United States

Securities and Exchange Commission

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 28, 2015

Jones Lang LaSalle Incorporated

(Exact name of registrant as specified in its charter)

|

| | | | |

Maryland | | 001-13145 | | 36-4150422 |

(State or other jurisdiction | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

of incorporation or organization) | | | | |

|

| | |

200 East Randolph Drive, Chicago, IL | | 60601 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: 312-782-5800

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): |

| |

[ ] | Written communications pursuant to Rule 425 under Securities Act (17 CFR 230.425) |

[ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

[ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

[ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

On October 28, 2015, Jones Lang LaSalle Incorporated issued a press release and supporting supplemental information announcing its financial results for the third quarter ended September 30, 2015. The full text of the press release and supplemental information are attached as Exhibits 99.1 and 99.2 to this Current Report on Form 8-K and are incorporated by reference herein.

The information contained in this Current Report, including the exhibits, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the Exchange Act), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

The following exhibits are included with this Report:

|

| |

99.1. | News release issued by Jones Lang LaSalle Incorporated on October 28, 2015 announcing its financial |

| results for the third quarter ended September 30, 2015. |

| |

99.2. | Supplemental Information to Third Quarter 2015 Earnings Call issued on October 28, 2015. |

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| Dated: October 28, 2015 | |

| Jones Lang LaSalle Incorporated | |

| | | |

| By: /s/ Christie B. Kelly | |

| Name: Christie B. Kelly | |

| Title: Executive Vice President and Chief Financial Officer | |

EXHIBIT INDEX

|

| |

99.1. | News release issued by Jones Lang LaSalle Incorporated on October 28, 2015 announcing its financial |

| results for the third quarter ended September 30, 2015. |

| |

99.2. | Supplemental Information to Third Quarter 2015 Earnings Call issued on October 28, 2015. |

JLL Reports Record Third-Quarter Performance for 2015

Adjusted EPS up 11 percent to $2.52; fee revenue grows to $1.3 billion

CHICAGO, October 28, 2015 -- Jones Lang LaSalle Incorporated (NYSE: JLL) today reported adjusted earnings per share of $2.52, up from $2.27 in the prior year. Third-quarter fee revenue totaled $1.3 billion, up 17 percent in local currency from the third quarter of 2014. All percentage variances are calculated on a local currency basis.

| |

• | Ongoing investment fuels broad-based fee revenue growth and margin expansion |

| |

• | Acquisition pace accelerates; 15 acquisitions year to date |

| |

• | LaSalle Investment Management continues strong performance and capital raise momentum |

| |

• | Robust pipelines in place for seasonally strong fourth quarter |

| |

• | Semi-annual dividend increases 7 percent to $0.29 per share |

|

| | | | | | | | | | | | | | | |

| | | | | | | | |

| | Summary Financial Results ($ in millions, except per share data) | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| |

| | | | 2015 | 2014 | | 2015 | 2014 |

| | | | | | | | |

| | Revenue | | $ | 1,501 |

| $ | 1,366 |

| | $ | 4,078 |

| $ | 3,681 |

|

| | Fee Revenue1 | | $ | 1,287 |

| $ | 1,181 |

| | $ | 3,498 |

| $ | 3,144 |

|

| | Adjusted Net Income2 | | $ | 114 |

| $ | 103 |

| | $ | 249 |

| $ | 196 |

|

| | U.S. GAAP Net Income2 | | $ | 110 |

| $ | 104 |

| | $ | 243 |

| $ | 192 |

|

| | Adjusted Earnings per Share2 | | $ | 2.52 |

| $ | 2.27 |

| | $ | 5.47 |

| $ | 4.32 |

|

| | Earnings per Share | | $ | 2.43 |

| $ | 2.30 |

| | $ | 5.34 |

| $ | 4.24 |

|

| | Adjusted EBITDA3 | | $ | 190 |

| $ | 167 |

| | $ | 438 |

| $ | 351 |

|

| | Adjusted EBITDA, Real Estate Services | | $ | 127 |

| $ | 99 |

| | $ | 308 |

| $ | 243 |

|

| | Adjusted EBITDA, LaSalle Investment Management | | $ | 63 |

| $ | 68 |

| | $ | 130 |

| $ | 108 |

|

| | See Financial Statement Notes (1), (2) and (3) following the Financial Statements in this news release |

CEO Comment:

“We completed another record quarter at JLL, with double-digit fee revenue growth across all service lines and geographic segments, healthy margin expansion and continued outstanding performance by LaSalle Investment Management,” said Colin Dyer, President and CEO. “We continue to invest strategically in the long-term growth of our company, and have excellent momentum as we move into 2016,” Dyer added.

