Johnson & Johnson Pulls Out of Talks to Buy Actelion -- Update

December 13 2016 - 8:42PM

Dow Jones News

By Jonathan D. Rockoff and Dana Mattioli

Johnson & Johnson pulled out of talks to buy Swiss drug

company Actelion Pharmaceuticals Ltd. after the price needed to

seal the deal got too high.

New Brunswick, N.J.,-based J&J issued a statement Tuesday

evening saying it had ended talks after the companies confirmed

J&J's approach last month.

In its own statement, Actelion said it's "engaged in discussions

with another party regarding a possible strategic transaction."

It isn't clear exactly what price the two sides discussed, but

should they have reached a deal it was expected to be valued at as

much as $30 billion. Actelion currently has a market value just

above $22 billion after its shares ran up on expectations of a

takeover.

At that level, a deal would have eclipsed J&J's biggest to

date, the $21 billion acquisition of trauma-device maker Synthes

Inc. in 2011.

J&J decided the price was too high to make the kind of

return the health-products company expects on a deal, a person

familiar with the matter said.

"Johnson & Johnson was not able to reach an agreement that

it believed would create adequate value for its shareholders," the

company said in its statement.

It isn't clear whether other suitors are still circling

Actelion.

J&J had been pursuing Actelion because its portfolio of

rare-disease drugs would have helped the health-products giant

overcome low-priced competition for its top-selling drug Remicade.

Actelion has a specialty in the treatment of pulmonary arterial

hypertension.

Last year, Actelion reported revenue of 2.05 billion Swiss

francs ($2.03 billion) and a profit of 551.9 million francs.

With a market value of more than $300 billion and about $40

billion in cash, J&J had the financial firepower to do a

deal.

But Chief Executive Alex Gorsky and Chief Financial Officer

Dominic Caruso have said they would not overpay for

acquisitions.

J&J lost out in an auction of Pharmacyclics, a cancer-drug

company that AbbVie Inc. ended up buying last year for $21

billion.

Actelion was an imperfect fit for J&J, which doesn't have a

franchise selling rare-disease drugs, like some other big

pharmaceutical companies do.

It isn't the first time lately that a bid to seal a big drug

merger has fallen apart.

There have been more than $250 billion of health care deals

announced so far in 2016, according to Dealogic, down from a total

of more than $500 billion in all of 2015. Last year's tally would

have been even greater if Pfizer's roughly $150 billion agreement

to buy drugmaker Allergan PLC hadn't fallen apart amid resistance

from the Obama administration. The deal was to be a so-called

inversion, moving Pfizer abroad for tax purposes. Indeed,

resistance in Washington is one factor cited by deal makers for the

drop in merger activity in 2016.

Write to Jonathan D. Rockoff at Jonathan.Rockoff@wsj.com and

Dana Mattioli at dana.mattioli@wsj.com

(END) Dow Jones Newswires

December 13, 2016 20:27 ET (01:27 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

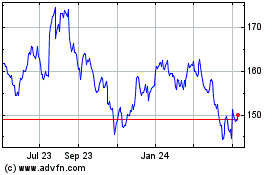

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

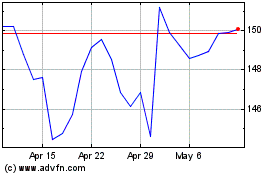

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Apr 2023 to Apr 2024