UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 30, 2015

(Exact name of registrant as specified in charter)

|

|

|

|

|

| Ohio |

|

001-11302 |

|

34-6542451 |

| (State or other jurisdiction

of incorporation) |

|

Commission

File Number |

|

(I.R.S. Employer

Identification No.) |

|

|

|

| 127 Public Square, Cleveland, Ohio |

|

|

|

44114-1306 |

| (Address of principal executive offices) |

|

|

|

(Zip Code) |

(216) 689-3000

Registrant’s telephone number, including area code

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| x |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

On October 30, 2015, KeyCorp and First Niagara Financial Group, Inc.

(“First Niagara”) issued a joint press release announcing the signing of a definitive merger agreement pursuant to which, on the terms and subject to the conditions set forth therein, First Niagara will merge with and into KeyCorp, with

KeyCorp as the surviving corporation in the merger. A copy of the joint press release announcing the transaction is attached hereto as Exhibit 99.1.

In addition, KeyCorp intends to provide supplemental information regarding the proposed transaction in connection with presentations to analysts and

investors. A copy of the slides that will be made available in connection with the presentations is attached hereto as Exhibit 99.2.

* * *

Forward-Looking Statements

This communication contains

forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including, but not limited to, KeyCorp’s and First Niagara’s expectations or predictions of future financial or business performance or

conditions. Forward-looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,”

“positions,” “plan,” “predict,” “project,” “forecast,” “guidance,” “goal,” “objective,” “prospects,” “possible” or “potential,” by future

conditional verbs such as “assume,” “will,” “would,” “should,” “could” or “may”, or by variations of such words or by similar expressions. These forward-looking statements are subject to

numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made and we assume no duty to update forward-looking statements. Actual results may differ materially from current

projections.

In addition to factors previously disclosed in KeyCorp’s and First Niagara’s reports filed with the SEC and those identified

elsewhere in this communication, the following factors, among others, could cause actual results to differ materially from forward-looking statements or historical performance: ability to obtain regulatory approvals and meet other closing conditions

to the merger, including approval by KeyCorp and First Niagara shareholders on the expected terms and schedule, including the risk that regulatory approvals required for the merger are not obtained or are obtained subject to conditions that are not

anticipated; delay in closing the merger; difficulties and delays in integrating the First Niagara business or fully realizing cost savings and other benefits; business disruption following the merger; changes in asset quality and credit risk; the

inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer acceptance of KeyCorp’s products and services; customer borrowing, repayment, investment and deposit practices; customer

disintermediation; the introduction, withdrawal, success and timing of business initiatives; competitive conditions; the inability to realize cost savings or revenues or to implement integration plans and other consequences associated with mergers,

acquisitions and divestitures; economic conditions; and the impact, extent and timing of technological changes, capital management activities, and other actions of the Federal Reserve Board and legislative and regulatory actions and reforms.

Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results.

Important Additional Information and Where to Find it

In

connection with the proposed merger, KeyCorp will file with the SEC a Registration Statement on Form S-4 that will include the Joint Proxy Statement of KeyCorp and First Niagara and a Prospectus of KeyCorp, as well as other relevant documents

concerning the proposed transaction. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. INVESTORS AND SHAREHOLDERS ARE URGED TO READ THE

REGISTRATION STATEMENT AND THE JOINT PROXY

STATEMENT/PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY

WILL CONTAIN IMPORTANT INFORMATION.

A free copy of the Joint Proxy Statement/Prospectus, as well as other filings containing information about KeyCorp

and First Niagara, may be obtained at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from KeyCorp at investor.key.com or from First Niagara by accessing First Niagara’s

website at www.firstniagara.com. Copies of the Joint Proxy Statement/Prospectus can also be obtained, free of charge, by directing a request to KeyCorp Investor Relations at Investor Relations, KeyCorp, 127 Public Square, Mailcode OH-01-27-0737,

Cleveland, Ohio 44114-1306, by calling (216) 689-3000, or by sending an e-mail to investor_relations@keybank.com or to First Niagara Investor Relations at 726 Exchange Street, Suite 618, Buffalo, New York 14210, by calling (716) 819-5669

or by sending an e-mail to investor@fnfg.com. In addition, KeyCorp and First Niagara use their respective Investor Relations websites and social media outlets as channels of distribution of material company information. Such information is

accessible on KeyCorp’s and First Niagara’s Investor Relations websites, as well as on their respective Facebook pages and through their Twitter accounts and LinkedIn accounts.

