805 |

|

Receivables: | | | | |

Contributions | | 164 |

| | — |

|

Dividends | | 29 |

| | 268 |

|

Due from broker | | — |

| | 133 |

|

Notes receivable from participants | | — |

| | 982 |

|

Total Receivables | | 193 |

| | 1,383 |

|

Total Assets | | 193 |

| | 34,188 |

|

| | | | |

Liabilities | | | | |

Due to broker | | — |

| | 264 |

|

Due to Kimberly-Clark Corporation 401(k) and Profit Sharing Plan | | 188 |

| | — |

|

Dividends payable to participants | | 5 |

| | — |

|

Total Liabilities | | 193 |

| | 264 |

|

| | | | |

Net Assets Available for Benefits, at fair value | | — |

| | 33,924 |

|

| | | | |

Adjustment from fair value to contract value for fully benefit-responsive stable income fund | | — |

| | (17 | ) |

| | | | |

Net Assets Available for Benefits | | $ | — |

| | $ | 33,907 |

|

See Notes to Financial Statements.

KIMBERLY-CLARK CORPORATION

401(K) AND RETIREMENT CONTRIBUTION PLAN

STATEMENTS OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

|

| | | | | | | | |

| | For the Period From January 1 to March 20 2015 | | For the Year Ended December 31 2014 |

(Thousands of dollars) | | |

| | | | |

Additions to Net Assets Available for Benefits | | | | |

Investment income: | | | | |

Net appreciation in fair value of investments | | $ | 534 |

| | $ | 20,246 |

|

Dividends - Kimberly-Clark Corporation stock | | 29 |

| | 1,190 |

|

Dividends - SDBA | | 9 |

| | 449 |

|

Interest | | — |

| | 34 |

|

Net investment income | | 572 |

| | 21,919 |

|

Contributions: | | | | |

Employee contributions | | 396 |

| | 13,974 |

|

Employer matching contributions | | 102 |

| | 3,881 |

|

Employer retirement contributions | | 342 |

| | 4,753 |

|

Forfeitures used to reduce employer contributions | | — |

| | (84 | ) |

Total contributions | | 840 |

| | 22,524 |

|

Interest on notes receivable from participants | | 9 |

| | 200 |

|

Total Additions | | 1,421 |

| | 44,643 |

|

| | | | |

Deductions from Net Assets Available for Benefits | | | | |

Benefits paid to participants | | 731 |

| | 28,862 |

|

Administrative expenses | | 191 |

| | 698 |

|

Total Deductions | | 922 |

| | 29,560 |

|

Net increase prior to transfer | | 499 |

| | 15,083 |

|

| | | | |

Net Transfers to Kimberly-Clark Corporation 401(k) and Profit Sharing Plan | | (34,406 | ) | | (335,788 | ) |

| | | | |

Net Decrease in Net Assets Available for Benefits | | (33,907 | ) | | (320,705 | ) |

| | | | |

Net Assets Available for Benefits | | | | |

Beginning of Year | | 33,907 |

| | 354,612 |

|

End of Year | | $ | — |

| | $ | 33,907 |

|

See Notes to Financial Statements.

KIMBERLY-CLARK CORPORATION

401(K) AND RETIREMENT CONTRIBUTION PLAN

NOTES TO FINANCIAL STATEMENTS

Note 1. Description of the Plan

The following brief description of the Kimberly-Clark Corporation 401(k) and Retirement Contribution Plan (the “Plan”) is provided for general information purposes only. Participants should refer to the Plan document for more complete information.

General

The Plan, sponsored by Kimberly-Clark Corporation (the "Corporation"), was a defined contribution plan covering eligible participants of the Corporation, and its participating subsidiaries. The Plan was established on January 1, 2010, as a result of a merger between the Incentive Investment Plan (“IIP”) and the Retirement Contribution Plan as of the end of the day on December 31, 2009. The IIP was an employee stock ownership plan, as defined in Section 4975 of the Internal Revenue Code of 1986 (the “Code”), and thus the Plan maintained that status.

