Fourth Quarter Revenues Up 21% to $1.2

Billion

Net Orders Increase 20% to 2,254; Net Order

Value Up 27% to $856 Million

Backlog Value Increases to $1.5 Billion,

Highest Year-End Level Since 2006

KB Home (NYSE: KBH) today reported results for its fourth

quarter and year ended November 30, 2016.

“We made considerable progress on several fronts in 2016 with

solid operational execution driving year-over-year increases in our

annual deliveries, revenues and earnings,” said Jeffrey Mezger,

chairman, president and chief executive officer. “We finished the

year with strong fourth quarter performance and poised for

long-term success with a roadmap for returns-focused growth, a

refined core business strategy, and specific three-year financial

targets. We also took decisive actions to improve our asset

efficiency, committing to sell certain non-core land assets over

the coming year. While this resulted in inventory-related

impairment charges in the quarter, we intend to productively

redeploy the cash proceeds to deleverage our balance sheet and

invest in our business.”

“With healthy net order activity in the fourth quarter

contributing to our highest backlog value level in 10 years, we are

entering 2017 with strong momentum,” said Mezger. “Our strategy is

to continue to grow the scale of our business within our current

geographic footprint, increase our operating profits, and generate

cash internally to both support our future growth and improve our

leverage ratio. We believe we are well positioned to capitalize on

the continuing increase in demand from first-time homebuyers

accompanying current positive economic and demographic trends in

many of our served markets.”

Three Months Ended November 30, 2016

(comparisons on a year-over-year basis)

- Total revenues of $1.19 billion

increased 21%, with housing revenues also up 21%.

- Land sale revenues were $3.2 million,

compared to $2.3 million.

- Deliveries grew 19% to 3,060 homes,

with increases in each of the Company’s four regions.

- Average selling price increased 2% to

$387,400.

- Housing gross profit margin decreased

70 basis points to 16.5%.

- Adjusted housing gross profit margin, a

metric that excludes the amortization of previously capitalized

interest and inventory impairment and land option contract

abandonment charges of $5.5 million, declined 60 basis points to

21.6%. On a sequential basis, this metric improved 40 basis points

from the 2016 third quarter.

- Selling, general and administrative

expenses improved 80 basis points to 9.2% of housing revenues, the

lowest fourth-quarter ratio in the Company’s history.

- Homebuilding operating income decreased

20% to $56.0 million, reflecting total inventory-related charges of

$36.1 million, compared to $5.1 million.

- Homebuilding operating income margin

was 4.7%. Excluding total inventory-related charges, homebuilding

operating income margin was 7.7%.

- Land sale losses of $30.4 million

included $30.6 million of inventory impairment charges related to

planned future land sales.

- Financial services posted a loss of $.7

million, primarily due to the wind-down of Home Community Mortgage,

LLC, the Company’s mortgage banking joint venture with Nationstar

Mortgage LLC.

- In connection with the wind-down

process, Home Community Mortgage’s operations and certain assets

have been transferred to Stearns Lending, LLC. Stearns Lending is

currently offering mortgage banking services to the Company’s

homebuyers.

- The Company and Stearns Lending have

formed a mortgage banking joint venture that is expected to be

operational in most of the Company’s served markets by the end of

the 2017 second quarter, subject to obtaining requisite regulatory

approvals.

- Pretax income decreased 21% to $55.0

million. Excluding total inventory-related charges, pretax income

increased 21% to $91.1 million.

- Income tax expense of $17.5 million was

favorably impacted by $4.8 million of federal energy tax credits

earned from building energy-efficient homes, and represented an

effective tax rate of 31.8%.

- Net income totaled $37.5 million, or

$.40 per diluted share.

Twelve Months Ended November 30, 2016

(comparisons on a year-over-year basis)

- Total revenues increased 19% to $3.59

billion.

- Land sale revenues totaled $7.4

million, compared to $112.8 million.

- Housing revenues grew 23% to $3.58

billion.

- Deliveries rose 20% to 9,829

homes.

- Average selling price increased 3% to

$363,800.

- Homebuilding operating income rose 10%

to $152.4 million.

- Inventory impairment and land option

contract abandonment charges totaled $52.8 million, compared to

$9.6 million.

- Net income grew 25% to $105.6 million,

and earnings per diluted share increased 32% to $1.12 from

$.85.

Backlog and Net Orders (comparisons on

a year-over-year basis)

- Net orders for the quarter increased

20% to 2,254, and net order value grew 27% to $855.9 million.

