KeyCorp Reports 18% Profit Increase -- Update

October 15 2015 - 11:38AM

Dow Jones News

By Lisa Beilfuss

Regional lender KeyCorp said third-quarter profit rose, thanks

to higher commercial lending and increased fee revenue.

While revenue topped expectations, per-share earnings fell a

penny short of Wall Street expectations. KeyCorp shares, down about

14% over the past three months, rose 4.5% in morning trading.

The Cleveland-based bank reported a profit of $219 million, or

26 cents a share, up from $186 million, or 21 cents, a year

earlier. Revenue increased 7% to $1.07 billion. Analysts projected

27 cents in per-share profit on $1.05 billion in revenue, according

to Thomson Reuters. Key said a pension settlement charged reduced

earnings per share by one cent.

As it grapples with low rates, the bank, like other regional

lenders, has tried to amp up its fee-based businesses to generate

stable fees. Noninterest income jumped 13% to $470

million--accounting for 44% of total revenue--in the latest

quarter, aided by Pacific Crest. KeyCorp also said it saw higher

investment banking and credit card fees during the quarter. Mr.

Kimble said fee revenue would grow roughly 4% to 6% this year.

Commercial lending was strong during the quarter and surged 15%

from a year earlier, offsetting declines in other segments and

pushing average loans up 6.2%. On a call with analysts, E.J. Burke,

Co-President of Key Community Bank, said the lender has made a

significant investment in commercial bankers. Key is "putting more

feet on the street" and is "starting to see dividends coming from

those," Mr. Burke said.

Deposits also increased and were up about 2% from the year-ago

period.

Like many other lenders hamstrung by low interest rates, Key has

moved to cut costs and has closed some branches. Despite those

initiatives, the lender saw noninterest expenses rise 2.5% from the

year-ago quarter as it spent more on banker salaries and due to

costs associated with last year's acquisition of Pacific Crest.

Still, KeyCorp managed to push its efficiency ratio, a measure

of costs as a percentage of revenue where lower is better, down to

66.9% from 69.7% a year earlier. On a call with analysts and

investors, Chief Financial Officer Don Kimble said Key still thinks

it can get its efficiency ratio to the low-60s range, despite the

uncertainty over when interest rates will rise.

KeyCorp's net interest margin, an important gauge of lending

profitability that measures how much a bank earns from the

difference between what it pays on deposits and what it takes in on

loans and investments, declined. The metric edged down to 2.87%

from 2.88% in the second quarter and fell from 2.96% a year

earlier. The company had in July signaled that its net interest

margin might worsen during the quarter.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

October 15, 2015 11:23 ET (15:23 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

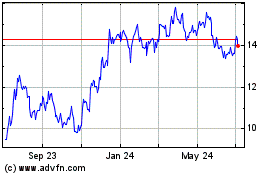

KeyCorp (NYSE:KEY)

Historical Stock Chart

From Mar 2024 to Apr 2024

KeyCorp (NYSE:KEY)

Historical Stock Chart

From Apr 2023 to Apr 2024