Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

July 02 2015 - 5:11PM

Edgar (US Regulatory)

Free Writing Prospectus

Filed Pursuant to Rule 433

Registration Statement No. 333-199966

Dated July 2, 2015

|

|

GRAPHIC OMMITTED

J. P. Morgan U.S. Sector Rotator 5 Index (Series 1)

Performance Update - July 2015

OVERVIEW

The J.P. Morgan U.S. Sector Rotator 5 Index (Series 1) (the "Index" or "U.S.

Sector Rotator 5 Index") is a notional rules-based proprietary index that, on a

monthly basis, tracks the excess return of a synthetic portfolio of (i) up to

five U.S. Sector Constituents, which are U.S. sector exchange-traded funds,

that are selected according to their past month return with a volatility

feature, or, (ii) the U.S. Sector Constituents that meet the selection criteria

and the Bond Constituent, which is the PIMCO Total Return Active

Exchange-Traded Fund.

Hypothetical and Actual Historical Performance -June 30, 2005 to June 30, 2015

GRAPHIC OMMITTED

Hypothetical and Actual Historical Volatility --December 30, 2005 to June 30,

2015

GRAPHIC OMMITTED

* See "Notes" on following page

Key Features of the Index

The strategy is based on a universe of 11 investible underlyings (10 ETFs

across U.S. sectors and an ETF representing fixed income exposure)

Monthly rebalancing of portfolio allocation, with all positions financed by

short term borrowing of cash.

Targets a volatility of 5%

Daily deduction of a fee of 0.50% per annum

Levels published on Bloomberg under the ticker JPUSSC5E.

Recent Index Performance

Historical

Performance Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec Full Year

------------- ----------------------- ------ ------ ------ ------ ------ ------ ------ ------ ------ ------ ------ ---------

2015 -0.31% -0.32% -0.88% -0.77% 0.17% -0.56% -2.64%

------------- ----------------------- ------ ------ ------ ------ ------ ------ ------ ------ ------ ------ ------ ---------

2014 -2.39% 1.25% -0.07% 1.24% 0.65% 0.83% -1.33% 2.16% -0.43% 1.41% 0.97% -0.38% 3.88%

------------- ----------------------- ------ ------ ------ ------ ------ ------ ------ ------ ------ ------ ------ ---------

2013 1.78% 0.43% 2.14% 1.91% -1.18% -0.41% 1.09% -1.47% 1.67% 1.62% 0.91% 1.25% 10.12%

------------- ----------------------- ------ ------ ------ ------ ------ ------ ------ ------ ------ ------ ------ ---------

2012 0.32% 1.04% 1.50% 0.03% -0.21% 0.60% 0.33% -0.34% 1.23% -0.36% 0.20% 0.13% 4.55%

------------- ----------------------- ------ ------ ------ ------ ------ ------ ------ ------ ------ ------ ------ ---------

2011 1.26% 1.34% -0.06% 1.14% 0.78% -0.92% 0.91% -1.08% -1.66% 0.89% -0.14% 1.69% 4.16%

------------- ----------------------- ------ ------ ------ ------ ------ ------ ------ ------ ------ ------ ------ ---------

** As calculated though June 30, 2015

Recent Index Composition

Consumer Consumer

Month Discretionary Staples Select Energy Select Financial Health Care Industrial Utilities Select

Materials Technology iShares US

Select Sector Sector SPDR Sector SPDR Select Sector Select Sector Select Sector Sector SPDR

Select Sector Select Sector Real Estate PIMCO Total Return Active

SPDR Fund Fund Fund SPDR Fund SPDR Fund SPDR Fund Fund SPDR

Fund SPDR Fund ETF Exchange-Traded Fund

------------------------ ------------- -------------- ------------- ------------- ------------- ------------- ----------------

------------- ------------- ----------- -------------------------

July 15 8.39% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00%

0.00% 0.00% 68.39%

------------------------ ------------- -------------- ------------- ------------- ------------- ------------- ----------------

------------- ------------- ----------- -------------------------

June 15 9.64% 10.80% 0.00% 9.01% 7.56% 0.00% 0.00% 0.00%

6.75% 0.00% 0.00%

J.P. Morgan Structured Investments | 800 576 3529 |

JPM_Structured_Investments@jpmorgan.com July 01, 2015

|

|

|

Comparative Hypothetical and Historical Total Returns (%), Volatility (%) and Correlation -- June 30, 2015

Three Year Annualized Five Year Annualized Ten Year Annualized Ten Year Annualized

Return Return Return Volatility Ten Year

Sharpe Ratio Ten Year Correlation

--------------------------------------- --------------------- -------------------- ------------------- -------------------

--------------------- --------------------

J.P. Morgan U.S. Sector Rotator 5 Index

4.06% 4.81% 3.54% 4.54%

0.78 100.00%

(Series 1)

--------------------------------------- --------------------- -------------------- ------------------- -------------------

--------------------- --------------------

SandP 500 Index (Excess Return) 16.79% 16.75% 5.68% 20.48%

0.28 54.77%

--------------------------------------- --------------------- -------------------- ------------------- -------------------

--------------------- --------------------

JPM US Gov Bond Index (Excess Return) 0.52% 2.34% 2.03% 4.76%

0.43 -16.72%

Notes

Hypothetical, historical performance measures: Represent the performance of the

U.S. Sector Rotator 5 Index based on, as applicable to the relevant measurement

period, the hypothetical backtested daily closing levels through June 20, 2013,

and the actual historical performance of the Index based on the daily closing

levels from June 21, 2013 through June 30, 2015, as well as the performance of

the SandP 500 Index (Excess Return), and the JPMorgan US Government Bond Index

(Excess Return) over the same periods. For purposes of these examples, each

index was set equal to 100 at the beginning of the relevant measurement period

and returns are calculated arithmetically (not compounded). There is no

guarantee the U.S. Sector Rotator 5 Index will outperform the SandP 500 Index

(Excess Return), the JPMorgan US Government Bond Index (Excess Return) or any

alternative investment strategy. Sources: Bloomberg and JPMorgan.