Hourly union employees at certain facilities of the Corporation and its participating U.S. subsidiaries (collectively, the “Employer”) were eligible to participate in the Plan. Effective December 31, 2014, hourly union employees at Chester, Marinette, Mobile, Neenah Cold Spring, and Lakeview Satellite collectively bargained to end participation in the Plan leaving Fullerton hourly union employees as the remaining participants eligible for the Plan. The participant balances for the employees who ceased participation were transferred to the Kimberly-Clark Corporation 401(k) and Profit Sharing Plan (“PSP”).

Pursuant to the collectively bargained labor agreement, the hourly organized employees at Fullerton, who were the only remaining Plan participants, ceased participation in the Plan as of March 20, 2015, and began participating in the PSP effective March 21, 2015. The Plan merged into the PSP to form a single plan, effective March 20, 2015, and as a result all remaining participant account balances were transferred to the PSP on March 23, 2015, the first banking workday following the merger date.

Until March 20, 2015 (Date of Merger), the assets of the Plan were held with The Northern Trust Company (“Trustee”). The named fiduciary for the Plan was the Benefits Administration Committee.

The contributions receivable as of March 20, 2015 (Date of Merger), presented on the Statement of Net Assets Available for Benefits, represent payroll withholdings from employees' March 20th payroll and the related Employer matching contributions which were deposited directly into the PSP on March 23, 2015. Also included are the Employer retirement contributions for participants' eligible March earnings. These contributions were deposited into the PSP in April 2015.

The dividends receivable as of March 20, 2015 (Date of Merger), presented on the Statement of Net Assets Available for Benefits, are the first quarter dividends for the Corporation’s common stock held by the Plan on the date of record of March 6, 2015 and were received by participants on April 2, 2015. The dividends receivable are comprised of $24 thousand distributed through the PSP to participants' accounts and $5 thousand paid directly to participants.

Contributions

An eligible employee who was considered non-highly compensated could elect to make contributions that were deducted from compensation paid by the Employer before federal income taxes were withheld (“401(k) contributions”), after-tax contributions, and Roth 401(k) contributions in any combination up to 75% (in whole percentages or flat dollar amounts) of base salary or 20% for highly compensated employees. A non-highly compensated employee was an employee whose prior year annual compensation was $115 thousand or less. Employees that were new hires or re-hires were automatically enrolled in the Plan at a 6% 401(k) contribution rate.

Employer matching contributions were determined based upon a percentage of qualifying employee contributions. The Corporation made a matching contribution of seventy-five cents for each dollar contributed by the employee on the first 2% of base pay plus fifty cents for each dollar invested on the next 3% of base pay. Employer matching contributions were accounted for separately and shared in the net appreciation or depreciation in fair value of investments, dividends, interest and expenses in the same manner as contributions made by a participant. All employer matching contributions were invested according to the participants' contribution investment elections. Employer matching contributions and future earnings (losses) on that amount could be reallocated to another investment fund within the Plan.

The Code contains certain limitations on the amount of contributions which can be made to the Plan by and on behalf of a participant. Specifically, there are limitations on 401(k) contributions, after-tax contributions, Roth 401(k) contributions, and employer matching contributions made on behalf of highly compensated eligible employees to ensure that no prohibited discrimination takes place under the Code. A participant affected by such limitations could have the 401(k) contributions deemed to be after-tax contributions and could also have a portion of the after-tax contributions refunded. 401(k), after-tax, and Roth 401(k) contributions qualify for employer matching contributions as described above. For the period from January 1, 2015 to March 20, 2015 (Date of Merger), and for the year ended December 31, 2014, there were no re-classifications of contributions.

The Employer made a retirement contribution for each eligible employee based on an annual formula calculated considering the employee's age and eligible earnings. These contributions were made monthly.

The employee contributions presented on the Statement of Changes in Net Assets Available for Benefits for period from January 1, 2015 to March 20, 2015 (Date of Merger), of $400 thousand included 401(k) contributions, after-tax, Roth 401(k), and rollover contributions.

