Fourth Quarter Revenues Up 24% to $986

Million; Pretax Income Up Significantly to $70 Million

Backlog Value Increases 40% to $1.3

Billion

KB Home (NYSE: KBH), one of the nation’s largest and most

recognized homebuilders, today reported results for its fourth

quarter and year ended November 30, 2015. Highlights and

developments include the following:

Three Months Ended November 30,

2015

- Total revenues grew 24% from the

year-earlier quarter to $985.8 million, marking the Company’s 17th

consecutive quarter of year-over-year revenue increases.

- Housing revenues rose 25% to $979.8

million from $783.5 million in the fourth quarter of 2014, driven

by increased delivery volume and a higher overall average selling

price.

- The Company delivered 2,580 homes, up

16% from 2,229 a year ago, representing its highest number of

fourth-quarter deliveries since 2009.

- The overall average selling price of

$379,800 rose 8% from $351,500 in the year-earlier quarter,

reflecting increases in each of the Company’s four regions,

including double-digit increases in the Southwest and Central

regions.

- Land sale revenues totaled $2.3

million, compared to $9.3 million in the fourth quarter of

2014.

- Homebuilding operating income increased

to $70.4 million from $30.0 million in the corresponding quarter of

2014. The current quarter included $5.1 million of inventory

impairment and land option contract abandonment charges, while the

year-earlier quarter included $34.2 million of inventory impairment

charges.

- The Company’s housing gross profit

margin of 17.2% improved 100 basis points from the third quarter of

2015 and was essentially flat with the year-earlier quarter. The

current quarter housing gross profit margin included approximately

50 basis points of inventory impairment and land option contract

abandonment charges.

- The Company’s adjusted housing gross

profit margin, which excludes the amortization of previously

capitalized interest associated with housing operations and housing

inventory impairment and land option contract abandonment charges,

was 22.2%, representing a 110 basis-point improvement from the

third quarter of 2015 and a 50 basis-point decrease from the fourth

quarter of 2014. The year-over-year adjusted housing gross profit

margin comparison for the current period improved by 180 basis

points relative to the year-over-year comparison for the first

quarter of 2015.

- Selling, general and administrative

expenses represented 10.0% of housing revenues, a 190 basis-point

improvement compared to the third quarter of 2015 and 50

basis-point improvement from the year-earlier quarter. It was the

Company’s lowest fourth-quarter ratio since 2007.

- Interest expense of $4.0 million

decreased slightly from $4.5 million in the year-earlier quarter,

largely due to a higher amount of the Company’s inventory

qualifying for interest capitalization.

- The Company’s financial services

operations generated pretax income of $4.1 million, up from $3.4

million in the fourth quarter of 2014, reflecting an increase in

the equity in income from Home Community Mortgage, LLC, the

Company’s mortgage banking joint venture.

- The Company’s pretax income increased

to $69.9 million, its highest fourth-quarter level since 2005 and a

144% increase from the $28.6 million reported in the year-earlier

quarter.

- Net income totaled $44.0 million, or

$.43 per diluted share, versus $852.8 million, or $8.36 per diluted

share a year ago. The 2014 fourth-quarter result reflected the

Company’s reversal of $825.2 million of its deferred tax asset

valuation allowance.

- Income tax expense for the current

quarter was $25.9 million and represented an effective tax rate of

37.0%. The income tax benefit of $824.2 million in the year-earlier

quarter included the impact of the deferred tax asset valuation

allowance reversal.

Twelve Months Ended November 30,

2015

- Total revenues increased to $3.03

billion, up 26% from $2.40 billion in the year-earlier period.

- Housing revenues rose 23% to $2.91

billion from $2.37 billion in 2014.

- Homes delivered increased 14% to 8,196,

compared to 7,215 a year ago.

- The overall average selling price of

$354,800 rose 8% from $328,400 in the prior year.

- Land sale revenues increased to $112.8

million from $20.0 million in 2014.

- Homebuilding operating income of $138.6

million rose 20% from $116.0 million in 2014.

- Pretax income increased 34% to $127.0

million, up from $94.9 million a year ago.

- Net income totaled $84.6 million, or

$.85 per diluted share, compared to $918.3 million, or $9.25 per

diluted share in 2014.

