J.P. Morgan to Exit Part of Its Government Securities Business

July 21 2016 - 5:41PM

Dow Jones News

By Katy Burne

Thirty clients of J.P. Morgan Chase & Co. are losing access

to the bank's government securities settlements business, the unit

that ensures that the quantities agreed to in trades are physically

exchanged, in the bank's latest re-evaluation of its most

capital-intensive businesses.

The move means the bank will no longer settle Treasury and

agency bonds through its U.S. broker-dealer arm for those 30

clients, which are banks and brokers that use J.P. Morgan as a

third party to settle trades on their behalf. The firm said it

hoped the majority of clients would have a smooth transition, and

that it would complete its exit by the end of 2017.

J.P. Morgan's decision affects only few dozen clients, but is

significant because there are only a handful of large providers in

the business, meaning those clients jettisoned are now under

pressure to find alternatives.

Shifts in the plumbing underlying Wall Street's trading in

government securities are closely watched because they can help

determine how freely financial institutions lend and borrow

trillions of dollars from one another overnight.

"After careful review, we have determined that it [government

securities settlement] is a non-core service, particularly as we

simplify our business and continue to prioritize strategic growth

opportunities," said a spokesman for J.P. Morgan in a

statement.

One of the businesses most caught up in J.P. Morgan's exit is a

type of bond-for-cash exchange called a repurchase agreement, or

repo, between large banks. The bank is not exiting its tri-party

repo service, however, in which a third party facilitates

settlement of the trades.

Write to Katy Burne at katy.burne@wsj.com

(END) Dow Jones Newswires

July 21, 2016 17:26 ET (21:26 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

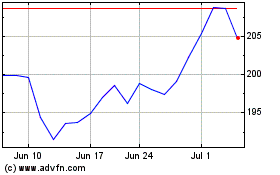

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Mar 2024 to Apr 2024

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Apr 2023 to Apr 2024