UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 11-K

| |

þ | ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2014

OR

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

Commission File No. 1-09195

KB HOME 401(k) SAVINGS PLAN

(Full title of the plan)

KB HOME

10990 Wilshire Boulevard

Los Angeles, California 90024

(Name of issuer of the securities held pursuant to the plan

and the address of its principal executive office)

|

|

FINANCIAL STATEMENTS AND SUPPLEMENTAL SCHEDULE KB Home 401(k) Savings Plan Years ended December 31, 2014 and 2013 |

KB Home 401(k) Savings Plan

Financial Statements and Supplemental Schedule

Years ended December 31, 2014 and 2013

Contents

|

| | |

| | |

| | |

Audited Financial Statements | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Report of Independent Registered Public Accounting Firm

The Administrative Committee, as Plan Administrator

of KB Home 401(k) Savings Plan

We have audited the accompanying statements of net assets available for benefits of KB Home 401(k) Savings Plan as of December 31, 2014 and 2013, and the related statements of changes in net assets available for benefits for the years then ended. These financial statements are the responsibility of KB Home 401(k) Savings Plan’s management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. We were not engaged to perform an audit of KB Home 401(k) Savings Plan’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of KB Home 401(k) Savings Plan’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements referred to above present fairly, in all material respects, the net assets available for benefits of KB Home 401(k) Savings Plan at December 31, 2014 and 2013, and the changes in its net assets available for benefits for the years then ended, in conformity with U.S. generally accepted accounting principles.

The accompanying supplemental schedule of assets (held at end of year) as of December 31, 2014, has been subjected to audit procedures performed in conjunction with the audit of KB Home 401(k) Savings Plan’s financial statements. The information in the supplemental schedules is the responsibility of the Plan’s management. Our audit procedures included determining whether the information reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the information, we evaluated whether such information, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the information is fairly stated, in all material respects, in relation to the financial statements as a whole.

/s/ Ernst & Young LLP

Los Angeles, California

June 26, 2015

KB Home 401(k) Savings Plan

Statements of Net Assets Available for Benefits

|

| | | | | | | |

| December 31, |

| 2014 | | 2013 |

Assets | | | |

Investments, at fair value: | | | |

Mutual funds | $ | 127,285,076 |

| | $ | 116,540,319 |

|

Money market fund | 12,189,751 |

| | 12,486,391 |

|

Real-time traded employer stock fund | 8,451,356 |

| | 9,453,435 |

|

| 147,926,183 |

| | 138,480,145 |

|

Receivables: | | | |

Notes receivable from participants | 3,218,312 |

| | 3,329,031 |

|

| 3,218,312 |

| | 3,329,031 |

|

Net assets available for benefits | $ | 151,144,495 |

| | $ | 141,809,176 |

|

See accompanying notes to financial statements.

KB Home 401(k) Savings Plan

Statements of Changes in Net Assets Available for Benefits

|

| | | | | | | |

| Years ended December 31, |

| 2014 | | 2013 |

Additions (Deductions) | | | |

Contributions: | | | |

Plan participants | $ | 7,251,359 |

| | $ | 6,166,744 |

|

Employer, net of forfeitures | 3,824,697 |

| | 3,432,649 |

|

Rollovers | 404,682 |

| | 334,268 |

|

| 11,480,738 |

| | 9,933,661 |

|

Investment income: | | | |

Interest and dividends | 7,614,875 |

| | 5,603,642 |

|

Net appreciation in fair value of investments | 198,259 |

| | 19,315,553 |

|

| 7,813,134 |

| | 24,919,195 |

|

| | | |

Interest on notes receivable from participants | 133,105 |

| | 136,693 |

|

Benefits paid to participants | (10,072,488 | ) | | (14,846,231 | ) |

Administrative expenses | (19,170 | ) | | (21,327 | ) |

| | | |

Net increase in net assets available for benefits | 9,335,319 |

| | 20,121,991 |

|

Net assets available for benefits | | | |

Beginning of year | 141,809,176 |

| | 121,687,185 |

|

End of year | $ | 151,144,495 |

| | $ | 141,809,176 |

|

See accompanying notes to financial statements.

