Johnson & Johnson Approaches Swiss Firm Actelion About Potential Deal -- 2nd Update

November 25 2016 - 3:58PM

Dow Jones News

By Jonathan D. Rockoff

Johnson & Johnson said Friday it is in "preliminary

discussions" with Swiss drug company Actelion Pharmaceuticals Ltd.,

a deal that would help the health-products company overcome looming

competition to its top-selling drug.

New Brunswick, N.J.,-based J&J has been trying to reassure

Wall Street that it can overcome competition to its drug Remicade,

an autoimmune therapy that had $4.5 billion in U.S. sales last

year. Pfizer Inc. has said it plans to start selling its copy,

Inflectra, in the U.S. this month.

J&J has argued that it has several new drugs in development

whose launch could make up for any revenue loss. A deal for

Actelion, however, would help J&J quickly plug the lost sales,

which analysts estimate could amount to $1 billion in 2017.

Actelion sells drugs for rare diseases, such as an artery

disorder that affects the lung and heart known as pulmonary

arterial hypertension. The company reported about 1.785 billion

Swiss francs ($1.8 billion) in sales during the first nine months

of this year.

A deal for all of Actelion would come at a steep price. As of

Wednesday's close, Actelion had a market value of about 16.7

billion Swiss francs. With a typical takeover premium of 25% or

more, a deal for the company would be valued at more than $20

billion.

Shares of Actelion rose nearly 17% to 182.50 Swiss francs

($184.03) on the SIX Swiss Exchange on Friday, after the company

confirmed J&J had approached it about a possible transaction.

Bloomberg had earlier reported J&J's interest in the Swiss

company.

With a market value more than $300 billion and billions of

dollars in cash overseas, J&J could afford the high price.

J&J's biggest deal to date was the $21 billion acquisition of

trauma-device maker Synthes in 2011.

Both J&J and Actelion cautioned in their statements that a

transaction wouldn't necessarily happen. It isn't clear where talks

between the companies stand or whether Actelion is receptive.

Actelion was founded in 1997 by husband-and-wife team Jean-Paul

and Martine Clozel and other former Roche Holding Ltd. employees

who left the Swiss drug firm after it decided not to pursue a

project their group was working on, according to its website.

In 2000, Actelion went public and its valuation has climbed

sharply since then.

This year, it successfully averted a decline in revenue after

its best-selling drug Tracleer lost patent protection, thanks to a

swift ramp-up in sales for new pulmonary arterial hypertension

drugs Opsumit and Uptravi.

Last year, the company reported revenue of 2.05 billion Swiss

francs and a profit of 551.9 million Swiss francs ($556.5

million).

Johnson & Johnson makes an array of products from baby soap

to Tylenol pills and devices that manage diabetes care. In

September, it reached a deal to buy Abbott Laboratories'

eye-surgery equipment business for $4.3 billion.

Rare diseases aren't an area of focus for the company. Yet

Actelion's top-selling drugs could complement J&J's portfolio

of heart drugs, and rare-disease therapies would fit with J&J's

stated goal of providing treatments that make a difference for

patients.

Big drug companies such as Pfizer and Sanofi SA have prioritized

rare diseases, because advances understanding the molecular roots

of disease have led to new treatments and health insurers have been

willing to pay the high costs because few of their members require

treatment.

Shares of J&J rose nearly 1% to close at $114.13 Friday on

the New York Stock Exchange.

--Austen Hufford and Denise Roland contributed to this

article

Write to Jonathan D. Rockoff at Jonathan.Rockoff@wsj.com

(END) Dow Jones Newswires

November 25, 2016 15:43 ET (20:43 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

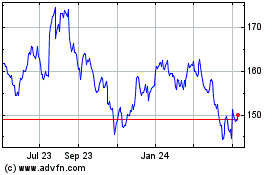

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

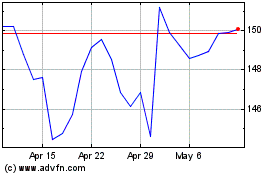

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Apr 2023 to Apr 2024