JLL Reports Third-Quarter 2015 Results - Page 2

|

| | | | | | | | | | |

Consolidated Revenue ($ in millions, “LC” = local currency) | Three Months Ended September 30, | | % Change in USD | | % Change in LC |

2015 |

| 2014 |

| | |

| | | | | | |

Real Estate Services (“RES”) | | | | | | |

Leasing | $ | 417.8 |

| $ | 368.1 |

| | 14% | | 19% |

Capital Markets & Hotels | 223.7 |

| 192.9 |

| | 16% | | 26% |

Property & Facility Management Fee Revenue1 | 270.7 |

| 259.6 |

| | 4% | | 14% |

Property & Facility Management | 378.3 |

| 376.3 |

| | 1% | | 10% |

Project & Development Services Fee Revenue1 | 125.9 |

| 112.6 |

| | 12% | | 21% |

Project & Development Services | 232.3 |

| 181.3 |

| | 28% | | 43% |

Advisory, Consulting and Other | 115.0 |

| 105.1 |

| | 9% | | 19% |

Total RES Fee Revenue1 | $ | 1,153.1 |

| $ | 1,038.3 |

| | 11% | | 17% |

Total RES Revenue | $ | 1,367.1 |

| $ | 1,223.7 |

| | 12% | | 19% |

| | | | | | |

LaSalle Investment Management ("LaSalle") | | | | | | |

Advisory Fees | $ | 60.7 |

| $ | 60.9 |

| | —% | | 7% |

Transaction Fees & Other | 5.0 |

| 10.8 |

| | (54)% | | (50)% |

Incentive Fees | 68.5 |

| 70.6 |

| | (3)% | | 8% |

Total LaSalle Revenue | $ | 134.2 |

| $ | 142.3 |

| | (6)% | | 3% |

| | | | | | |

Total Firm Fee Revenue1 | $ | 1,287.3 |

| $ | 1,180.6 |

| | 9% | | 17% |

Total Firm Revenue | $ | 1,501.3 |

| $ | 1,366.0 |

| | 10% | | 19% |

| | | | | | |

n.m. - not meaningful | | | | | | |

JLL Reports Third-Quarter 2015 Results - Page 3

|

| | | | | | | | | | |

Consolidated Revenue ($ in millions, “LC” = local currency) | Nine Months Ended September 30, | | % Change in USD | | % Change in LC |

