UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): May 20, 2015

JPMorgan Chase & Co.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-5805 |

|

13-2624428 |

| (State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(I.R.S. employer

identification no.) |

|

|

|

| 270 Park Avenue, New York, New York |

|

10017 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (212) 270-6000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 8.01 Other Events.

On May 20, 2015, JPMorgan Chase & Co. (the “Firm”) announced that it had reached separate settlements with the U.S.

Department of Justice (“DOJ”) and the Board of Governors of the Federal Reserve System (“Federal Reserve”) to resolve their respective investigations relating to the Firm’s foreign exchange (“FX”) business

(collectively, the “Settlement Agreements”). Under the DOJ settlement, the Firm agreed to plead guilty to a single violation of federal antitrust law and to pay a fine of $550 million. Under the Federal Reserve settlement, the

Firm agreed to the entry of a Consent Order, to pay a fine of $342 million, and to take various remedial actions.

The Firm has been working to secure

necessary waivers and authorizations from regulators. In connection with the Settlement Agreements, the U.S. Securities and Exchange Commission has granted three waivers to the Firm, including a waiver under Section 9 of the Investment Company

Act to permit the Firm to continue to act as an investment adviser and sub-adviser to U.S. mutual funds and exchange-traded funds. In addition, the Firm is in the process of submitting its application to the U.S. Department of Labor to maintain its

status as a Qualified Professional Asset Manager (“QPAM”).

Other FX-related investigations and civil litigation involving the Firm are

ongoing. The Firm continues to cooperate with the various investigations.

The Settlement Agreements can be accessed at the DOJ and Federal Reserve

websites at www.justice.gov and www.federalreserve.gov. Attached as Exhibits to this Form 8-K are copies of the Firm’s plea agreement with DOJ, the Firm’s press release regarding the Settlement Agreements and corresponding

Frequently Asked Questions.

Item 9.01 Financial Statements and Exhibits.

|

|

|

| Exhibit

No. |

|

Description of Exhibit |

|

|

| 99.1 |

|

JPMorgan Chase & Co. press release dated May 20, 2015 |

|

|

| 99.2 |

|

Frequently Asked Questions |

|

|

| 99.3 |

|

Plea Agreement dated May 20, 2015 between JPMorgan Chase & Co. and the U.S. Department of Justice |

2

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

|

|

|

JPMorgan Chase & Co. |

|

|

(Registrant) |

|

|

| By: |

|

/s/ Anthony J.

Horan |

|

|

Anthony J. Horan |

|

|

Corporate Secretary |

Dated: May 20, 2015

3

INDEX TO EXHIBITS

|

|

|

| Exhibit

No. |

|

Description of Exhibit |

|

|

| 99.1 |

|

JPMorgan Chase & Co. press release dated May 20, 2015 |

|

|

| 99.2 |

|

Frequently Asked Questions |

|

|

| 99.3 |

|

Plea Agreement dated May 20, 2015 between JPMorgan Chase & Co. and the U.S. Department of Justice |

4

Exhibit 99.1

JPMorgan Chase & Co.

270 Park Avenue, New York, NY 10017-2070

NYSE symbol: JPM

www.jpmorganchase.com

News release: IMMEDIATE RELEASE

JPMorgan Chase Announces Settlements with the U.S. Department of Justice and the Federal Reserve Related to Foreign Exchange Activities

New York, May 20, 2015 – JPMorgan Chase & Co. (NYSE: JPM) today announced settlements with the U.S. Department of Justice (DOJ) and

the Federal Reserve (Fed) relating to the Firm’s foreign exchange (FX) trading business. Under the DOJ resolution, JPMorgan Chase & Co. will plead guilty to a single antitrust violation and pay a fine of $550 million. Under

the resolution with the Fed, the Firm will pay a fine of $342 million and has agreed to the entry of a Consent Order. The Firm has previously reserved for these settlements.

These settlements are in addition to agreements announced in November 2014 with the U.K. Financial Conduct Authority, the U.S. Commodity Futures Trading

Commission and the U.S. Office of the Comptroller of the Currency relating to the FX trading business. Today’s resolutions, along with similar government settlements with other major banks announced today, call for certain remedial actions that

are consistent with those required under the Firm’s prior settlements relating to FX. The Firm has already commenced significant efforts in this regard to help ensure it is operating according to the high standards that the company and its

regulators demand. With today’s agreements and the remediation and other efforts it is making, the company is able to continue to serve its clients, and does not anticipate future material constraints on its business activities. The DOJ

agreement will be submitted to the court for its consideration. The Fed Agreement is effective immediately.

The conduct underlying the antitrust

charge is principally attributable to a single trader (who has since been dismissed) and his coordination with traders at other firms. Jamie Dimon, Chairman and CEO of JPMorgan Chase, said: “The conduct described in the government’s

pleadings is a great disappointment to us. We demand and expect better of our people. The lesson here is that the conduct of a small group of employees, or of even a single employee, can reflect badly on all of us, and have significant

ramifications for the entire firm. That’s why we’ve redoubled our efforts to fortify our controls and enhance our historically strong culture.”

|

|

|

| Investor Contact: Sarah M. Youngwood 212-270-7325 |

|

Media Contact: Joe Evangelisti 212-270-7438 |

The complete DOJ agreement, including the firm’s obligations thereunder, can be accessed at

www.justice.gov. The Fed Agreement is available at www.federalreserve.gov.

The Firm continues to cooperate with still-pending

investigations being conducted by other regulators relating to the Firm’s FX trading business.

JPMorgan Chase & Co. (NYSE: JPM) is a leading

global financial services firm with assets of $2.6 trillion and operations worldwide. The Firm is a leader in investment banking, financial services for consumers and small businesses, commercial banking, financial transaction processing, and asset

management. A component of the Dow Jones Industrial Average, JPMorgan Chase & Co. serves millions of consumers in the United States and many of the world’s most prominent corporate, institutional and government clients under its J.P.

Morgan and Chase brands. Information about JPMorgan Chase & Co. is available at www.jpmorganchase.com.

