Chicago's LaSalle Buys 270 Rental Units in U.K.

January 12 2016 - 10:28AM

Dow Jones News

By Art Patnaude

U.S. real-estate investor LaSalle Investment Management has

struck two U.K. rental apartment deals in its latest step toward

becoming one of the country's biggest owners of multifamily

properties.

Chicago-based LaSalle said Tuesday it bought a total of 270

multifamily units in London and Leeds for a combined GBP55 million

($79 million). The firm has now invested GBP115 million in 562 U.K.

apartments specifically built to rent since making its first

acquisition last summer.

The multifamily sector in Britain is still in a nascent stage.

Small landlords with a handful of homes dominate the rental market.

But a decadeslong effort to institutionalize the fragmented sector

is gaining traction.

A decade ago, there were practically no purpose-built rental

homes here. These typically have amenities like concierge services

or gyms. Now there are over 23,080 either completed, under

construction or in the planning process, according to the British

Property Federation, an industry group.

"In the U.S. it's a fully-established sector. We see no reason

why that can't happen in the U.K.," said Andrew Stanford, U.K.

residential fund manager at LaSalle. "It's certainly been a long

time coming."

One major driver: More British people are renting. In the past

few years, buying homes has been increasingly unaffordable as house

prices moved higher, outstripping wage growth.

Investor demand for less-developed parts of the real-estate

market, from industrial warehouses to student housing, is also

playing a role. Demand for property has pushed up prices around the

world, as returns on property investment appear attractive because

interest rates remain low.

Lasalle bought 87 apartments in the Rathbone Market

redevelopment in East London for GBP30 million from the English

Cities Fund, created by the U.K. government to spur private-rented

sector investment. The gross-initial yield was 5.2%.

In Leeds, the firm bought Waterside Apartments from U.S.

private-equity firm CarVal Investors LLC for GBP25 million at a

gross-initial yield of 6.7%. The 2008-built blocks have 183 one and

two-bedroom apartments.

LaSalle has around $5 billion of residential assets under

management globally. It plans to invest GBP500 million in the U.K.

multifamily sector "within the next few years" on behalf of its

institutional clients, Mr. Standford said.

Write to Art Patnaude at art.patnaude@wsj.com

(END) Dow Jones Newswires

January 12, 2016 10:13 ET (15:13 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

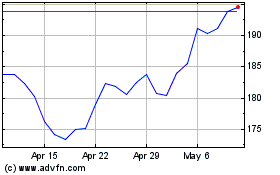

Jones Lang LaSalle (NYSE:JLL)

Historical Stock Chart

From Mar 2024 to Apr 2024

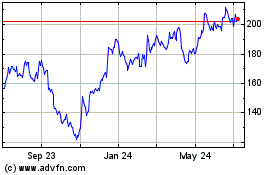

Jones Lang LaSalle (NYSE:JLL)

Historical Stock Chart

From Apr 2023 to Apr 2024