The employee contributions presented on the Statement of Changes in Net Assets Available for Benefits for year ended December 31, 2014, of $14.0 million included 401(k) contributions of $12.0 million and after-tax, Roth 401(k), and rollover contributions, collectively, of $2.0 million.

Participant Accounts

Individual accounts were maintained for each Plan participant. Each participant's account was credited with the employee's contributions, the employer matching contributions, and Plan earnings and losses, including expenses.

Investments

All investment elections were held by the Trustee and employee contributions allocated to a specific fund were commingled with those of other participants and were invested in accordance with the nature of the specific fund. Pending such investment, the Trustee was authorized to invest in short-term securities of the United States of America or in other investments of a short-term nature. Employees could elect to have their contributions in any of the nineteen fund options available. The fund options consisted of Kimberly-Clark Corporation Stock Fund (“K-C Stock Fund”), two different collective funds offered by Columbia Management (formerly, Ameriprise), which were the Money Market and Stable Income Fund and sixteen collective funds offered by BlackRock which included the Russell 1000 Value Index Non-Lendable Fund F, Russell 2000 Index Non-Lendable Fund F, Russell 1000 Growth Index Non-Lendable Fund F, U.S. Debt Index Non-Lendable Fund F, Russell 1000 Index Non-Lendable Fund F, MSCI ACWI ex-U.S. IMI Index Non-Lendable Fund F, and nine LifePath Index Non-Lendable Fund F funds which were the Retirement Fund, 2020 Fund, 2025 Fund, 2030 Fund, 2035 Fund, 2040 Fund, 2045 Fund, 2050 Fund, and 2055 Fund. The participant could also choose from a broad range of funds and certain other investments offered through a brokerage account.

During 2014 the LifePath Index 2015 Non-Lendable Fund F assets were transferred to the LifePath Index Target Conservative Non-Lendable Fund F.

Vesting

Employees were immediately vested in their 401(k), after-tax, Roth 401(k), and rollover contributions. Vesting in company match and retirement contributions occurred after three years of service.

Participant Loans

Participants could borrow from their fund accounts a minimum of $1 thousand up to a maximum of 50% or $50 thousand of their vested account balance, whichever was less. The loans were secured by the balance in the participant's account and bore interest at the prime +1 percent interest rate as published in the Wall Street Journal on the 15th of the month prior to the first day of the month to which it applied. Principal and interest were paid ratably through payroll deductions. A participant could have only one outstanding loan. A loan processing fee of fifty dollars was charged to the participant. A loan could be a general purpose loan, which had to be repaid within a maximum of four years, or a primary residence loan, which had to be repaid within a maximum of ten years.

Distributions

Upon termination of a participant's employment and after three years or more of qualified service, or because of death, the value of the participant's accounts, including the value of all employer matching contributions, was distributable in either a lump sum or partial amount per the participant's request. An automatic distribution occurred within 90 days if the participant's balance was $5 thousand or less. If the balance was $1 thousand or less, the distribution was in the form of cash. If the balance was $5 thousand

or less but more than $1 thousand, the balance was automatically rolled over to Millennium Trust, a financial services company serving individuals, where a separate IRA account was established for the participant. If termination occurred other than as noted above, the value of nonvested employer matching contributions was forfeited and used to reduce subsequent employer matching contributions to the Plan.

A participant invested in the K-C Stock Fund earned dividends quarterly and had the option to reinvest the dividends earned into the fund or receive a distribution. Dividends distributed to participants for the period from January 1, 2015 to March 20, 2015 (Date of Merger), and for the year ended December 31, 2014, were $5 thousand and $472 thousand, respectively. The dividends distributed to participants are presented on the Statements of Changes in Net Assets as benefits paid to participants.

Withdrawals

An employee could withdraw the value of their after-tax accounts and the value of employer matching contributions. Subject to certain conditions, a participant could withdraw the value of 401(k) contributions, Roth 401(k) contributions and earnings credited in the case of hardship or after attaining age 59½. The employee was required to suspend subsequent contributions to the Plan for six months following any hardship withdrawal of 401(k) contributions and earnings thereon.