# # #

Exhibit 99.2

FREQUENTLY ASKED QUESTIONS (FAQs)

| 1. |

What issues were resolved with today’s foreign exchange (FX) settlements? |

| |

• |

|

JPMorgan Chase & Co., along with other major banks, reached settlements with the U.S. Department of Justice (“DOJ”) and the Federal Reserve (“Fed”) relating to wholesale foreign exchange

activities. |

| |

• |

|

Under the DOJ settlement, the firm agreed to plead guilty to a single violation of federal antitrust law and pay a fine of $550 million. |

| |

• |

|

Under the Fed settlement, the firm agreed to the entry of a Consent Order and will pay a fine of $342 million. |

| 2. |

What conduct was cited in today’s settlements? |

| |

• |

|

The antitrust violation referenced in the plea agreement arises principally from the conduct of one trader between July 2010 and January 2013. As set forth in the plea agreement, that trader, who has been dismissed from

the firm, improperly communicated with traders from other institutions in an attempt to improperly influence prices in the U.S. Dollar/Euro spot market pairing. The DOJ has alleged that the JPMorgan trader was already a part of the conspiracy when

he joined the firm in 2010. |

| 3. |

Why was JPMorgan Chase criminally charged? |

| |

• |

|

JPMorgan Chase is being held responsible for the conduct of its employee, as are the other financial institutions settling with DOJ today. |

| |

• |

|

This is consistent with the approach frequently taken by the DOJ’s Antitrust Division, which often resolves criminal matters through a guilty plea lodged at the parent/holding company level. |

| |

• |

|

Senior management was not involved. |

| 4. |

Didn’t JPMorgan Chase already announce FX settlements? |

| |

• |

|

Today’s settlements are in addition to agreements announced in November 2014 related to this matter. Those were with the U.K. Financial Conduct Authority, the U.S. Commodity Futures Trading Commission and the U.S.

Office of the Comptroller of the Currency. |

| 5. |

Has JPMorgan Chase set aside money for today’s settlements? |

| |

• |

|

Yes. The firm has previously reserved for today’s settlements. |

| 6. |

Is the trader cited in the charges still at the firm? |

| 7. |

Are there other FX related regulatory actions or litigation outstanding? |

| |

• |

|

Today’s agreements wrap up some of the most significant FX inquiries, though as set forth in our most recent 10-Q, certain investigations remain ongoing. |

| 8. |

How will this guilty plea impact JPMorgan Chase businesses and the way we serve clients? |

| |

• |

|

The firm is able to continue serving its clients, and does not anticipate future material constraints on its business activities. |

| |

• |

|

We have been working with regulators to help ensure we have all necessary waivers and authorizations in place. |

| 9. |

How has JPMorgan Chase improved controls to ensure a similar issue could not happen again? |

| |

• |

|

The firm has strengthened our controls over the past several years, including improving monitoring and surveillance; increasing training; adding staff; and limiting electronic chatroom participation. |

| 10. |

With this settlement, are JPMorgan Chase’s major legal issues largely behind it? |

| |

• |

|

We have made significant progress resolving issues and improving controls. While we still face some significant litigation matters, which are detailed in our public filings, we expect litigation costs to normalize, or

diminish, over time. |

| 11. |

Is JPMorgan Chase still committed to the foreign exchange (FX) business? |

| |

• |

|

Yes. Foreign exchange is a core product for our global clients, and we remain firmly committed to it. |

| 12. |

Did the trader’s activity in the U.S. Dollar/Euro spot market pairing affect customers’ foreign exchange rates in that pairing? |

| |

• |

|

The plea agreement does not allege a specific impact on rates. |

| 13. |

Will any of the settlement money go to customers? |

| |

• |

|

This is a settlement between government agencies and JPMorgan Chase. |

| 14. |

The agreement describes other relevant conduct; what does that include? |

| |

• |

|

The agreement contains a section called “Other Relevant Conduct” that describes certain other sales practices. |

| |

• |

|

This conduct is not the basis for any criminal charge. |

| |

• |

|

As part of the resolution with DOJ, and to ensure there are no ambiguities or misunderstandings with respect to our practices when acting as a dealer, on a principal basis, in the wholesale spot FX markets, we have

agreed to provide a disclosure detailing those practices to spot FX customers and counterparties. |

| 15. |

What waivers have you secured and are there any areas in which you’re still uncertain as to whether you can continue your activities? |

| |

• |

|

The firm is able to continue serving its clients, and does not anticipate future material constraints on its business activities. |

| |

• |

|

We have been working with regulators to help ensure we have in place all necessary waivers and authorizations. |

| |

• |

|

Specifically, we have received 3 waivers: |

| |

1. |

First, the SEC granted us a waiver under Section 9 of the Investment Company Act. This waiver allows us to continue to act as an investment adviser and sub-adviser to U.S. mutual funds and exchange-traded funds.

|

| |

2. |

Second, the SEC also granted us a waiver related to our status as a Well Known Seasoned Issuer (“WKSI”). |

| |

3. |

Third, we received a waiver from the SEC permitting us to continue to rely on the PSLRA safe harbor protection. |

| |

• |

|

With respect to our status as a Qualified Professional Asset Manager (“QPAM”), we are in the process of applying to the Department of Labor to maintain our status. Today’s announcement does not affect our

QPAM status; we continue to be eligible to service ERISA and IRA plans. We are committed to working closely with the Department of Labor to secure the necessary exemption. Other financial institutions have applied for and received similar QPAM

relief in connection with plea agreements. |

Exhibit 99.3

UNITED STATES DISTRICT COURT

DISTRICT OF CONNECTICUT

|

|

|

|

|

| ------------------------------------------------------------------------- |

|

x |

|

|

|

|

|

| UNITED STATES OF AMERICA |

|

: |

|

Criminal No. |

|

|

|

| v. |

|

: |

|

Filed: |

|

|

|

| JPMORGAN CHASE & CO., |

|

: |

|

Violation: 15 U.S.C. § 1 |

|

|

|

| Defendant. |

|

: |

|

|

|

|

|

| ------------------------------------------------------------------------- |

|

x |

|

|

PLEA AGREEMENT

The United States of America and JPMorgan Chase & Co. (“defendant”), a financial services holding company organized and

existing under the laws of Delaware, hereby enter into the following Plea Agreement pursuant to Rule 11(c)(1)(C) of the Federal Rules of Criminal Procedure (“Fed. R. Crim. P.”):

RIGHTS OF DEFENDANT

1. The defendant understands its rights:

(a) to be represented by an attorney;

(b) to be charged by Indictment;

(c) as a corporation organized and existing under the laws of Delaware, to decline to accept service of the Summons in this

case, and to contest the jurisdiction of the United States to prosecute this case against it in the United States District Court for the District of Connecticut, and to contest venue in that District;

(d) to plead not guilty to any criminal charge brought against it;

1

(e) to have a trial by jury, at which it would be presumed not guilty of the

charge and the United States would have to prove every essential element of the charged offense beyond a reasonable doubt for it to be found guilty;

(f) to confront and cross-examine witnesses against it and to subpoena witnesses in its defense at trial;

(g) to appeal its conviction if it is found guilty; and

(h) to appeal the imposition of sentence against it.

