Forex, Competitive Headwinds Hit Johnson & Johnson's Profit -- 2nd Update

October 13 2015 - 9:20AM

Dow Jones News

By Lisa Beilfuss

Johnson & Johnson said profit dropped in its latest quarter

as adverse exchange rates hit revenue and as the health-care

giant's hepatitis C treatment continues to face competition.

Separately Tuesday, J&J said it plans to buy back up to $10

billion in stock, or about 3.7% of shares outstanding, in a move to

tweak its capital structure. The company said it would issue debt

to fund the program.

The stronger U.S. dollar has pressured J&J's results in

recent quarters. In the latest period, unfavorable currency rates

shaved 8.2% off the top line.

Despite the disappointing revenue figures, J&J lifted its

full-year earnings outlook to $6.15 to $6.20 a share, excluding

certain items, up from an earlier range of $6.04 to $6.19.

In addition to currency headwinds, J&J is facing patent

expirations and increased competition for many of its pharma

products, such as its hepatitis C treatment Olysio. Sales of the

drug have weakened since a rival pill from Gilead Sciences hit the

market, and on Tuesday J&J said lower Olysio sales, due to new

entrants, offset growth in its diabetes drug Invokana, its

blood-cancer drug Imbruvica and its blood-thinner Xarelto. Olysio,

approved in 2013, last year represented about 7% of the company's

overall pharmaceutical sales.

The company is also grappling with competition from lower-cost

knockoffs of its blockbuster anti-inflammatory drug Remicade. In

its prescription drug unit, which has been the New Brunswick, N.J.,

company's bright spot, revenue declined 7.4% to $7.69 billion,

thanks in large part to a stronger dollar that makes its products

more expensive abroad.

Sales at the consumer-health unit fell 7.7% to $3.31 billion as

the foreign exchange effect offset a 3.1% revenue increase driven

by over-the-counter products like Tylenol and personal-care

products including Listerine. The company's medical-device business

continued to struggle and posted a sales decline of 7.3% to $6.09

billion.

In all, J&J reported a profit of $3.36 billion, or $1.20 a

share, down from $4.75 billion, or $1.66 a share, a year earlier.

Excluding items, per-share profit fell to $1.49 from $1.61. Revenue

slid 7.4% to $17.10 billion.

Analysts had projected $1.45 in earnings per share and $17.45

billion in revenue, according to Thomson Reuters.

Shares in the company, up 0.7% this year, declined 2%

premarket.

Write to Lisa Beilfuss at lisa.beilfuss@wsj.com

(END) Dow Jones Newswires

October 13, 2015 09:05 ET (13:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

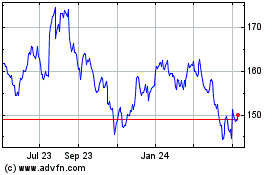

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

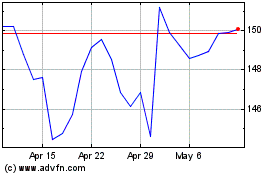

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Apr 2023 to Apr 2024