UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

|

|

Date of Report (Date of Earliest Event Reported):

|

|

June 30, 2015

|

The St. Joe Company

__________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Florida

|

1-10466

|

59-0432511

|

_____________________

(State or other jurisdiction

|

_____________

(Commission

|

______________

(I.R.S. Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

|

|

|

|

133 South WaterSound Parkway, WaterSound, Florida

|

|

32413

|

_________________________________

(Address of principal executive offices)

|

|

___________

(Zip Code)

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

|

850-231-6400

|

Not Applicable

______________________________________________

Former name or former address, if changed since last report

Check the appropriate box below if the Form 8-K filing is intended to

simultaneously satisfy the filing obligation of the registrant under any

of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 2.01 Results of Operations and Financial Condition.

On June 30, 2015, The St. Joe Company (the “Company”) issued a press release announcing its

preliminary unaudited financial results for the quarter ended June 30, 2015. A copy of the press

release is furnished with this Current Report on Form 8-K as Exhibit 99.1.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain

Officers; Compensatory Arrangements of Certain Officers.

(e) On June 30, 2015, the Company held its 2015 Annual Meeting of Shareholders (the “2015

Annual Meeting”). At the Annual Meeting, the Company’s shareholders approved The St. Joe Company

2015 Performance and Equity Incentive Plan (the “2015 Incentive Plan”). A description of the terms

and conditions of the 2015 Incentive Plan is set forth in Proposal 4 of the Company’s Definitive

Proxy Statement for its 2015 Annual Meeting filed with the Securities and Exchange Commission on

May 19, 2015, which description is hereby incorporated by reference into this Item 5.02(e).

Item 5.07 Submission of Matters to Vote of Security Holders.

At the 2015 Annual Meeting, the Company’s shareholders voted on (i) the election of seven

director nominees (Proposal 1), (ii) the ratification of the appointment of KPMG LLP as the

Company’s independent registered public accounting firm for the 2015 fiscal year (Proposal 2),

(iii) the approval, on an advisory basis, of the compensation of the Company’s named executive

officers (Proposal 3), and (iv) the approval of The St. Joe Company 2015 Performance and Equity

Incentive Plan (Proposal 4). The results of the votes are set forth below.

Proposal 1

The shareholders voted in favor of the election of the following director nominees for a term

of office expiring at the 2016 Annual Meeting of Shareholders and, in each case, until his or her

successor is duly elected and qualified.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Director Nominee |

|

For |

|

Against |

|

Abstain |

|

Broker Non-Vote |

Cesar L. Alvarez |

|

|

61,099,332 |

|

|

|

19,418,615 |

|

|

|

375,948 |

|

|

|

7,219,313 |

|

Bruce R. Berkowitz |

|

|

68,645,175 |

|

|

|

11,879,064 |

|

|

|

369,656 |

|

|

|

7,219,313 |

|

Howard S. Frank |

|

|

68,481,214 |

|

|

|

12,051,345 |

|

|

|

361,336 |

|

|

|

7,219,313 |

|

Jeffrey C. Keil |

|

|

68,617,904 |

|

|

|

11,903,698 |

|

|

|

372,293 |

|

|

|

7,219,313 |

|

Stanley Martin |

|

|

68,630,349 |

|

|

|

11,891,152 |

|

|

|

372,394 |

|

|

|

7,219,313 |

|

Thomas P. Murphy, Jr. |

|

|

68,630,083 |

|

|

|

11,891,526 |

|

|

|

372,286 |

|

|

|

7,219,313 |

|

Vito S. Portera |

|

|

68,648,363 |

|

|

|

11,871,381 |

|

|

|

374,151 |

|

|

|

7,219,313 |

|

Proposal 2

The shareholders voted in favor of ratification of the appointment of KPMG LLP as the

Company’s independent registered public accounting firm for the 2015 fiscal year.

| |

|

|

|

|

|

|

|

|

| For |

|

Against |

|

Abstain |

78,799,649

|

|

|

8,922,663 |

|

|

|

390,896 |

|

Proposal 3

The shareholders voted in favor of approving, on an advisory basis, of the compensation of the

Company’s named executive officers.

| |

|

|

|

|

|

|

|

|

|

|

|

|

| For |

|

Against |

|

Abstain |

|

Broker Non-Vote |

70,995,194

|

|

|

9,488,160 |

|

|

|

410,541 |

|

|

|

7,219,313 |

|

Proposal 4

The shareholders voted in favor of approving The St. Joe Company 2015 Performance and Equity

Incentive Plan.

| |

|

|

|

|

|

|

|

|

|

|

|

|

| For |

|

Against |

|

Abstain |

|

Broker Non-Vote |

70,924,552

|

|

|

9,562,471 |

|

|

|

406,872 |

|

|

|

7,219,313 |

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

The St. Joe Company

|

|

|

|

|

|

|

|

July 7, 2015

|

|

By:

|

|

Marek Bakun

|

|

|

|

|

|

|

|

|

|

|

|

Name: Marek Bakun

|

|

|

|

|

|

Title: Chief Financial Officer

|

Exhibit Index

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

99.1

|

|

Press Release by The St. Joe Company issued on June 30, 2015 announcing its preliminary unaudited financial results for the quarter ended June 30, 2015.