AGREEMENT TO PLEAD GUILTY

AND WAIVE CERTAIN RIGHTS

2. The defendant knowingly and voluntarily waives the rights set out in Paragraph 1(b)-(g) above. The defendant also knowingly and

voluntarily waives the right to file any appeal, any collateral attack, or any other writ or motion, including but not limited to an appeal under 18 U.S.C. § 3742, that challenges the sentence imposed by the Court if that sentence is consistent

with or below the Recommended Sentence in Paragraph 9 of this Plea Agreement, regardless of how the sentence is determined by the Court. This agreement does not affect the rights or obligations of the United States as set forth in 18 U.S.C. §

3742(b)-(c). Nothing in this paragraph, however, will act as a bar to the defendant perfecting any legal remedies it may otherwise have on appeal or collateral attack respecting claims of ineffective assistance of counsel or prosecutorial

misconduct. The defendant agrees that there is currently no known evidence of ineffective assistance of counsel or prosecutorial misconduct. Pursuant to Fed. R. Crim. P. 7(b), the defendant will waive indictment and plead guilty to a one-count

Information to be filed in the United States District Court for the District of Connecticut. The Information will charge that the defendant and its co-conspirators entered into and engaged in a combination and

2

conspiracy to fix, stabilize, maintain, increase or decrease the price of, and rig bids and offers for, the euro/U.S. dollar (“EUR/USD”) currency pair exchanged in the foreign currency

exchange spot market (“FX Spot Market”), which began at least as early as December 2007 and continued until at least January 2013, by agreeing to eliminate competition in the purchase and sale of the EUR/USD currency pair in the United

States and elsewhere, in violation of the Sherman Antitrust Act, 15 U.S.C. § 1. The Information will further charge that the defendant knowingly joined and participated in the conspiracy from at least as early as July 2010 until at least

January 2013.

3. The defendant will plead guilty to the criminal charge described in Paragraph 2 above pursuant to the terms of this Plea

Agreement and will make a factual admission of guilt to the Court in accordance with Fed. R. Crim. P. 11, as set forth in Paragraph 4 below.

FACTUAL BASIS FOR OFFENSE CHARGED

4. Had this case gone to trial, the United States would have presented evidence sufficient to prove the following facts:

(a) For purposes of this Plea Agreement, the “Relevant Period” is that period from at least as early as December 2007

and continuing until at least January 2013.

(b) The FX Spot Market is a global market in which participants buy and sell

currencies. In the FX Spot Market, currencies are traded against one another in pairs. The EUR/USD currency pair is the most traded currency pair by volume, with a worldwide trading volume that can exceed $500 billion per day, in a market involving

the exchange of currencies valued at approximately $2 trillion a day during the Relevant Period.

3

(c) The FX Spot Market is an over-the-counter market and, as such, is

decentralized and requires financial institutions to act as dealers willing to buy or sell a currency. Dealers, also known throughout the FX Spot Market as market makers, therefore play a critical role in ensuring the continued functioning of the

market.

(d) During the Relevant Period, the defendant and certain of its Related Entities, as defined in Paragraph 14 of

this Plea Agreement, employing approximately 250,000 individuals worldwide, acted as a dealer, in the United States and elsewhere, for currency traded in the FX Spot Market.

(e) A dealer in the FX Spot Market quotes prices at which the dealer stands ready to buy or sell the currency. These price

quotes are expressed as units of a given currency, known as the “counter” currency, which would be required to purchase one unit of a “base” currency, which is often the U.S. dollar and so reflects an “exchange rate”

between the currencies. Dealers generally provide price quotes to four decimal points, with the final digit known as a “percentage in point” or “pip.” A dealer may provide price quotes to potential customers in the form of a

“bid/ask spread,” which represents the difference between the price at which the dealer is willing to buy the currency from the customer (the “bid”) and the price at which the dealer is willing to sell the currency to the

customer (the “ask”). A dealer may quote a spread, or may provide just the bid to a potential customer inquiring about selling currency or just the ask to a potential customer inquiring about buying currency.

(f) A customer wishing to trade currency may transact with a dealer by placing an order through the dealer’s internal,

proprietary electronic trading platform or

4

by contacting the dealer’s salesperson to obtain a quote. When a customer accepts a dealer’s quote, that dealer now bears the risk for any change in the currency’s price that may

occur before the dealer is able to trade with other dealers in the “interdealer market” to fill the order by buying the currency the dealer has agreed to sell to the customer, or by selling the currency the dealer has agreed to buy from

the customer. A dealer may also take and execute orders from customers such as “fix orders,” which are orders to trade at a subsequently determined “fix rate.” When a dealer accepts a fix order from a customer, the dealer agrees

to fill the order at a rate to be determined at a subsequent fix time based on trading in the interdealer market. Two such “fixes” used to determine a fix rate are the European Central Bank fix, which occurs each trading day at 2:15 PM

(CET) and the World Markets/Reuters fix, which occurs each trading day at 4:00 PM (GMT).

(g) During the Relevant Period,

the defendant and its corporate co-conspirators, which were also financial services firms acting as dealers in the FX Spot Market, entered into and engaged in a conspiracy to fix, stabilize, maintain, increase or decrease the price of, and rig bids

and offers for, the EUR/USD currency pair exchanged in the FX Spot Market by agreeing to eliminate competition in the purchase and sale of the EUR/USD currency pair in the United States and elsewhere. The defendant, through one of its EUR/USD

traders, participated in the conspiracy from at least as early as July 2010 and continuing until at least January 2013.

(h) In furtherance of the conspiracy, the defendant and its co-conspirators engaged in communications, including near daily

conversations, some of which were in code, in an exclusive electronic chat room which chat room participants, as well as others

5

in the FX Spot Market, referred to as “The Cartel” or “The Mafia.” Participation in this electronic chat room was limited to specific EUR/USD traders, each of whom was

employed, at certain times, by a co-conspirator dealer in the FX Spot Market. The defendant participated in this electronic chat room through one of its EUR/USD traders from July 2010 until January 2013.

