U.S. Investigates Drugmaker Contracts With Pharmacy-Benefit Managers -- Update

May 10 2016 - 1:54PM

Dow Jones News

By Peter Loftus

Federal prosecutors are investigating drugmakers' contracts with

companies that manage prescription benefits in the U.S., the latest

sign of government scrutiny of how drug companies and industry

middlemen do business.

The U.S. Attorney's Office for the Southern District of New York

has sent demands for information to at least three drug companies:

Johnson & Johnson, Merck & Co. and Endo International PLC,

according to recent company filings with the U.S. Securities and

Exchange Commission.

The so-called civil investigative demands seek information about

the companies' contracts with pharmacy-benefit managers, or PBMs,

which administer drug benefits for employers and health insurers.

The drug companies didn't name any specific PBMs in their

disclosures.

J&J said in an SEC filing Tuesday it received a civil

investigative demand in March, seeking information about

contractual relationships between its Janssen Pharmaceuticals unit

and PBMs since 2006, for certain Janssen products. J&J said the

demand was issued in connection with an investigation under the

False Claims Act, a federal law that prohibits people and companies

from defrauding the federal government.

A J&J spokesman said the company is cooperating with the

investigation.

Merck said in an SEC filing Monday it received a civil

investigative demand for information about its "contracts with,

services from and payments to pharmacy-benefit managers" since

2006, in connection with the products Maxalt and Levitra. Maxalt is

a treatment for migraines and Levitra treats erectile dysfunction.

The company said it is cooperating with the investigation. A Merck

spokeswoman declined immediate comment.

Endo said in an SEC filing last week it received a demand for

documents and information about contracts with PBMs for the

migraine drug Frova. The company said it is cooperating with the

investigation. An Endo spokeswoman said the company doesn't yet

have additional details on the investigation.

A spokesman for the U.S. Attorney's Office in New York declined

to comment. A civil investigative demand is a government tool to

request information that is sometimes broader in scope than a

subpoena for documents.

The disclosures of the civil investigative demands don't

identify any PBM's by name.

Among the largest PBMs are Express Scripts Holding Co. and CVS

Health Corp. Representatives for the companies declined immediate

comment.

It is common for drug companies to agree to pay rebates or offer

other forms of discounts to PBMs in exchange for PBMs agreeing to

pay for their members' use of certain drugs.

Federal investigators in recent months have been stepping up

scrutiny of these relationships. In November, Merck said the U.S.

Attorney for the Eastern District of Pennsylvania sent it a request

for information about its pricing and contracting with PBMs and

Medicare drug-benefit plans for the asthma drug Dulera.

Last year, AstraZeneca PLC agreed to pay $7.9 million to resolve

Justice Department allegations that it provided price concessions

on drugs including Prilosec to Medco Health Solutions, a PBM, in

exchange for Medco providing favorable coverage for AstraZeneca's

heartburn drug Nexium, in violation of a federal anti-kickback

statute. AstraZeneca denied the allegations. Express Scripts, which

acquired Medco in 2012, didn't immediately respond to a request for

comment.

Federal investigators also have probed drug company

relationships with other health-care middlemen such as pharmacies.

In November, Novartis agreed to pay $390 million to settle Justice

Department allegations that it provided discounts and rebates to

specialty pharmacies to induce them to recommend that doctors

prescribe certain Novartis drugs. Specialty pharmacies dispense

drugs that can be complicated to handle and are often expensive. As

part of the settlement, Novartis said it "admits, acknowledges, and

accepts responsibility" for certain facts about its relationships

with specialty pharmacies, according to a court document.

Write to Peter Loftus at peter.loftus@wsj.com

(END) Dow Jones Newswires

May 10, 2016 13:39 ET (17:39 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

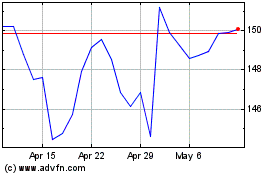

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

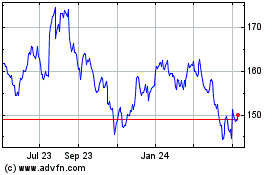

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Apr 2023 to Apr 2024