- Homes in backlog as of November 30,

2016 rose 11% to 4,420. Ending backlog value grew 19% to $1.52

billion, with double-digit increases in three of the Company’s four

regions.

- The cancellation rate as a percentage

of beginning backlog for the quarter improved to 15% from 19%, and

as a percentage of gross orders improved to 25% from 32%.

- Average community count for the quarter

decreased 8% to 231.

Balance Sheet as of November 30, 2016

(comparisons on a year-over-year basis)

- Cash and cash equivalents increased to

$592.1 million, compared to $559.0 million.

- Inventories were $3.40 billion, with

investments in land acquisition and development totaling $1.36

billion for the year ended November 30, 2016.

- Lots owned or controlled totaled

44,825, of which 79% were owned.

- There were no cash borrowings

outstanding under the Company’s unsecured revolving credit

facility.

- In 2016, the Company repurchased nearly

8.4 million shares of its common stock at a total cost of $85.9

million, while improving its ratio of debt to capital to 60.5% and

its ratio of net debt to total capital to 54.3%. All of these

repurchases occurred during the 2016 first quarter.

- Reflecting the first-quarter

repurchases of common stock, average diluted shares outstanding for

the quarter decreased 7% from the year-earlier quarter to 95.7

million.

- Book value per share increased 11% to

$20.25.

- As announced last month, the Company

elected to exercise its optional redemption rights under the terms

of its 9.100% Senior Notes due 2017, which mature on September 15,

2017. On January 13, 2017, the Company will redeem $100.0 million

in aggregate principal amount of the notes using internally

generated cash. In connection with this early extinguishment of

debt, the Company will recognize a charge of approximately $5.4

million in the 2017 first quarter.

Earnings Conference Call

The conference call to discuss the Company’s fourth quarter 2016

earnings will be broadcast live TODAY at 2:00 p.m. Pacific Time,

5:00 p.m. Eastern Time. To listen, please go to the Investor

Relations section of the Company’s website at www.kbhome.com.

About KB Home

KB Home (NYSE: KBH) is one of the largest and most recognized

homebuilders in the United States and an industry leader in

sustainability, building innovative and highly energy- and

water-efficient new homes. Founded in 1957 and the first

homebuilder listed on the New York Stock Exchange, the Company has

built nearly 600,000 homes for families from coast to coast.

Distinguished by its personalized homebuilding approach, KB Home

lets each buyer choose their lot location, floor plan, décor

choices, design features and other special touches that matter most

to them. To learn more about KB Home, call 888-KB-HOMES, visit

www.kbhome.com or connect on Facebook.com/KBHome or

Twitter.com/KBHome.

Forward-Looking and Cautionary

Statements

Certain matters discussed in this press release, including any

statements that are predictive in nature or concern future market

and economic conditions, business and prospects, our future

financial and operational performance, or our future actions and

their expected results are “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are based on current expectations and

projections about future events and are not guarantees of future

performance. We do not have a specific policy or intent of updating

or revising forward-looking statements. Actual events and results

may differ materially from those expressed or forecasted in

forward-looking statements due to a number of factors. The most

important risk factors that could cause our actual performance and

future events and actions to differ materially from such

forward-looking statements include, but are not limited to the

following: general economic, employment and business conditions;

population growth, household formations and demographic trends;

conditions in the capital, credit and financial markets; our

ability to access external financing sources and raise capital

through the issuance of common stock, debt or other securities,

and/or project financing, on favorable terms; material and trade

costs and availability; changes in interest rates; our debt level,

including our ratio of debt to capital, and our ability to adjust

our debt level and maturity schedule; our compliance with the terms

of our revolving credit facility; volatility in the market price of

our common stock; weak or declining consumer confidence, either

generally or specifically with respect to purchasing homes;

competition from other sellers of new and resale homes; weather

events, significant natural disasters and other climate and

environmental factors, including the severe prolonged drought and

related water-constrained conditions in the southwest United States

and California; government actions, policies, programs and

regulations directed at or affecting the housing market (including

the Dodd-Frank Act, tax benefits associated with purchasing and

owning a home, and the standards, fees and size limits applicable

to the purchase or insuring of mortgage loans by

government-sponsored enterprises and government agencies), the

homebuilding industry, or construction activities; the availability

and cost of land in desirable areas; our warranty claims experience

with respect to homes previously delivered and actual warranty

costs incurred; costs and/or charges arising from regulatory

compliance requirements or from legal, arbitral or regulatory

proceedings, investigations, claims or settlements, including

unfavorable outcomes in any such matters resulting in actual or

potential monetary damage awards, penalties, fines or other direct

or indirect payments, or injunctions, consent decrees or other

voluntary or involuntary restrictions or adjustments to our

business operations or practices that are beyond our current

expectations and/or accruals; our ability to use/realize the net

deferred tax assets we have generated; our ability to successfully

implement our current and planned strategies and initiatives

related to our product, geographic and market positioning

(including our plans to transition out of the Metro Washington,

D.C. area), gaining share and scale in our served markets; our

operational and investment concentration in markets in California;