(i) The defendant and its co-conspirators carried out the conspiracy to eliminate competition in the purchase and sale of the

EUR/USD currency pair by various means and methods including, in certain instances, by: (i) coordinating the trading of the EUR/USD currency pair in connection with European Central Bank and World Markets/Reuters benchmark currency

“fixes” which occurred at 2:15 PM (CET) and 4:00 PM (GMT) each trading day; and (ii) refraining from certain trading behavior, by withholding bids and offers, when one conspirator held an open risk position, so that the price of the

currency traded would not move in a direction adverse to the conspirator with an open risk position.

(j) During the

Relevant Period, the defendant and its co-conspirators purchased and sold substantial quantities of the EUR/USD currency pair in a continuous and uninterrupted flow of interstate and U.S. import trade and commerce to customers and counterparties

located in U.S. states other than the U.S. states or foreign countries in which the defendant agreed to purchase or sell these currencies. The business activities of the defendant and its co-conspirators in connection with the purchase and sale of

the EUR/USD currency pair, were the subject of this conspiracy and were within the flow of, and substantially affected, interstate and U.S. import trade and commerce. The

6

conspiracy had a direct effect on trade and commerce within the United States, as well as on U.S. import trade and commerce, and was carried out, in part, within the United States.

(k) Acts in furtherance of the charged offense were carried out within the District of Connecticut and elsewhere.

ELEMENTS OF THE OFFENSE

5. The elements of the charged offense are that:

(a) the conspiracy described in the Information existed at or about the time alleged;

(b) the defendant knowingly became a member of the conspiracy; and

(c) the conspiracy described in the Information either substantially affected interstate and U.S. import commerce in goods or

services or occurred within the flow of interstate and U.S. import commerce in goods and services.

POSSIBLE MAXIMUM SENTENCE

6. The defendant understands that the statutory maximum penalty which may be imposed against it upon conviction for a violation

of Section One of the Sherman Antitrust Act is a fine in an amount equal to the greatest of:

(a) $100 million (15 U.S.C.

§ 1);

(b) twice the gross pecuniary gain the conspirators derived from the crime (18 U.S.C. § 3571(c) and (d));

or

(c) twice the gross pecuniary loss caused to the victims of the crime by the conspirators (18 U.S.C. § 3571(c) and

(d)).

7

7. In addition, the defendant understands that:

(a) pursuant to 18 U.S.C. § 3561(c)(1), the Court may impose a term of probation of at least one year, but not more than

five years;

(b) pursuant to § 8B1.1 of the United States Sentencing Guidelines (“U.S.S.G.,”

“Sentencing Guidelines,” or “Guidelines”) or 18 U.S.C. § 3563(b)(2) or 3663(a)(3), the Court may order it to pay restitution to the victims of the offense charged; and

(c) pursuant to 18 U.S.C. § 3013(a)(2)(B), the Court is required to order the defendant to pay a $400 special assessment

upon conviction for the charged crime.

SENTENCING GUIDELINES

8. The defendant understands that the Sentencing Guidelines are advisory, not mandatory, but that the Court must consider, in determining and

imposing sentence, the Guidelines Manual in effect on the date of sentencing unless that Manual provides for greater punishment than the Manual in effect on the last date that the offense of conviction was committed, in which case the Court must

consider the Guidelines Manual in effect on the last date that the offense of conviction was committed. The parties agree there is no ex post facto issue under the November 1, 2014 Guidelines Manual. The Court must also consider the other

factors set forth in 18 U.S.C. §§ 3553(a), 3572(a), in determining and imposing sentence. The defendant understands that the Guidelines determinations will be made by the Court by a preponderance of the evidence standard. The defendant

understands that although the Court is not ultimately bound to impose a sentence within the applicable Guidelines range, its sentence must be reasonable based upon consideration of all relevant sentencing factors set forth in 18 U.S.C. §§

3553(a), 3572(a).

8

SENTENCING AGREEMENT

9. Pursuant to Fed. R. Crim. P. 11(c)(1)(C) and subject to the full, truthful, and continuing cooperation of the defendant and its Related

Entities, as defined in Paragraphs 14 and 15 of this Plea Agreement, the United States and the defendant agree that the appropriate disposition of this case is, and agree to recommend jointly that the Court impose, a sentence requiring the defendant

to pay to the United States a criminal fine of $550 million, pursuant to 18 U.S.C. § 3571(d), payable in full before the fifteenth (15th) day after the date of judgment, no order of restitution, and a term of probation of 3 years (the

“Recommended Sentence”). The parties agree not to seek at the sentencing hearing any sentence outside of the Guidelines range nor any Guidelines adjustment for any reason that is not set forth in this Plea Agreement. The parties further

agree that the Recommended Sentence set forth in this Plea Agreement is reasonable.

(a) The defendant understands that the

Court will order it to pay a $400 special assessment, pursuant to 18 U.S.C. § 3013(a)(2)(B), in addition to any fine imposed.

(b) In light of the availability of civil causes of action, which potentially provide for a recovery of a multiple of actual

damages, the Recommended Sentence does not include a restitution order for the offense charged in the Information.

9

(c) The United States and the defendant agree that the Court shall order a term

of probation, which should include at least the following conditions, the violation of which is subject to 18 U.S.C. § 3565:

(i) The defendant shall not commit another crime in violation of the federal laws of the United States or engage in the conduct

set forth in Paragraph 4(g)-(i) above during the term of probation. On a date not later than that on which the defendant pleads guilty (currently scheduled for Wednesday, May 20, 2015), the defendant shall prominently post on its website a

retrospective disclosure (“Disclosure Notice”) of its conduct set forth in Paragraph 13 in the form agreed to by the Department (a copy of the Disclosure Notice is attached as Attachment B hereto), and shall maintain the Disclosure Notice

on its website during the term of probation. The defendant shall make best efforts to send the Disclosure Notice not later than thirty (30) days after the defendant pleads guilty to its spot FX customers and counterparties, other than customers

and counterparties who the defendant can establish solely engaged in buying or selling foreign currency through the defendant’s consumer bank units and not the defendant’s spot FX sales or trading staff.

(ii) The defendant shall notify the probation officer upon learning of the commencement of any federal criminal investigation

in which the defendant is a target, or federal criminal prosecution against it.