2015 |

| 2014 |

| | |

| | | | | | |

Real Estate Services (“RES”) | | | | | | |

Leasing | $ | 1,103.8 |

| $ | 1,004.1 |

| | 10% | | 14% |

Capital Markets & Hotels | 623.9 |

| 492.3 |

| | 27% | | 38% |

Property & Facility Management Fee Revenue1 | 790.8 |

| 762.8 |

| | 4% | | 12% |

Property & Facility Management | 1,115.8 |

| 1,093.2 |

| | 2% | | 10% |

Project & Development Services Fee Revenue1 | 348.5 |

| 302.9 |

| | 15% | | 25% |

Project & Development Services | 603.5 |

| 508.8 |

| | 19% | | 33% |

Advisory, Consulting and Other | 331.1 |

| 306.1 |

| | 8% | | 18% |

Total RES Fee Revenue1 | $ | 3,198.1 |

| $ | 2,868.2 |

| | 12% | | 19% |

Total RES Revenue | $ | 3,778.1 |

| $ | 3,404.5 |

| | 11% | | 20% |

| | | | | | |

LaSalle Investment Management ("LaSalle") | | | | | | |

Advisory Fees | $ | 181.3 |

| $ | 176.8 |

| | 3% | | 11% |

Transaction Fees & Other | 19.5 |

| 19.8 |

| | (2)% | | 7% |

Incentive Fees | 99.3 |

| 79.5 |

| | 25% | | 38% |

Total LaSalle Revenue | $ | 300.1 |

| $ | 276.1 |

| | 9% | | 18% |

| | | | | | |

Total Firm Fee Revenue1 | $ | 3,498.2 |

| $ | 3,144.3 |

| | 11% | | 20% |

Total Firm Revenue | $ | 4,078.2 |

| $ | 3,680.6 |

| | 11% | | 20% |

| | | | | | |

n.m. - not meaningful | | | | | | |

Consolidated Performance Highlights:

| |

• | Consolidated fee revenue for the third quarter was $1.3 billion, up 17 percent from 2014. Growth was broad-based, led by Leasing, up $50 million or 19 percent, Capital Markets & Hotels, up $31 million or 26 percent, and Project & Development Services, up $13 million or 21 percent. |

| |

• | Consolidated fee-based operating expenses, excluding restructuring and acquisition charges, were $1.2 billion for the third quarter, compared with $1.1 billion last year. The firm continued to invest in technology and people for its clients in support of the growing business. |

| |

• | LaSalle Investment Management's advisory fees grew 7 percent; total revenue increased 3 percent driven by substantial incentive fees as certain funds near the end of their stated investment periods. LaSalle also recognized significant equity earnings from net valuation increases and investment dispositions. |

| |

• | Adjusted EBITDA margin calculated on a fee revenue basis was 14.8 percent for the third quarter, compared with 14.1 percent last year. |

| |

• | Adjusted earnings per share reached $2.52 for the third quarter, up 11 percent from last year despite a negative foreign exchange impact of approximately $0.23, or 10 percent compared with a year ago. |

JLL Reports Third-Quarter 2015 Results - Page 4

Balance Sheet and Net Interest Expense:

| |

• | The firm's total net debt was $435 million at quarter end, a decrease of $87 million from the second quarter of 2015. |

| |

• | Net interest expense for the third quarter was $6.8 million, down from $7.4 million in the third quarter of 2014 primarily due to lower average borrowings compared with last year. |

| |

• | Reflecting confidence in the firm's cash generation, the Board of Directors declared a semi-annual dividend of $0.29 per share, a 7 percent increase from the $0.27 per share payment made in June 2015. The dividend payment will be made on December 15, 2015, to shareholders of record at the close of business on November 13, 2015. |

JLL Reports Third-Quarter 2015 Results - Page 5

Business Segment Performance Highlights

Americas Real Estate Services

|

| | | | | | | | | | |

Americas Revenue ($ in millions, “LC” = local currency) | Three Months Ended September 30, | | % Change in USD | | % Change in LC |

2015 |

| 2014 |

| | |

| | | | | | |

Leasing | $ | 296.9 |

| $ | 256.2 |

| | 16% | | 17% |

Capital Markets & Hotels | 74.9 |

| 72.2 |

| | 4% | | 5% |

Property & Facility Management Fee Revenue1 | 117.5 |

| 106.1 |

| | 11% | | 16% |

Property & Facility Management | 168.0 |

| 166.7 |

| | 1% | | 8% |

Project & Development Services Fee Revenue1 | 63.4 |

| 57.2 |

| | 11% | | 15% |

Project & Development Services | 65.1 |

| 57.2 |

| | 14% | | 18% |

Advisory, Consulting and Other | 34.5 |

| 30.1 |

| | 15% | | 17% |

Operating Revenue | $ | 587.2 |

| $ | 521.8 |

| | 13% | | 16% |

| | | | | | |

Equity Earnings | 4.5 |

| (0.8 | ) | | n.m. | | n.m. |

Total Segment Fee Revenue1 | $ | 591.7 |

| $ | 521.0 |

| | 14% | | 16% |

Total Segment Revenue | $ | 643.9 |

| $ | 581.6 |

| | 11% | | 14% |

| | | | | | |

n.m. - not meaningful | | | | | | |

|

| | | | | | | | | | |

Americas Revenue

($ in millions, “LC” = local currency) | Nine Months Ended September 30, | | % Change in USD | | % Change in LC |