- Income tax expense totaled $42.4

million and represented an effective tax rate of 33.4% in 2015. The

effective tax rate reflects the favorable impact of federal energy

tax credits the Company earned from building energy efficient

homes. The Company’s income tax benefit of $823.4 million in 2014

reflected the impact of the deferred tax asset valuation allowance

reversal.

Backlog and Net Orders

- The dollar value of homes in backlog

grew 40% to $1.28 billion at November 30, 2015 from $914.0

million at November 30, 2014, reflecting substantial increases in

each of the Company’s four regions. These increases ranged from 15%

in the West Coast region to 104% in the Southwest region.

- The number of homes in backlog at

November 30, 2015 increased 36% to 3,966, compared to 2,909 a

year ago.

- The Company’s ending backlog, in terms

of both homes and value, reached its highest fourth-quarter level

since 2007.

- The value of the Company’s

fourth-quarter net orders increased 15% to $675.8 million from

$587.4 million in the year-earlier quarter. The Company’s net order

value has now increased year over year for 15 consecutive quarters.

- Each of the Company’s four regions

produced year-over-year growth in net order value, ranging from 8%

in the West Coast region to 30% in the Southeast region.

- Net orders for the current quarter grew

10% to 1,882, compared to 1,706 in the year-earlier quarter.

- The cancellation rate as a percentage

of gross orders improved to 32% from 37% for the fourth quarter of

2014, and as a percentage of beginning backlog improved to 19%

versus 29% a year ago.

- The Company’s overall average community

count for the fourth quarter increased 17% to 250, compared to 214

for the year-earlier quarter. At November 30, 2015, the Company had

247 communities open for sales, up 9% from 227 communities a year

ago.

- Net order value for the year rose 26%

from the previous year, reflecting a 22% increase in net orders to

9,253, the Company’s highest annual net orders since 2007.

Balance Sheet

- Cash, cash equivalents and restricted

cash totaled $568.4 million at November 30, 2015 and $383.6

million at November 30, 2014.

- Inventories increased to $3.31 billion

at November 30, 2015 from $3.22 billion at November 30, 2014,

reflecting the Company’s investments in land acquisition and

development during 2015.

- The Company’s investments in land

acquisition and development totaled $967.2 million in 2015 and

$1.47 billion in 2014.

- At November 30, 2015, the Company owned

or controlled 47,399 lots, of which 38,060 lots were owned and

9,339 lots were controlled under land option contracts.

- Notes payable totaled $2.63 billion at

November 30, 2015, compared to $2.58 billion at November 30,

2014.

- The Company had no cash borrowings

outstanding under its unsecured revolving credit facility as of

November 30, 2015.

- The Company’s ratio of debt to capital

was 60.8% as of November 30, 2015 and 61.8% as of November 30,

2014. The ratio of net debt to capital was 54.9% at

November 30, 2015 and 57.9% at November 30, 2014.

Management Comments

“Our fourth-quarter results represent a strong finish to a

successful year for KB Home, where we generated substantial

improvement in many key metrics, including our highest

fourth-quarter pretax income since 2005,” said Jeffrey Mezger,

president and chief executive officer. “In 2015, we achieved

measurable growth and profitability, advanced our core strategies

and continued to invest in our operating platform. Of particular

importance, we effectively targeted and executed on key initiatives

that accelerated our revenues and earnings in the second half of

the year and produced sequential improvement in our housing gross

profit margin as 2015 progressed.”

“While inclement weather and trade shortages in certain markets

tempered our fourth-quarter deliveries and revenues, we have a

positive rhythm in our business and substantial momentum as we

enter 2016,” continued Mezger. “With our higher backlog giving us

strong visibility for potential future deliveries and revenues, and

housing market conditions expected to remain generally healthy, we

believe we are well-positioned strategically, financially and

operationally for further success in 2016. As we move forward, we

will remain focused on executing on our strategy, providing an

outstanding customer experience, and creating stockholder

value.”

Earnings Conference Call

The conference call on the fourth quarter 2015 earnings will be

broadcast live TODAY at 8:30 a.m. Pacific Standard Time, 11:30 a.m.

Eastern Standard Time. To listen, please go to the Investor

Relations section of the Company’s website at www.kbhome.com.