(iii) The defendant shall implement and

shall continue to implement a compliance program designed to prevent and detect the conduct set forth in Paragraph 4 (g)-(i) above and, absent appropriate disclosure, the conduct in Paragraph 13 below

10

throughout its operations including those of its affiliates and subsidiaries and provide an annual report to the probation officer and the United States on its progress in implementing the

program, commencing on a schedule agreed to by the parties.

(iv) The defendant shall further strengthen its compliance and

internal controls as required by the U.S. Commodity Futures Trading Commission, the United Kingdom Financial Conduct Authority, and any other regulatory or enforcement agencies that have addressed the conduct set forth in Paragraph 4

(g)-(i) above and Paragraph 13 below, and report to the probation officer and the United States, upon request, regarding its remediation and implementation of any compliance program and internal controls, policies, and procedures that relate to

the conduct described in Paragraph 4 (g)-(i) above and Paragraph 13 below. Moreover, the defendant agrees that it has no objection to any regulatory agencies providing to the United States any information or reports generated by such agencies

or by the defendant relating to conduct described in Paragraph 4 (g)-(i) above or Paragraph 13 below. Such information and reports will likely include proprietary, financial, confidential, and competitive business information, and public disclosure

of the information and reports could discourage cooperation, impede pending or potential government investigations, and thus undermine the objective of the United States in obtaining such reports. For these reasons, among others, the information and

reports and the contents thereof are intended to remain and shall remain nonpublic, except as otherwise agreed to by the parties in writing, or except to the extent that the United States determines in its sole discretion that disclosure would be in

furtherance of the United States’ discharge of its duties and responsibilities or is otherwise required by law.

11

(v) The defendant understands that during the term of probation it shall:

(1) report to the Antitrust Division all credible information regarding criminal violations of U.S. antitrust laws by the defendant or any of its employees as to which the defendant’s Board of Directors, management (that is, all

supervisors within the bank), or legal and compliance personnel are aware; and (2) report to the Criminal Division, Fraud Section all credible information regarding criminal violations of U.S. law concerning fraud, including securities or

commodities fraud by the defendant or any of its employees as to which the defendant’s Board of Directors, management (that is, all supervisors within the bank), or legal and compliance personnel are aware.

(vi) The defendant shall bring to the Antitrust Division’s attention all federal criminal investigations in which the

defendant is identified as a subject or a target, and all administrative or regulatory proceedings or civil actions brought by any federal or state governmental authority in the United States against the defendant or its employees, to the extent

that such investigations, proceedings or actions allege facts that could form the basis of a criminal violation of U.S. antitrust laws, and the defendant shall also bring to the Criminal Division, Fraud Section’s attention all federal criminal

or regulatory investigations in which the defendant is identified as a subject or a target, and all administrative or regulatory proceedings or civil actions brought by any federal governmental authority in the United States against the defendant or

its employees, to the extent such investigations, proceedings or actions allege violations of U.S. law concerning fraud, including securities or commodities fraud.

12

(d) The parties agree that the term and conditions of probation imposed by the

Court will not void this Plea Agreement.

(e) The defendant intends to file an application for a prohibited transaction

exemption with the United States Department of Labor (“Department of Labor”) requesting that the defendant, its subsidiaries, and affiliates be allowed to continue to be qualified as a Qualified Professional Asset Manager pursuant to

Prohibited Transactions Exemption 84-14. The defendant will seek such exemption in an expeditious manner and will provide all information requested of it by the Department of Labor in a timely manner. The decision regarding whether or not to grant

an exemption, temporary or otherwise, is committed to the Department of Labor, and the United States takes no position on whether or not an exemption should be granted; however, if requested, the United States will advise the Department of Labor of

the fact, manner, and extent of the cooperation of the defendant and its Related Entities, as defined in Paragraphs 14 and 15 of this Plea Agreement, and the relevant facts regarding the charged conduct. If the Department of Labor denies the

exemption, or takes any other action adverse to the defendant, the defendant may not withdraw its plea or otherwise be released from any of its obligations under this Plea Agreement. The United States agrees that it will support a motion or request

by the defendant that sentencing in this matter be adjourned until the Department of Labor has issued a ruling on the defendant’s request for an exemption, temporary or otherwise, so long as the defendant is proceeding with the Department of

13

Labor in an expeditious manner. To the extent that this Plea Agreement triggers other regulatory exclusions, disqualifications or penalties, the United States likewise agrees that, if requested,

it will advise the appropriate officials of any governmental agency considering such action, or any waiver or exemption therefrom, of the fact, manner, and extent of the cooperation of the defendant and its Related Entities and the relevant facts

regarding the charged conduct as a matter for that agency to consider before determining what action, if any, to take.

(f)

The United States contends that had this case gone to trial, the United States would have presented evidence to prove that the gain derived from or the loss resulting from the charged offense is sufficient to justify the Recommended Sentence set

forth in Paragraph 9 of this Plea Agreement, pursuant to 18 U.S.C. § 3571(d). For purposes of this plea and sentencing only, the defendant waives its right to contest this calculation.

(g) The defendant agrees to waive its right to the issuance of a Presentence Investigation Report pursuant to Fed. R. Crim. P.

32 and the defendant and the United States agree that the information contained in this Plea Agreement and the Information may be sufficient to enable the Court to meaningfully exercise its sentencing authority under 18 U.S.C. § 3553, pursuant

to Fed. R. Crim. P. 32(c)(1)(A)(ii). Except as set forth in this Plea Agreement, the parties reserve all other rights to make sentencing recommendations and to respond to motions and arguments by the opposition.

10. The United States and the defendant agree that the applicable Guidelines fine range exceeds the fine contained in the Recommended Sentence

set forth in Paragraph 9 of this

14

Plea Agreement. The parties agree that they will request the Court to impose the Recommended Sentence set forth in Paragraph 9 of this Plea Agreement in consideration of the Guidelines fine range

and other factors set forth in 18 U.S.C. §§ 3553(a), 3572(a). Subject to the full, truthful and continuing cooperation of the defendant and its Related Entities, as defined in Paragraphs 14 and 15 of this Plea Agreement, and prior to

sentencing in this case, the United States agrees that it will make a motion, pursuant to U.S.S.G. § 8C4.1 for a downward departure from the Guidelines fine range because of the defendant’s and its Related Entities’ substantial

assistance in the United States’ investigation and prosecution of violations of federal criminal law in the FX Spot Market. The parties further agree that the Recommended Sentence is sufficient, but not greater than necessary to comply with the

purposes set forth in 18 U.S.C. §§ 3553(a), 3572(a).