KeyCorp and First Niagara and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies

from the respective shareholders of KeyCorp and First Niagara in respect of the transaction described in the Joint Proxy Statement/Prospectus. Information regarding KeyCorp’s directors and executive officers is contained in KeyCorp’s Proxy

Statement on Schedule 14A, dated April 7, 2015, which is filed with the SEC. Information regarding First Niagara’s directors and executive officers is contained in First Niagara’s Proxy Statement on Schedule 14A, dated March 23,

2015, which is filed with the SEC. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the Joint Proxy Statement/Prospectus regarding the

proposed merger when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph.

| Item 9.01 |

Financial Statements and Exhibits. |

|

|

|

| 99.1 |

|

Joint Press Release, dated October 30, 2015. |

|

|

| 99.2 |

|

Investor Presentation, dated October 30, 2015. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

KEYCORP |

|

|

|

|

(Registrant) |

|

|

|

| Date: October 30, 2015 |

|

|

|

/s/ Donald R. Kimble |

|

|

|

|

By: |

|

Donald R. Kimble |

|

|

|

|

|

|

Chief Financial Officer |

Exhibit 99.1

KeyCorp to Acquire First Niagara Financial Group

Powerful Combination Creates High-Performing Regional Bank With Compelling Shareholder Returns

Significant Synergies Provide for Stronger Financial Performance and Improved Efficiency

Becomes 13th Largest U.S. Commercial Bank with Enhanced Presence in Northeast and

Mid-Atlantic

Expects Acquisition to be Accretive to EPS in 2017

October 30, 2015 – Cleveland, Ohio — KeyCorp (NYSE: KEY) and First Niagara Financial Group (NASDAQ: FNFG) announced today that they have

entered into a definitive agreement under which KeyCorp will acquire First Niagara in a cash and stock transaction for total consideration valued at approximately $4.1 billion.

First Niagara headquartered in Buffalo, N.Y., has $39 billion in assets and $29 billion in deposits and 394 banking offices in New York, Pennsylvania,

Connecticut and Massachusetts. With approximately $135 billion of assets, the combined bank will be the 13th largest commercial bank headquartered in the U.S.

The combination will create a leading regional bank with enhanced scale to serve three million clients across diverse markets in the Northeast, Mid-Atlantic,

Midwest and Pacific Northwest. The acquisition will make KeyCorp a leading bank in Upstate New York, with a strong market presence in Buffalo, Albany, Syracuse and Rochester. KeyCorp will also expand its operations to attractive markets throughout

Pennsylvania, Massachusetts and Connecticut.

Under the terms of the agreement, which was unanimously approved by the Boards of Directors of each company,

the merger consideration will be approximately $4.1 billion. First Niagara shareholders will receive 0.68 KeyCorp shares and $2.30 in cash for each First Niagara common share. The per share consideration is valued at $11.40 per share based on the

closing price of KeyCorp common stock on October 29, 2015. In conjunction with the closing of the transaction, three members of the First Niagara Board of Directors are expected to join the KeyCorp Board, which will be expanded accordingly.

“Key and First Niagara are a powerful combination, driven by a shared commitment to the clients and to the communities we serve,” said KeyCorp

Chairman and CEO Beth Mooney. “This transformational opportunity will bring compelling and complementary capabilities to our shared 3 million clients, while driving meaningful synergies and enhancing shareholder value. KeyBank

and First Niagara both have values-based cultures and a long-term commitment to and experience with the region”

“I am confident that the

combination of First Niagara and Key will benefit our shareholders, customers and the communities we serve and will build off the great progress that the First Niagara team has made,” said Nathaniel D. Woodson, Chairman of the Board of

Directors of First Niagara. “We believe that this partnership provides significant value for our shareholders and allows them to participate in the upside potential of the combined Key and First Niagara.”

1

“I am incredibly proud of all that my team has accomplished to put our customers at the center of all we

do,” said Gary M. Crosby, President and CEO of First Niagara. “Combining our strengths with those of Key will enable us to even better serve customers with a broader set of product features and functionality, while providing our team

members with expanded opportunities as part of a larger, more-diversified organization. Key shares our values and our culture of diversity, inclusion and community service – I look forward to working with their team to ensure a seamless

integration of our businesses for the benefit of all of our stakeholders.”

“We have known First Niagara for a long time and have always been

impressed by the quality of their people and their commitment to the community. We look forward to welcoming First Niagara clients and employees to Key,” said Mooney.

Importantly, the compelling financial rationale for the transaction provides significant upside potential for shareholders of both companies. The acquisition

diversifies KeyCorp’s loan portfolio, strengthens its core retail deposit franchise and provides expanded scale. Upon completion of the transaction, the combined company will have approximately $99.8 billion in deposits, $83.6 billion in loans

and 1,366 branches across 15 states. The combined company will have approximately $135 billion of pro forma assets providing increased operating leverage to deliver improved financial performance.

Shareholders of both companies will benefit from annual cost savings in excess of $400 million from maximizing efficiencies of technology infrastructure,

procurement savings across the combined organization, and optimizing overlapping branches. The combined bank will be better positioned to generate attractive financial returns for shareholders through improved efficiency, strong returns on capital

and earnings accretion. Finally KeyCorp will maintain its strong capital position, enabling the company to continue to return capital to shareholders.