About KB Home

KB Home is one of the largest and most recognized homebuilders

in the United States and an industry leader in sustainability,

building innovative and highly energy- and water-efficient new

homes. Founded in 1957 and the first NYSE-listed homebuilder

(ticker symbol: KBH), the company has built nearly 600,000 homes

for families from coast to coast. Distinguished by its personalized

homebuilding approach, KB Home lets each buyer choose their lot

location, floor plan, décor choices, design features and other

special touches that matter most to them. To learn more about KB

Home, call 888-KB-HOMES, visit www.kbhome.com or connect on

Facebook.com/KBHome or Twitter.com/KBHome.

Forward-Looking and Cautionary

Statements

Certain matters discussed in this press release, including any

statements that are predictive in nature or concern future market

and economic conditions, business and prospects, our future

financial and operational performance, or our future actions and

their expected results are “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are based on current expectations and

projections about future events and are not guarantees of future

performance. We do not have a specific policy or intent of updating

or revising forward-looking statements. Actual events and results

may differ materially from those expressed or forecasted in

forward-looking statements due to a number of factors. The most

important risk factors that could cause our actual performance and

future events and actions to differ materially from such

forward-looking statements include, but are not limited to the

following: general economic, employment and business conditions;

population growth, household formations and demographic trends;

adverse market conditions, including an increased supply of unsold

homes, declining home prices and greater foreclosure and short sale

activity, among other things, that could negatively affect our

consolidated financial statements, including due to additional

impairment or land option contract abandonment charges, lower

revenues and operating and other losses; conditions in the capital,

credit and financial markets (including residential mortgage

lending standards, the availability of residential mortgage

financing and mortgage foreclosure rates); material prices and

availability; trade costs and availability; changes in interest

rates; inflation; our debt level, including our ratio of debt to

capital, and our ability to adjust our debt level, maturity

schedule and structure and to access the equity, credit, capital or

other financial markets or other external financing sources,

including raising capital through the public or private issuance of

common stock, debt or other securities, and/or project financing,

on favorable terms; our compliance with the terms and covenants of

our revolving credit facility; weak or declining consumer

confidence, either generally or specifically with respect to

purchasing homes; competition for home sales from other sellers of

new and resale homes, including lenders and other sellers of homes

obtained through foreclosures or short sales; weather events,

significant natural disasters and other climate and environmental

factors, including the severe prolonged serious drought and related

water-constrained conditions in the southwest United States and

California; government actions, policies, programs and regulations

directed at or affecting the housing market (including the

Dodd-Frank Act, tax credits, tax incentives and/or subsidies for

home purchases, tax deductions for residential mortgage interest

payments and property taxes, tax exemptions for profits on home

sales, programs intended to modify existing mortgage loans and to

prevent mortgage foreclosures and the standards, fees and size

limits applicable to the purchase or insuring of mortgage loans by

government-sponsored enterprises and government agencies), the

homebuilding industry, or construction activities; decisions

regarding federal fiscal and monetary policies, including those

relating to taxation, government spending, interest rates and

economic stimulus measures; the availability and cost of land in

desirable areas; our warranty claims experience with respect to

homes previously delivered and actual warranty costs incurred,

including our warranty claims and costs experience at certain of

our communities in Florida; costs and/or charges arising from

regulatory compliance requirements or from legal, arbitral or

regulatory proceedings, investigations, claims or settlements,

including unfavorable outcomes in any such matters resulting in

actual or potential monetary damage awards, penalties, fines or

other direct or indirect payments, or injunctions, consent decrees

or other voluntary or involuntary restrictions or adjustments to

our business operations or practices that are beyond our current

expectations and/or accruals; our ability to use/realize the net