11. Subject to the full, truthful, and continuing cooperation of the

defendant and its Related Entities, as defined in Paragraphs 14 and 15 of this Plea Agreement, and prior to sentencing in the case, the United States will fully advise the Court of the fact, manner, and extent of the defendant’s and its Related

Entities’ cooperation, and their commitment to prospective cooperation with the United States’ investigation and prosecutions of violations of federal criminal law in the FX Spot Market, all material facts relating to the defendant’s

involvement in the charged offense and all other relevant conduct.

12. The United States and the defendant understand that the Court

retains complete discretion to accept or reject the Recommended Sentence provided for in Paragraph 9 of this Plea Agreement.

15

(a) If the Court does not accept the Recommended Sentence, the United States and

the defendant agree that this Plea Agreement, except for Paragraph 12(b) below, will be rendered void.

(b) If the Court

does not accept the Recommended Sentence, the defendant will be free to withdraw its guilty plea (Fed. R. Crim. P. 11(c)(5) and (d)). If the defendant withdraws its plea of guilty, this Plea Agreement, the guilty plea, and any statement

made in the course of any proceedings under Fed. R. Crim. P. 11 regarding the guilty plea or this Plea Agreement, or made in the course of plea discussions with an attorney for the United States, will not be admissible against the defendant in any

criminal or civil proceeding, except as otherwise provided in Federal Rule of Evidence 410. In addition, the defendant agrees that, if it withdraws its guilty plea pursuant to this subparagraph of the Plea Agreement, the statute of limitations

period for any offense referred to in Paragraph 16 of this Plea Agreement will be tolled for the period between the date of signature of this Plea Agreement and the date the defendant withdrew its guilty plea or for a period of sixty (60) days

after the date of signature of this Plea Agreement, whichever period is greater.

OTHER RELEVANT CONDUCT

13. In addition to its participation in a conspiracy to fix, stabilize, maintain, increase or decrease the price of, and rig bids and offers

for, the EUR/USD currency pair exchanged in the FX Spot Market, the defendant, through its currency traders and sales staff, also engaged in other currency trading and sales practices in conducting FX Spot Market transactions with customers via

telephone, email, and/or electronic chat, to wit: (i) intentionally working

16

customers’ limit orders one or more levels, or “pips,” away from the price confirmed with the customer; (ii) including sales markup, through the use of live hand signals or

undisclosed prior internal arrangements or communications, to prices given to customers that communicated with sales staff on open phone lines; (iii) accepting limit orders from customers and then informing those customers that their orders

could not be filled, in whole or in part, when in fact the defendant was able to fill the order but decided not to do so because the defendant expected it would be more profitable not to do so; and (iv) disclosing non-public information

regarding the

identity and trading activity of the defendant’s customers to other banks or other market participants, in order to generate revenue

for the defendant at the expense of its customers.

DEFENDANT’S COOPERATION

14. The defendant and its Related Entities as defined below shall cooperate fully and truthfully with the United States in the investigation

and prosecution of this matter, involving: (a) the purchase and sale of the EUR/USD currency pair, or any other currency pair, in the FX Spot Market, or any foreign exchange forward, foreign exchange option or other foreign exchange derivative, or

other financial product (to the extent disclosed to the United States); (b) the conduct set forth in Paragraph 13 of this Plea Agreement; and (c) any investigation, litigation or other proceedings arising or resulting from such

investigation to which the United States is a party. Such investigation and prosecution includes, but is not limited to, an investigation, prosecution, litigation, or other proceeding regarding obstruction of, the making of a false statement or

declaration in, the commission of perjury or subornation of perjury in, the commission of contempt in, or conspiracy to commit such conduct or offenses in, an investigation and prosecution. The defendant’s Related Entities for purposes of this

Plea

17

Agreement are entities in which the defendant had, indirectly or directly, a greater than 50% ownership interest as of the date of signature of this Plea Agreement, including but not limited to

JPMorgan Chase Bank N.A. The full, truthful, and continuing cooperation of the defendant and its Related Entities shall include, but not be limited to:

(a) producing to the United States all documents, factual information, and other materials, wherever located, not protected

under the attorney-client privilege or work product doctrine, in the possession, custody, or control of the defendant or any of its Related Entities, that are requested by the United States; and

(b) using its best efforts to secure the full, truthful, and continuing cooperation of the current or former directors,

officers and employees of the defendant and its Related Entities as may be requested by the United States, including making these persons available in the United States and at other mutually agreed-upon locations, at the defendant’s expense,

for interviews and the provision of testimony in grand jury, trial, and other judicial proceedings. This obligation includes, but is not limited to, sworn testimony before grand juries or in trials, as well as interviews with law enforcement and

regulatory authorities. Cooperation under this paragraph shall include identification of witnesses who, to the knowledge of the defendant, may have material information regarding the matters under investigation.

15. For the duration of any term of probation ordered by the Court, the defendant also shall cooperate fully with the United States and any

other law enforcement authority or government agency designated by the United States, in a manner consistent with applicable law and regulations, with regard to all investigations identified in Attachment A (filed under seal) to

18

this Plea Agreement. The defendant shall, to the extent consistent with the foregoing, truthfully disclose to the United States all factual information not protected by a valid claim of

attorney-client privilege or work product doctrine protection with respect to the activities, that are the subject of the investigations identified in Attachment A, of the defendant and its Related Entities. This obligation of truthful disclosure

includes the obligation of the defendant to provide to the United States, upon request, any non-privileged or non-protected document, record, or other tangible evidence about which the aforementioned authorities and agencies shall inquire of the

defendant, subject to the direction of the United States.

GOVERNMENT’S AGREEMENT

16. Subject to the full, truthful, and continuing cooperation of the defendant and its Related Entities, as defined in Paragraphs 14 and 15 of

this Plea Agreement, and upon the Court’s acceptance of the guilty plea called for by this Plea Agreement and the imposition of the Recommended Sentence, the United States agrees that it will not bring further criminal charges, whether under

Title 15 or Title 18, or other federal criminal statutes, against the defendant or any of its Related Entities:

(a) for

any combination and conspiracy occurring before the date of signature of this Plea Agreement to fix, stabilize, maintain, increase or decrease the price of, and rig bids and offers for, the EUR/USD currency pair, or any other currency pair exchanged

in the FX Spot Market, or any foreign exchange forward, foreign exchange option or other foreign exchange derivative, or other financial product (to the extent such financial product was disclosed to the United States), and

19

(b) for the conduct specifically identified in Paragraph 13 of this Plea

Agreement that the defendant disclosed to the United States and that occurred between January 1, 2009 and the date of signature of this Plea Agreement.