KB Home 401(k) Savings Plan

Notes to Financial Statements

| |

1. | Description of the Plan |

General

The following description of the KB Home 401(k) Savings Plan (Plan) provides only general information. Eligible employees of KB Home (Company) who elect to participate in the Plan (each, a Participant) should refer to the governing Plan document for a more complete description of the Plan’s provisions.

The Plan is a defined contribution plan in which all eligible employees of the Company may participate beginning on the first day of the month following their date of hire. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (ERISA).

Contributions

Participants in the Plan may contribute up to 25% of their annual eligible compensation on a pretax basis. Participants may also contribute up to an additional 15% of their annual eligible compensation on an after-tax basis. All contributions are made in whole percentages through payroll deductions. Pretax contributions are eligible for tax deferred treatment up to the limits provided by the Internal Revenue Code (Code).

Each Participant whose designated per payroll period contribution rate is at least 6%, who has attained (or will attain) age 50 before the close of a Plan year and whose contributions for the Plan year will exceed the limits of Code Section 402(g) or other Plan limits, is eligible to make a catch-up contribution in accordance with, and subject to the limitations of, Code Section 414(v).

Unless otherwise determined by its Board of Directors, the Company matches 100% of a Participant’s pretax contribution up to 6% of eligible compensation for that payroll period (for Participants who are sales representatives, the Company matches 100% of pretax contributions up to 6% of eligible compensation for that payroll period on up to $50,000 of such eligible compensation per year).

The Plan accepts rollover contributions transferred from other qualified retirement plans or from individual retirement accounts, subject to the applicable provisions of the Plan.

Plan assets are held in trust by Fidelity Management Trust Company, Inc. (Trustee). Participants may direct the investment of their contributions among one or more of the several options offered under the Plan, and may elect to change the investment of their contributions or to transfer all or part of their individual Plan account balances among such options, subject in each case to applicable conditions and limitations established under the Plan.

A Participant can invest no more than 20% of new Plan contributions in the KB Home Stock Fund (as described below), and cannot transfer funds from another Plan investment option into the KB Home Stock Fund if the transfer would cause the proportionate value of the Participant’s overall Plan account balance that is invested in the KB Home Stock Fund to exceed 20%.

Vesting

Participants are immediately vested in their contributions and the earnings thereon. Subject to applicable Internal Revenue Service (IRS) rules and regulations, Company matching contributions and the earnings thereon are 100% vested to Participants after five years of service.

KB Home Stock Fund

On May 9, 2013, the employer stock fund investment option offered under the Plan was converted from a unitized employer stock fund to a real-time traded employer stock fund (KB Home Stock Fund), and Participant Plan account balances invested in the unitized employer stock fund were transferred to the KB Home Stock Fund. With the conversion, Participant Plan account balances in the KB Home Stock Fund represent investments in shares of the common stock of the Company rather than in units composed of such common stock and cash. Participant contributions to, and transactions in, the KB Home Stock Fund are direct investments and transactions in shares of the common stock of the Company, and investments in the KB Home Stock Fund will be valued at the then-current market price per share instead of a composed unit price.

Notes Receivable from Participants

Subject to the provisions of the Plan, a Participant may borrow up to 50% of the vested balance in the Participant’s Plan account not to exceed $50,000 in any one-year period. The minimum amount of any such loan is $1,000. Loans must be repaid within five years unless a loan is used to purchase a Participant’s principal residence, in which case the loan must be repaid within 15 years. The loans are secured by the vested balance in the borrowing Participant’s Plan account and bear interest at the prime rate plus 1%, as of the last day of the preceding calendar quarter in which a loan was made. Loans are generally repaid through payroll deductions. Loans not repaid within the timeframe specified by the Plan are considered to be in default and treated as a distribution to the Participant.