deferred tax assets we have generated; our ability to successfully

implement our current and planned strategies and initiatives with

respect to product, geographic and market positioning (including

our efforts to expand our inventory base/pipeline with desirable

land positions or interests at reasonable cost and to expand our

community count, open additional communities for sales, sell

higher-priced homes and more design options, increase the size and

value of our backlog, and our operational and investment

concentration in markets in California), revenue growth, asset

optimization (including by effectively balancing home sales prices

and sales pace in our communities), asset activation and/or

monetization, local field management and talent investment,

containing and leveraging overhead costs, gaining share and scale

in our served markets and increasing our housing gross profit

margins and profitability; consumer traffic to our new home

communities and consumer interest in our product designs and

offerings, particularly from higher-income consumers; cancellations

and our ability to realize our backlog by converting net orders to

home deliveries and revenues; our home sales and delivery

performance, particularly in key markets in California; our ability

to generate cash from our operations, enhance our asset efficiency,

increase our operating income margin and/or improve our return on

invested capital; the manner in which our homebuyers are offered

and whether they are able to obtain residential mortgage loans and

mortgage banking services, including from Home Community Mortgage;

the performance of Home Community Mortgage; information technology

failures and data security breaches; and other events outside of

our control. Please see our periodic reports and other filings with

the Securities and Exchange Commission for a further discussion of

these and other risks and uncertainties applicable to our

business.

KB HOME CONSOLIDATED STATEMENTS OF OPERATIONS

For the Twelve Months and Three Months Ended November 30, 2015 and

2014 (In Thousands, Except Per Share Amounts)

Twelve Months Three Months 2015

2014 2015 2014

Total

revenues $ 3,032,030 $ 2,400,949 $ 985,783

$ 796,041

Homebuilding: Revenues $ 3,020,987 $

2,389,643 $ 982,091 $ 792,749 Costs and expenses (2,882,366

) (2,273,674 ) (911,712 ) (762,701 ) Operating

income 138,621 115,969 70,379 30,048 Interest income 458 443 116 50

Interest expense (21,856 ) (30,750 ) (4,006 ) (4,461 ) Equity in

income (loss) of unconsolidated joint ventures (1,804 )

741 (624 ) (420 ) Homebuilding pretax

income 115,419 86,403 65,865

25,217

Financial services: Revenues

11,043 11,306 3,692 3,292 Expenses (3,711 ) (3,446 ) (909 ) (883 )

Equity in income of unconsolidated joint ventures 4,292

686 1,269 975

Financial services pretax income 11,624 8,546

4,052 3,384

Total pretax

income 127,043 94,949 69,917 28,601 Income tax benefit

(expense) (42,400 ) 823,400 (25,900 )

824,200

Net income $ 84,643 $ 918,349

$ 44,017 $ 852,801

Earnings per share:

Basic $ .92 $ 10.26 $ .48 $ 9.25

Diluted $ .85 $ 9.25 $ .43 $ 8.36

Weighted average shares outstanding: Basic

92,054 89,265 92,200

91,902

Diluted 102,857

99,314 102,844 101,831

KB HOME CONSOLIDATED BALANCE SHEETS

(In Thousands)

November 30,

November 30, 2015 2014

Assets Homebuilding: Cash and

cash equivalents $ 559,042 $ 356,366 Restricted cash 9,344 27,235

Receivables 152,682 125,488 Inventories 3,313,747 3,218,387

Investments in unconsolidated joint ventures 71,558 79,441 Deferred

tax assets, net 782,196 825,232 Other assets 112,774

114,915 5,001,343 4,747,064

Financial services 14,028

10,486

Total assets $ 5,015,371 $ 4,757,550

Liabilities and stockholders’ equity Homebuilding:

Accounts payable $ 183,770 $ 172,716 Accrued expenses and other

liabilities 513,414 409,882 Notes payable 2,625,536

2,576,525 3,322,720 3,159,123

Financial services 1,817 2,517

Stockholders’ equity 1,690,834 1,595,910

Total liabilities and stockholders’ equity $ 5,015,371 $

4,757,550

KB HOME SUPPLEMENTAL

INFORMATION For the Twelve Months and Three Months Ended

November 30, 2015 and 2014 (In Thousands, Except Average Selling

Price) Twelve Months

Three Months 2015 2014 2015

2014

Homebuilding revenues: Housing $

2,908,236 $ 2,369,633 $ 979,841 $ 783,460 Land 112,751

20,010 2,250 9,289

Total $ 3,020,987 $ 2,389,643 $ 982,091 $

792,749 Twelve Months Three Months 2015 2014 2015

2014

Homebuilding costs and expenses: Construction and land

costs Housing $ 2,433,683 $ 1,940,100 $ 811,153 $ 647,876 Land

105,685 45,551 2,239

32,517 Subtotal 2,539,368 1,985,651 813,392 680,393

Selling, general and administrative expenses 342,998

288,023 98,320 82,308

Total $ 2,882,366 $ 2,273,674 $ 911,712 $

762,701 Twelve Months Three Months 2015 2014 2015

2014

Interest expense: Interest incurred $ 186,885 $ 171,541

$ 46,096 $ 44,500 Interest capitalized (165,029 )