(c) The nonprosecution terms of Paragraph 16 of this Plea Agreement do not extend to any other product, activity, service or

market of the defendant, and do not apply to (i) any acts of subornation of perjury (18 U.S.C. § 1622), making a false statement (18 U.S.C. § 1001), obstruction of justice (18 U.S.C. § 1503, et seq), contempt (18 U.S.C.

§§ 401-402), or conspiracy to commit such offenses; (ii) civil matters of any kind; (iii) any violation of the federal tax or securities laws or conspiracy to commit such offenses; or (iv) any crime of violence.

REPRESENTATION BY COUNSEL

17. The defendant has been represented by counsel and is fully satisfied that its attorneys have provided competent legal representation. The

defendant has thoroughly reviewed this Plea Agreement and acknowledges that counsel has advised it of the nature of the charge, any possible defenses to the charge, and the nature and range of possible sentences.

VOLUNTARY PLEA

18. The defendant’s decision to enter into this Plea Agreement and to tender a plea of guilty is freely and voluntarily made and is not

the result of force, threats, assurances, promises, or representations other than the representations contained in this Plea Agreement. The United States has made no promises or representations to the defendant as to whether the Court will accept or

reject the recommendations contained within this Plea Agreement.

20

VIOLATION OF PLEA AGREEMENT

19. The defendant agrees that, should the United States determine in good faith, during the period that any investigation or prosecution

covered by Paragraph 14 is pending, or during the period covered by Paragraph 15, that the defendant or any of its Related Entities has failed to provide full, truthful, and continuing cooperation, as defined in Paragraphs 14 and 15 of this Plea

Agreement respectively, or has otherwise violated any provision of this Plea Agreement, except for the conditions of probation set forth in Paragraphs 9(c)(i)-(vi), the violations of which are subject to 18 U.S.C. § 3565, the United States will

notify counsel for the defendant in writing by personal or overnight delivery, email, or facsimile transmission and may also notify counsel by telephone of its intention to void any of its obligations under this Plea Agreement (except its

obligations under this paragraph), and the defendant and its Related Entities will be subject to prosecution for any federal crime of which the United States has knowledge including, but not limited to, the substantive offenses relating to the

investigation resulting in this Plea Agreement. The defendant agrees that, in the event that the United States is released from its obligations under this Plea Agreement and brings criminal charges against the defendant or its Related Entities for

any offense referred to in Paragraph 16 of this Plea Agreement, the statute of limitations period for such offense will be tolled for the period between the date of signature of this Plea Agreement and six (6) months after the date the United

States gave notice of its intent to void its obligations under this Plea Agreement.

20. The defendant understands and agrees that in any

further prosecution of it or its Related Entities resulting from the release of the United States from its obligations under this Plea Agreement, because of the defendant’s or its Related Entities’ violation of this Plea

21

Agreement, any documents, statements, information, testimony, or evidence provided by it, its Related Entities, or current or former directors, officers, or employees of it or its Related

Entities to attorneys or agents of the United States, federal grand juries or courts, and any leads derived therefrom, may be used against it or its Related Entities. In addition, the defendant unconditionally waives its right to challenge the use

of such evidence in any such further prosecution, notwithstanding the protections of Federal Rule of Evidence 410.

ENTIRETY OF

AGREEMENT

21. This Plea Agreement, Attachment A, and Attachment B constitute the entire agreement between the United States and

the defendant concerning the disposition of the criminal charge in this case. This Plea Agreement cannot be modified except in writing, signed by the United States, the defendant and the defendant’s counsel.

22. The undersigned is authorized to enter this Plea Agreement on behalf of the defendant as evidenced by the Resolution of the Board of

Directors of the defendant attached to, and incorporated by reference in, this Plea Agreement.

23. The undersigned attorneys for the

United States have been authorized by the Attorney General of the United States to enter this Plea Agreement on behalf of the United States.

24. A facsimile or PDF signature will be deemed an original signature for the purpose of executing this Plea Agreement. Multiple signature

pages are authorized for the purpose of executing this Plea Agreement.

[REMAINDER OF THIS PAGE INTENTIONALLY LEFT BLANK]

