UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

Tender Offer Statement under Section 14(d)(1) or 13(e)(1)

Of the Securities Exchange Act of 1934

The St. Joe Company

(Name of Subject Company (Issuer) and Filing Person (Offeror))

Common Stock, no par value

(Title of Class of Securities)

790148100

(CUSIP Number

of Class of Securities)

Kenneth M. Borick, Esq.

The St. Joe Company

133

South WaterSound Parkway

WaterSound, Florida 32413

(850) 231-6400

(Name,

address and telephone number of person authorized to receive notices and communications on behalf of the filing persons)

with a

copy to:

Robert E. Buckholz, Esq.

Andrew G. Dietderich, Esq.

Sullivan & Cromwell LLP

125 Broad Street

New

York, New York 10004

(212) 558-4000

CALCULATION

OF FILING FEE

|

|

|

| Transaction Valuation* |

|

Amount of Filing Fee** |

| $299,999,988 |

|

$34,860 |

| |

| * |

Estimated for purposes of calculating the filing fee only. The amount assumes the purchase of 16,666,666 shares of the outstanding common stock, no par value, of The St. Joe Company at a price of $18.00 per share in

cash. |

| ** |

The amount of the filing fee, calculated in accordance with Rule 0–11 under the Securities Exchange Act of 1934, as amended, equals $116.20 per million dollars of the value of the transaction. |

| ¨ |

Check the box if any part of the fee is offset as provided by Rule 0–11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing. |

|

|

|

| Amount Previously Paid: Not Applicable |

|

Filing Party: Not Applicable |

| Form or Registration No.: Not Applicable |

|

Date Filed: Not Applicable |

| ¨ |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes below to designate any transactions to which the statement relates:

| |

¨ |

third-party tender offer subject to Rule 14d–1. |

| |

x |

issuer tender offer subject to Rule 13e–4. |

| |

¨ |

going-private transaction subject to Rule 13e–3. |

| |

¨ |

amendment to Schedule 13D under Rule 13d–2. |

Check the following box if the filing is a

final amendment reporting the results of the tender offer: ¨

If applicable,

check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

| |

¨ |

Rule 13e–4(i) (Cross-Border Issuer Tender Offer) |

| |

¨ |

Rule 14d–1(d) (Cross-Border Third-Party Tender Offer) |

This Tender Offer Statement on Schedule TO (“Schedule TO”) is being filed by The St.

Joe Company, a Florida corporation (“St. Joe” or the “Company”), pursuant to Rule 13e–4 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), in connection with the Company’s offer to

purchase for cash up to 16,666,666 shares of its common stock, no par value (the “Shares”), at a price of $18.00 per Share, net to the seller in cash, less any applicable withholding taxes and without interest, upon the terms and subject

to the conditions described in the Offer to Purchase, dated August 24, 2015 (the “Offer to Purchase”), a copy of which is filed herewith as Exhibit (a)(1)(A), and the related Letter of Transmittal, a copy of which is filed herewith as

Exhibit (a)(1)(B), which together, as they may be amended or supplemented from time to time, constitute the tender offer. This Schedule TO is being filed in accordance with Rule 13e–4(c)(2) under the Exchange Act.

All information in the Offer to Purchase and the related Letter of Transmittal is hereby expressly incorporated by reference in answer to all

items in this Schedule TO, and as more particularly set forth below.

| ITEM 1. |

Summary Term Sheet. |

The information set forth in the section of

the Offer to Purchase titled “Summary Term Sheet” is incorporated herein by reference.

| ITEM 2. |

Subject Company Information. |

(a) The name of the issuer is The St.

Joe Company. The address of the Company’s principal executive offices is 133 South WaterSound Parkway, WaterSound, Florida 32413. The Company’s telephone number is (850) 231-6400.

(b) This Schedule TO relates to the Shares of St. Joe. As of August 21, 2015, there were 92,332,565 issued and 91,677,700 outstanding

Shares (and 99,775 Shares reserved for issuance upon exercise of all outstanding stock options). The information set forth on the cover page of the Offer to Purchase, in the section of the Offer to Purchase titled “Introduction” and in

Section 11 (“Interests of Directors, Executive Officers and Affiliates; Recent Securities Transactions; Transactions and Arrangements Concerning Shares”) of the Offer to Purchase is incorporated herein by reference.

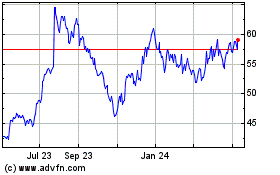

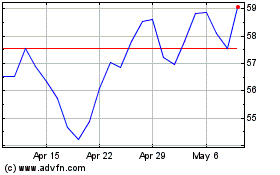

(c) The information set forth in Section 8 (“Price Range of Shares; Dividends”) of the Offer to Purchase is incorporated herein

by reference.

| ITEM 3. |

Identity and Background of Filing Person. |

(a) The St. Joe Company

is the filing person and issuer. The information set forth in Item 2(a) is incorporated herein by reference. The information set forth in Section 11 (“Interests of Directors, Executive Officers and Affiliates; Recent Securities

Transactions; Transactions and Arrangements Concerning the Shares”) of the Offer to Purchase is incorporated herein by reference.

| ITEM 4. |

Terms of the Transaction. |

(a)(1)(i) The information set forth in

the sections of the Offer to Purchase titled “Summary Term Sheet” and “Introduction,” and in Section 1 (“Aggregate Purchase Price for Shares; Priority of Purchase; Proration”) of the Offer to Purchase is

incorporated herein by reference.

(a)(1)(ii) The information set forth in the sections of the Offer to Purchase titled “Summary Term

Sheet” and “Introduction,” and in Section 1 (“Aggregate Purchase Price for Shares; Priority of Purchase; Proration”), Section 5 (“Purchase of Shares and Payment of Purchase Price”) and Section 9

(“Source and Amount of Funds”) of the Offer to Purchase is incorporated herein by reference.

(a)(1)(iii) The information set

forth in the sections of the Offer to Purchase titled “Summary Term Sheet” and “Introduction,” and in Section 1 (“Aggregate Purchase Price for Shares; Priority of Purchase; Proration”), Section 3

(“Procedures for Tendering Shares”) and Section 15 (“Extension of the Tender Offer; Termination; Amendment”) of the Offer to Purchase is incorporated herein by reference.

2

(a)(1)(iv) Not applicable.

(a)(1)(v) The information set forth in the section of the Offer to Purchase titled “Summary Term Sheet” and in Section 15

(“Extension of the Tender Offer; Termination; Amendment”) of the Offer to Purchase is incorporated herein by reference.

(a)(1)(vi) The information set forth in the section of the Offer to Purchase titled “Summary Term Sheet” and in Section 4

(“Withdrawal Rights”) of the Offer to Purchase is incorporated herein by reference.

(a)(1)(vii) The information set forth in

the section of the Offer to Purchase titled “Summary Term Sheet” and in Section 3 (“Procedures for Tendering Shares”) and Section 4 (“Withdrawal Rights”) of the Offer to Purchase is incorporated herein by

reference.

(a)(1)(viii) The information set forth in the section of the Offer to Purchase titled “Summary Term Sheet” and in

Section 3 (“Procedures for Tendering Shares”) and Section 5 (“Purchase of Shares and Payment of Purchase Price”) of the Offer to Purchase is incorporated herein by reference.

(a)(1)(ix) The information set forth in the sections of the Offer to Purchase titled “Summary Term Sheet” and

“Introduction” and in Section 1 (“Aggregate Purchase Price for Shares; Priority of Purchase; Proration”) and Section 5 (“Purchase of Shares and Payment of Purchase Price”) of the Offer to Purchase is

incorporated herein by reference.

(a)(1)(x) The information set forth in the section of the Offer to Purchase titled “Summary Term

Sheet” and in Section 2 (“Purpose of the Tender Offer; Certain Effects of the Tender Offer”) of the Offer to Purchase is incorporated herein by reference.

