Pfizer Plans to Launch Remicade Biosimilar in November -- Update

October 17 2016 - 7:16PM

Dow Jones News

By Jonathan D. Rockoff

Pfizer Inc. said Monday it will begin selling a biosimilar

version of blockbuster rheumatoid-arthritis treatment Remicade in

late November at a 15% discount off the brand-name drug's list

price.

The announcement is likely to set up a fierce battle, in the

courts as well as in contract talks with health insurers, between

two of the biggest drug companies in the world by sales. Pfizer is

launching its version, called Inflectra, before the resolution of

an ongoing patent dispute with Remicade's maker Johnson &

Johnson.

Johnson & Johnson in a statement promised to fight the

biosimilar's launch on a range of fronts. The company vowed to

"defend our intellectual property rights" and to "compete through a

variety of innovative contracting options."

Johnson & Johnson also noted Remicade's "well-established

profile" built over 22 years of use in 2.6 million patients and

that Inflectra can't be automatically substituted for Remicade.

Pfizer's Inflectra would be only the second biosimilar to go on

sale under the regulatory framework established as part of the

federal health-care overhaul to bring competition to the high-price

biotech drugs, much like generics did with traditional pills.

Despite the promise, analysts say the launch of the first

biosimilar -- Zarxio from Novartis AG, a version of Amgen Inc.'s

Neupogen -- has gone relatively slowly. Analysts expect use will

pick up, however, as more of the copies enter the market and

doctors become more comfortable prescribing them.

Remicade is a lucrative target. The drug is one of Johnson &

Johnson's top selling products, notching $4.5 billion in U.S. sales

last year.

J&J could lose $1 billion in Remicade revenue in 2017 due to

Inflectra, though the company has new drugs whose sales could help

offset the loss, J.P. Morgan analyst Michael Weinstein said in a

research note. "Inflectra's 15% discount should provide enough of

an incentive to help attract new patients to start on Inflectra,

but probably won't be enough of a discount to entice stable

patients to switch over," Mr. Weinstein wrote.

A year's treatment for a typical patient lists for $28,945, the

J&J spokeswoman said, though the cost varies depending on the

patient's weight and condition.

J&J says the average price paid for Remicade, after

discounts, is 30% less than the list price, and nearly half of

commercially insured patients don't have a copay under their

medical benefits. J&J also says it provides assistance that

reduces the out-of-pocket cost of an infusion to no more than

$5.

Health insurers have complained that drug companies have

weakened the potential cost savings from biosimilar competition by

raising the list prices of the original brands far above the 15% to

30% discounted list price expected for biosimilars.

Pfizer plans to list a vial of Inflectra for $946.28, a company

spokeswoman said. The biosimilar is also approved for treatment of

certain patients with Crohn's disease and ulcerative colitis.

Write to Jonathan D. Rockoff at Jonathan.Rockoff@wsj.com

(END) Dow Jones Newswires

October 17, 2016 19:01 ET (23:01 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

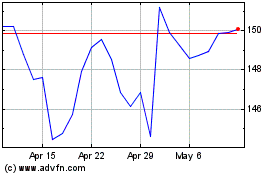

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

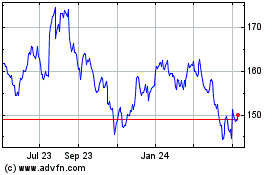

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Apr 2023 to Apr 2024