consumer interest in our new home communities and products,

particularly from first-time homebuyers and higher-income

consumers; our ability to generate orders and convert our backlog

of orders to home deliveries and revenues, particularly in key

markets in California; our ability to successfully implement our

returns-focused growth roadmap/strategy and achieve the associated

revenue, margin, profitability, cash flow, community reactivation,

land sales, business growth, asset efficiency, return on invested

capital, return on equity, net debt-to-capital ratio and other

financial and operational targets and objectives; the ability of

our homebuyers to obtain residential mortgage loans and mortgage

banking services; the performance of mortgage lenders to our

homebuyers; completing the wind-down of Home Community Mortgage as

planned; Stearns Lending, LLC’s management of Home Community

Mortgage’s assets and operations; whether we can operate a joint

venture with Stearns Lending, LLC or any other mortgage banking

services provider, and the performance of any such mortgage banking

joint venture once operational; information technology failures and

data security breaches; and other events outside of our control.

Please see our periodic reports and other filings with the

Securities and Exchange Commission for a further discussion of

these and other risks and uncertainties applicable to our

business.

KB HOME CONSOLIDATED STATEMENTS OF OPERATIONS

For the Twelve Months and Three Months Ended November 30, 2016 and

2015 (In Thousands, Except Per Share Amounts)

Twelve Months Ended Three Months Ended

November 30, November 30, 2016 2015 2016

2015

Total revenues $ 3,594,646

$ 3,032,030 $ 1,191,942 $ 985,783

Homebuilding: Revenues $ 3,582,943 $ 3,020,987 $ 1,188,628 $

982,091 Costs and expenses (3,430,542 ) (2,882,366 )

(1,132,634 ) (911,712 ) Operating income 152,401

138,621 55,994 70,379 Interest income 529 458 134 116 Interest

expense (5,900 ) (21,856 ) (233 ) (4,006 ) Equity in loss of

unconsolidated joint ventures (2,181 ) (1,804 )

(217 ) (624 ) Homebuilding pretax income

144,849 115,419 55,678

65,865

Financial services: Revenues 11,703 11,043

3,314 3,692 Expenses (3,817 ) (3,711 ) (1,196 ) (909 ) Equity in

income (loss) of unconsolidated joint ventures (3,420 )

4,292 (2,768 ) 1,269 Financial

services pretax income (loss) 4,466 11,624

(650 ) 4,052

Total pretax income

149,315 127,043 55,028 69,917 Income tax expense (43,700 )

(42,400 ) (17,500 ) (25,900 )

Net

income $ 105,615 $ 84,643 $ 37,528 $

44,017

Earnings per share: Basic $ 1.23

$ .92 $ .44 $ .48

Diluted $ 1.12

$ .85 $ .40 $ .43

Weighted average shares

outstanding: Basic 85,706 92,054

84,961 92,200

Diluted

96,278 102,857 95,744

102,844

KB HOME CONSOLIDATED

BALANCE SHEETS

(In Thousands)

November 30,

November 30, 2016 2015

Assets Homebuilding: Cash and

cash equivalents $ 592,086 $ 559,042 Restricted cash — 9,344

Receivables 231,665 247,998 Inventories 3,403,228 3,313,747

Investments in unconsolidated joint ventures 64,016 71,558 Deferred

tax assets, net 738,985 782,196 Other assets 91,145

88,992 5,121,125 5,072,877

Financial services 10,499

14,028

Total assets $ 5,131,624 $ 5,086,905

Liabilities and stockholders’ equity Homebuilding:

Accounts payable $ 215,331 $ 183,770 Accrued expenses and other

liabilities 550,996 608,730 Notes payable 2,640,149

2,601,754 3,406,476 3,394,254

Financial services 2,003 1,817

Stockholders’ equity 1,723,145 1,690,834

Total liabilities and stockholders’ equity $ 5,131,624 $

5,086,905

KB HOME SUPPLEMENTAL

INFORMATION For the Twelve Months and Three Months Ended

November 30, 2016 and 2015 (In Thousands, Except Average Selling

Price) Twelve Months Ended

Three Months Ended November 30, November 30, 2016

2015 2016 2015

Homebuilding revenues: Housing $ 3,575,548 $ 2,908,236 $

1,185,383 $ 979,841 Land 7,395 112,751

3,245 2,250 Total $ 3,582,943 $

3,020,987 $ 1,188,628 $ 982,091

Homebuilding costs and expenses: Construction and land costs

Housing $ 2,997,073 $ 2,433,683 $ 989,452 $ 811,153 Land

44,028 105,685 33,627

2,239 Subtotal 3,041,101 2,539,368 1,023,079 813,392

Selling, general and administrative expenses 389,441

342,998 109,555 98,320

Total $ 3,430,542 $ 2,882,366 $ 1,132,634 $

911,712

Interest expense: Interest

incurred $ 185,466 $ 186,885 $ 46,472 $ 46,096 Interest capitalized

(179,566 ) (165,029 ) (46,239 ) (42,090

) Total $ 5,900 $ 21,856 $ 233 $ 4,006

Other information: Depreciation and

amortization $ 11,213 $ 11,149 $ 2,782 $ 2,736 Amortization of

previously capitalized interest 161,285

143,255 54,622 43,767

Average selling price: West Coast $ 579,900 $ 587,000

$ 593,400 $ 617,600 Southwest 287,000 284,600 288,600 295,300

Central 270,100 252,200 280,300 269,400 Southeast 281,400

281,900 285,900 291,100

Total $ 363,800 $ 354,800 $ 387,400 $

379,800

KB HOME SUPPLEMENTAL

INFORMATION For the Twelve Months and Three Months Ended

November 30, 2016 and 2015

(Dollars in Thousands)

Twelve Months Ended

Three Months Ended November 30, November 30, 2016

2015 2016 2015

Homes

delivered: West Coast 2,825 2,258 1,026 760 Southwest 1,559

1,311 448 423 Central 3,744 3,183 1,097 971 Southeast 1,701

1,444 489 426 Total 9,829 8,196

3,060 2,580

Net orders: West

Coast 3,000 2,403 675 517 Southwest 1,758 1,592 421 287 Central

3,881 3,536 839 672 Southeast 1,644 1,722 319

406 Total 10,283 9,253 2,254

1,882

Net order value: West Coast $ 1,756,945

$ 1,378,644 $ 410,854 $ 290,469 Southwest 507,870 455,918 122,369

87,524 Central 1,075,586 943,568 230,422 184,976 Southeast

472,754 477,040 92,245 112,871 Total $

3,813,155 $ 3,255,170 $ 855,890 $ 675,840

November 30, 2016 November 30, 2015 Backlog Homes Backlog Value

Backlog Homes Backlog Value

Backlog data: West Coast 913 $

526,840 738 $ 407,972 Southwest 804 227,822 605 167,425 Central

1,979 559,172 1,842 494,836 Southeast 724 205,255

781 211,245 Total 4,420 $ 1,519,089

3,966 $ 1,281,478

KB HOMERECONCILIATION OF NON-GAAP

FINANCIAL MEASURESFor the Twelve Months and Three Months Ended

November 30, 2016 and 2015(In Thousands, Except

Percentages)

This press release contains, and Company management’s discussion

of the results presented in this press release may include,

information about the Company’s adjusted housing gross profit

margin and ratio of net debt to capital, both of which are not

calculated in accordance with generally accepted accounting

principles (“GAAP”). The Company believes these non-GAAP financial

measures are relevant and useful to investors in understanding its

operations and the leverage employed in its operations, and may be

helpful in comparing the Company with other companies in the

homebuilding industry to the extent they provide similar

information. However, because the adjusted housing gross profit

margin and the ratio of net debt to capital are not calculated in

accordance with GAAP, these financial measures may not be

completely comparable to other companies in the homebuilding

industry and, therefore, should not be considered in isolation or

as an alternative to operating performance and/or financial

measures prescribed by GAAP. Rather, these non-GAAP financial

measures should be used to supplement their respective most

directly comparable GAAP financial measures in order to provide a

greater understanding of the factors and trends affecting the

Company’s operations.