(a)(1)(xi) The information set forth in the section of the Offer to Purchase titled “Summary Term Sheet” and in Section 2

(“Purpose of the Tender Offer; Certain Effects of the Tender Offer”) of the Offer to Purchase is incorporated herein by reference.

(a)(1)(xii) The information set forth in the section of the Offer to Purchase titled “Summary Term Sheet” and in Section 3

(“Procedures for Tendering Shares”) and Section 13 (“United States Federal Income Tax Consequences”) of the Offer to Purchase is incorporated herein by reference.

(a)(2)(i–vii) Not applicable.

(b) The information set forth in Section 2 (“Purpose of the Tender Offer; Certain Effects of the Tender Offer”) and

Section 11 (“Interests of Directors, Executive Officers and Affiliates; Recent Securities Transactions; Transactions and Arrangements Concerning the Shares”) of the Offer to Purchase is incorporated herein by reference.

| ITEM 5. |

Past Contacts, Transactions, Negotiations and Agreements. |

(e) The

information set forth in the section of the Offer to Purchase titled “Summary Term Sheet” and in Section 11 (“Interests of Directors, Executive Officers and Affiliates; Recent Securities Transactions; Transactions and

Arrangements Concerning the Shares”) of the Offer to Purchase is incorporated herein by reference.

| ITEM 6. |

Purposes of the Transaction and Plans or Proposals. |

(a) The

information set forth in the section of the Offer to Purchase titled “Summary Term Sheet” and in Section 2 (“Purpose of the Tender Offer; Certain Effects of the Tender Offer”) of the Offer to Purchase is incorporated herein

by reference.

3

(b) The information set forth in Section 2 (“Purpose of the Tender Offer; Certain

Effects of the Tender Offer”) of the Offer to Purchase is incorporated herein by reference.

(c)(1–10) The information set forth

in the section of the Offer to Purchase titled “Summary Term Sheet” and “Introduction” and in Section 2 (“Purpose of the Tender Offer; Certain Effects of the Tender Offer”), Section 9 (“Source and Amount

of Funds”), Section 10 (“Certain Information Concerning St. Joe”) and Section 11 (“Interests of Directors, Executive Officers and Affiliates; Recent Securities Transactions; Transactions and Arrangements Concerning the

Shares”) of the Offer to Purchase is incorporated herein by reference.

| ITEM 7. |

Source and Amount of Funds or Other Consideration. |

(a),

(b) and (d) The information set forth in the section of the Offer to Purchase titled “Summary Term Sheet” and in Section 9 (“Source and Amount of Funds”) of the Offer to Purchase is incorporated herein by

reference.

| ITEM 8. |

Interest in Securities of the Subject Company. |

(a) and

(b) The information set forth in Section 11 (“Interests of Directors, Executive Officers and Affiliates; Recent Securities Transactions; Transactions and Arrangements Concerning the Shares”) of the Offer to Purchase is

incorporated herein by reference.

| ITEM 9. |

Persons/Assets, Retained, Employed, Compensated or Used. |

(a) The

information set forth in the section of the Offer to Purchase titled “Introduction” and in Section 16 (“Fees and Expenses; Information Agent; Depositary”) of the Offer to Purchase is incorporated herein by reference.

| ITEM 10. |

Financial Statements. |

(a) and (b) Not applicable. In

accordance with the instructions to Item 10 of Schedule TO, the financial statements are not considered material because: (1) the consideration offered consists solely of cash; (2) the tender offer is not subject to any financing

condition; and (3) St. Joe is a public reporting company under Section 13(a) or 15(d) of the Exchange Act that files reports electronically on EDGAR.

| ITEM 11. |

Additional Information. |

(a)(1) The information set forth in

Section 11 (“Interests of Directors, Executive Officers and Affiliates; Recent Securities Transactions; Transactions and Arrangements Concerning the Shares”) of the Offer to Purchase is incorporated herein by reference.

(a)(2) The information set forth in Section 12 (“Certain Legal Matters; Regulatory Approvals”) of the Offer to Purchase is

incorporated herein by reference.

(a)(3) Not applicable.

(a)(4) Not applicable.

(a)(5)

None.

(c) The information set forth in the Offer to Purchase and the related Letter of Transmittal, copies of which are filed as Exhibits

(a)(l)(A) and (a)(l)(B) hereto, respectively, as each may be amended or supplemented from time to time, is incorporated herein by reference. The Company will amend this Schedule TO to include documents that the Company may file with the SEC after

the date of the Offer to Purchase pursuant to Sections 13(a), 13(c) or 14 of the Exchange Act and prior to the expiration of the tender offer to the extent required by Rule 13e-4(d)(2) promulgated under the Exchange Act. The information contained in

all of the exhibits referred to in Item 12 below is incorporated herein by reference.

4

|

|

|

| Exhibit

Number |

|

Description |

|

|

| (a)(1)(A) |

|

Offer to Purchase, dated August 24, 2015. |

|

|

| (a)(1)(B) |

|

Letter of Transmittal. |

|

|

| (a)(1)(C) |

|

Notice of Guaranteed Delivery. |

|

|

| (a)(1)(D) |

|

Letter to Brokers, Dealers, Banks, Trust Companies and Other Nominees. |

|

|

| (a)(1)(E) |

|

Letter to Clients for use by Brokers, Dealers, Banks, Trust Companies and Other Nominees. |

|

|

| (a)(1)(F) |

|

Form of Summary Advertisement published in the Wall Street Journal on August 24, 2015. |

|

|

| (a)(5) |

|

Press Release issued by the Company on August 21, 2015. |

|

|

| (d)(1) |

|

Form of Indemnification Agreement for Directors and Officers (incorporated by reference to the Company’s Current Report on Form 8-K filed on February 13, 2009). |

|

|

| (d)(2) |

|

Stockholder Agreement dated September 14, 2011 by and between the Company, Fairholme Capital Management, L.L.C. and Fairholme Funds, Inc. (incorporated by reference to the Company’s Annual Report on Form 10-K for the year ended

December 31, 2011). |

|

|

| (d)(3) |

|

2009 Equity Incentive Plan (incorporated by reference to Appendix A to the Company’s Proxy Statement on Schedule 14A filed on March 31, 2009). |

|

|

| (d)(4) |

|

2015 Performance and Equity Incentive Plan. |

|

|

| (d)(5) |

|

Investment Management Agreement, dated April 8, 2013, between Fairholme Capital Management, L.L.C. and the Company (incorporated by reference to the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31,

2013). |

|

|

| (d)(6) |

|

Amendment to Investment Management Agreement, dated February 21, 2014, between Fairholme Capital Management, L.L.C. and the Company (incorporated by reference to the Company’s Annual Report on Form 10-K for the year ended

December 31, 2013). |

|

|

| (d)(7) |

|

Amendment to Investment Management Agreement, dated April 21, 2014, between Fairholme Capital Management, L.L.C. and the Company (incorporated by referenced to the Company’s Quarterly Report on Form 10-Q for the quarter ended

March 31, 2014). |

| ITEM 13. |

Information Required by Schedule 13E-3. |

Not applicable.