Forfeited Accounts

For the period from January 1, 2015 to March 20, 2015 (Date of Merger), there were no forfeitures. For the year ended December 31, 2014, forfeitures totaled $84 thousand and were used to offset employer contributions.

Voting of Company Stock

A participant has the right to direct the Trustee as to the manner in which to vote at each annual meeting and special meeting of the stockholders of the Corporation the number of whole shares of the Corporation's common stock held by the Trustee and attributable to his or her K-C Stock Fund account as of the valuation date coincident with the record date for the meeting. In addition, the participant has the right to determine whether whole shares of the Corporation's common stock held by the Trustee and attributable to his or her K-C Stock Fund account should be tendered in response to offers thereof.

Note 2. Accounting Principles and Practices

Basis of Accounting

The accompanying financial statements for the Plan have been prepared on the accrual basis and are in accordance with the accounting principles generally accepted in the United States of America ("U.S. GAAP") for defined contribution benefit plans. The significant accounting policies employed in the preparation of the accompanying financial statements are described below:

Use of Estimates

The preparation of financial statements requires management to make estimates and assumptions that affect the reported amounts of net assets available for benefits and changes therein. Actual results could differ from those estimates.

Investment Valuation and Income Recognition

All investments were stated at fair value. The Plan primarily invests in collective funds that have underlying investments and the fair value is determined by the Plan's proportionate share of the underlying investments and is estimated using the net asset value per share. Funds with underlying investments in benefit-responsive investment contracts are valued at fair market value of the underlying investments and then adjusted by the issuer to contract value. The fair value of the Corporation's common stock held by the Plan is determined as the last selling price on the last business day of the year, as published by an independent source. Security transactions are recorded on the trade date. Cash equivalents represent the following: 1) funds held for distributions and transfers in the K-C Stock Fund, 2) funds held for pending participant disbursements in the clearing account, and 3) funds invested in cash equivalent securities and pending transactions in the SDBA. Interest income is recorded on the accrual basis. Dividends are recorded on the ex-dividend date. Net appreciation (depreciation) includes the Plan's gains and losses on investments bought and sold as well as held during the year.

The Stable Income Fund is a stable value fund which is invested in other funds that are commingled pools sponsored by Columbia Management. These funds may invest in fixed interest insurance investment contracts, money market funds, corporate and government bonds, mortgage-backed securities, bond funds, and other fixed income securities. Participants may ordinarily direct the withdrawal or transfer of all or a portion of their investment at contract value. Contract value represents contributions made to the fund, plus earnings, less participant withdrawals. There are no redemption restrictions in the Stable Income Fund.

Notes Receivable from Participants

Notes receivable from participant loans were valued at their unpaid principal balance plus any accrued but unpaid interest.

Administrative Expenses

Administrative expenses of the Plan were paid by the Plan as provided in the Plan document.

Benefits Paid to Participants

Distributions were recorded when paid. Amounts allocated to accounts of participants who have elected to withdraw from the Plan, but have not yet been paid, were $9 thousand at December 31, 2014.

Transfers from the Plan

For the period from January 1, 2015 to March 20, 2015 (Date of Merger), net transfers from the Plan to the PSP were $34.4 million, all as a result of the collectively bargained labor agreement at Fullerton.

For the year ended December 31, 2014, net transfers from the Plan to the PSP were $335.8 million, substantially all as a result of collectively bargained labor agreements at Chester, Marinette, Mobile, Neenah Cold Spring, and Lakeview Satellite. Transfers as a result of employment status changes from non-union to hourly union resulted in a transfer of assets to the Plan of $28 thousand. Eligibility can be impacted if a participant's employment status changes to or from hourly union resulting in a transfer of assets.

Note 3. Fair Value Measurements

ASC 820, Fair Value Measurements and Disclosures, provides the framework for measuring fair value. That framework provides a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (level 1 measurements) and the lowest priority to unobservable inputs (level 3 measurements). The three levels of the fair value hierarchy under ASC 820 are described as follows:

Level 1 – Unadjusted quoted prices in active markets accessible at the reporting date for identical assets and liabilities.

