J&J's Revenue Falls on Currency Woes -- Update

January 26 2016 - 12:34PM

Dow Jones News

By Jonathan D. Rockoff and Chelsey Dulaney

Johnson & Johnson said Tuesday that a strong dollar

contributed heavily to a 2.4% drop in fourth-quarter sales to $17.8

billion world-wide, but the company expressed optimism that both

its underlying business and the global health-care market generally

would grow this year.

J&J said relatively new drugs such as Xarelto and Imbruvica

were driving increased sales in its pharmaceuticals division, while

nearly all of the company's recalled consumer health-products like

children's Tylenol were back on store shelves and helping turn

around that business after years of manufacturing issues.

Executives said they expected a similar revival of the company's

struggling medical-device business, due to 3,000 layoffs that are

pegged to save as much as $1 billion in costs and the launches of

several new products, including knee-replacement parts and contact

lenses.

"We're optimistic about the opportunities in health care and

frankly, the underlying strength of our core business," J&J CEO

Alex Gorsky told investors and analysts during a conference

call.

J&J, of New Brunswick, N.J., is considered an industry

bellwether because it is one of the world's biggest health-products

companies with a portfolio that spans across markets. The company

expects the world-wide health-care market to grow 3% to 5% annually

over the next few years, while coping with pricing pressures.

In response to increasing attention on drug prices, Mr. Gorsky

urged politicians and policy makers to "take a holistic approach to

reforming the health-care system." He said pharmaceuticals account

for just 12% of total health-care spending in the U.S. while often

cutting other costs by preventing or curing disease.

At the same time, J&J executives sought to ease Wall Street

concerns that one emerging tool for cutting spending on drugs, the

introduction of lower-priced versions of biotech drugs, posed a big

and imminent threat to sales of one of the company's top-selling

therapies, Remicade.

The executives said they aren't expecting so-called biosimilar

competition for the rheumatoid-arthritis agent in the U.S. this

year, because the drug's patent expires in September 2018 and the

company will defend it.

When the biosimilar competition comes, J&J executives said

they expect most Remicade patients will stay on the drug, because

they are satisfied with the results.

Overall in the quarter, J&J's revenue fell to $17.8 billion

from $18.3 billion a year earlier. About half of the company's

sales are outside the U.S., and unfavorable currency rates shaved

6.8% off the latest quarter's total. In addition, competition for

the company's hepatitis C drugs also hurt year-over-year

comparisons.

Earnings in the fourth quarter rose to $3.22 billion, or $1.15 a

share, from $2.52 billion, or 89 cents a share. Excluding a charge

for restructuring the medical-devices business and other items,

J&J reported earnings of $1.44 in the latest fourth

quarter.

Shares of the company rose 3% in trading on the New York Stock

Exchange, as analysts said the company's forecast for 2016 earnings

was better than they expected.

For 2016, J&J projected sales between $70.8 billion and

$71.5 billion, below analyst expectations of $71.89 billion, and

per-share earnings excluding certain items of $6.43 to $6.58, above

analyst expectations of $6.38.

J&J executives gave the strongest indication to date that

the company is eyeing deals. "We are actively looking for the right

opportunities," J&J Chief Financial Officer Dominic Caruso

said.

J&J has about $18.5 billion in cash available, which Mr.

Caruso said is more than it typically carries. Last year, J&J

bid for Pharmacyclics, the company's partner selling Imbruvica

cancer drug. But AbbVie Inc. won the bidding with a deal worth $21

billion.

Mr. Gorsky said he saw a "number of opportunities" for deals

across all of J&J's businesses, but the company wouldn't over

pay and wanted to do friendly deals. "We are intending to be quite

active," Mr. Gorsky said.

Write to Jonathan D. Rockoff at Jonathan.Rockoff@wsj.com and

Chelsey Dulaney at Chelsey.Dulaney@wsj.com

(END) Dow Jones Newswires

January 26, 2016 12:19 ET (17:19 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

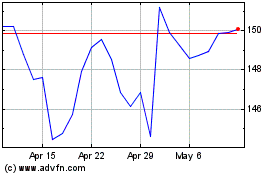

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

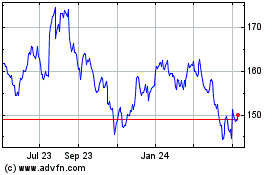

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Apr 2023 to Apr 2024