Ex-SEC Official Picked to Monitor Deutsche Bank's Derivatives Overhaul

October 20 2016 - 5:40PM

Dow Jones News

A former Securities and Exchange Commission official has been

appointed to monitor an overhaul of Deutsche Bank AG's systems for

reporting trades in its giant derivatives book.

Paul Atkins was named to the role by a federal judge on

Thursday, following a request by the Commodity Futures Trading

Commission. Last year, that agency fined Deutsche Bank $2.5 million

for failing to make timely and accurate reports of derivatives

trades known as swaps.

In August the CFTC said the bank's systems were still having

problems making those reports, and sought court appointment of a

monitor. Mr. Atkins was an SEC commissioner from 2002 to 2008, and

is now chief executive of regulatory consulting firm Patomak Global

Partners LLC.

A spokesman for Deutsche Bank declined to comment. The bank has

previously said that it and the CFTC "have agreed on steps to

resolve this matter [and] continue to work on enhancing our

reporting systems." Mr. Atkins couldn't be reached for comment.

"Inaccurate and untimely reporting of swaps data undermines the

integrity of the markets," U.S. District Judge William Pauley III

wrote in his opinion. "The consequences are significant."

He further noted this was "particularly true" for Deutsche Bank,

saying the bank "reportedly commands one of the largest derivatives

portfolios in the world." The bank said its exposure was a

notional, or face value, $47 trillion as of last year.

The unusual appointment of an outside monitor is the most vivid

example of the scale of technology challenges at big banks, which

face increasing technology costs at a time when revenues are being

squeezed by higher capital requirements and low interest rates.

Banks say swaps trades aren't simple to track, requiring

coordination of dozens of previously incompatible systems that

weren't designed for real-time reporting. The swaps-reporting rules

are meant to avoid the opacity that plagued derivatives markets in

the financial crisis and kept regulators in the dark about the

extent of bank exposures.

Judge Pauley had declined to accept Deutsche Bank and the CFTC's

recommended monitor, the consulting firm Chatham Financial. Mr.

Atkins must within three months give the court a timeline for the

necessary fixes to the bank's systems and procedures.

The CFTC this year has also fined J.P. Morgan Chase & Co.,

Wells Fargo & Co., and Barclays PLC for violations related to

reporting swaps trades. Those problems were resolved, the CFTC said

at the times of the fines.

Write to Telis Demos at telis.demos@wsj.com

(END) Dow Jones Newswires

October 20, 2016 17:25 ET (21:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

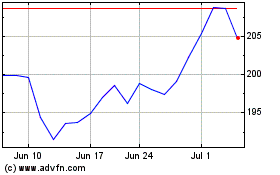

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Mar 2024 to Apr 2024

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Apr 2023 to Apr 2024