COSTCO WHOLESALE

Cheaper Gas Prices Hurt Same-Store Sales

Costco Wholesale Corp. on Thursday said cheaper gasoline prices

hurt same-store sales in May, which were flat from the a year

earlier.

Analysts had expected same-store sales to increase 1.4%,

according to Thomson Reuters.

Shares of the warehouse-club retailer fell $1.01 to $151.51 in 4

p.m. trading.

U.S. comparable sales increased 1%. Sales in Canada fell 1% and

in other international stores declined 3%.

Costco currently operates 706 warehouses, including 494 in the

U.S. and Puerto Rico and 90 in Canada.

Core same-store sales, which exclude gasoline-price deflation

and foreign-exchange fluctuations, increased 4%.

Costco said Los Angeles-area stores were particularly hit by the

decline in gasoline prices.

In total for the month, sales increased to $9.23 billion from

$8.98 billion.

Last week, Costco reported that its comparable sales stagnated

in the third quarter, coming in flat, though overall profit

increased 5.6%.

--Austen Hufford

AIRLINES

Record Profit Is Forecast for Year

The International Air Transport Association on Thursday raised

its profit forecast for the global air-transport industry to a

record $39.4 billion for 2016 even as traffic growth is slowing and

terrorist attacks hurt demand.

Airlines earned $35.3 billion last year and IATA, in December,

projected $36.3 billion for this year. Carriers in North America

are poised to lead the way in 2016 with $22.9 billion in net

profit, IATA said.

The outlook for European profit has weakened as terrorist

attacks in Paris in November and Brussels in March weigh on demand.

European carriers now are expected to collectively post $7.5

billion in profit, $1 billion less than expected six months

ago.

Profit growth is underpinned by the sharp drop in oil prices.

IATA said fuel should be about 20% of airline costs this year, down

from 33% in 2012-2013 and about 27% last year.

--Robert Wall

VOLKSWAGEN

Europe Still Doubts Emissions Data

BRUSSELS -- The European Commission continues to doubt

Volkswagen AG's data on carbon-dioxide emissions, despite

assurances by the car maker and the German government that

emissions didn't break European Union rules, documents seen by The

Wall Street Journal show.

The commission, in charge of enforcing the bloc's environmental

rules, has been tussling with Volkswagen since November, when the

Wolfsburg, Germany-based company first reported that it may have

understated CO(2) emissions from some 800,000 cars.

In contrast with nitrogen-oxide emissions -- which are at the

center of the car maker's diesel-engine troubles in the U.S., but

outside the commission's remit -- the EU's executive arm can impose

fines on auto makers that break legal caps on CO(2) emissions. CO2

is a greenhouse gas that contributes to climate change.

The commission first demanded that Volkswagen provide details on

its fleet's CO(2) emissions on Nov. 9, a few days after the company

announced that data inaccuracies spread beyond NOx emissions. At

the time, Climate and Energy Commissioner Miguel Arias Cañete gave

Volkswagen 10 days to send a response.

Since then, the company has received several extensions, citing

extra time needed for Germany's motor-transport authority KBA to

complete its assessment of the emissions from Volkswagen's

fleet.

Almost seven months after the initial request for information,

commission officials say they are growing frustrated with the slow

pace and lack of detail of the company's response to their

queries.

In a one-page letter dated May 3 and seen by the Journal,

Volkswagen Chief Executive Matthias Müller informed Mr. Cañete that

KBA had completed its assessment of CO(2) emissions from Volkswagen

cars and ordered adjustments to the fuel consumption of six model

variants of the 2016 production line. Those adjustments increase

fuel consumption by between 0.1 and 0.2 liter per kilometer and

will be applied to 36,000 cars, Mr. Müller wrote.

"Concerns that earlier mode years could have been affected

haven't materialized," he added.

A follow-up letter from German Transport Minister Alexander

Dobrindt three days later confirmed KBA's findings, but added that

the authority was still awaiting results for a seventh model

variant. Overall, Mr. Dobrindt wrote, the adjustments increase CO2

emissions for the affected cars by 1 to 6 grams per km.

That would leave average CO2 emissions from Volkswagen's fleet

below the EU's 130g/km limit and hence not subject it to fines from

the commission.

Internal commission documents indicate that Mr. Cañete's team

still harbors doubts on the German auto maker's CO(2) emissions.

"The commission needs more substantiated evidence to assess the

situation," according to one of the documents.

The commission wants more information on why both Volkswagen and

KBA believe emissions data for 2014 and 2015 don't need to be

corrected in addition to information on the number of cars that

were tested and the methods used, according to the documents. The

documents also say that the commission needs more details on why

emissions for some 2016 models were initially understated.

A Volkswagen spokesman didn't respond to a request for comment

on the commission doubts.

--Gabriele Steinhauser

STRATASYS

Board Member Levin Will Become CEO

Stratasys Ltd. said board member Ilan Levin would become chief

executive after current CEO David Reis resigns later this month.

Mr. Reis will remain on the board.

Stratasys makes 3-D printers and rapid-prototyping systems for

both businesses and consumers. During Mr. Reis's seven-year tenure,

Stratasys bought MakerBot in 2013, one of the leading

consumer-focused 3-D printer companies.

Stratasys wrote down the value of MakerBot in 2015 on the

combination of lower-than-expected consumer demand for the devices

and a supply glut. Shares have fallen from more than $100 in 2014

to just above $20 this year.

In March, Stratasys reported that its fourth-quarter loss

widened sharply, though the adjusted results and revenue decline

weren't as bad as analysts feared.

Mr. Levin served as president of Objet Ltd. and vice chairman of

that company's board. Objet merged with Stratasys in 2012.

Stratasys Chairman Elan Jaglom said Mr. Reis was "responsible

for initiating a critical business transformation designed to

support our long-term leadership in the prototyping market while

expanding into applications for manufacturing."

--Austen Hufford

(END) Dow Jones Newswires

June 03, 2016 02:48 ET (06:48 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

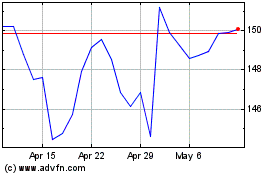

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

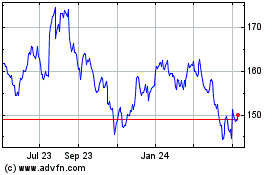

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Apr 2023 to Apr 2024