Distributions and Withdrawals

Participants who terminate their service with the Company may elect to withdraw or rollover their contributions, vested Company matching contributions, and related earnings thereon. Vested Plan account balances totaling $1,000 or less will be distributed as a lump-sum payment, and vested Plan account balances totaling more than $1,000, but less than $5,000 will be rolled into an individual retirement account. Such distributions or rollovers may be processed without a formerly employed Participant’s consent. Vested Plan account balances totaling $5,000 or more may be kept in the Plan. Participants may take hardship withdrawals from their Plan account balances subject to the limitations and requirements of the Plan. Participants must pay any outstanding loans under the Plan in full upon their termination of service with the Company.

Forfeitures

Unvested Company matching contributions for formerly employed Participants are forfeited and used by the Company in the following order: a) to restore the employer match and profit-sharing subaccounts of former Participants, if any; b) to reduce matching contributions for the Plan year allocated to the Participants’ employer match subaccounts in the same manner as matching contributions are allocated for the Plan year; c) to add to the profit-sharing contributions for the Plan year, if any; and d) to pay expenses of the Plan. For the Plan years ended December 31, 2014 and 2013, the Company used $500,264 and $340,493, respectively, of forfeitures to offset matching contributions. The forfeiture balances available to offset future matching contributions were $64,484 and $13,597 at December 31, 2014 and 2013, respectively.

Administrative Expenses

Certain administrative expenses of the Plan, such as recordkeeping fees, are paid directly by the Company. Other administrative expenses arising from Participants’ individual investment elections or transactions under the Plan, such as from the administration of Participant loans and Plan account withdrawals, are paid directly by such Participants.

Plan Termination

As of the date of this report, the Company expects and intends to continue the Plan, but it reserves the right to amend, suspend or terminate the Plan (in whole or in part) at any time. In the event of Plan termination, the Plan account balances of the individuals who are Participants at that time, if not already so, shall become 100% vested and not subject to forfeiture.

| |

2. | Summary of Significant Accounting Policies |

Basis of Accounting

The financial statements of the Plan are prepared on the accrual basis of accounting.

The financial statements are based on information provided to Plan management by the Trustee. Certain adjustments have been made to the information provided by the Trustee in order for the financial statements to conform to the accrual basis of accounting and U.S. generally accepted accounting principles (GAAP).

Use of Estimates

The preparation of financial statements in conformity with GAAP requires Plan management to make informed estimates and judgments that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from those estimates.

Investment Valuation and Income Recognition

Investments held by the Plan are stated at fair value. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. Refer to Note 3. Fair Value Measurements for the fair value measurement disclosures associated with the investments held by the Plan.

Purchases and sales of securities are recorded on a trade-date basis. Investment income is recorded as earned. Dividends are recorded on the ex-dividend date.

Notes Receivable from Participants

Notes receivable from Participants represent Participant loans that are recorded at their unpaid principal balance plus accrued but unpaid interest, if any. Interest income on notes receivable from Participants is recorded when earned.

Distributions

Distributions of Plan benefits to Participants who withdraw from the Plan are recorded when distributed.

Recent Accounting Pronouncements

In May 2015, the Financial Accounting Standards Board issued Accounting Standards Update No. 2015-07, “Fair Value Measurement (Topic 820): Disclosures for Investments in Certain Entities That Calculate Net Asset Value per Share (or its Equivalent) (a consensus of the Emerging Issues Task Force)” (ASU 2015-07). ASU 2015-07 removes the requirement to categorize within the fair value hierarchy all investments for which fair value is measured using the net asset value per share practical expedient. ASU 2015-07 is effective fiscal years beginning after December 15, 2016, and interim periods within those fiscal years. ASU 2015-07 is to be applied retrospectively to all periods presented. Early adoption is permitted. Plan management is currently evaluating the potential impact of adopting this guidance on the Plan’s financial statements.

