Horizon Pharma Withdraws Bid for Depomed

November 19 2015 - 11:30PM

Dow Jones News

Horizon Pharma PLC withdrew its roughly $1 billion unsolicited

offer for Depomed Inc. after a California court blocked its bid,

saying it was based on Horizon's improper use of confidential

information.

The ruling ends Horizon's six-month pursuit of Depomed, one that

had run into stiff resistance from the California company's board

and been rattled by a sharp selloff in pharmaceutical stocks.

"While we are disappointed by the court's ruling, Depomed was

only one of many attractive acquisition opportunities we have been

actively pursuing," Chief Executive Timothy P. Walbert said in a

statement. He added that Horizon strongly disagreed with the

ruling.

Depomed, in a news release, said it has successfully executed

its acquisition and commercialization strategy and that it has a

bright future as an independent company.

Horizon focuses on treatments for orphan diseases. Depomed

specializes in products that treat pain and central nervous system

disorders.

Horizon first made an all-stock offer to buy Depomed in a letter

sent May 27, and it then went public with an increased bid in July

after the earlier offer was rejected.

Depomed's board repeatedly said Horizon's takeover attempt was

"not in the best interest" of the company, given that it is in a

period of significant growth and is expected to benefit from its

recent acquisition of the U.S. rights to pain killer Nucynta from

Janssen Pharmaceuticals Inc., a unit of Johnson & Johnson.

It was Depomed's purchase of Nucynta that gave rise to the

unusual legal claims at issue in the California court. Depomed and

Horizon had both bid in 2013 for Nucynta, and each signed a

confidentiality agreement with Janssen not to use the information

gleaned during the bidding for any other purpose, Depomed argued in

court filings.

Depomed accused Horizon of improperly using that information to

inform its bid. Details about key products can often help buyers

determine how much to offer.

The judge granted an injunction temporarily blocking Horizon's

bid, after which Horizon said it would abandon the effort.

The case echoed a similar fight in 2012 between Martin Marietta

Materials Inc. and Vulcan Materials Co., two construction-materials

companies. In that case—widely watched among merger advisers—a

Delaware court blocked Martin Marietta's hostile bid for its rival

after finding it, too, was based on confidential information.

The decision put a spotlight on nondisclosure agreements, which

are routinely signed in merger scenarios, and it is likely that the

Depomed ruling will shed fresh scrutiny on these documents.

Horizon's latest takeover proposal for Depomed offered 0.95 of a

Horizon share for each Depomed share, which valued the company at

$17.88 a share as of Thursday's close.

Depomed shares closed Thursday at $19.39. The stock is up 28%

over the past year but down 39% over the past three months amid a

broader slide in pharmaceutical stocks.

George Stahl contributed to this article.

Write to Liz Hoffman at liz.hoffman@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 19, 2015 23:15 ET (04:15 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

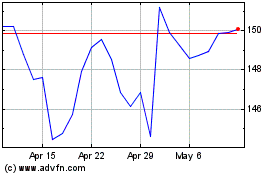

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

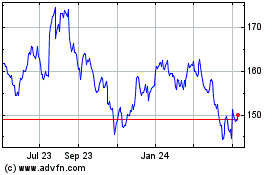

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Apr 2023 to Apr 2024