Adjusted Housing Gross Profit

Margin

The following table reconciles the Company’s housing gross

profit margin calculated in accordance with GAAP to the non-GAAP

financial measure of the Company’s adjusted housing gross profit

margin:

Twelve Months Ended

Three Months Ended November 30, November 30, 2016

2015 2016 2015 Housing revenues

$ 3,575,548 $ 2,908,236 $ 1,185,383 $ 979,841 Housing construction

and land costs (2,997,073 ) (2,433,683 )

(989,452 ) (811,153 ) Housing gross profits 578,475 474,553

195,931 168,688 Add: Amortization of previously capitalized

interest (a) 160,633 126,817 54,452 43,767 Inventory-related

charges (b) 16,152 9,591 5,537

5,075 Adjusted housing gross profits $ 755,260

$ 610,961 $ 255,920 $ 217,530 Housing

gross profit margin as a percentage of housing revenues 16.2

% 16.3 % 16.5 % 17.2 % Adjusted housing gross

profit margin as a percentage of housing revenues 21.1 %

21.0 % 21.6 % 22.2 %

(a) Represents the amortization of previously capitalized

interest associated with housing operations.

(b) Represents inventory impairment and land option contract

abandonment charges associated with housing operations.

Adjusted housing gross profit margin is a non-GAAP financial

measure, which the Company calculates by dividing housing revenues

less housing construction and land costs excluding (1) amortization

of previously capitalized interest associated with housing

operations and (2) housing inventory impairment and land option

contract abandonment charges recorded during a given period, by

housing revenues. The most directly comparable GAAP financial

measure is housing gross profit margin. The Company believes

adjusted housing gross profit margin is a relevant and useful

financial measure to investors in evaluating the Company’s

performance as it measures the gross profits the Company generated

specifically on the homes delivered during a given period. This

non-GAAP financial measure isolates the impact that the

amortization of previously capitalized interest associated with

housing operations, and housing inventory impairment and land

option contract abandonment charges have on housing gross profit

margins, and allows investors to make comparisons with the

Company’s competitors that adjust housing gross profit margins in a

similar manner. The Company also believes investors will find

adjusted housing gross profit margin relevant and useful because it

represents a profitability measure that may be compared to a prior

period without regard to variability of amortization of previously

capitalized interest associated with housing operations, and

housing inventory impairment and land option contract abandonment

charges. This financial measure assists management in making

strategic decisions regarding community location and product mix,

product pricing and construction pace.

KB HOMERECONCILIATION OF NON-GAAP

FINANCIAL MEASURES(In Thousands, Except Percentages)

Ratio of Net Debt to Capital

The following table reconciles the Company’s ratio of debt to

capital calculated in accordance with GAAP to the non-GAAP

financial measure of the Company’s ratio of net debt to

capital:

November 30,

November 30, 2016 2015 Notes payable $ 2,640,149 $ 2,601,754

Stockholders’ equity 1,723,145 1,690,834

Total capital $ 4,363,294 $ 4,292,588 Ratio of

debt to capital 60.5 % 60.6 % Notes

payable $ 2,640,149 $ 2,601,754 Less: Cash and cash equivalents and

restricted cash (592,086 ) (568,386 ) Net debt

2,048,063 2,033,368 Stockholders’ equity 1,723,145

1,690,834 Total capital $ 3,771,208 $

3,724,202 Ratio of net debt to capital 54.3 %

54.6 %

The ratio of net debt to capital is a non-GAAP financial

measure, which the Company calculates by dividing notes payable,

net of homebuilding cash and cash equivalents and restricted cash,

by capital (notes payable, net of homebuilding cash and cash

equivalents and restricted cash, plus stockholders’ equity). The

most directly comparable GAAP financial measure is the ratio of

debt to capital. The Company believes the ratio of net debt to

capital is a relevant and useful financial measure to investors in

understanding the leverage employed in the Company’s

operations.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170111006026/en/

KB HomeJill Peters, Investor Relations Contact(310)

893-7456jpeters@kbhome.comorSusan Martin, Media Contact(310)

231-4142smartin@kbhome.com

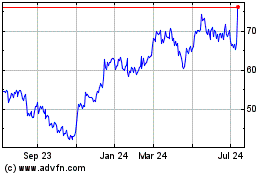

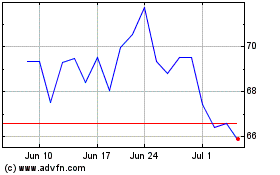

KB Home (NYSE:KBH)

Historical Stock Chart

From Mar 2024 to Apr 2024

KB Home (NYSE:KBH)

Historical Stock Chart

From Apr 2023 to Apr 2024