| |

3. | Fair Value Measurements |

The fair value measurements of assets and liabilities are categorized based on the following hierarchy:

| |

Level 1 | Fair value determined based on quoted prices in active markets for identical assets or liabilities. |

| |

Level 2 | Fair value determined using significant observable inputs, such as quoted prices for similar assets or liabilities or quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than quoted prices that are observable for the asset or liability, or inputs that are derived principally from or corroborated by observable market data, by correlation or other means. |

| |

Level 3 | Fair value determined using significant unobservable inputs, such as pricing models, discounted cash flows, or similar techniques. |

The following table presents the Plan’s fair value hierarchy and its financial assets measured at fair value on a recurring basis as of December 31, 2014 and 2013:

|

| | | | | | | | | | |

| | Fair Value Hierarchy | | December 31, |

Description | | | 2014 | | 2013 |

Money market fund | | Level 1 | | $ | 12,189,751 |

| | $ | 12,486,391 |

|

Mutual funds: | | | | | | |

Domestic stock funds | | Level 1 | | 80,215,989 |

| | 73,187,752 |

|

International stock funds | | Level 1 | | 8,958,028 |

| | 9,914,051 |

|

Bond funds | | Level 1 | | 11,428,152 |

| | 11,013,768 |

|

Balanced funds | | Level 1 | | 25,834,805 |

| | 21,873,128 |

|

Participant-directed brokerage account investments | | Level 1 | | 848,102 |

| | 551,620 |

|

KB Home stock fund | | Level 1 | | 8,451,356 |

| | 9,453,435 |

|

Total | | | | $ | 147,926,183 |

| | $ | 138,480,145 |

|

The fair value of the money market fund, mutual funds (including the Participant-directed brokerage account investments), and the KB Home stock fund are determined based on quoted market prices.

The following table presents the fair value of the individual investments held by the Plan that represent 5% or more of the Plan’s net assets as of December 31, 2014 and 2013:

|

| | | | | | | |

| December 31, |

| 2014 | | 2013 |

Fidelity Contrafund – Class K | $ | 33,432,176 |

| | $ | — |

|

Spartan 500 Index Fund – Institutional Class | 16,006,699 |

| | 14,098,879 |

|

DFA US Large Cap Value Portfolio Institutional Class | 13,197,213 |

| | 11,388,090 |

|

Fidelity Money Market Trust Retirement Money Market Portfolio | 12,189,751 |

| | 12,486,391 |

|

Aston/Fairpointe Mid Cap Fund Class I | 11,623,656 |

| | 9,954,257 |

|

Metropolitan West Total Return Bond Fund Class M | 9,699,083 |

| | — |

|

KB Home Stock Fund | 8,451,356 |

| | 9,453,435 |

|

Fidelity Freedom K 2030 Fund | 8,038,295 |

| | — |

|

Fidelity Freedom K 2040 Fund | 7,793,531 |

| | — |

|

Fidelity Contrafund | — |

| | 32,027,960 |

|

PIMCO Total Return Fund Administrative Class | — |

| | 9,793,051 |

|

The Plan offers a Participant-directed brokerage account as an investment option. If elected, a Participant-directed brokerage account, which is administered by an affiliate of the Trustee, allows a Participant to direct the investment of the Participant’s contributions to the Plan among various mutual fund options offered by such affiliate, including mutual funds that are not otherwise offered as investment options under the Plan, subject to certain minimum investment and withdrawal requirements and an overall investment limit of not more than 50% of the value of the Participant’s overall Plan account balance. Participant-directed brokerage accounts are not monitored or managed by the Company or the Plan.

During 2014, the Plan replaced eight mutual fund investment options that were previously offered under the Plan with new mutual fund investment options for Participants. The new replacement mutual fund investment options generally provided similar asset/investment risk and return characteristics as the mutual fund investment options that were removed. The respective Participant Plan account balances invested in each removed mutual fund investment option were transferred to the corresponding most similar new replacement mutual fund investment option. The Plan also added four new investment options that expanded the range of targeted retirement date funds offered under the Plan to provide Participants with more flexibility within this particular asset type.