2015 |

| 2014 |

| | |

| | | | | | |

Leasing | $ | 790.7 |

| $ | 694.4 |

| | 14% | | 15% |

Capital Markets & Hotels | 226.2 |

| 172.5 |

| | 31% | | 32% |

Property & Facility Management Fee Revenue1 | 345.2 |

| 315.4 |

| | 9% | | 13% |

Property & Facility Management | 499.3 |

| 466.8 |

| | 7% | | 13% |

Project & Development Services Fee Revenue1 | 176.5 |

| 153.2 |

| | 15% | | 19% |

Project & Development Services | 180.4 |

| 154.7 |

| | 17% | | 20% |

Advisory, Consulting and Other | 94.4 |

| 85.1 |

| | 11% | | 13% |

Operating Revenue | $ | 1,633.0 |

| $ | 1,420.6 |

| | 15% | | 17% |

| | | | | | |

Equity Earnings | 5.4 |

| 0.4 |

| | n.m. | | n.m. |

Total Segment Fee Revenue1 | $ | 1,638.4 |

| $ | 1,421.0 |

| | 15% | | 17% |

Total Segment Revenue | $ | 1,796.4 |

| $ | 1,573.9 |

| | 14% | | 17% |

| | | | | | |

n.m. - not meaningful | | | | | | |

Americas Performance Highlights:

| |

• | Fee revenue for the quarter was $592 million, an increase of 16 percent from 2014. Revenue growth compared with last year was broad-based with Leasing up 17 percent; Advisory, Consulting and Other up 17 percent; Property and Facility Management up 16 percent; and Project & Development Services up 15 percent. Growth in the region was primarily led by U.S. markets including New York, Los Angeles and Atlanta. |

JLL Reports Second-Quarter 2015 Results - Page 6

| |

• | Fee-based operating expenses, excluding restructuring and acquisition charges, were $530 million for the quarter, compared with $473 million last year. |

| |

• | Operating income was $62 million for the quarter, compared with $48 million in 2014. Year-to-date operating income was $143 million, up from $112 million in 2014. |

| |

• | Adjusted EBITDA was $77 million for the quarter, compared with $60 million last year. Adjusted EBITDA margin for the quarter, calculated on a fee revenue basis, was 13.0 percent, compared with 11.4 percent in 2014. Year-to-date Adjusted EBITDA was $190 million, up from $150 million in 2014. Year-to-date Adjusted EBITDA margin calculated on a fee revenue basis was 11.6 percent, compared with 10.6 percent in 2014. |

JLL Reports Third-Quarter 2015 Results - Page 7

EMEA Real Estate Services

|

| | | | | | | | | | |

EMEA Revenue ($ in millions, “LC” = local currency) | Three Months Ended September 30, | | % Change in USD | | % Change in LC |

2015 |

| 2014 |

| | |

| | | | | | |

Leasing | $ | 72.4 |

| $ | 66.6 |

| | 9% | | 23% |

Capital Markets & Hotels | 110.3 |

| 90.8 |

| | 21% | | 35% |

Property & Facility Management Fee Revenue1 | 53.8 |

| 58.8 |

| | (9)% | | 3% |

Property & Facility Management | 75.0 |

| 81.6 |

| | (8)% | | 3% |

Project & Development Services Fee Revenue1 | 40.7 |

| 35.8 |

| | 14% | | 27% |

Project & Development Services | 133.6 |

| 83.4 |

| | 60% | | 83% |

Advisory, Consulting and Other | 55.7 |

| 46.2 |

| | 21% | | 35% |

Operating Revenue | $ | 332.9 |

| $ | 298.2 |

| | 12% | | 25% |

| | | | | | |

Equity Earnings | — |

| — |

| | n.m. | | —% |

Total Segment Fee Revenue1 | $ | 332.9 |

| $ | 298.2 |

| | 12% | | 25% |

Total Segment Revenue | $ | 447.0 |

| $ | 368.6 |

| | 21% | | 37% |

| | | | | | |

n.m. - not meaningful

| | | | | | |

|

| | | | | | | | | | |

EMEA Revenue

($ in millions, “LC” = local currency) | Nine Months Ended September 30, | | % Change in USD | | % Change in LC |