KeyCorp expects the acquisition to be accretive to earnings per share in 2017, excluding one-time charges, and expects the transaction to deliver an

attractive Internal Rate of Return of approximately 15%.

KeyCorp and First Niagara have built a legacy of philanthropy and civic involvement and will

continue this commitment to the markets the combined company will serve. Together, the combined companies have nearly $5 billion in lending and investments supporting underserved individuals and communities. Additionally, Key will make a $20 million

contribution to the First Niagara Foundation to continue its important community initiatives.

Upon closing the transaction, KeyCorp expects to

successfully integrate First Niagara into its business. KeyCorp and First Niagara have the shared expertise, the culture and the capital to ensure a successful transition. Christopher M. Gorman, President of Key Corporate Bank, will lead

the merger integration team which will be comprised of both KeyCorp and First Niagara team members. “Chris is a dynamic, client-centric leader who is credited with successfully leading, integrating, transforming, and growing businesses

throughout his 30-year career in financial services,” said Mooney.

The acquisition is subject to customary closing conditions, including regulatory

approvals and approval by KeyCorp and First Niagara shareholders. The transaction is expected to close in the third quarter of 2016.

2

Advisors

Morgan Stanley & Co. LLC served as lead financial advisor and KeyBanc Capital Markets as financial advisor to KeyCorp. Simpson Thacher &

Bartlett LLP served as legal counsel to KeyCorp.

J.P. Morgan Securities LLC served as financial advisor to First Niagara, and Sullivan &

Cromwell served as legal counsel to First Niagara.

Conference Call

A conference call will be held at 8:00 a.m. ET on Friday, October 30, 2015. The live audio webcast of the conference call and presentation materials will

be available at www.key.com/ir. If you are unable to join the live conference call, or wish to hear a re-broadcast, access www.key.com/ir and select Presentations & Webcasts.

About Key

KeyCorp was organized more than 160 years ago

and is headquartered in Cleveland, Ohio. One of the nation’s largest bank-based financial services companies, Key had assets of approximately $95.4 billion at September 30, 2015. Key provides deposit, lending, cash management and

investment services to individuals and small and mid-sized businesses in 12 states under the name KeyBank National Association. Key also provides a broad range of sophisticated corporate and investment banking products, such as merger and

acquisition advice, public and private debt and equity, syndications and derivatives to middle market companies in selected industries throughout the United States under the KeyBanc Capital Markets trade name. For more information, visit

https://www.key.com/. KeyBank is Member FDIC.

About First Niagara

First Niagara, through its wholly owned subsidiary, First Niagara Bank, N.A., is a multi-state community-oriented bank with approximately 390 branches, $39

billion in assets, $29 billion in deposits, and approximately 5,400 employees providing financial services to individuals, families and businesses across New York, Pennsylvania, Connecticut and Massachusetts. For more information, visit

www.firstniagara.com.

|

|

|

|

|

| KeyCorp Contacts: |

|

|

|

|

|

|

|

| ANALYSTS |

|

MEDIA |

|

|

| Vernon L. Patterson |

|

Jack Sparks |

|

|

| 216.689.0520 |

|

720.904.4554 |

|

|

| Vernon_Patterson@KeyBank.com |

|

Jack_Sparks@KeyBank.com |

|

|

|

|

|

| First Niagara Contacts: |

|

|

|

|

|

|

|

| ANALYSTS |

|

MEDIA |

|

|

| Ram Shankar |

|

David Lanzillo |

|

|

| 716.270.8623 |

|

716.819.5780 |

|

|

| Ram.Shankar@fnfg.com |

|

David.Lanzillo@fnfg.com |

|

|

***

3

IMPORTANT ADDITIONAL INFORMATION AND WHERE TO FIND IT

In connection with the proposed merger, KeyCorp will file with the SEC a Registration Statement on Form S-4 that will include the Joint Proxy Statement of

KeyCorp and First Niagara and a Prospectus of KeyCorp, as well as other relevant documents concerning the proposed transaction. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a

solicitation of any vote or approval. INVESTORS AND SHAREHOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE

SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION.

A free copy of

the Joint Proxy Statement/Prospectus, as well as other filings containing information about KeyCorp and First Niagara, may be obtained at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free

of charge, from KeyCorp at investor.key.com or from First Niagara by accessing First Niagara’s website at www.firstniagara.com. Copies of the Joint Proxy Statement/Prospectus can also be obtained, free of charge, by directing a request to

KeyCorp Investor Relations at Investor Relations, KeyCorp, 127 Public Square, Mailcode OH-01-27-0737, Cleveland, Ohio 44114-1306, by calling (216) 689-3000, or by sending an e-mail to investor_relations@keybank.com or to First Niagara

Investor Relations at 726 Exchange Street, Suite 618, Buffalo, New York 14210, by calling (716) 819-5669 or by sending an e-mail to investor@fnfg.com. In addition, KeyCorp and First Niagara use their respective Investor Relations

websites and social media outlets as channels of distribution of material company information. Such information is accessible on KeyCorp’s and First Niagara’s Investor Relations websites, as well as on their respective Facebook pages and

through their Twitter accounts and LinkedIn accounts.