The following table presents the net appreciation (depreciation) in fair value of investments held by the Plan (including investments bought, sold, and held during the year) for the Plan years ended December 31, 2014 and 2013:

|

| | | | | | | |

| Years ended December 31, |

| 2014 | | 2013 |

| | | |

Mutual funds | $ | 1,066,454 |

| | $ | 18,097,199 |

|

KB Home stock fund | (868,195 | ) | | (3,139,687 | ) |

Unitized employer stock fund* | — |

| | 4,358,041 |

|

Total | $ | 198,259 |

| | $ | 19,315,553 |

|

| |

* | The unitized employer stock fund was converted to the KB Home stock fund on May 9, 2013. See Note 1. Description of the Plan for further information. |

| |

5. | Risks and Uncertainties |

The Plan’s concentrations of credit and market risk are dictated by its terms, as well as by ERISA, and the investments directed by individual Participants in various mutual funds and other securities. These investment securities are exposed to various risks, such as interest rate, market and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect Participants’ individual Plan account balances and the amounts reported in the financial statements of the Plan.

| |

6. | Tax Status of the Plan |

The Plan has received a determination letter from the IRS dated March 24, 2014 stating that the Plan is qualified under Code Section 401(a) and, therefore, the related trust is exempt from taxation. The Plan is required to operate in conformity with the Code to maintain its qualification. Plan management believes the Plan is being operated in compliance with the applicable requirements of the Code and, therefore, that the Plan is qualified and the related trust is tax exempt.

GAAP requires Plan management to evaluate uncertain tax positions taken by the Plan. The financial statement effects of a tax position are recognized when the position is more likely than not, based on the technical merits, to be sustained upon examination by the IRS. Plan management has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2014, there were no uncertain positions taken or expected to be taken. The Plan has recognized no interest or penalties related to uncertain tax positions. The Plan is subject to routine audits by taxing jurisdictions and is currently under IRS audit for the Plan year ended December 31, 2012. Plan management believes the Plan is no longer subject to income tax examinations for years prior to 2011.

| |

7. | Related Party and Party-in-Interest Transactions |

Investments held by the Plan include shares of mutual funds managed by an affiliate of the Trustee. The Trustee acts as a trustee for only those investments held by the Plan. An investment held by the Plan also includes the common stock of the Company. The transactions associated with these investments qualify as exempt party-in-interest transactions under ERISA.

Supplemental Schedule

KB Home 401(k) Savings Plan

EIN: 95-3666267 Plan Number: 001

Schedule H, Line 4(i) – Schedule of Assets (Held at End of Year)

December 31, 2014

|

| | | | | | |

Identity of Issuer, Borrower, Lessor, or Similar Party | Description of Investment Including Maturity Date, Rate of Interest, Collateral, Par, or Maturity Value | Shares/ Units | Cost | Current Value |

| | | | |

American Beacon Advisors | American Beacon Small Cap Value Fund Class Institutional | 195,168.169 | ** | $ | 4,892,866 |

|

Aston Asset Management | Aston/Fairpointe Mid Cap Fund Class I | 279,616.447 | ** | 11,623,656 |

|

Dimensional Fund Advisors | DFA US Large Cap Value Portfolio Institutional Class | 388,267.523 | ** | 13,197,213 |

|

Fidelity Investments* | Fidelity BrokerageLink | 122,168.858 | ** | 848,102 |

|

Fidelity Investments* | Fidelity Contrafund – Class K | 341,493.127 | ** | 33,432,176 |

|

Fidelity Investments* | Fidelity Freedom K Income | 148,590.485 | ** | 1,759,311 |

|

Fidelity Investments* | Fidelity Freedom K 2010 Fund | 146,709.733 | ** | 1,936,568 |

