DepoMed Urges Holders to Reject Horizon Offer

September 14 2015 - 10:20AM

Dow Jones News

DepoMed Inc. said its board urged its shareholders to reject

Horizon Pharma PLC's unsolicited bid to acquire the company in a

share-exchange offer, reiterating that the deal significantly

undervalues the company.

Depomed holders have been offered 0.95 Horizon share for each

Depomed share held, an offer valued at roughly $27.54 a share as of

Friday's close.

Horizon first made an all-stock offer to buy Depomed in a letter

sent May 27, and then went public with an increased proposal

mid-July after the previous offer was rejected by Depomed's

board.

Horizon also has been seeking to replace the Depomed board.

A Horizon spokesman wasn't immediately available to comment on

Monday.

Depomed's board has repeatedly said Horizon's takeover attempt

is "not in the best interest" of the company, given that it is in a

period of significant growth and is expected to benefit from its

recent acquisition of the U.S. rights to pain killer Nucynta from

Janssen Pharmaceuticals Inc., a unit of Johnson & Johnson.

In its news release Monday, DepoMed said it thinks Nucynta has

the potential to exceed $1 billion in annual net sales. The company

also said that during the first quarter DepoMed sold the drug,

Nucynta sales reached $56.7 million.

Write to Tess Stynes at tess.stynes@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 14, 2015 10:05 ET (14:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

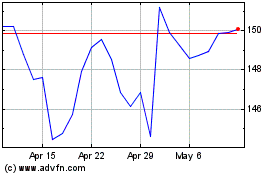

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

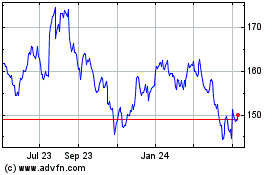

Johnson and Johnson (NYSE:JNJ)

Historical Stock Chart

From Apr 2023 to Apr 2024