Johnson & Johnson's Profit Hit By Forex Headwinds -- 3rd Update

October 13 2015 - 12:48PM

Dow Jones News

By Jonathan D. Rockoff And Lisa Beilfuss

Johnson & Johnson reported lower sales and profit in its

latest quarter largely due to a stronger dollar that the company

expects will keep squeezing its results.

Also on Tuesday, J&J said it plans to buy back up to $10

billion in stock, or about 3.7% of shares outstanding. The company

said it would issue debt to fund the program and wouldn't give a

timeline for the repurchases.

Despite the buybacks, Chief Financial Officer Dominic Caruso

said on a conference call with analysts and investors that J&J

was looking at potential acquisitions, and that size wasn't a

factor.

J&J ended the latest period with about $17 billion in net

cash.

"This is a higher level of cash than we typically hold, and we

are actively looking for the right opportunities to use that

capital," Mr. Caruso said.

He also commented about recent criticism of drug pricing, which

analysts say has contributed to a drop in pharmaceutical and

biotech shares amid fears of some kind of government crackdown.

Yet Mr. Caruso seemed to pour water on such a threat, saying

politicians haven't reached a consensus on how to limit price

increases while encouraging the discovery of new medicines.

Mr. Caruso said J&J is "very responsible in our drug

pricing," which he said is based on data reflecting the drugs'

benefits to patients and on medical costs saved.

"We think the real answer to this dilemma is to monitor and

provide outcome-based metrics and not simply focus only on price,"

Mr. Caruso said.

About half of the company's sales are overseas, which has left

results vulnerable to the strengthening dollar and slowing growth

in emerging markets.

In the third quarter, unfavorable currency rates shaved 8.2% off

J&J's top line. The company said its revenue slid 7.4% to

$17.10 billion.

Profit fell 29.3% from the period a year earlier, to $3.36

billion. Earnings per share were $1.20, down from $1.66 a share.

Aside from the stronger dollar, the company's results were also hit

by some special items, divestitures and higher spending on

marketing and research.

The comparison to last year's third quarter was also hurt by a

plunge in sales for a hepatitis C drug, Olysio, which provided a

surprising but brief sales jolt last year, before new pills hit the

market and eroded its sales.

Olysio, which was approved for sale in 2013, accounted for about

7% of the company's overall pharmaceutical sales last year.

Despite the disappointing revenue figures, J&J lifted the

floor of its full-year earnings outlook to $6.15 to $6.20 a share,

excluding certain items, up from an earlier range of $6.04 to

$6.19.

Earnings from J&J, of New Brunswick, N.J., are considered an

industry bellwether because the company's lineup spans prescription

drugs, medical devices and consumer-health items such as Tylenol

cough and cold pills.

Write to Jonathan D. Rockoff at Jonathan.Rockoff@wsj.com and

Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

October 13, 2015 12:33 ET (16:33 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

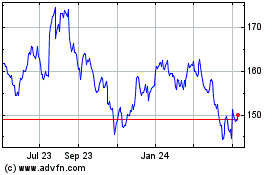

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

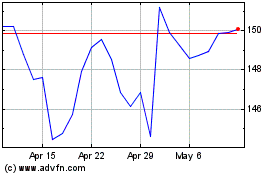

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Apr 2023 to Apr 2024