KeyCorp and First Niagara and certain of their respective directors and

executive officers may be deemed to be participants in the solicitation of proxies from the respective shareholders of KeyCorp and First Niagara in respect of the transaction described in the Joint Proxy Statement/Prospectus. Information regarding

KeyCorp’s directors and executive officers is contained in KeyCorp’s Proxy Statement on Schedule 14A, dated April 7, 2015, which are filed with the SEC. Information regarding First Niagara’s directors and executive officers is

contained in First Niagara’s Proxy Statement on Schedule 14A, dated March 23, 2015, which are filed with the SEC. Additional information regarding the interests of those participants and other persons who may be deemed participants in the

transaction may be obtained by reading the Joint Proxy Statement/Prospectus regarding the proposed merger when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph.

FORWARD-LOOKING STATEMENTS

This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including,

but not limited to, KeyCorp’s and First Niagara’s expectations or predictions of future financial or business performance or conditions. Forward-looking statements are typically identified by words such as “believe,”

“expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,” “positions,” “plan,” “predict,” “project,” “forecast,”

“guidance,” “goal,” “objective,” “prospects,” “possible” or “potential,” by future conditional verbs such as “assume,” “will,” “would,” “should,”

“could” or “may”, or by variations of such words or by similar expressions. These forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak

only as of the date they are made and we assume no duty to update forward-looking statements. Actual results may differ materially from current projections.

In addition to factors previously disclosed in KeyCorp’s and First Niagara’s reports filed with the SEC and those identified

elsewhere in this communication, the following factors, among others, could cause actual results to differ materially from forward-looking statements or historical performance: ability to obtain regulatory approvals and meet other closing conditions

to the merger, including approval by KeyCorp and First Niagara shareholders on the expected terms and schedule, including the risk that regulatory approvals required for the merger are not obtained or are obtained subject to conditions that are not

anticipated; delay in closing the merger; difficulties and delays in integrating the First Niagara business or fully realizing cost savings and other benefits; business disruption following the merger; changes in asset quality and credit risk; the

inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer acceptance of KeyCorp’s products and services; customer borrowing, repayment, investment and deposit practices; customer

disintermediation; the introduction, withdrawal, success and timing of business initiatives; competitive conditions;

4

the inability to realize cost savings or revenues or to implement integration plans and other consequences associated with mergers, acquisitions and divestitures; economic conditions; and the

impact, extent and timing of technological changes, capital management activities, and other actions of the Federal Reserve Board and legislative and regulatory actions and reforms.

Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual

results.

###

5

|

KeyCorp Acquisition of First Niagara Financial Group October 30, 2015 Better Together Exhibit 99.2 |

|

FORWARD-LOOKING STATEMENTS AND ADDITIONAL

INFORMATION DISCLOSURE This communication contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 including, but not limited to, KeyCorp’s and First Niagara’s expectations or predictions of future financial or business performance or conditions. Forward-looking statements are typically identified by words such as “believe,” “expect,” “anticipate,” “intend,” “target,” “estimate,” “continue,” “positions,” “plan,” “predict,” “project,” “forecast,” “guidance,” “goal,” “objective,” “prospects,” “possible” or “potential,” by future conditional verbs such as “assume,” “will,” “would,” “should,” “could” or “may”, or by variations of such words or by similar expressions. These forward-looking statements are subject to numerous assumptions, risks and uncertainties, which change over time. Forward-looking statements speak only as of the date they are made and we assume no duty to update forward-looking statements. Actual results may differ materially from current projections. In addition to factors previously disclosed in KeyCorp’s and First Niagara’s reports filed with the SEC and those identified elsewhere in this communication, the following factors, among others, could cause actual results to differ materially from forward-looking statements or historical performance: ability to obtain regulatory approvals and meet other closing conditions to the merger, including approval by KeyCorp and First Niagara shareholders on the expected terms and schedule, including the risk that regulatory approvals required for the merger are not obtained or are obtained subject to conditions that are not anticipated; delay in closing the merger; difficulties and delays in integrating the First Niagara business or fully realizing cost savings and other benefits; business disruption following the merger; changes in asset quality and credit risk; the inability to sustain revenue and earnings growth; changes in interest rates and capital markets; inflation; customer acceptance of KeyCorp’s products and services; customer borrowing, repayment, investment and deposit practices; customer disintermediation; the introduction, withdrawal, success and timing of business initiatives; competitive conditions; the inability to realize cost savings or revenues or to implement integration plans and other consequences associated with mergers, acquisitions and divestitures; economic conditions; and the impact, extent and timing of technological changes, capital management activities, and other actions of the Federal Reserve Board and legislative and regulatory actions and reforms. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. This presentation also includes certain non-GAAP financial measures related to “tangible common equity,” “Common Equity Tier 1,” “Tier 1 common equity,” “pre-provision net revenue,” and “cash efficiency ratio.” Management believes these ratios may assist investors, analysts and regulators in analyzing Key’s financials. Although Key has procedures in place to ensure that these measures are calculated using the appropriate GAAP or regulatory components, they have limitations as analytical tools and should not be considered in isolation, or as a substitute for analysis of results under GAAP. For more information on these calculations and to view the reconciliations to the most comparable GAAP measures, please refer to our most recent earnings press release. 2 Better Together |