5

SIGNATURES

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and

correct.

|

|

|

| THE ST. JOE COMPANY |

|

|

| By: |

|

/s/ Marek Bakun |

| Name: |

|

Marek Bakun |

| Title: |

|

Chief Financial Officer |

Date: August 24, 2015

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| (a)(1)(A) |

|

Offer to Purchase, dated August 24, 2015. |

|

|

| (a)(1)(B) |

|

Letter of Transmittal. |

|

|

| (a)(1)(C) |

|

Notice of Guaranteed Delivery. |

|

|

| (a)(1)(D) |

|

Letter to Brokers, Dealers, Banks, Trust Companies and Other Nominees. |

|

|

| (a)(1)(E) |

|

Letter to Clients for use by Brokers, Dealers, Banks, Trust Companies and Other Nominees. |

|

|

| (a)(1)(F) |

|

Form of Summary Advertisement published in the Wall Street Journal on August 24, 2015. |

|

|

| (a)(5) |

|

Press Release issued by the Company on August 21, 2015. |

|

|

| (d)(1) |

|

Form of Indemnification Agreement for Directors and Officers (incorporated by reference to the Company’s Current Report on Form 8-K filed on February 13, 2009). |

|

|

| (d)(2) |

|

Stockholder Agreement dated September 14, 2011 by and between the Company, Fairholme Capital Management, L.L.C. and Fairholme Funds, Inc. (incorporated by reference to the Company’s Annual Report on Form 10-K for the year ended

December 31, 2011). |

|

|

| (d)(3) |

|

2009 Equity Incentive Plan (incorporated by reference to Appendix A to the Company’s Proxy Statement on Schedule 14A filed on March 31, 2009). |

|

|

| (d)(4) |

|

2015 Performance and Equity Incentive Plan. |

|

|

| (d)(5) |

|

Investment Management Agreement, dated April 8, 2013, between Fairholme Capital Management, L.L.C. and the Company (incorporated by reference to the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31,

2013). |

|

|

| (d)(6) |

|

Amendment to Investment Management Agreement, dated February 21, 2014, between Fairholme Capital Management, L.L.C. and the Company (incorporated by reference to the Company’s Annual Report on Form 10-K for the year ended

December 31, 2013). |

|

|

| (d)(7) |

|

Amendment to Investment Management Agreement, dated April 21, 2014, between Fairholme Capital Management, L.L.C. and the Company (incorporated by referenced to the Company’s Quarterly Report on Form 10-Q for the quarter ended

March 31, 2014). |

Exhibit (a)(1)(A)

OFFER TO PURCHASE FOR CASH

BY

THE ST. JOE COMPANY

OF UP TO 16,666,666 SHARES OF ITS COMMON STOCK

AT A PURCHASE PRICE OF $18.00 PER SHARE

THE TENDER OFFER AND WITHDRAWAL RIGHTS WILL EXPIRE AT 5:00 P.M., NEW YORK CITY TIME, ON SEPTEMBER 22,

2015, UNLESS THE TENDER OFFER IS EXTENDED.

The St. Joe Company (“St. Joe,” “we,” “us” or

“our”) is offering to purchase up to 16,666,666 shares of its common stock, no par value, at a price of $18.00 per share, net to the seller in cash, less any applicable withholding taxes and without interest, upon the terms and subject to

the conditions set forth in this Offer to Purchase and the related Letter of Transmittal, which together, as they may be amended and supplemented from time to time, constitute the “tender offer.” Unless the context otherwise requires, all

references to “shares” shall refer to the shares of common stock, no par value, of St. Joe.

Only shares properly tendered and

not properly withdrawn pursuant to the tender offer will be purchased, upon the terms and subject to the conditions of the tender offer. However, because of the “odd lot” priority, proration and conditional tender provisions described in

this Offer to Purchase, all of the shares tendered may not be purchased if more than the number of shares we seek are properly tendered. Shares tendered but not purchased pursuant to the tender offer will be returned at our expense promptly after

the expiration date. See Section 1. We reserve the right, in our sole discretion, to purchase more than 16,666,666 shares in the tender offer, subject to applicable law.

THE TENDER OFFER IS NOT CONDITIONED UPON OBTAINING FINANCING OR ANY MINIMUM NUMBER OF SHARES BEING TENDERED. THE TENDER OFFER IS, HOWEVER,

SUBJECT TO OTHER CONDITIONS. SEE SECTION 7.

Our shares are listed and traded on the New York Stock Exchange (“NYSE”) under

the symbol “JOE.” On August 21, 2015, the last trading day prior to the announcement and commencement of the tender offer, the last sale price of our shares reported on the NYSE was $16.89 per share. YOU ARE URGED TO OBTAIN CURRENT

MARKET QUOTATIONS FOR THE SHARES BEFORE DECIDING WHETHER TO TENDER YOUR SHARES. SEE SECTION 8.

OUR BOARD OF DIRECTORS HAS APPROVED

THE TENDER OFFER. HOWEVER, NEITHER ST. JOE, OUR BOARD OF DIRECTORS, THE DEPOSITARY NOR THE INFORMATION AGENT MAKES ANY RECOMMENDATION TO YOU AS TO WHETHER TO TENDER OR REFRAIN FROM TENDERING ANY SHARES. YOU SHOULD CAREFULLY EVALUATE ALL INFORMATION

IN THIS OFFER TO PURCHASE AND THE RELATED LETTER OF TRANSMITTAL, SHOULD CONSULT WITH YOUR OWN FINANCIAL AND TAX ADVISORS, AND SHOULD MAKE YOUR OWN DECISIONS ABOUT WHETHER TO TENDER SHARES, AND, IF SO, HOW MANY SHARES TO TENDER.

Questions and requests for assistance may be directed to D.F. King & Co., Inc., the Information Agent for the tender offer, at its

address and telephone number set forth on the back cover page of this Offer to Purchase. Requests for additional copies of this Offer to Purchase, the Letter of Transmittal or the Notice of Guaranteed Delivery, or any document incorporated herein by

reference, may be directed to the Information Agent.

Neither the Securities and Exchange Commission nor any state securities commission

has approved or disapproved of this transaction or passed upon the merits or fairness of such transaction or passed upon the adequacy or accuracy of the information contained in this Offer to Purchase. Any representation to the contrary is a

criminal offense.

August 24, 2015

IMPORTANT

If you wish to tender all or any part of your shares, you should either (1)(a) complete and sign the Letter of Transmittal, or a

facsimile of it, according to the instructions in the Letter of Transmittal and mail or deliver it, together with any required signature guarantee and any other required documents, to American Stock Transfer & Trust Company, LLC, the

Depositary for the tender offer, and mail or deliver the share certificates to the Depositary together with any other documents required by the Letter of Transmittal, or (b) tender the shares according to the procedure for book-entry transfer

described in Section 3, or (2) request a broker, dealer, commercial bank, trust company or other nominee to effect the transaction for you. If your shares are registered in the name of a broker, dealer, commercial bank, trust company or

other nominee, you should contact that person if you desire to tender your shares. If you desire to tender shares pursuant to the tender offer and the certificates for your shares are not immediately available or you cannot deliver certificates for

your shares and all other required documents to the Depositary before the expiration of the tender offer, or your shares cannot be delivered before the expiration of the tender offer under the procedure for book-entry transfer, you must tender your

shares according to the guaranteed delivery procedure described in Section 3.

The tender offer does not constitute an offer to buy

or the solicitation of an offer to sell securities in any jurisdiction in which such offer or solicitation would not be in compliance with the laws of the jurisdiction, provided that St. Joe will comply with the requirements of Rule 13e-4(f)(8) of

the Securities Exchange Act of 1934, as amended.

You should only rely on the information contained in this Offer to Purchase and the

Letter of Transmittal. We have not authorized any person to make any recommendation on our behalf as to whether you should tender or refrain from tendering your shares in the tender offer. We have not authorized any person to give any information or

to make any representation in connection with the tender offer other than those contained in this Offer to Purchase or in the Letter of Transmittal. If given or made, any recommendation or any such information or representation must not be relied

upon as having been authorized by us, the Information Agent or the Depositary.

