Depomed Says Starboard Has Month to Call Shareholder Meeting

April 25 2016 - 12:40PM

Dow Jones News

Depomed Inc. told activist shareholder Starboard Value LP—which

is seeking to replace the drugmaker's board—that it has up to a

month to request a special shareholder meeting.

Assuming Starboard does so, Depomed said a special meeting then

could occur between June 1 and July 25. Starboard, which owns 9.9%

of Depomed shares, has said the drugmaker should consider selling

itself and that it would nominate a slate of candidates for

Depomed's board.

A Starboard representative didn't immediately respond to a

request for comment. Starboard has argued that the value of

Depomed's shares could rise with improved capital deployment,

rationalized research and development, and a potential sale of the

company. Depomed has said it "welcomes open communications with its

shareholders and values constructive input."

Separately Monday, Depomed said it settled a lawsuit that

previously scuttled Horizon Pharma PLC's unsolicited offer for the

company last year. As part of the settlement, Horizon Pharma agreed

not to initiate another unsolicited takeover of the Depomed until

2020.

In November, Horizon Pharma withdrew its roughly $1 billion

unsolicited offer for Depomed after a California court blocked its

bid, saying it was based on Horizon's improper use of confidential

information.

In January 2015, Depomed acquired the U.S. rights to pain killer

Nucynta from Janssen Pharmaceuticals Inc., a unit of Johnson &

Johnson. Depomed and Horizon both bid in 2013 for Nucynta, and each

signed a confidentiality agreement with Janssen not to use the

information gleaned during the bidding for any other purpose,

Depomed argued in court filings.

Depomed accused Horizon of improperly using that information to

inform its bid. Details about key products can often help buyers

determine how much to offer. The judge granted an injunction

temporarily blocking Horizon's bid, after which Horizon said it

would abandon the effort.

Horizon also agreed Monday to maintain the privacy of

confidential information that it received from Janssen.

Both Depomed and Horizon said further details of the settlement

are confidential and that neither side has admitted liability.

Horizon focuses on treatments for orphan diseases. Depomed

specializes in products that treat pain and central nervous system

disorders.

Horizon shares fell 2.7% as Depomed shares fell 0.2%.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

April 25, 2016 12:25 ET (16:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

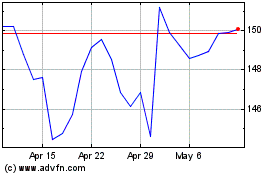

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

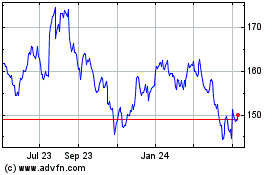

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Apr 2023 to Apr 2024