|

3 Shelby_Sales-Presentation_150928_v5.pptx28 SEP 20156:59 PM11 A Compelling Strategic Opportunity (a) Upon full realization of cost savings (FY2018); no revenue synergies assumed (b) MSA denotes Metropolitan Statistical Area Better Together Strengthens Franchise Strengthens Franchise Leverages Complementary Business Models Leverages Complementary Business Models Generates Attractive Financial Returns Generates Attractive Financial Returns Strengthens core operating and financial metrics (a) Creates leading bank in Upstate New York with a strong presence across the Northeast, Midwest and Pacific Northwest

Builds on Key’s brand and presence in shared markets with complementary new

markets –

Leading position in MSAs

(b) of Buffalo, Albany, Syracuse and Rochester – Establishes Key’s presence in attractive MSAs (Pittsburgh, Philadelphia, Hartford, New Haven) EPS accretion of 5% (a) IRR approximates 15% and ROIC exceeds 10% Expected cost savings of $400 million create $2.8 billion of shareholder value Drives revenue synergies by deploying stronger combined product set into existing client relationships

Efficient use of capital –

capital ratios remain strong

Significant revenue opportunity by delivering broader suite of products to new and

existing clients –

KEY: commercial payments; capital markets; commercial mortgage; private banking

and investments –

FNFG: residential mortgage; indirect auto lending; retail and commercial

insurance brokerage Complementary business mix creates a more balanced

franchise across consumer and commercial businesses Powerful combination

creates high-performing regional bank with compelling shareholder returns

13 Largest U.S. Commercial Bank

$135 billion assets $100 billion deposits – Increases ROTCE by ~200 bps – Cash efficiency ratio improves by ~300 bps – Adds one million clients and $25 billion of core deposits th (b) |

|

• Operates similar businesses in attractive, core and contiguous markets to Key – Banking segment is 95% of FNFG revenue – ~65% of First Niagara’s core deposits are in its New York markets -- all known and core to Key – One million clients and more than $14B in commercial loan balances – Strong risk culture • Compatible culture with Key – Focused on clients and communities Company Overview (3Q15) Company Overview (3Q15) Branch Footprint Branch Footprint Loan Portfolio (3Q15) Loan Portfolio (3Q15) 394 Branches | $29B Deposits 43 | $2.1B 58 | $2.8B 52 | $10.3B 20 | $1.4B 31 | $2.2B 35 | $1.9B 27 | $1.8B Better Together Company Company Financial Financial Business Profile Business Profile • Headquarters: Buffalo, NY • Employees: 5,397 • Branches: 394 • Revenue (LTM) (a) : $1.4B • Assets: $39B • Loans: $23B • Deposits: $29B 4 Overview of First Niagara (a) LTM denotes last twelve months $23.4B $ in billions Commercial & Industrial ($6.0) Residential Real Estate ($6.3) Other Consumer ($2.8) Commercial Real Estate ($8.3) |

|

5 Attractive Transaction Economics Better Together • $4.1 billion in aggregate consideration – First Niagara shareholders receive 0.68 Key shares and $2.30 in cash for each FNFG common share

– Implied value of $11.40 per FNFG common share, based on Key’s closing share price as of October 29

• Transaction metrics in-line with precedent transactions – P / TBV: 1.7x Core deposit premium: 6.7% P / 2016E EPS: 18.7x P / 2016E EPS (with synergies): 8.5x Key Transaction Terms Key Transaction Terms Financial Impact Financial Impact • Generates compelling financial metrics – Increases ROTCE by ~200 bps – Cash efficiency ratio improves by ~300 bps, driven by $400 million in annual cost savings

– EPS accretion of 5% – IRR approximates 15% and ROIC exceeds 10% – Tangible book value dilution of ~12% • Drives revenue synergies by deploying stronger combined product set to existing clients