Level 2 – Quoted prices for similar assets or liabilities in active markets. Quoted prices for identical or similar assets and liabilities in markets that are not considered active or financial instruments for which all significant inputs are observable, either directly or indirectly.

Level 3 – Prices or valuations that require inputs that are significant to the valuation and are unobservable.

The fair value measurement level within the fair value hierarchy is based on the lowest level of any input that is significant to the fair value measurement. Valuation techniques used maximize the use of observable inputs and minimize the use of unobservable inputs.

At March 20, 2015 (Date of Merger), the Plan held no investments. The following tables set forth by level, within the fair value hierarchy, a summary of the Plan's investments measured at fair value at December 31, 2014:

|

| | | | | | | | | | | |

| December 31

2014 | | Fair Value Measurements |

| Level 1 | | Level 2 |

| (Thousands of dollars) |

Cash Equivalents | $ | 880 |

| | $ | — |

| | $ | 880 |

|

| | | | | |

Fixed Income | | | | | |

Held through units of mutual and pooled funds: | | | | | |

Multi-sector | 8,142 |

| | — |

| | 8,142 |

|

Total Fixed Income | 8,142 |

| | — |

| | 8,142 |

|

| | | | | |

Equity | | | | | |

Assets held directly: | | | | | |

US equity | 1,907 |

| | 1,907 |

| | — |

|

Non-US equity | 266 |

| | 266 |

| | — |

|

Held through units of mutual and pooled funds: | | | | | |

US equity | 12,181 |

| | 119 |

| | 12,062 |

|

Non-US equity | 3,865 |

| | — |

| | 3,865 |

|

World equity | 2 |

| | 2 |

| | — |

|

Total Equity | 18,221 |

| | 2,294 |

| | 15,927 |

|

| | | | | |

Multi-Asset Class | 5,562 |

| | — |

| | 5,562 |

|

| | | | | |

Total | $ | 32,805 |

| | $ | 2,294 |

| | $ | 30,511 |

|

As of December 31, 2014, there were no assets with a Level 3 fair value determination. The availability of observable market data was monitored to assess the appropriate classification of financial instruments within the fair value hierarchy. Changes in economic conditions or model-based valuation techniques may require the transfer of financial instruments from one fair value level to another. The Plan's policy is to recognize significant transfers between levels at the end of the year. We evaluate the significance of transfers between levels based upon the nature of the financial instrument and size of the transfer relative to total net assets available for benefits. During the year ended December 31, 2014, there were no significant transfers among level 1 or 2 fair value determinations.

Following is a description of the valuation methodologies used for the Plan's investments that have been measured at level 2 fair value. There have been no changes in the methodologies used as of December 31, 2014.

Cash equivalents: The cash equivalents are a result of the cash liquidity held in the K-C Stock Fund, SDBA, and clearing account. The valuation of the cash equivalents is considered a level 2 due to the cash being held in a fund or short-term cash that has movement between funds or out of the Plan.

US government and municipal fixed income securities: The valuation is determined by observing the value at the closing price reported in the active market in which the individual securities are traded and the trading activity in the market place.

Multi-Sector fixed income mutual and pooled funds: The net asset value of the units of the pooled fund as determined by the investment manager is used as a practical expedient to estimate fair value.

US equity, non-US equity and multi-asset class: The investments include K-C Stock Fund and equity collective funds. Fair value of the Corporation's common stock held in the K-C Stock Fund is determined based on the unadjusted quoted prices for identical assets and the valuation of the common stock is considered a level 2 due to the common stock being held in a fund with cash equivalents.