-i-

TABLE OF CONTENTS

|

|

|

|

|

|

|

| |

|

|

|

Page |

|

| Summary Term Sheet |

|

|

1 |

|

|

|

| Cautionary Notice Regarding Forward-Looking Statements |

|

|

9 |

|

|

|

| Introduction |

|

|

12 |

|

|

|

| The Tender Offer |

|

|

14 |

|

|

|

|

| 1. |

|

Aggregate Purchase Price for Shares; Priority of Purchase; Proration. |

|

|

14 |

|

|

|

|

| 2. |

|

Purpose of the Tender Offer; Certain Effects of the Tender Offer. |

|

|

16 |

|

|

|

|

| 3. |

|

Procedures for Tendering Shares. |

|

|

20 |

|

|

|

|

| 4. |

|

Withdrawal Rights. |

|

|

24 |

|

|

|

|

| 5. |

|

Purchase of Shares and Payment of Purchase Price. |

|

|

24 |

|

|

|

|

| 6. |

|

Conditional Tender of Shares. |

|

|

26 |

|

|

|

|

| 7. |

|

Conditions of the Tender Offer. |

|

|

26 |

|

|

|

|

| 8. |

|

Price Range of Shares; Dividends. |

|

|

28 |

|

|

|

|

| 9. |

|

Source and Amount of Funds. |

|

|

29 |

|

|

|

|

| 10. |

|

Certain Information Concerning St. Joe. |

|

|

29 |

|

|

|

|

| 11. |

|

Interests of Directors, Executive Officers and Affiliates; Recent Securities Transactions; Transactions and Arrangements Concerning the Shares. |

|

|

30 |

|

|

|

|

| 12. |

|

Certain Legal Matters; Regulatory Approvals. |

|

|

34 |

|

|

|

|

| 13. |

|

United States Federal Income Tax Consequences. |

|

|

34 |

|

|

|

|

| 14. |

|

Effects of the Tender Offer on the Market for Shares; Registration under the Exchange Act. |

|

|

38 |

|

|

|

|

| 15. |

|

Extension of the Tender Offer; Termination; Amendment. |

|

|

38 |

|

|

|

|

| 16. |

|

Fees and Expenses; Information Agent; Depositary. |

|

|

39 |

|

|

|

|

| 17. |

|

Miscellaneous. |

|

|

40 |

|

-ii-

SUMMARY TERM SHEET

We are providing this summary term sheet for your convenience. It highlights the most material information in this Offer to Purchase, but

you should understand that it does not describe all of the details of the tender offer to the same extent described in this Offer to Purchase. We urge you to read the entire Offer to Purchase and the related Letter of Transmittal because they

contain the full details of the tender offer. We have included references to the sections of this Offer to Purchase where you will find a more complete discussion.

| Who is offering to purchase my shares? |

The St. Joe Company, which we refer to as “St. Joe,” “we,” “us” or “our,” is offering to purchase shares of its common stock, no par value, in a tender offer. |

| What will the purchase price for the shares be and what will be the form of payment? |

We are offering to purchase your shares at a price of $18.00 per share. If your shares are purchased in the tender offer, you will be paid the purchase price in cash, less any applicable withholding taxes and without interest, promptly after the

expiration of the tender offer. Under no circumstances will we pay interest on the purchase price, even if there is a delay in making payment. See Sections 1 and 5. |

| How many shares will St. Joe purchase? |

We are offering to purchase 16,666,666 shares validly tendered in the tender offer, or such fewer number of shares as are properly tendered and not properly withdrawn prior to the expiration date (as defined below). 16,666,666 shares represents

approximately 18.2% of our outstanding common stock as of August 21, 2015. We also expressly reserve the right to purchase an additional number of shares not to exceed 2% of the outstanding shares, and could decide to purchase more shares,

subject to applicable legal requirements. As of August 21, 2015, we had 92,332,565 issued and 91,677,700 outstanding shares (and 99,775 shares reserved for issuance upon exercise of all outstanding stock options). See Section 11. The tender

offer is not conditioned on any minimum number of shares being tendered. See Section 7. |

| Why is St. Joe making the tender offer? |

The primary purpose of the tender offer is to provide our shareholders with the opportunity to tender all or a portion of their shares and, thereby, receive a return of some or all of their investment if they so elect. As discussed in our Annual

Report on Form 10-K for the fiscal year ended December 31, 2014, we currently have significant liquid assets as a result of the completion of the AgReserves Sale and RiverTown Sale (each as defined in Section 2). Based on an evaluation of

St. Joe’s operations, financial condition, capital needs, regulatory requirements, strategy and expectations for the future, including the fact that we are currently studying a longer-term property development strategy that could generate

losses and negative cash flows for an extended period of time if we continue with the self-development of recently granted entitlements, our management and Board of Directors believe that it is appropriate at this time to offer to repurchase shares

pursuant to the tender offer using a portion of the cash proceeds we received from the AgReserves Sale and the RiverTown Sale. See Section 2. |

| |

We also believe that the tender offer provides shareholders with an opportunity to obtain liquidity with respect to all or a portion of their

|

| |

shares without the potential disruption to the share price that can result from market sales. The liquidity of the trading market in our shares is currently limited as a result of relatively

concentrated ownership by our major shareholders and the long-term nature of our business, and trading in our shares will likely continue to be relatively illiquid for the foreseeable future. See Section 2. |

| |

The tender offer also provides our shareholders with an efficient way to sell their shares without incurring brokerage commissions, solicitation fees or stock transfer taxes associated with open market sales.

Furthermore, “odd lot holders,” as defined in Section 1, who hold shares registered in their names and tender their shares directly to the Depositary and whose shares are purchased in the tender offer will avoid any odd lot discounts

that might otherwise be applicable to sales of their shares. See Sections 1 and 2. |

| |

In addition, if St. Joe completes the tender offer, shareholders who choose not to tender will own, and shareholders who retain an equity interest in St. Joe as a result of a partial or conditional tender of shares may

own, a greater percentage ownership of our outstanding shares to the extent we purchase shares in the tender offer. However, following consummation of the tender offer, shareholders retaining an equity interest in St. Joe may also face reduced

trading liquidity. See Section 2. |

| How will St. Joe pay for the shares? |

Assuming we purchase 16,666,666 shares in the tender offer, approximately $300 million will be required to purchase such shares. We expect to fund the share purchases in the tender offer, and to pay related fees and expenses, from our current

assets, including cash and cash equivalents and investments. The tender offer is not subject to a financing contingency. See Sections 7 and 9. |

| How long do I have to tender my shares? |

You may tender your shares until the tender offer expires. The tender offer will expire on September 22, 2015 at 5:00 p.m., New York City time, unless we extend it. If a broker, dealer, commercial bank, trust company or other nominee holds your

shares, it is likely that they will have an earlier deadline for you to act to instruct them to accept the tender offer on your behalf. We urge you to immediately contact your broker, dealer, commercial bank, trust company or other nominee to find

out their deadline. See Section 1. |

| |

We may choose to extend the tender offer for any reason, subject to applicable laws. We cannot assure you, however, that we will extend the tender offer or, if we extend it, for how long. If we extend the tender offer,

we will delay the acceptance of any shares that have been tendered. See Section 15. |

| How will I be notified if St. Joe extends the tender offer? |

We will issue a press release by no later than 9:00 a.m., New York City time, on the business day after the previously scheduled expiration date if we decide to extend the tender offer. See Section 15. |

| What will happen if I do not tender my shares? |

Upon the completion of the tender offer, non-tendering shareholders will realize a proportionate increase in their relative ownership

|

-2-

| |

interest in us and thus in our future earnings and assets, subject to our right to issue additional shares of common stock and other equity securities in the future. See Section 2.

|

| Are there any conditions to the tender

offer? |

Yes. Our obligation to accept and pay for your tendered shares depends upon a number of conditions, which must be satisfied or waived by us on or prior to the expiration date, including: |

| |

• |

|

No legal action shall have been proposed, instituted or pending, nor shall we have received notice of such action that challenges or otherwise relates to the tender offer. |

| |

• |

|

No general suspension of trading in, or limitation on prices for, securities on any national securities exchange or in the over-the-counter markets in the United States, declaration of a banking moratorium or any

suspension of payment in respect of banks in the United States, or any governmental or regulatory limitation or any event or adverse change in the financial or capital markets generally, that, in our reasonable judgment, might affect the extension

of credit by banks or other lending institutions in the United States, shall have occurred. |

| |

• |

|

No changes in the general political, market, economic or financial conditions in the United States or abroad that could have a material adverse effect on our business, financial condition, income, operations or business

or financial prospects shall have occurred. |

| |

• |

|

No commencement or escalation of war, armed hostilities or other international or national calamity directly or indirectly involving the United States or any of its territories, including, but not limited to, an act of

terrorism, shall have occurred. |

| |

• |

|

No decline of 10% or more in the market price of our common stock or in the Dow Jones Industrial Average, New York Stock Exchange Index, Nasdaq Composite Index or Standard & Poor’s 500 Composite Index measured

from the close of trading on August 21, 2015 shall have occurred. |

| |

• |

|

No person shall have proposed, announced or made a tender or exchange offer (other than this tender offer), merger, business combination or other similar transaction involving us or any of our subsidiaries nor shall we

or any of our subsidiaries have entered into a definitive agreement or an agreement in principle with any person with respect to a merger, business combination or other similar transaction. |

| |

• |

|

No person (including a group) shall have acquired or proposed to acquire beneficial ownership of more than 5% of the outstanding shares (other than

anyone who publicly disclosed such ownership in a filing with the Securities and Exchange Commission (the “SEC”) on or before August 21, 2015). No person or group which has made such a filing on or before August 21, 2015 shall

acquire or propose to acquire an additional 2% or more of our outstanding shares. In addition, no new group |