2015 |

| 2014 |

| | |

| | | | | | |

Leasing | $ | 185.9 |

| $ | 188.3 |

| | (1)% | | 14% |

Capital Markets & Hotels | 298.7 |

| 238.6 |

| | 25% | | 42% |

Property & Facility Management Fee Revenue1 | 156.4 |

| 171.2 |

| | (9)% | | 4% |

Property & Facility Management | 219.6 |

| 246.6 |

| | (11)% | | 1% |

Project & Development Services Fee Revenue1 | 111.3 |

| 98.5 |

| | 13% | | 30% |

Project & Development Services | 324.1 |

| 258.0 |

| | 26% | | 48% |

Advisory, Consulting and Other | 160.8 |

| 144.6 |

| | 11% | | 26% |

Operating Revenue | $ | 913.1 |

| $ | 841.2 |

| | 9% | | 24% |

| | | | | | |

Equity Earnings | 0.7 |

| — |

| | n.m. | | n.m |

Total Segment Fee Revenue1 | $ | 913.8 |

| $ | 841.2 |

| | 9% | | 24% |

Total Segment Revenue | $ | 1,189.8 |

| $ | 1,076.1 |

| | 11% | | 27% |

| | | | | | |

n.m. - not meaningful | | | | | | |

EMEA Performance Highlights:

| |

• | EMEA's performance during the third quarter was significantly higher in local currencies than in U.S. dollars due to the continued strength of the U.S. dollar against European currencies. |

JLL Reports Third-Quarter 2015 Results - Page 8

| |

• | Fee revenue for the quarter was $333 million, an increase of 25 percent from 2014. Revenue growth was driven by Capital Markets & Hotels up 35 percent; Advisory, Consulting and Other up 35 percent; Project & Development Services up 27 percent; and Leasing up 23 percent compared with last year. Growth in the region was led by the U.K., Germany and France. |

| |

• | Fee-based operating expenses, excluding restructuring and acquisition charges, were $307 million for the quarter, compared with $282 million last year. |

| |

• | Operating income was $26 million for the quarter, compared with $16 million in 2014. Year-to-date operating income was $56 million, up from $36 million in 2014. |

| |

• | Adjusted EBITDA was $33 million for the quarter, compared with $23 million last year. Adjusted EBITDA margin calculated on a fee revenue basis was 10.0 percent for the quarter, compared with 7.6 percent in 2014. Year-to-date Adjusted EBITDA was $74 million, up from $54 million in 2014. Year-to-date Adjusted EBITDA margin calculated on a fee revenue basis was 8.1 percent, compared with 6.4 percent in 2014. |

JLL Reports Third-Quarter 2015 Results - Page 9

Asia Pacific Real Estate Services

|

| | | | | | | | | | |

Asia Pacific Revenue ($ in millions, “LC” = local currency) | Three Months Ended September 30, | | % Change in USD | | % Change in LC |

2015 |

| 2014 |

| | |

| | | | | | |

Leasing | $ | 48.5 |

| $ | 45.3 |

| | 7% | | 19% |

Capital Markets & Hotels | 38.5 |

| 29.9 |

| | 29% | | 48% |

Property & Facility Management Fee Revenue1 | 99.4 |

| 94.7 |

| | 5% | | 18% |

Property & Facility Management | 135.3 |

| 128.0 |

| | 6% | | 18% |

Project & Development Services Fee Revenue1 | 21.8 |

| 19.6 |

| | 11% | | 26% |

Project & Development Services | 33.6 |

| 40.7 |

| | (17)% | | (6)% |

Advisory, Consulting and Other | 24.8 |

| 28.8 |

| | (14)% | | (3)% |

Operating Revenue | $ | 233.0 |

| $ | 218.3 |

| | 7% | | 20% |

| | | | | | |

Equity Earnings | 0.2 |

| 0.2 |

| | —% | | 8% |

Total Segment Fee Revenue1 | $ | 233.2 |

| $ | 218.5 |

| | 7% | | 20% |

Total Segment Revenue | $ | 280.9 |

| $ | 272.9 |

| | 3% | | 15% |

| | | | | | |

n.m. - not meaningful

| | | | | | |

|

| | | | | | | | | | |

Asia Pacific Revenue ($ in millions, “LC” = local currency) | Nine Months Ended September 30, | | % Change in USD | | % Change in LC |

