KeyCorp Revenue Climbs on First Niagara Deal -- Update

October 25 2016 - 1:57PM

Dow Jones News

By Joshua Jamerson

Regional lender KeyCorp said third-quarter revenue climbed in

the latest period on its merger with First Niagara Financial Group

Inc.

The Ohio-based regional bank announced plans last fall to buy

First Niagara for about $4.1 billion, and the deal closed over the

summer.

Over all, the Cleveland-based bank reported a profit of $172

million, or 17 cents a share, down from $219 million, or 25 cents a

share, a year earlier. Merger-related charges dented profit by 14

cents a share, the company said.

KeyCorp shares, which have risen more than 17% in the past three

months, rose nearly 5% after the earnings announcement.

"People are seeing this will indeed reward our shareholders,"

Key Chief Executive Beth Mooney said of the First Niagara deal.

Some analysts had been skeptical of the deal's benefits when it was

announced.

Revenue rose 25% to $1.34 billion. Noninterest income rose 17%

to to $549 million, helped by Investment banking and debt placement

fees as well as cards and payments income.

Like many other lenders, Key has moved to cut costs and has

closed some branches. Deal-related costs added up to $189 million

in the quarter, but excluding merger-related charges and the impact

of adding in First Niagara, noninterest expense rose 4% from a year

ago.

KeyCorp's net interest margin -- a gauge of lending

profitability that measures how much a bank earns from the

difference between what it pays on deposits and what it takes in on

loans and investments -- was 2.83%, up from 2.74% in the prior

quarter but down slightly from 2.84% a year ago.

KeyCorp shares, which have risen 12% in the past three months,

were inactive premarket.

--Rachel Louise Ensign contributed to this article.

Write to Joshua Jamerson at joshua.jamerson@wsj.com

(END) Dow Jones Newswires

October 25, 2016 13:42 ET (17:42 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

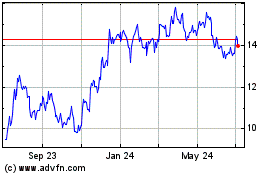

KeyCorp (NYSE:KEY)

Historical Stock Chart

From Mar 2024 to Apr 2024

KeyCorp (NYSE:KEY)

Historical Stock Chart

From Apr 2023 to Apr 2024