SandP 500 Index (Excess Return) represents a hypothetical index constructed from

the total returns of the SandP 500 Index with the returns of the JP Morgan Cash

Index USD 3 Month (the "Cash Index") deducted. JPMorgan US Government Bond

Index (Excess Return) represents a hypothetical index constructed from the

returns of the JPMorgan US Government Bond Index with the returns of the Cash

Index deducted.

Volatility: hypothetical, historical six-month annualized volatility levels are

presented for informational purposes only. Volatility levels are calculated

from the historical returns, as applicable to the relevant measurement period,

of the U.S. Sector Rotator 5 Index, SandP 500 Index (Excess Return), and the

JPMorgan US Government Bond Index (Excess Return). Volatility represents the

annualized standard deviation of the relevant index's arithmetic daily returns

since December 30, 2005. The Sharpe Ratio, which is a measure of risk-adjusted

performance, is computed as the ten year annualized historical return divided

by the ten year annualized volatility.

The back-tested, hypothetical, historical annualized volatility and index

returns may use substitutes for any ETF that was not in existence or did not

meet the liquidity standards at that particular time.

The back-tested, hypothetical, historical annualized volatility and index

returns have inherent limitations. These volatility and return results were

achieved by means of a retroactive application of a back-tested volatility

model designed with the benefit of hindsight. No representation is made that in

the future the relevant indices will have the volatility shown. Alternative

modeling techniques or assumptions might produce significantly different

results and may prove to be more appropriate. Actual annualized volatilities

and returns may vary materially from this analysis.

Source: Bloomberg and JPMorgan.

Key Risks

The payment on any investments linked to the Index that we may issue is

exposed to the credit risk of JPMorgan Chase and Co.

The levels of the Index will include the deduction of a fee of 0.50% per

annum.

There are risks associated with a momentum-based investment strategy--The

Strategy seeks to capitalize on positive market price trends based on the

supposition that positive market price trends may continue. This Strategy is

different from a strategy that seeks long-term exposure to a portfolio

consisting of constant components with fixed weights. The Strategy may fail to

realize gains that could occur from holding assets that have experienced price

declines, but experience a sudden price spike thereafter.

Correlation of performances among the basket constituents may reduce the

performance of strategy--Performances among the Basket Constituents may become

highly correlated from time to time during the term of your investment. High

correlation during periods of negative returns among Basket Constituents

representing any one sector or asset type that have a substantial weighting in

the Strategy could have a material adverse effect on the performance of the

Strategy.

Our affiliate, JPMS plc, is the Index Sponsor and Calculation Agent and may

adjust the Index in a way that affects its level--The policies and judgments

for which JPMS plc is responsible could have an impact, positive or negative,

on the level of the Index and the value of your investment. JPMS plc is under

no obligation to consider your interest as an investor with returns linked to

the Index.

The Index may not be successful, may not outperform any alternative strategy

related to the Basket Constituents, or may not achieve its target volatility of

5%.

The investment strategy involves monthly rebalancing and maximum weighting

caps applied to the Basket Constituents.

Changes in the value of the Basket Constituents may offset each other.

The Index was established on June 21, 2013 and has a limited operating

history

The risks identified above are not exhaustive. You should also review carefully

the related "Risk Factors" section in the relevant product supplement and

underlying supplement and the "Selected Risk Considerations" in the relevant

term sheet or pricing supplement.

Disclaimer

JPMorgan Chase and Co. ("J.P. Morgan") has filed a registration statement

(including a prospectus) with the Securities and Exchange Commission (the

"SEC") for any offerings to which these materials relate. Before you invest in

any offering of securities by J.P. Morgan, you should read the prospectus in

that registration statement, the prospectus supplement, as well as the

particular underlying supplement, the relevant term sheet or pricing

supplement, and any other documents that J.P. Morgan will file with the SEC

relating to such offering for more complete information about J.P. Morgan and

the offering of any securities. You may get these documents without cost by

visiting EDGAR on the SEC Website at www.sec.gov. Alternatively, J.P. Morgan,

any agent, or any dealer participating in the particular offering will arrange

to send you the prospectus and the prospectus supplement, as well as any

product supplement and term sheet or pricing supplement, if you so request by

calling toll-free (800) 576-3529.

Free Writing Prospectus filed pursuant to Rule 433; Registration Statement No.

333-199966

J.P. Morgan Structured Investments | 800 576 3529 |

JPM_Structured_Investments@jpmorgan.com July 01, 2015

|

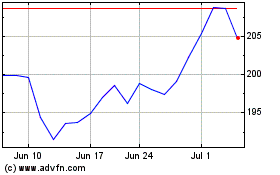

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Mar 2024 to Apr 2024

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Apr 2023 to Apr 2024