|

Fidelity Investments* | Fidelity Freedom K 2020 Fund | 435,489.738 | ** | 6,201,374 |

|

Fidelity Investments* | Fidelity Freedom K 2025 Fund | 2,606.574 | ** | 38,734 |

|

Fidelity Investments* | Fidelity Freedom K 2030 Fund | 529,881.004 | ** | 8,038,295 |

|

Fidelity Investments* | Fidelity Freedom K 2035 Fund | 1,374.161 | ** | 21,451 |

|

Fidelity Investments* | Fidelity Freedom K 2040 Fund | 497,989.220 | ** | 7,793,531 |

|

Fidelity Investments* | Fidelity Freedom K 2045 Fund | 298.635 | ** | 4,796 |

|

Fidelity Investments* | Fidelity Freedom K 2050 Fund | 2,016.691 | ** | 32,610 |

|

Fidelity Investments* | Fidelity Freedom K 2055 Fund | 683.594 | ** | 8,135 |

|

Fidelity Investments* | Fidelity Money Market Trust Retirement Money Market Portfolio | 12,189,751.400 | ** | 12,189,751 |

|

Harbor Capital Advisors | Harbor International Fund Institutional Class | 85,305.041 | ** | 5,526,061 |

|

Lazard Asset Management | Lazard Emerging Markets Equity Portfolio Institutional Shares | 199,649.019 | ** | 3,431,967 |

|

Metropolitan West Asset Management | Metropolitan West Total Return Bond Fund Class M | 889,008.530 | ** | 9,699,083 |

|

Fidelity Investments* | Spartan 500 Index Fund – Institutional Class | 219,691.173 | ** | 16,006,699 |

|

Vanguard Group | Vanguard Short-Term Investment-Grade Fund Admiral Shares | 162,201.595 | ** | 1,729,069 |

|

Wasatch Advisors | Wasatch Small Cap Growth Fund | 21,675.070 | ** | 1,063,379 |

|

KB Home* | KB Home Stock Fund | 510,596.928 | ** | 8,451,356 |

|

Notes receivable from Participants* | Individual notes receivable from Participants with interest rates ranging from 4.25% to 9.25% and maturity dates through 2029 | | | 3,218,312 |

|

Total | | | | $ | 151,144,495 |

|

| |

* | Party-in-interest to the Plan. |

| |

** | Participant-directed investments, cost information omitted. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | | |

| | | | | KB Home 401(k) Savings Plan By: KB Home Plan Administrator |

| | |

| |

| |

| | Dated: | June 26, 2015 | | By: /s/ WILLIAM R. HOLLINGER |

| | | | | William R. Hollinger |

| | | | | Senior Vice President and Chief Accounting Officer |

EXHIBIT INDEX

|

| | | | |

Exhibit No. | | Description | | Sequentially Numbered Page |

| | | | |

23.1 | | Consent of Independent Registered Public Accounting Firm | | 14 |

| | | | |

| | | | |

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

We consent to the incorporation by reference in the Registration Statements (Forms S-8 Nos. 333-129273, 333-168179 and 333-197521) pertaining to the 401(k) Savings Plan of KB Home of our report dated June 26, 2015, with respect to the financial statements and schedule of the KB Home 401(k) Savings Plan included in this Annual Report (Form 11-K) for the year ended December 31, 2014.

/s/ Ernst & Young LLP

Los Angeles, California

June 26, 2015

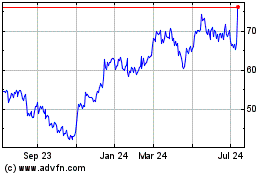

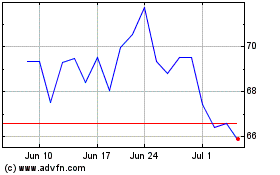

KB Home (NYSE:KBH)

Historical Stock Chart

From Mar 2024 to Apr 2024

KB Home (NYSE:KBH)

Historical Stock Chart

From Apr 2023 to Apr 2024