Note 4. Net Asset Value (NAV) Per Share

There were no investments held by the Plan as of March 20, 2015 (Date of Merger). The following table as of December 31, 2014, sets forth a summary of the Plan's investments with a reported NAV:

|

| | | | | | | | | |

Investment | December 31 2014 Fair Value (a) | Unfunded Commitment | Redemption Frequency | Other Redemption Restrictions | Redemption Notice Period |

| (Thousands of dollars) | |

|

|

|

Short-term investment funds (b) | $ | 5 |

| $ | — |

| Daily | None | Daily |

Fixed income funds (c) | 8,142 |

| — |

| Daily | None | Daily |

Multi-asset class funds (d) | 5,562 |

| — |

| Daily | None | Daily |

Equity index funds (e) | 15,927 |

| — |

| Daily | None | Daily |

(a) The fair values of the investments have been estimated using the NAV of the investment.

(b) Short-term investment fund strategies seek to invest in high-quality, short-term securities which is included in cash and cash equivalents.

(c) Fixed income fund strategies seek to replicate the Barclays Capital Aggregate Bond Index or provide capital preservation and income.

(d) Multi-asset class funds are target date funds that seek to provide a diversified asset allocation consistent with the participants' current stage of life.

(e) Equity index fund strategies seek to replicate the return of an index of a specific financial market, such as the S&P 500 Index or Russell 2000 Index.

Note 5. Investments

There were no investments held by the Plan as of March 20, 2015 (Date of Merger). The following table presents the fair value of investments that were five percent or more of the Plan's net assets as of December 31, 2014:

|

| | | | |

| | December 31, 2014 |

| | (Thousands of dollars)

|

K-C Stock | | $ | 2,619 |

|

Collective funds - BlackRock: | | |

U.S. Debt Index Non-Lending Fund F | | 4,453 |

|

Russell 1000 Index Non-Lendable Fund F | | 5,181 |

|

LifePath Index Conservative Retirement Non-Lendable Fund F | | 1,999 |

|

LifePath Index 2025 Non-Lendable Fund F | | 1,926 |

|

MSCI ACWI ex-US IMI Index Non-Lendable F | | 3,864 |

|

Collective funds - Columbia Management: | | |

Money Market Fund Z | | 1,776 |

|

SDBA | | 2,294 |

|

The Plan's investments (including gains and losses on investments bought and sold, as well as held during the period) appreciated / (depreciated) in value as follows:

|

| | | | | | | |

| For the period ended March 20 2015 | | For the year ended December 31 2014 |

| |

| (Thousands of dollars) |

K-C Stock | $ | (273 | ) | | $ | 5,614 |

|

Collective funds - BlackRock | 781 |

| | 13,825 |

|

Collective funds - Columbia Management | 4 |

| | 727 |

|

| 512 |

| | 20,166 |

|

|

| |

|

SDBA: |

|

| |

|

|

Common stock | 3 |

| | (122 | ) |

Mutual funds | 19 |

| | 272 |

|

Limited partnerships | — |

| | (70 | ) |

| 22 |

| | 80 |

|

Net appreciation in fair value of investments | $ | 534 |

| | $ | 20,246 |

|

Note 6. Party-In-Interest Transactions

Prior to the transfer of assets mentioned in Note 2, the Plan held 32 thousand shares of the Corporation's common stock at a fair value of $3.5 million. During the period ended March 20, 2015, 14 thousand shares were acquired and 5 thousand shares were disposed. 32 thousand shares were then transferred out of the Plan to the PSP.

At December 31, 2014, the Plan held 23 thousand shares of the Corporation's common stock at a fair value of $2.6 million. During the year ended December 31, 2014, 1.0 million shares were acquired, 1.1 million shares were disposed, and 289 thousand shares were transferred out of the Plan to the PSP.

The market value recorded on the Statement of Net Assets Available for Benefits include the first quarter and fourth quarter dividends receivable that are not included in the common stock noted above as of March 20, 2015 and December 31, 2014, respectively.

All of the above transactions are exempt from the prohibitions against party-in-interest transactions under ERISA.

Note 7. Plan Termination

Prior to the final transfer of the Plan's assets to the PSP, and subject to the collective bargaining provisions, the Corporation had the right under the Plan to discontinue its contributions at any time and to terminate the Plan in accordance with the provisions set forth in ERISA. In the event that the Plan had been terminated, participants would have become 100% vested in their accounts.