(140,791 ) (42,090 ) (40,039 ) Total $ 21,856

$ 30,750 $ 4,006 $ 4,461 Twelve Months

Three Months 2015 2014 2015 2014

Other information:

Depreciation and amortization $ 11,149 $ 9,544 $ 2,736 $ 2,621

Amortization of previously capitalized interest 143,255

90,804 43,767 31,333

Twelve Months Three Months 2015 2014 2015 2014

Average selling price: West Coast $ 587,000 $ 569,700 $

617,600 $ 611,700 Southwest 284,600 271,100 295,300 255,400 Central

252,200 223,800 269,400 234,500 Southeast 281,900

263,600 291,100 279,300

Total $ 354,800 $ 328,400 $ 379,800 $ 351,500

KB HOME

SUPPLEMENTAL INFORMATION

For the Twelve Months and Three Months

Ended November 30, 2015 and 2014

(Dollars in Thousands)

Twelve Months

Three Months 2015 2014 2015

2014

Homes delivered: West Coast 2,258 1,913 760 625

Southwest 1,311 736 423 215 Central 3,183 3,098 971 931 Southeast

1,444 1,468 426 458 Total 8,196

7,215 2,580 2,229 Twelve Months Three

Months 2015 2014 2015 2014

Net orders: West Coast 2,403

2,086 517 468 Southwest 1,592 872 287 282 Central 3,536 3,239 672

652 Southeast 1,722 1,370 406 304 Total

9,253 7,567 1,882 1,706 Twelve

Months Three Months 2015 2014 2015 2014

Net order value:

West Coast $ 1,378,644 $ 1,217,590 $ 290,469 $ 267,796 Southwest

455,918 230,632 87,524 75,040 Central 943,568 755,684 184,976

157,673 Southeast 477,040 376,045 112,871

86,866 Total $ 3,255,170 $ 2,579,951 $ 675,840 $ 587,375

November 30, 2015 November 30, 2014 Backlog Homes Backlog

Value Backlog Homes Backlog Value

Backlog data: West Coast

738 $ 407,972 593 $ 355,651 Southwest 605 167,425 324 82,140

Central 1,842 494,836 1,489 334,007 Southeast 781

211,245 503 142,227 Total 3,966 $ 1,281,478

2,909 $ 914,025

KB HOMERECONCILIATION OF NON-GAAP

FINANCIAL MEASURESFor the Twelve Months and Three Months Ended

November 30, 2015 and 2014(In Thousands, Except

Percentages)

This press release contains, and Company management’s discussion

of the results presented in this press release may include,

information about the Company’s adjusted housing gross profit

margin and ratio of net debt to capital, both of which are not

calculated in accordance with generally accepted accounting

principles (“GAAP”). The Company believes these non-GAAP financial

measures are relevant and useful to investors in understanding its

operations and the leverage employed in its operations, and may be

helpful in comparing the Company with other companies in the

homebuilding industry to the extent they provide similar

information. However, because the adjusted housing gross profit

margin and the ratio of net debt to capital are not calculated in

accordance with GAAP, these financial measures may not be

completely comparable to other companies in the homebuilding

industry and, therefore, should not be considered in isolation or

as an alternative to operating performance and/or financial

measures prescribed by GAAP. Rather, these non-GAAP financial

measures should be used to supplement their respective most

directly comparable GAAP financial measures in order to provide a

greater understanding of the factors and trends affecting the

Company’s operations.

