Current Report Filing (8-k)

June 06 2016 - 8:07AM

Edgar (US Regulatory)

United States

Securities and Exchange Commission

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

June 2, 2016

Jones Lang LaSalle Incorporated

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

Maryland

|

|

001-13145

|

|

36-4150422

|

|

(State or other jurisdiction

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

of incorporation or organization)

|

|

|

|

|

|

|

|

|

|

|

|

200 East Randolph Drive, Chicago, IL

|

|

60601

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code:

312-782-5800

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

|

|

|

|

|

[ ]

|

Written communications pursuant to Rule 425 under Securities Act (17 CFR 230.425)

|

|

[ ]

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

[ ]

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 7.01 Regulation FD Disclosure

Additional information regarding the registrant's proposed acquisition of Integral UK Ltd. is attached hereto as Exhibit 99.1. The registrant undertakes no obligation to update this information, including any forward-looking statements, to reflect subsequently occurring events or circumstances.

The information in this Current Report, including the exhibits, shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing. This information will not be deemed an admission as to the materiality of any information contained herein that is required to be disclosed solely by Regulation FD.

Item 8.01 Other Events

In a press release issued on June 6, 2016, JLL announced it reached a definitive agreement with Integral UK Ltd. ("Integral"), the UK's leading provider of mechanical and electrical property maintenance. A summary description of such agreement is provided below and in the copy of the press release which is attached hereto as Exhibit 99.2 and is incorporated by reference.

The acquisition will strengthen JLL’s ability to self-perform property maintenance for clients across Europe, Middle East and Africa, adding to the more than 4 billion square feet of property currently serviced globally. It also will add to the company's already strong base of transactional services and establishes an engineering center of excellence in Bristol, which will help grow and develop existing and new talent.

The acquisition has a total valuation of $330 million and is expected to close in August, subject to clearance from the European Commission. It is the latest example of JLL’s disciplined acquisition strategy which, since the start of 2015, has seen JLL announce or close 38 margin-accretive transactions with a combined value of approximately $1.2 billion.

Cautionary Note Regarding Forward-Looking Statements

Statements in this communication regarding, among other things, future financial results and performance, achievements, plans and objectives may be considered forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors which may cause actual results, performance, achievements, plans and objectives of JLL to be materially different from those expressed or implied by such forward-looking statements. For additional information concerning risks, uncertainties and other factors that could cause actual results to differ materially from those anticipated in forward-looking statements, and risks to JLL’s business in general, please refer to those factors discussed under “Business,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Quantitative and Qualitative Disclosures about Market Risk,” and elsewhere in JLL’s Annual Report on Form 10-K for the year ended December 31, 2015, in the Quarterly Report on Form 10-Q for the quarter ended March 31, 2016, and in other reports filed with the Securities and Exchange Commission. Any forward-look

ing statements speak only as of the date of this presentation, and except to the extent required by applicable securities laws, JLL expressly disclaims any obligation or undertaking to publicly update or revise any forward-looking statements contained herein to reflect any change in JLL’s expectations or results, or any change in events.

Item 9.01 Financial Statements and Exhibits

|

|

|

|

|

|

|

Exhibit Number

|

|

Description

|

|

99.1

|

|

Investor Presentation relating to Acquisition of Integral UK Ltd.

|

|

99.2

|

|

Press Release dated June 6, 2016

|

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

Dated: June 6, 2016

|

Jones Lang LaSalle Incorporated

|

|

|

|

|

|

|

By: /s/ Christie B. Kelly

|

|

|

Name: Christie B. Kelly

|

|

|

Title: Executive Vice President and Chief Financial Officer

|

EXHIBIT INDEX

|

|

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

Investor Presentation relating to Acquisition of Integral UK Ltd.

|

|

99.2

|

|

Press Release dated June 6, 2016

|

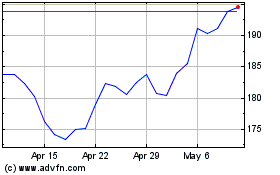

Jones Lang LaSalle (NYSE:JLL)

Historical Stock Chart

From Mar 2024 to Apr 2024

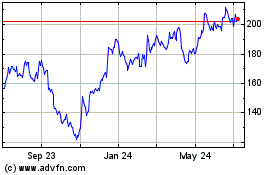

Jones Lang LaSalle (NYSE:JLL)

Historical Stock Chart

From Apr 2023 to Apr 2024