• Efficient use of capital – capital ratios remain strong • Increases scale of Key by ~40% in loans; deposits; total assets (a) Upon full realization of cost savings (FY2018); no revenue synergies assumed

Financial Assumptions Financial Assumptions • Cost savings of $400 million pre-tax, or ~40% of FNFG’s current noninterest expense

• Meaningful revenue synergies identified, but not included in financial analysis

• Merger and integration costs of approximately $550 million pre-tax • Purchase accounting adjustments include ~3% loan mark and ~1.5% core deposit intangible

• Key’s existing share repurchase program suspended until closing of transaction; no change to

Key’s dividend plans, including anticipated increase to $0.085 per share in

2Q16 –

Key anticipates requesting resumption of share repurchase activity in our 2016 CCAR

submission •

Expected closing in 3Q16, subject to shareholder approval from Key and First Niagara

and customary regulatory approvals

(a) |

| Combined

Company Uniquely Positioned to Unlock Value 6

High Growth Markets High Growth Markets Three Million Clients Three Million Clients High Density Markets High Density Markets Commercial payments Retail banking (branch; card; auto; etc.) Private banking Residential mortgage Indirect auto lending Insurance brokerage Small business banking Business banking Commercial banking Asset-based lending Equipment finance Commercial mortgage banking & servicing Investment banking (mid market/industry focus) Leading market presence across the I-90 corridor from Toledo, OH to Albany, NY Top 5 branch share in Seattle, Denver, Portland, Salt Lake City and Boise – all growing faster than national average Broad, Complementary Product Capabilities Broad, Complementary Product Capabilities Complementary products provide extensive client cross-sell and revenue growth opportunities Compelling Franchise and Capabilities Attractive Geographic Footprint Attractive Geographic Footprint Complementary Product Offering Complementary Product Offering Better Together |

|

Strengthens Position in Attractive Northeast Markets

7 Source: SNL Financial; data as of June 2015 (a) Excludes any potential deposit divestiture; all figures cap all branches at $250MM to adjust for commercial and headquarters deposits; MSA

rankings reflect total deposit rankings

(b) Northeast region defined as Connecticut, Maine, Massachusetts, New York, Pennsylvania and Vermont

Better Together Pro Forma Branch Footprint Pro Forma Branch Footprint Leading Retail Presence in Upstate NY (a) Leading Retail Presence in Upstate NY (a) 3.3 4.7 8.0 KEY FNFG Pro Forma 1.7 2.2 3.9 KEY FNFG Pro Forma 1.1 1.4 2.5 KEY FNFG Pro Forma $ in billions Buffalo, NY Buffalo, NY Albany, NY Albany, NY Rochester, NY Rochester, NY Syracuse, NY Syracuse, NY KEY FNFG #3 #2 #1 #4 #2 #1 #6 #5 #1 #4 #6 #1 Leading Position from Toledo to Albany Leading Market Share Banks Outperform Shared Market Presence Accelerates Value Realization • Combination creates the 13 largest U.S. commercial bank • Approximately $50 billion in deposits and nearly 700 branches in the Northeast, representing approximately half of the combined national franchise (b) 1.1 0.8 1.9 KEY FNFG Pro Forma th |

|

8 Enhanced Product Capabilities Drive Value Traditional Bank Products Traditional Bank Products Capital Markets Capabilities Capital Markets Capabilities Deposits & payments Loans Wealth management & private banking Equipment finance Commercial mortgage banking Derivatives & foreign exchange Equity capital markets Equity research M&A / financial sponsors / leveraged finance Investment grade & high-yield debt Loan syndications Public finance Consumer Energy

Healthcare Industrial Public Sector Real Estate

Technology Consumer

Energy Healthcare Industrial Public Sector Real

Estate Technology …as well as

deep industry expertise… Key has broad product capabilities…

4% Y-o-Y average loan

growth $39 B in AUM $70 B deposits at 15 bps #3 bank-owned equipment finance co. by new business volume (a) #3 commercial mortgage servicer (master/primary) (b) >125 M&A deals completed since 2011 106 transactions, raising $96 B YTD15 Rates, commodity & currency solutions 144 transactions, raising $ 49 B YTD15 55 transactions, raising $22 B YTD15 759 companies under coverage >140 transactions, raising $27 B YTD15 1 2 …that can be deployed against our common targeted client and prospect base (middle market businesses and their

owners)… 3 …Driving Meaningful Opportunities to Acquire and Expand Client Relationships