Adjusted Housing Gross Profit

Margin

The following table reconciles the Company’s housing gross

profit margin calculated in accordance with GAAP to the non-GAAP

financial measure of the Company’s adjusted housing gross profit

margin:

Twelve Months

Three Months 2015 2014 2015

2014 Housing revenues $ 2,908,236 $ 2,369,633 $ 979,841 $

783,460 Housing construction and land costs (2,433,683 )

(1,940,100 ) (811,153 ) (647,876 ) Housing

gross profits 474,553 429,533 168,688 135,584

Add:

Amortization of previously capitalized

interest associated with housing operations

126,817 90,804 43,767 31,333 Housing inventory impairment and land

option contract abandonment charges 9,591

12,788 5,075 10,985 Adjusted

housing gross profits $ 610,961 $ 533,125 $ 217,530

$ 177,902 Housing gross profit margin as a percentage

of housing revenues 16.3 % 18.1 % 17.2 %

17.3 % Adjusted housing gross profit margin as a percentage

of housing revenues 21.0 % 22.5 % 22.2 %

22.7 %

Adjusted housing gross profit margin is a non-GAAP financial

measure, which the Company calculates by dividing housing revenues

less housing construction and land costs excluding (a) amortization

of previously capitalized interest associated with housing

operations and (b) housing inventory impairment and land option

contract abandonment charges recorded during a given period, by

housing revenues. The most directly comparable GAAP financial

measure is housing gross profit margin. The Company believes

adjusted housing gross profit margin is a relevant and useful

financial measure to investors in evaluating the Company’s

performance as it measures the gross profits the Company generated

specifically on the homes delivered during a given period. This

non-GAAP financial measure isolates the impact that the

amortization of previously capitalized interest associated with

housing operations, and housing inventory impairment and land

option contract abandonment charges have on housing gross profit

margins, and allows investors to make comparisons with the

Company’s competitors that adjust housing gross profit margins in a

similar manner. The Company also believes investors will find

adjusted housing gross profit margin relevant and useful because it

represents a profitability measure that may be compared to a prior

period without regard to variability of the amortization of

previously capitalized interest associated with housing operations,

and housing inventory impairment and land option contract

abandonment charges. This financial measure assists management in

making strategic decisions regarding product mix, product pricing

and construction pace.

KB HOMERECONCILIATION OF NON-GAAP

FINANCIAL MEASURES(In Thousands, Except Percentages)

Ratio of Net Debt to Capital

The following table reconciles the Company’s ratio of debt to

capital calculated in accordance with GAAP to the non-GAAP

financial measure of the Company’s ratio of net debt to

capital:

November 30,

November 30, 2015 2014 Notes payable $ 2,625,536 $ 2,576,525

Stockholders’ equity 1,690,834 1,595,910

Total capital $ 4,316,370 $ 4,172,435 Ratio of

debt to capital 60.8 % 61.8 % Notes payable $

2,625,536 $ 2,576,525 Less: Cash and cash equivalents and

restricted cash (568,386 ) (383,601 ) Net debt

2,057,150 2,192,924 Stockholders’ equity 1,690,834

1,595,910 Total capital $ 3,747,984 $

3,788,834 Ratio of net debt to capital 54.9 %

57.9 %

The ratio of net debt to capital is a non-GAAP financial

measure, which the Company calculates by dividing notes payable,

net of homebuilding cash and cash equivalents and restricted cash,

by capital (notes payable, net of homebuilding cash and cash

equivalents and restricted cash, plus stockholders’ equity). The

most directly comparable GAAP financial measure is the ratio of

debt to capital. The Company believes the ratio of net debt to

capital is a relevant and useful financial measure to investors in

understanding the leverage employed in the Company’s

operations.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20160107005331/en/

KB HomeKatoiya Marshall, Investor Relations Contact(310)

893-7446kmarshall@kbhome.comorSusan Martin, Media Contact(310)

231-4142smartin@kbhome.com

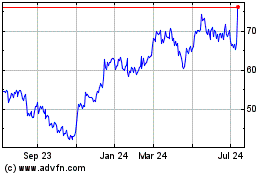

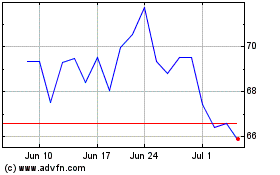

KB Home (NYSE:KBH)

Historical Stock Chart

From Mar 2024 to Apr 2024

KB Home (NYSE:KBH)

Historical Stock Chart

From Apr 2023 to Apr 2024