-3-

| |

shall have been formed that beneficially owns (as a group) more than 5% of our outstanding shares. No one shall have filed a Notification and Report Form under the Hart-Scott-Rodino Antitrust

Improvements Act of 1976, or made a public announcement reflecting an intent to acquire us or any of our subsidiaries or any of our respective assets or securities. |

| |

• |

|

No change, condition or event (or any condition or event involving a prospective change) shall have occurred in our and our subsidiaries’ business, properties, assets, liabilities, capitalization,

shareholders’ equity, financial condition, operations, licenses, franchises, permits, permit applications, results of operations or business or financial prospects that, in our reasonable judgment, has, or could reasonably be expected to have,

a material adverse effect on us and our subsidiaries, on the value of or trading in our common stock, on our ability to consummate the tender offer or on the benefits of the tender offer to us. |

| |

• |

|

No determination shall have been made by St. Joe that there shall be any reasonable likelihood, as determined by St. Joe in its reasonable judgment, that the consummation of the tender offer and the purchase of shares

could result in either (a) the tender offer being considered a “going private transaction” under Rule 13e-3 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or (b) St. Joe failing to comply with the

distribution requirements of Section 607.06401 of the Florida Statutes. |

| |

The tender offer is subject to these conditions and a number of other conditions. See Section 7. |

| How do I tender my shares? |

To tender your shares, prior to 5:00 p.m., New York City time, on September 22, 2015 (unless the tender offer is extended): |

| |

• |

|

you must deliver your share certificate(s) and a properly completed and duly executed Letter of Transmittal to the Depositary at one of its addresses appearing on the back cover page of this Offer to Purchase; or

|

| |

• |

|

the Depositary must receive a confirmation of receipt of your shares by book-entry transfer and a properly completed and duly executed Letter of Transmittal or “agent’s message”; or |

| |

• |

|

you must comply with the guaranteed delivery procedure. |

| |

If your shares are held through a broker, dealer, commercial bank or other nominee, you must request such broker, dealer, commercial bank or other nominee to effect the transaction for you. You may also contact the

Information Agent for assistance. |

| |

See Section 3 and the instructions to the Letter of Transmittal. |

| How do holders of vested stock options for shares participate in the tender offer? |

Options to purchase shares cannot be tendered in the tender offer. If you hold vested but unexercised options, you may exercise such options in accordance with the terms of our share-based

compensation plans and St. Joe’s policies and practices, and tender the shares |

-4-

| |

received upon such exercise in accordance with the tender offer. Exercises of options cannot be revoked even if some or all of the shares received upon the exercise thereof and tendered in the

tender offer are not purchased pursuant to the tender offer for any reason. You should evaluate this Offer to Purchase carefully to determine if participation would be advantageous to you based on your stock option exercise prices and the expiration

date of your options and the provisions for pro rata purchases by St. Joe. We strongly encourage optionholders to discuss the tender offer with their own financial or tax advisor. |

| |

Please be advised that it is the optionholder’s responsibility to tender shares in the tender offer to the extent such holder wants to participate and it may be difficult to secure delivery of shares issued

pursuant to vested stock options in a time period sufficient to allow tender of those shares prior to the expiration date. Accordingly, we suggest that you exercise your vested options and satisfy the exercise price for such shares in accordance

with the terms of the related stock option plan and option agreement and St. Joe policies and practices at least four business days prior to the expiration date. See Section 3. |

| May I tender only a portion of the shares that I hold? |

Yes. You do not have to tender all or any minimum amount of the shares that you own to participate in the tender offer. |

| Once I have tendered shares in the tender offer, can I withdraw my tender? |

You may withdraw any shares you have tendered at any time before 5:00 p.m., New York City time, on September 22, 2015, unless we extend the tender offer, in which case you may withdraw tendered shares until the tender offer, as so extended,

expires. If we have not accepted for payment the shares you have tendered to us, you may also withdraw your shares after October 20, 2015. See Section 4. |

| How do I withdraw shares I previously tendered? |

You must deliver, on a timely basis, a written or facsimile notice of your withdrawal to the Depositary at one of its addresses appearing on the back cover page of this Offer to Purchase. Your notice of withdrawal must specify your name, the

number of shares to be withdrawn and the name of the registered holder of these shares. Some additional requirements apply if the share certificates to be withdrawn have been delivered to the Depositary or if your shares have been tendered under the

procedure for book-entry transfer set forth in Section 3. If you have tendered shares by giving instructions to a bank, broker, dealer, trust company or other nominee, you must instruct that person to arrange for withdrawal of your shares. See

Section 4. |

| Has St. Joe or its Board of Directors adopted a position on the tender offer? |

Our Board of Directors has approved the tender offer. However, neither we nor our Board of Directors makes any recommendation to you as to whether you should tender or refrain from tendering your shares. You must make your own decision as to

whether to tender your shares and, if so, how many shares to tender. See Section 2. In doing so, you should read carefully the information in this Offer to Purchase and in the Letter of Transmittal. |

-5-

| Will St. Joe’s directors and executive officers tender shares in the tender offer? |

Our directors, executive officers and affiliates are entitled to participate in the tender offer on the same basis as all other shareholders. All of our directors and executive officers have indicated that they do not currently intend to

participate in the tender offer (though no final decision has been made). Fairholme Capital Management, L.L.C. has advised us that it does not intend to cause client accounts over which it exercises investment discretion, including The Fairholme

Fund, a series of Fairholme Funds, Inc., to tender any shares into the offer, and we are not aware of any of our other affiliates that intend to tender any shares in the tender offer. See Section 11. |

| Following the tender offer, will St. Joe continue as a public company? |

We do not believe that our purchase of shares in the tender offer will cause us to be eligible for deregistration under the Exchange Act or delisted from the NYSE. |

| What happens if more than 16,666,666 shares are tendered in the tender offer? |

We will purchase shares: |

| |

• |

|

first, from all holders of “odd lots” of less than 100 shares who properly tender all of their shares and do not properly withdraw them before the expiration date; |

| |

• |

|

second, after purchasing the shares from the “odd lot” holders, from all other shareholders who properly tender shares and who do not properly withdraw them before the expiration date, on a pro rata basis,

subject to the conditional tender provisions described in Section 6, with appropriate adjustments to avoid purchases of fractional shares until we have purchased 16,666,666 shares (or such greater number of shares as we may elect to purchase,

subject to applicable law); and |

| |

• |

|

third, only if necessary to permit us to purchase 16,666,666 shares (or such greater number of shares as we may elect to purchase, subject to applicable law), from holders who have tendered shares subject to the

condition that a specified minimum number of the holder’s shares be purchased if any shares are purchased in the tender offer as described in Section 6 (for which the condition was not initially satisfied) and not properly withdrawn before the

expiration date by random lot, to the extent feasible. To be eligible for purchase by random lot, shareholders whose shares are conditionally tendered must have tendered all of their shares. Therefore, all of the shares that you tender on a

conditional basis in the tender offer may not be purchased. See Section 1. |

| When will St. Joe pay for the shares I tender? |

We will pay the purchase price, net to you in cash, less any applicable withholding taxes and without interest, for the shares we purchase within three business days after the expiration of the tender offer and the acceptance of the shares for

payment (but only after timely receipt by the Depositary of the documents required by the Letter of Transmittal). In the event of proration, we do not expect to be able to commence payment for shares until approximately five business days after the

expiration date. See Sections 1 and 5. |

-6-

| What is the recent market price of my St. Joe shares? |

On August 21, 2015, the last trading day prior to the announcement and commencement of the tender offer, the last sale price for our shares reported on the NYSE was $16.89 per share. You are urged to obtain current market

quotations for the shares before deciding whether to tender your shares. See Section 8. |

| Does St. Joe intend to repurchase any shares other than pursuant to the tender offer during or after the tender offer? |