Note: Data as of 3Q15 unless otherwise noted

(a) Source: Monitor Bank 100; ranking based on new business volume as of FY14 (b) Source: Mortgage Bankers Association year-end 2014 rankings Better Together $10 $50 $1,500 $2,000 Commercial client revenue size ($MM) $25 $100 $250 $500 KEY Focus FNFG Focus |

|

9 Significant Value Created from Cost Savings Unlocked value from cost synergies provides strong upside for shareholders • High degree of market overlap accelerates benefit realization – > 30% of FNFG branches within two miles of a Key branch • FNFG’s technology infrastructure largely outsourced Key has opportunity to efficiently scale our existing platform Summary Summary Note: Analysis assumes effective tax rate of 35% Better Together KEY / First Niagara -Tax $260 12x 3,120 -tax Restructuring Charges (358) $2,762 67% Total Deal Value Synergies ~67% $2.8B $4.1B |

|

Substantial Revenue Growth Potential

Comparative Revenue Productivity (Key’s Business Bank, Middle Market &

Commercial Real Estate vs. FNFG) Comparative Revenue Productivity

(Key’s Business Bank, Middle Market & Commercial Real Estate vs. FNFG) Commercial Deposits / Loan Commitments Commercial Deposits / Loan Commitments Payments Fee Income / Loan Commitments Payments Fee Income / Loan Commitments Investment Management Fees / Consumer Household Investment Management Fees / Consumer Household Insurance Revenue / Client Insurance Revenue / Client ~3x ~2x ~3x ~50x Better Together Opportunity to drive revenue growth by delivering broader suite of products to new and

existing clients • All transaction return metrics presented herein exclude the benefit of revenue synergies

10 Complementary products provide significant potential to expand revenue across our collective client base |

|

Better Together FY18 Financial Performance Metrics FY18 Financial Performance Metrics Key Pro Forma Key Pro Forma Key Pro Forma > 300 bps > 200 bps ~5% 11 Attractive Financial Impact The First Niagara acquisition generates compelling financial returns for Key • IRR approximates 15% and ROIC exceeds 10% • Meaningful improvement in efficiency and profitability metrics Note: Above figures depict consensus International Brokers’ Estimate System estimates (I/B/E/S) FY18 estimates for Key and First

Niagara, adjusted for the transaction and $400MM in annual cost

savings. No revenue synergies assumed |

|

12 Strong Pro Forma Capital Position The acquisition is an efficient use of capital – Key’s capital ratios remain strong • Key is well-positioned for 2016 CCAR submission and additional capital actions

CET1 Ratio (%) (a)(b)(c) CET1 Ratio (%) (a)(b)(c) Tier 1 Ratio (%) (a)(b) Tier 1 Ratio (%) (a)(b) Leverage Ratio (%) (a)(b) Leverage Ratio (%) (a)(b) 10.5 ~9.5 KEY Current Pro Forma Est. at Close 10.9 ~10.0 KEY Current Pro Forma Est. at Close 10.7 ~9.5 KEY Current Pro Forma Est. at Close Better Together (a) Non-GAAP measure

(b) 9-30-15 ratio is estimated

(c) The final Basel III capital framework rules, effective January 1, 2015 for Key, introduced a new capital measure, “Common Equity Tier

1” (CET1) |

|

Disciplined Diligence and Integration Approach

Thorough Due Diligence Process Thorough Due Diligence Process • -Comprehensive, executive-led due diligence process involving more than 300 employees of

both Key and First Niagara

• -Organized teams across focus diligence areas led by senior leaders with support from

functional experts and external advisors

• --Extensive credit diligence, including thorough loan file review – Reviewed loans to more than 1,100 borrowers representing ~50% of First Niagara’s total

commitments – Balanced review of commercial and consumer loan portfolios, including top credit relationships

and all substandard loans > $250k

• Holistic risk assessment across all major risk categories, including compliance and legal;

operational; model; market; credit; rate; and strategic risks

Disciplined Integration

Approach Disciplined Integration Approach • Key has the management resources and infrastructure to acquire and integrate First Niagara

seamlessly into our Company

• Familiarity with First Niagara’s businesses and markets will accelerate Key’s ability to

integrate successfully

• Key’s technology and operations infrastructure is scalable and can efficiently leverage the

incremental volume and activity generated by the transaction

• Core integration leadership team has significant prior M&A integration experience

– Integration team will be led by Chris Gorman, President of Key Corporate Bank, and staffed with

representatives from both Key and First Niagara

Better Together 13 |

|

14 Our Mission: Helping Clients and Communities Thrive Strong commitment to our communities Key and FNFG have award winning cultures of philanthropy, community development and civic service – $30 million dollars given annually to nonprofit organizations – Nearly $5 billion combined in lending and investments supporting underserved individuals and communities – Over 500,000 employee volunteer hours in the past three years One of America’s Most Community-minded Companies (The Civic 50) Diversity Inc. “Top 50” company 7x winner: “One of the Best Places to Work” (Corporate Equality Index, Human Rights Campaign) FNFG selected as “Best Bank in the Northeast” by Money

magazine Corporate Responsibility is Important to the Communities That We So Proudly Serve