|

The St. Joe Company

133 South WaterSound Parkway

WaterSound, FL 32413

850-231-6400

FOR IMMEDIATE RELEASE

THE ST. JOE COMPANY PROVIDES AN UPDATE ON THE BAY-WALTON COUNTY SECTOR PLAN ENTITLEMENTS AND

REPORTS SELECTED PRELIMINARY RESULTS FOR SECOND QUARTER 2015

WaterSound, Florida – (June 30, 2015) – The St. Joe Company (NYSE: JOE) (the “Company”) announced

today that the Bay-Walton County Sector Plan (the “Sector Plan”) has been officially adopted by Bay

County and Walton County. In addition, the Sector Plan has been found in compliance with state law

and is therefore in effect. The Sector Plan is a master plan that includes entitlements, or legal

rights, to develop over 170,000 residential units and over 22 million square feet of retail,

commercial, and industrial uses on 110,500 acres of the Company’s land holdings. A significant

amount of these entitlements are planned to service the active adult retirement market and

additionally, the Company anticipates a wide range of other residential and commercial uses. While

these entitlements are broadly defined, what will actually be developed will be a function of more

detailed planning, analysis, and market conditions, which will occur over time. Additional

information on the Sector Plan will be discussed at today’s annual meeting of shareholders which

the Company will webcast on its website at www.joe.com.

The Company also announced today preliminary unaudited selected financial information for the

second quarter of 2015. Based upon preliminary financial data, the Company expects revenue for the

second quarter of 2015 to be approximately $36 million to $38 million as compared to $68.2 million

in the second quarter of 2014. The RiverTown sale accounted for $43.6 million of revenue in the

second quarter of 2014. The Company anticipates pre-tax income to be in the range of $2 million to

$3 million for the second quarter of 2015 as compared to pre-tax income of $23.3 million for the

second quarter of 2014, which included $26 million pre-tax income from the RiverTown sale.

Preliminary results for the second quarter of 2015 include approximately $6.4 million for legal

reserves that the Company expects to record during the quarter arising from the ongoing SEC

investigation. Of this amount, $2.9 million is related to legal expenses for which the Company has

received a reservation of rights from the insurer and $3.5 million is related to potential

settlement costs. The Company expects that its effective tax rate for the quarter will be higher

than its historical rates as amounts reserved for settlement costs may not be deductible for income

tax purposes.

The preliminary financial results presented in this release are based solely upon information

available as of the date of this release, are not a comprehensive statement of Company’s financial

results or positions as of or for the quarter, and have not been audited or reviewed by our

independent registered accounting firm. During the course of that process, the Company may

identify items that would require it to make adjustments, which may be material, to the information

presented above. As a result, the preliminary results above constitute forward-looking information

and are subject to risks and uncertainties, including possible adjustments to preliminary operating

results.

Additional information with respect to the Company’s results for the second quarter of 2015 will be

available in a Form 10-Q that will be filed with the Securities and Exchange Commission.

Important Notice Regarding Forward-Looking Statements

This press release includes forward-looking statements, including statements regarding the intended

use and impact of the Sector Plan and the Company’s preliminary unaudited 2015 financial

performance including estimated revenue, pre-tax income, legal reserves and expenses, and tax rate.

The statements made by the Company are based upon management’s current expectations and are subject

to certain risks and uncertainties that could cause actual results to differ materially from those

described in the forward-looking statements. These risks and uncertainties include market

conditions and other factors beyond the Company’s control and the risk factors and other cautionary

statements described in the Company’s filings with the SEC, including the final results of the

Company’s audit.

About The St. Joe Company

The St. Joe Company together with its consolidated subsidiaries is a real estate development and

operating company with real estate assets and operations currently concentrated primarily between

Tallahassee and Destin, Florida. The Company currently uses these assets in its residential or

commercial real estate developments, resorts and leisure operations, leasing operations or its

forestry operations. More information about the Company can be found on its website at www.joe.com.

© 2015, The St. Joe Company. “St. Joe®”, “JOE®”, the “Taking Flight” Design®, “St. Joe (and Taking

Flight Design)®” are registered service marks of The St. Joe Company.

St. Joe Investor Relations Contact:

Marek Bakun

Chief Financial Officer

1-866-417-7132

Marek.Bakun@Joe.Com

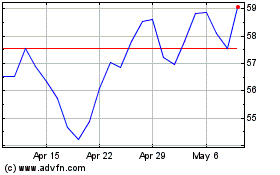

St Joe (NYSE:JOE)

Historical Stock Chart

From Mar 2024 to Apr 2024

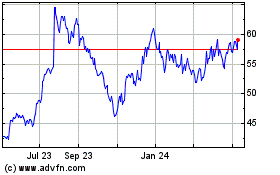

St Joe (NYSE:JOE)

Historical Stock Chart

From Apr 2023 to Apr 2024