Rule 13e–4(f) under the Exchange Act prohibits us from purchasing any shares, other than in the tender offer, until at least ten business days have elapsed after the expiration date. Accordingly, any additional purchases outside the tender

offer may not be consummated until at least ten business days have elapsed after the expiration date. |

| |

Through December 31, 2011, our Board of Directors had authorized a total of $950.0 million for the repurchase of outstanding shares from shareholders under our Stock Repurchase Program (as defined in Section 2). Through

June 30, 2015, a total of approximately $846.2 million had been expended in the Stock Repurchase Program from its inception. During the period beginning July 21, 2015 and ending on August 10, 2015, St. Joe purchased shares under the Stock Purchase

Program with an aggregate purchase price of $10.2 million pursuant to its Rule 10b5-1 trading plan. On August 15, 2015, our Board of Directors authorized the repurchase of additional shares with an aggregate purchase price of up to $300 million

(including the previously unused $93.6 million of authority). As a result, as of the commencement of the tender offer, St. Joe has remaining authority under the Stock Repurchase Program of $300 million, substantially all of which will be used if the

tender offer is fully subscribed. |

| |

After completing the tender offer, we may consider from time to time various means of returning additional cash to shareholders, including open market purchases, tender offers, privately negotiated transactions and/or

accelerated share repurchases after taking into account our results of operations, financial position and capital requirements, general business conditions, legal, tax and regulatory constraints or restrictions, any contractual restrictions and

other factors we deem relevant. However, there can be no assurance that we will pursue any such actions. See Section 2. |

| Will I have to pay brokerage commissions if I tender my shares? |

If you are a registered shareholder and you tender your shares directly to the Depositary, you will not incur any brokerage commissions. If you hold shares through a broker or bank, we urge you to consult your broker or bank to determine whether

transaction costs are applicable. See Sections 1 and 3. |

| What are the U.S. federal income tax consequences if I tender my shares? |

If you are a U.S. Holder (as defined in Section 13), the receipt of cash for your tendered shares generally will be treated for United States federal income tax purposes either as (a) a sale or exchange eligible for capital gain or

loss treatment or (b) a distribution. See Section 13. If you are a Non-U.S. Holder (as defined in Section 13), the payment of cash for your tendered shares may be subject to United States federal income tax withholding at a 30% rate

unless one of certain exemptions applies. See Sections 3 and 13. |

-7-

| Will I have to pay any stock transfer tax if I tender my shares? |

We will pay all stock transfer taxes unless payment is made to, or if shares not tendered or accepted for payment are to be registered in the name of, someone other than the registered holder, or tendered certificates are registered in the name

of someone other than the person signing the letter of transmittal. See Section 5. |

| What will happen if I do not tender my shares? |

Shareholders who choose not to tender will own a greater percentage ownership of our outstanding shares to the extent we purchase shares in the tender offer. To the extent we purchase shares in the tender offer, shareholders retaining an equity

interest in St. Joe may also face reduced trading liquidity. See Section 2. |

| To whom can I talk if I have questions? |

The Information Agent can help answer your questions. The Information Agent is D.F. King & Co., Inc. Its contact information is set forth on the back cover page of this Offer to Purchase. |

-8-

CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

This document may contain or incorporate by reference “forward-looking statements” within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the Exchange Act. These statements concern expectations, beliefs, projections, plans and strategies, anticipated events or trends and similar expressions concerning matters that are not

historical facts, and may include the words “believes,” “plans,” “intends,” “expects,” “anticipates,” “forecasts,” “hopes,” “should,” “estimates” or words of

similar meaning. Specifically, the documents incorporated by reference in this document, including St. Joe’s Annual Report on Form 10-K for the fiscal year ended December 31, 2014 and St. Joe’s Quarterly Reports on Form 10-Q for the

quarterly periods ended March 31, 2015 and June 30, 2015, contain forward-looking statements regarding:

| |

• |

|

our expectations concerning our future business strategy; |

| |

• |

|

our expectations concerning our intent to seek additional opportunities to invest our liquid assets, including our intent to seek opportunities that could increase our returns; |

| |

• |

|

our expectations concerning the timing and effect of selecting a future replacement for our CEO; |

| |

• |

|

our expectations concerning demand for residential real estate, including mixed-use and active adult communities, in Northwest Florida and our ability to develop projects that meet that demand; |

| |

• |

|

our expectations concerning the volatility in the consistency and pace of our residential real estate sales, the type of buyers interested in our residential real estate, and the mix of homesites that will be available

for sale and the related effect on our gross profit margins; |

| |

• |

|

our beliefs concerning the seasonality of our revenues; |

| |

• |

|

our expectations regarding the demand for commercial and industrial uses, and our ability to develop projects that meet that demand; |

| |

• |

|

our expectations regarding unrealized losses related to our investments, including potential future downturns related to our corporate debt securities and other investments; |

| |

• |

|

our belief that St. Joe Club & Resorts will provide us with a competitive advantage and help us increase our market share; |

| |

• |

|

our expectations regarding the financial impact of our decision to launch St. Joe Club & Resorts and to privatize certain golf courses and resorts facilities; |

| |

• |

|

our expectations regarding the amount and timing of the impact fees which we will receive in connection with the RiverTown Sale; |

| |

• |

|

our expectations regarding the costs and benefits of the Timber Note monetization structure as discussed in St. Joe’s Form 10-K for the fiscal year ended December 31, 2014, including the timing and amount of

the expenses that NFTF will incur during the life of the Timber Note and the amount of the remaining principal balance; |

| |

• |

|

our expectation regarding our liquidity or ability to satisfy our working capital needs, expected capital expenditures, principal and interest payments on our debt and deferred tax liabilities; |

| |

• |

|

our expectation regarding the impact of pending litigation, claims, other disputes or governmental proceedings, including the pending SEC investigation, on our financial position or results of operations, and our belief

regarding the defenses to litigation claims against us; |

| |

• |

|

our belief regarding compliance with environmental and other applicable regulatory matters; |

| |

• |

|

our expectations with respect to the accounting treatment for the AgReserves Sale and RiverTown Sale; |

| |

• |

|

our estimates regarding certain tax matters and accounting valuations, including our ability to use our tax assets to mitigate any tax liabilities that arise from the AgReserves Sale and the timing and amount we expect

to pay in future income taxes; |

-9-

| |

• |

|

our expectations regarding the sufficiency of the surplus assets of the cash balance defined benefit pension plan previously sponsored by St. Joe (the “Pension Plan”) to fund future benefits to 401(k) plan

participants; and |

| |

• |

|

our expectations regarding the impact of new accounting pronouncements. |

These forward-looking

statements reflect our current views about future events and are subject to risks, uncertainties and assumptions. We wish to caution readers that certain important factors may have affected and could in the future affect our actual results and could

cause actual results to differ significantly from those expressed in any forward-looking statement. The most important factors that could prevent us from achieving our goals, and cause the assumptions underlying forward-looking statements and the

actual results to differ materially from those expressed in or implied by those forward-looking statements include, but are not limited to, those risk factors and disclosures set forth in our Form 10-K for the year ended December 31, 2014,

subsequent Form 10-Qs and other current reports, and the following:

| |

• |

|

any changes in our strategic objectives, including any such changes implemented as a result of our planned CEO search; |

| |

• |

|

significant decreases in the market value of our investments in securities or any other investments; |

| |

• |

|

our ability to capitalize on opportunities relating to a mixed use and active adult community or communities in Northwest Florida; |