Corporate Responsibility is Important to the Communities That We So Proudly

Serve Better

Together |

|

15 Shelby_Sales-Presentation_150928_v5.pptx28 SEP 20156:59 PM11 A Compelling Strategic Opportunity Better Together Strengthens Franchise Strengthens Franchise Leverages Complementary Business Models Leverages Complementary Business Models Generates Attractive Financial Returns Generates Attractive Financial Returns Powerful combination creates high-performing regional bank with compelling shareholder returns

Better Together

|

| CRE

22% Cost of Deposits = 0.18%

Cost of Deposits = 0.18%

Cost of Deposits = 0.24%

Cost of Deposits = 0.24%

Cost of Deposits = 0.15%

Cost of Deposits = 0.15%

Pro Forma Loan and Deposit Summary

17 Source: KEY & FNFG 3Q earnings releases Summary (3Q15) Summary (3Q15) Key First Niagara Pro Forma Total Average Loans = $23.4 B Total Average Loans = $82.7 B C&I 51% Residential Real Estate 22% Other Consumer 5% CRE 36% C&I 25% Residential Real Estate 27% Other Consumer 12% C&I 44% CRE 26% Residential Real Estate 23% Other Consumer 7% Commercial = 73% Consumer = 27% Commercial = 61% Consumer = 39% Commercial = 70% Consumer = 30% Yield on Loans = 3.7% Yield on Loans = 3.6% Yield on Loans = 3.7% Better Together Total Average Deposits = $70.5 B Total Average Deposits = $28.6 B Total Average Deposits = $99.1 B Noninterest- Bearing 37% Checking/ Savings/ MMDA 55% CDs 8% Noninterest- Bearing 20% CDs 14% CDs 10% Checking/ Savings/ MMDA 66% Checking/ Savings/ MMDA 58% Noninterest- Bearing 32% Total Average Loans = $59.3 B Non-Time = 92% Time = 8% Non-Time = 86% Time = 14% Non-Time = 90% Time = 10% |

| IMPORTANT

ADDITIONAL INFORMATION AND WHERE TO FIND IT

In connection with the proposed merger, KeyCorp will file with the SEC a Registration Statement on Form S-4 that will include the Joint Proxy Statement of KeyCorp and First Niagara and a Prospectus of KeyCorp, as well as other relevant documents concerning the proposed transaction. This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. INVESTORS AND SHAREHOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS REGARDING THE MERGER WHEN IT BECOMES AVAILABLE AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. A free copy of the Joint Proxy Statement/Prospectus, as well as other filings containing information about KeyCorp and First Niagara, may be obtained at the SEC’s Internet site (http://www.sec.gov). You will also be able to obtain these documents, free of charge, from KeyCorp at investor.key.com or from First Niagara by accessing First Niagara’s website at www.firstniagara.com. Copies of the Joint Proxy Statement/Prospectus can also be obtained, free of charge, by directing a request to KeyCorp Investor Relations at Investor Relations, KeyCorp, 127 Public Square, Mailcode OH-01-27-0737, Cleveland, Ohio 44114-1306, by calling (216) 689-3000, or by sending an e-mail to investor_relations@keybank.com or to First Niagara Investor Relations at 726 Exchange Street, Suite 618, Buffalo, New York 14210, by calling (716) 819-5669 or by sending an e-mail to investor@fnfg.com. In addition, KeyCorp and First Niagara use their respective Investor Relations websites and social media outlets as channels of distribution of material company information. Such information is accessible on KeyCorp’s and First Niagara’s Investor Relations websites, as well as on their respective Facebook pages and through their Twitter accounts and LinkedIn accounts. KeyCorp and First Niagara and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from the respective shareholders of KeyCorp and First Niagara in respect of the transaction described in the Joint Proxy Statement/Prospectus. Information regarding KeyCorp’s directors and executive officers is contained in KeyCorp’s Proxy Statement on Schedule 14A, dated April 7, 2015, which is filed with the SEC. Information regarding First Niagara’s directors and executive officers is contained in First Niagara’s Proxy Statement on Schedule 14A, dated March 23, 2015, which is filed with the SEC. Additional information regarding the interests of those participants and other persons who may be deemed participants in the transaction may be obtained by reading the Joint Proxy Statement/Prospectus regarding the proposed merger when it becomes available. Free copies of this document may be obtained as described in the preceding paragraph. 18 Better Together |

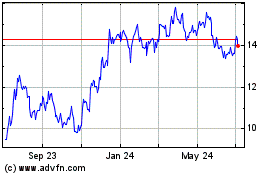

KeyCorp (NYSE:KEY)

Historical Stock Chart

From Mar 2024 to Apr 2024

KeyCorp (NYSE:KEY)

Historical Stock Chart

From Apr 2023 to Apr 2024