22

|

|

|

|

|

|

|

| AGREED: |

|

|

|

|

|

|

|

|

|

|

| FOR JPMORGAN CHASE & CO. |

|

|

|

|

|

|

|

|

|

|

| Date: 5/19/2015 |

|

|

|

By: |

|

/s/ Stephen M. Cutler |

|

|

|

|

|

|

Stephen M. Cutler |

|

|

|

|

| Date: 5/19/2015 |

|

|

|

By: |

|

/s/ John K. Carroll |

|

|

|

|

|

|

John K. Carroll, Esq. |

|

|

|

|

|

|

Skadden, Arps, Slate, Meagher & Flom LLP |

|

|

|

|

|

|

|

|

| FOR THE DEPARTMENT OF JUSTICE, ANTITRUST DIVISION: |

|

|

|

|

|

|

|

|

|

|

JEFFREY D. MARTINO |

|

|

|

|

|

|

Chief, New York Office |

|

|

|

|

|

|

Antitrust Division |

|

|

|

|

|

|

United States Department of Justice |

|

|

|

|

| Date: 5/20/15 |

|

|

|

By: |

|

/s/ Joseph Muoio |

|

|

|

|

|

|

Joseph Muoio, Trial Attorney |

|

|

|

|

|

|

Eric L. Schleef, Trial Attorney |

|

|

|

|

|

|

Bryan C. Bughman, Trial Attorney |

|

|

|

|

|

|

Carrie A. Syme, Trial Attorney |

|

|

|

|

|

|

George S. Baranko, Trial Attorney |

|

|

|

|

|

|

Eric C. Hoffmann, Trial Attorney |

|

|

|

|

|

|

Grace Pyun, Trial Attorney |

|

| FOR THE DEPARTMENT OF JUSTICE, CRIMINAL DIVISION, FRAUD SECTION: |

|

|

|

|

|

|

|

|

|

|

ANDREW WEISSMANN |

|

|

|

|

|

|

Chief Fraud Section |

|

|

|

|

|

|

Criminal Division |

|

|

|

|

|

|

United States Department of Justice |

|

|

|

|

| Date: 5/20/15 |

|

|

|

By: |

|

/s/ Benjamin D. Singer |

|

|

|

|

|

|

Daniel A. Braun, Deputy Chief |

|

|

|

|

|

|

Benjamin D. Singer, Deputy Chief |

|

|

|

|

|

|

Albert B. Stieglitz, Jr., Assistant Chief |

|

|

|

|

|

|

Melissa T. Aoyagi, Trial Attorney |

ATTACHMENT B

DISCLOSURE NOTICE

The purpose of this

notice is to disclose certain practices of JPMorgan Chase & Co. and its affiliates (together, “JPMorgan Chase” or the “Firm”) when it acted as a dealer, on a principal basis, in the spot foreign exchange (“FX”)

markets. We want to ensure that there are no ambiguities or misunderstandings regarding those practices.

To begin, conduct by certain individuals has

fallen short of the Firm’s expectations. The conduct underlying the criminal antitrust charge by the Department of Justice is unacceptable. Moreover, as described in our November 2014 settlement with the U.K. Financial Conduct Authority

relating to our spot FX business, in certain instances during the period 2008 to 2013, certain employees intentionally disclosed information relating to the identity of clients or the nature of clients’ activities to third parties in order to

generate revenue for the Firm. This also was contrary to the Firm’s policies, unacceptable, and wrong. The Firm does not tolerate such conduct and already has committed significant resources in strengthening its controls surrounding our FX

business.

The Firm has engaged in other practices on occasion, including:

| |

• |

|

We added markup to price quotes using hand signals and/or other internal arrangements or communications. Specifically, when obtaining price quotes for bids or offers from the Firm, certain clients requested to be placed

on open telephone lines, meaning the client could hear pricing not only from a salesperson, but also from the trader who would be executing the client’s order. In certain instances, certain of our salespeople used hand signals to indicate to

the trader to add markup to the price being quoted to the client on the open telephone line, so as to avoid informing the client listening on the phone of the markup and/or the amount of the markup. For example, prior to agreement between the client

and the Firm to transact for the purchase of €100, a salesperson would, in certain instances, indicate with hand signals that the trader should add two pips of markup in providing a specific price to the client (e.g., a EURUSD rate of

1.1202, rather than 1.1200) in order to earn the Firm markup in connection with the prospective transaction. |

| |

• |

|

We have, without informing clients, worked limit orders at levels (i.e., prices) better than the limit order price so that we would earn a spread or markup in connection with our execution of such orders. This practice

could have impacted clients in the following ways: (1) clients’ limit orders would be filled at a time later than when the Firm could have obtained currency in the market at the limit orders’ prices, and (2) clients’ limit

orders would not be filled at all, even though the Firm had or could have obtained currency in the market at the limit orders’ prices. For example, if we accepted an order to purchase €100 at a limit of 1.1200 EURUSD, we might choose to

try to purchase the currency at a EURUSD rate of 1.1199 or better so that, when we sought in turn to fill the client’s order at the order price (i.e., 1.1200), we would make a spread or markup of 1 pip or better on the transaction. If the Firm

were unable to obtain the currency at the 1.1199 price, the clients’ order may not be filled as a result of our choice to make this spread or markup. |

| |

• |

|

We made decisions not to fill clients’ limit orders at all, or to fill them only in part, in order to profit from a spread or markup in connection with our execution of such orders. For example, if we accepted a

limit order to purchase €100 at a EURUSD rate of 1.1200, we would in certain instances only partially fill the order (e.g., €70) even when we had obtained (or might have been able to obtain) the full €100 at a EURUSD rate of

1.1200 or better in the marketplace. We did so because of other anticipated client demand, liquidity, a decision by the Firm to keep inventory at a more advantageous price to the Firm, or for other reasons. In doing so, we did not inform our clients

as to our reasons for not filling the entirety of their orders. |

JPMorgan Chase & Co.

Secretary’s Certificate of Corporate Resolution

I, Anthony J. Horan, Corporate Secretary of JPMorgan Chase & Co. (“JPMC”), hereby certify that the following resolutions were adopted at a

meeting of the Board of Directors of JPMC, on May 19, 2015, which meeting was duly called and at which a quorum was present, and that such resolutions remain in force as of the date hereof:

WHEREAS, the Board of Directors of JPMorgan Chase & Co. (“JPMC”), having considered:

The discussions between JPMC, through its legal counsel, and the United States Department of Justice, Criminal Division, Fraud

Section, and the Antitrust Division regarding its investigation into potential criminal violations relating to foreign exchange spot trading;

The proposed Information and a Plea Agreement, with attachments, as circulated to the board on May 18, 2015; and

The advice to the Board from its legal counsel regarding the Information and the terms of the Plea Agreement, as well as the

advice regarding the waiver of rights and other consequences of signing the Plea Agreement.

After discussion, on motion duly made, the following

resolution was adopted:

RESOLVED: That the Board of Directors has been advised of the contents of the Information and the

proposed Plea Agreement and its attachments in the matter of the United States versus JPMC and voted to authorize entry into the proposed Plea Agreement and to authorize JPMC to plead guilty to the charge specified in the Information; and that

Stephen M. Cutler, Executive Vice President and General Counsel or any other executive officer of JPMC, or an appropriate designee, is hereby authorized (i) to execute the Plea Agreement on behalf of JPMC, with such modifications as he may approve,

(ii) to act and speak on behalf of JPMC, in any proceeding or as otherwise necessary for the purpose of executing the Plea Agreement, including entry of a guilty plea on behalf of JPMC, (iii) to take further action necessary to carry into effect the

intent and purpose of this written resolution, and (iv) to provide to the United States Department of Justice a certified copy of this written resolution.

|

| /s/ Anthony J. Horan |

| Anthony J. Horan |

| May 19, 2015 |

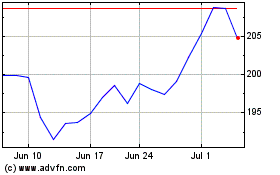

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Mar 2024 to Apr 2024

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Apr 2023 to Apr 2024