| |

• |

|

changes in our customer base and the mix of homesites available for sale in our residential real estate; |

| |

• |

|

any further downturns in real estate markets in Florida or across the nation; |

| |

• |

|

a slowing of the population growth in Florida, including a decrease of the migration of Baby Boomers to Florida; |

| |

• |

|

our dependence on the real estate industry and the cyclical nature of our real estate operations; |

| |

• |

|

our ability to successfully and timely obtain land-use entitlements and construction financing, and address issues that arise in connection with the use and development of our land, including the permits required for

the launch of our planned mixed-use and active adult communities; |

| |

• |

|

changes in laws, regulations or the regulatory environment affecting the development of real estate; |

| |

• |

|

any unrealized losses related to our investments, including any potential further downturns in our corporate debt securities or any other of our investments; |

| |

• |

|

our ability to effectively deploy and invest our assets, including our available-for-sale securities; |

| |

• |

|

the anticipated benefits from our decision to launch St. Joe Club & Resorts and to privatize certain golf courses and resort facilities may not be realized, may take longer to realize than expected, or may cost

more to achieve than expected; |

| |

• |

|

our ability to successfully estimate the amount and timing of the impact fees we will receive in connection with the RiverTown Sale; |

| |

• |

|

our ability to successfully estimate the costs and benefits of the Timber Note monetization structure; |

| |

• |

|

increases in operating costs, including costs related to real estate taxes, owner association fees, construction materials, labor and insurance, and our ability to manage our cost structure; |

| |

• |

|

our ability to anticipate the impact of pending environmental litigation matters or governmental proceedings on our financial position or results of operations; |

| |

• |

|

the expense, management distraction and possible liability associated with litigation, claims, other disputes or governmental proceedings, including the pending SEC investigation; |

| |

• |

|

potential liability under environmental or construction laws, or other laws or regulations; |

-10-

| |

• |

|

our ability to successfully estimate the impact of certain accounting and tax matters that arise from the AgReserves Sale and RiverTown Sale; |

| |

• |

|

significant tax payments arising from any acceleration of deferred taxes that arise from the AgReserves Sale and related transactions; |

| |

• |

|

the performance of the surplus assets in the Pension Plan may not be what we expected; and |

| |

• |

|

the commencement and completion of the tender offer. |

For further information on factors that

could cause actual results to materially differ from projections, please see our publicly available SEC filings, including our Form 10-K for the fiscal year ended December 31, 2014 and, in particular, the discussion of “Risk Factors”

set forth therein. St. Joe does not update any of its forward-looking statements except as required by law.

-11-

INTRODUCTION

To the Holders of our Shares:

The St.

Joe Company, a Florida corporation (“St. Joe,” “we,” “us” or “our”), is offering to purchase up to 16,666,666 shares of its common stock, no par value, at a price of $18.00 per share, net to the seller in

cash, less any applicable withholding taxes and without interest, upon the terms and subject to the conditions set forth in this Offer to Purchase and the related Letter of Transmittal, which, as amended and supplemented from time to time, together

constitute the “tender offer.” Unless the context otherwise requires, all references to “shares” shall refer to the shares of common stock, no par value, of St. Joe.

Only shares properly tendered and not properly withdrawn pursuant to the tender offer will be purchased, upon the terms and subject to the

conditions of the tender offer. However, because of the “odd lot” priority, proration and conditional tender provisions described in this Offer to Purchase, all of the shares tendered may not be purchased if more than the number of shares

St. Joe seeks are properly tendered. Shares tendered but not purchased pursuant to the tender offer will be returned at St. Joe’s expense promptly after the expiration date. See Section 1. St. Joe reserves the right, in its sole

discretion, to purchase more than 16,666,666 shares in the tender offer, subject to applicable law.

The tender offer will expire at 5:00

p.m., New York City time, on September 22, 2015, unless the tender offer is extended.

THE TENDER OFFER IS NOT CONDITIONED UPON

OBTAINING FINANCING OR ANY MINIMUM NUMBER OF SHARES BEING TENDERED. THE TENDER OFFER IS, HOWEVER, SUBJECT TO OTHER CONDITIONS. SEE SECTION 7.

OUR BOARD OF DIRECTORS HAS APPROVED THE TENDER OFFER. HOWEVER, NEITHER ST. JOE, OUR BOARD OF DIRECTORS, THE DEPOSITARY NOR THE INFORMATION

AGENT MAKES ANY RECOMMENDATION TO ANY SHAREHOLDER AS TO WHETHER TO TENDER OR REFRAIN FROM TENDERING ANY SHARES. ST. JOE HAS NOT AUTHORIZED ANY PERSON TO MAKE ANY RECOMMENDATION. SHAREHOLDERS SHOULD CAREFULLY EVALUATE ALL INFORMATION IN THIS OFFER TO

PURCHASE AND THE RELATED LETTER OF TRANSMITTAL, SHOULD CONSULT THEIR OWN FINANCIAL AND TAX ADVISORS, AND SHOULD MAKE THEIR OWN DECISIONS ABOUT WHETHER TO TENDER SHARES, AND, IF SO, HOW MANY SHARES TO TENDER.

Our directors, executive officers and affiliates are entitled to participate in the tender offer on the same basis as all other shareholders.

All of our directors and executive officers have indicated that they do not currently intend to participate in the tender offer (though no final decision has been made). Fairholme Capital Management, L.L.C. has advised us that it does not intend to

cause client accounts over which it exercises investment discretion, including The Fairholme Fund, a series of Fairholme Funds, Inc., to tender any shares into the offer, and we are not aware of any of our other affiliates that intend to tender any

shares in the tender offer.

The equity ownership of our directors, executive officers and affiliates who do not tender their shares in

the tender offer, and the equity ownership of other shareholders who do not tender their shares pursuant to the tender offer, will proportionately increase as a percentage of our issued and outstanding shares to the extent we purchase shares in the

tender offer.

The purchase price will be paid net to the tendering shareholder in cash, less any applicable withholding taxes and without

interest, for all the shares purchased. Tendering shareholders who hold shares registered in their own name and who tender their shares directly to the Depositary will not be obligated to pay brokerage commissions, solicitation fees or, subject to

Instruction 6 of the Letter of Transmittal, stock transfer taxes on the purchase of shares in the tender offer. Shareholders holding shares in a brokerage account or otherwise through

-12-

brokers, dealers, commercial banks, trust companies or other nominees are urged to consult their brokers or such other nominees to determine whether transaction costs may apply if shareholders

tender shares through such brokers or other nominees and not directly to the Depositary. See Sections 3 and 13 regarding certain tax consequences of the tender offer.

Also, any tendering shareholder or other payee who fails to complete, sign and return to the Depositary the Internal Revenue Service

(“IRS”) Form W-9 included with the Letter of Transmittal (or such other IRS form as may be applicable) may be subject to United States federal income tax backup withholding (at a rate of 28% of the gross proceeds), unless such holder

establishes that such holder is within the class of persons that is exempt from backup withholding, such as corporations and Non-U.S. Holders (as defined in Section 13). Certain U.S. Holders (including, among others, corporations) are not

subject to these backup withholding requirements. In addition, in order for a Non-U.S. Holder (as defined in Section 13) to avoid backup withholding, the Non-U.S. Holder must submit a statement (generally, an applicable IRS Form W-8), signed

under penalties of perjury and attesting to that holder’s exempt status, or other acceptable certification. Such statements can be obtained from the Depositary or from the IRS’s website. See Section 3. Also see Section 13

regarding United States federal income tax consequences of the tender offer.

As of August 21, 2015, St. Joe had 92,332,565 issued

and 91,677,700 outstanding shares (and 99,775 shares reserved for issuance upon exercise of all outstanding stock options). The 16,666,666 shares that St. Joe is offering to purchase represent approximately 18.2% of the shares outstanding on

August 21, 2015. On August 21, 2015, the last trading day before the announcement and commencement of the tender offer, the last reported sale price of the shares on the NYSE was $16.89 per share. Shareholders are urged to obtain

current market quotations for their shares before deciding whether to tender shares pursuant to the tender offer. See Section 8.