Note 8. Federal Income Tax Status

The Internal Revenue Service ("IRS") has determined and informed the Corporation in a letter dated October 17, 2014, that the Plan and the related trust were designed in accordance with the applicable requirements of the Internal Revenue Code (the “Code”). The Plan satisfies the requirement of Section 401(a) of the Code and Plan management is not aware of any Plan provision that would result in disqualification. The federal income tax status of participants with respect to the Plan is as follows: A participant's after-tax and Roth contributions, in whatever form, are not tax-deductible by the participant; however, the portion of a distribution attributable to such contributions is not taxable upon distribution. Participant pre-tax 401(k) contributions are considered contributions by the Employer rather than the participant and, as a result, are not taxable until the year in which they are distributed. Employer contributions and the earnings on employer and participant contributions are generally not taxable to the participant until the year in which they are distributed.

U.S. GAAP requires plan management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the IRS. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress. The Plan administrator believes it is no longer subject to income tax examinations for years prior to 2011.

Note 9. Changes to the Plan

During the period from January 1, 2015 to March 20, 2015 (Date of Merger), the Plan was amended to merge the Plan, effective March 20, 2015, and transfer all remaining assets to the PSP effective March 21, 2015.

During the year ended December 31, 2014, the Plan was amended to: (1) eliminate hardship withdrawals from Roth 401(k) Rollovers; effective July 1, 2014, (2) adjust the following items for the determination letter from the IRS: definition of compensation, dividends paid in cash to be distributed no later than 90 days, Roth elective deferrals may only be rolled over to designated Roth accounts or Roth IRAs; all effective January 1, 2010, (3) transfer balances and eligibility for all hourly union participants at Chester, Marinette, Mobile, Neenah Cold Spring, Lakeview Satellite, and former Everett employees from the Plan to the PSP as of December 31, 2014, (4) declare that the Plan Administrator is the Benefits Administration Committee; effective January 1, 2015, (5) adjust the Qualified Domestic Relation Order fee to $675; effective January 1, 2013.

Note 10. Reconciliation of Financial Statements to Form 5500

Benefit payments requested by participants are recorded on the Form 5500 for benefit payments that have been processed and approved for payment prior to year end, but not yet paid as of that date.

The following is a reconciliation of benefits paid to participants per the financial statements for the period from January 1, 2015 to March 20, 2015 (Date of Merger), to Form 5500:

|

| | | | |

| | March 20, 2015 |

| | (Thousands of dollars) |

Benefits paid to participants per the financial statements | | $ | 731 |

|

Less: Benefit payments requested by participants at December 31, 2014 | | (9 | ) |

Benefits paid to participants for Form 5500 |

| $ | 722 |

|

The following is a reconciliation of net assets available for benefits per the financial statements at December 31, 2014 to Form 5500:

|

| | | | |

| | December 31, 2014 |

| | (Thousands of dollars) |

Net assets available for benefits per the financial statements | | $ | 33,907 |

|

Less: Benefit payments requested by participants | | (9 | ) |

Add: Adjustment from contract value to fair value for fully benefit-responsive stable income fund | | 17 |

|

Net assets available for benefits per Form 5500 | | $ | 33,915 |

|

The following is a reconciliation of additions per the financial statements for the period ended March 20, 2015 to Form 5500:

|

| | | | |

| | March 20, 2015 |

| | (Thousands of dollars) |

Total additions per the financial statements | | $ | 1,421 |

|

Less: Adjustment from contract value to fair value for fully benefit responsive stable income fund for 2014 | | (17 | ) |

Total income per Form 5500 | | $ | 1,404 |

|

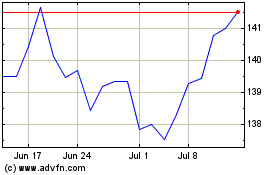

Kimberly Clark (NYSE:KMB)

Historical Stock Chart

From Mar 2024 to Apr 2024

Kimberly Clark (NYSE:KMB)

Historical Stock Chart

From Apr 2023 to Apr 2024