This Offer to Purchase and the Letter of Transmittal contain important information that you should read carefully before you make any

decision regarding the tender offer.

-13-

THE TENDER OFFER

| 1. |

Aggregate Purchase Price for Shares; Priority of Purchase; Proration. |

General. Upon the terms and subject to the conditions of the tender offer, St. Joe will purchase 16,666,666 shares, or

such fewer number of shares as are properly tendered and not properly withdrawn in accordance with Section 4, before the scheduled expiration date of the tender offer, at a price of $18.00 per share, net to the seller in cash, less any

applicable withholding taxes and without interest.

The term “expiration date” means 5:00 p.m., New York City time, on

September 22, 2015, unless and until St. Joe, in its sole discretion, shall have extended the period of time during which the tender offer will remain open, in which event the term “expiration date” shall refer to the latest time and

date at which the tender offer, as so extended by St. Joe, shall expire. See Section 15 for a description of St. Joe’s right to extend, delay, terminate or amend the tender offer. In accordance with the rules of the SEC, St. Joe may, and

St. Joe expressly reserves the right to, purchase pursuant to the tender offer an additional number of shares not to exceed 2% of the outstanding shares without amending or extending the tender offer. See Section 15. In the event of an

over-subscription of the tender offer as described below, shares tendered will be subject to proration, except for odd lots. Except as described herein, withdrawal rights expire on the expiration date.

If (1)(a) St. Joe increases or decreases the price to be paid for shares, (b) St. Joe increases the number of shares being sought in

the tender offer and the increase exceeds 2% of the outstanding shares, or (c) St. Joe decreases the number of shares being sought, and (2) the tender offer is scheduled to expire at any time earlier than the expiration of a period ending

on the tenth business day from, and including, the date that notice of any increase or decrease is first published, sent or given in the manner specified in Section 15, the tender offer will be extended until the expiration of ten business days

from the date that notice of any increase or decrease is first published. For the purposes of the tender offer, a “business day” means any day other than a Saturday, Sunday or U.S. federal holiday and consists of the time period from 12:01

a.m. through 12:00 Midnight, New York City time.

The tender offer is not conditioned upon obtaining financing or on any minimum number of

shares being tendered. The tender offer is, however, subject to other conditions. See Section 7.

Only shares properly tendered and

not properly withdrawn will be purchased, upon the terms and subject to the conditions of the tender offer. However, because of the odd lot priority, proration and conditional tender provisions of the tender offer, all of the shares tendered will

not be purchased if more than the number of shares St. Joe seeks are properly tendered. All shares tendered and not purchased pursuant to the tender offer, including shares not purchased because of proration or conditional tenders, will be returned

at St. Joe’s expense promptly after the expiration date. Shareholders also can specify the order in which the specified portions will be purchased in the event that, as a result of the proration provisions or otherwise, some but not all of the

tendered shares are purchased pursuant to the tender offer. In the event a shareholder does not designate the order and fewer than all shares are purchased due to proration, the order of shares purchased will be selected by the Depositary.

If the number of shares properly tendered and not properly withdrawn prior to the expiration date is fewer than or equal to 16,666,666 shares,

or such greater number of shares as St. Joe may elect to purchase, subject to applicable law, St. Joe will, upon the terms and subject to the conditions of the tender offer, purchase all such shares.

-14-

Priority of Purchases. Upon the terms and subject to the conditions

of the tender offer, if greater than 16,666,666 shares, or such greater number of shares as St. Joe may elect to purchase, subject to applicable law, have been properly tendered and not properly withdrawn prior to the expiration date, St. Joe will

purchase properly tendered shares on the basis set forth below:

(1) First, St. Joe will purchase all shares properly

tendered and not properly withdrawn prior to the expiration date by any odd lot holder (as defined below) who:

(a) tenders

all shares owned beneficially or of record by that odd lot holder (tenders of fewer than all the shares owned by that odd lot holder will not qualify for this preference); and

(b) completes the section entitled “Odd Lots” in the Letter of Transmittal and, if applicable, in the Notice of

Guaranteed Delivery.

(2) Second, after the purchase of all of the shares tendered by odd lot holders, subject to the

conditional tender provisions described in Section 6, St. Joe will purchase all other shares properly tendered and not properly withdrawn prior to the expiration date, on a pro rata basis, with appropriate adjustments to avoid purchases of

fractional shares, until St. Joe has purchased 16,666,666 shares (or such greater number of shares as St. Joe may elect to purchase, subject to applicable law).

(3) Third, only if necessary to permit St. Joe to purchase 16,666,666 shares (or such greater number of shares as St. Joe may

elect to purchase, subject to applicable law), St. Joe will purchase shares conditionally tendered (for which the condition was not initially satisfied) and not properly withdrawn prior to the expiration date, by random lot, to the extent feasible.

To be eligible for purchase by random lot, shareholders whose shares are conditionally tendered must have tendered all of their shares.

As a result of the foregoing priorities applicable to the purchase of shares tendered, it is possible that fewer than all shares tendered by a

shareholder will be purchased or that, if a tender is conditioned upon the purchase of a specified number of shares, none of those shares will be purchased.

Odd Lots. For purposes of the tender offer, the term “odd lots” shall mean all shares properly tendered prior

to the expiration date and not properly withdrawn by any person referred to as an “odd lot holder” who owns beneficially or of record an aggregate of fewer than 100 shares and so certifies in the appropriate place on the Letter of

Transmittal and, if applicable, on the Notice of Guaranteed Delivery. To qualify for this preference, an odd lot holder must tender all shares owned beneficially or of record by the odd lot holder in accordance with the procedures described in

Section 3. As set forth above, odd lots will be accepted for payment before proration, if any, of the purchase of other tendered shares. This preference is not available to partial tenders or to beneficial or record holders of an aggregate of

100 or more shares, even if these holders have share certificates representing fewer than 100 shares. By accepting the tender offer, an odd lot holder who holds shares in its name and tenders its shares directly to the Depositary would not only

avoid the payment of brokerage commissions, but also would avoid any applicable odd lot discounts in a sale of the odd lot holder’s shares. Any odd lot holder wishing to tender all of its shares pursuant to the tender offer should complete the

section entitled “Odd Lots” in the Letter of Transmittal and, if applicable, in the Notice of Guaranteed Delivery.

Proration. If proration of tendered shares is required, St. Joe will determine the proration factor as soon as practicable

following the expiration date. Subject to adjustment to avoid the purchase of fractional shares, proration for each shareholder tendering shares, other than odd lot holders, shall be based on the ratio of the number of shares properly tendered and

not properly withdrawn by the shareholder to the total number of shares properly tendered and not properly withdrawn by all shareholders, other than odd lot holders, subject to conditional tenders.

Because of the difficulty in determining the number of shares properly tendered, including shares tendered by the guaranteed delivery

procedure, as described in Section 3, and not properly withdrawn, and because of the odd lot procedure described above and the conditional tender procedure described in Section 6, St. Joe does not

-15-

expect that it will be able to announce the final proration factor or commence payment for any shares purchased pursuant to the tender offer until approximately five business days after the

expiration date. The preliminary results of any proration will be announced by press release promptly after the expiration date. Shareholders may obtain preliminary proration information from the Information Agent and may be able to obtain this

information from their brokers.

As described in Section 13, the number of shares that St. Joe will purchase from a shareholder

pursuant to the tender offer may affect the U.S. federal income tax consequences to that shareholder and, therefore, may be relevant to that shareholder’s decision whether or not to tender shares and whether or not to condition any tender upon

the purchase of a minimum number of shares held by such shareholder. The Letter of Transmittal affords each shareholder who tenders shares registered in such shareholder’s name directly to the Depositary the opportunity to designate the order

of priority in which shares tendered are to be purchased in the event of proration as well as the ability to condition such tender on a minimum number of shares being purchased. See Section 6.

This Offer to Purchase and the Letter of Transmittal will be mailed to record holders of shares and will be furnished to brokers, dealers,