2015 |

| 2014 |

| | |

| | | | | | |

Leasing | $ | 127.2 |

| $ | 121.4 |

| | 5% | | 14% |

Capital Markets & Hotels | 99.0 |

| 81.2 |

| | 22% | | 37% |

Property & Facility Management Fee Revenue1 | 289.2 |

| 276.2 |

| | 5% | | 15% |

Property & Facility Management | 396.9 |

| 379.8 |

| | 5% | | 13% |

Project & Development Services Fee Revenue1 | 60.7 |

| 51.2 |

| | 19% | | 31% |

Project & Development Services | 99.0 |

| 96.1 |

| | 3% | | 14% |

Advisory, Consulting and Other | 75.9 |

| 76.4 |

| | (1)% | | 9% |

Operating Revenue | $ | 652.0 |

| $ | 606.4 |

| | 8% | | 18% |

| | | | | | |

Equity Losses | 0.2 |

| 0.1 |

| | n.m. | | 92% |

Total Segment Fee Revenue1 | $ | 652.2 |

| $ | 606.5 |

| | 8% | | 18% |

Total Segment Revenue | $ | 798.2 |

| $ | 755.0 |

| | 6% | | 16% |

| | | | | | |

n.m. - not meaningful

| | | | | | |

Asia Pacific Performance Highlights:

| |

• | Asia Pacific's performance during the third quarter was significantly higher in local currencies than in U.S. dollars due to the continued strength of the U.S. dollar, particularly against the Australian dollar and Japanese yen. |

| |

• | Fee revenue for the quarter was $233 million, an increase of 20 percent from 2014. Revenue growth was driven by Capital Markets & Hotels up 48 percent, Leasing up 19 percent and Property & Facility Management up 18 percent, compared with last year. Growth in the region was led by Australia, India and China's tier one cities, including Beijing and Shanghai. |

JLL Reports Third-Quarter 2015 Results - Page 10

| |

• | Fee-based operating expenses, excluding restructuring and acquisition charges, were $220 million for the quarter, compared with $203 million last year. |

| |

• | Operating income was $13 million for the quarter, compared with $15 million in 2014. Year-to-date operating income was $34 million, up from $32 million in 2014. |

| |

• | Adjusted EBITDA was $17 million for the quarter, compared with $16 million last year. Adjusted EBITDA margin calculated on a fee revenue basis was 7.1 percent for the quarter, compared with 7.5 percent in 2014. Year-to-date Adjusted EBITDA was $44 million, up from $40 million in 2014. Year-to-date Adjusted EBITDA margin calculated on a fee revenue basis was 6.8 percent, compared with 6.5 percent in 2014. |

JLL Reports Third-Quarter 2015 Results - Page 11

LaSalle Investment Management

|

| | | | | | | | | | |

LaSalle Investment Management Revenue ($ in millions, “LC” = local currency) | Three Months Ended September 30, | | % Change in USD | | % Change in LC |

2015 |

| 2014 |

| | |

| | | | | | |

Advisory Fees | $ | 60.7 |

| $ | 60.9 |

| | —% | | 7% |

Transaction Fees & Other | 5.0 |

| 10.8 |

| | (54)% | | (50)% |

Incentive Fees | 68.5 |

| 70.6 |

| | (3)% | | 8% |

Operating Revenue | $ | 134.2 |

| $ | 142.3 |

| | (6)% | | 3% |

| | | | | | |

Equity Earnings | 20.7 |

| 20.1 |

| | 3% | | 4% |

Total Segment Revenue | $ | 154.9 |

| $ | 162.4 |

| | (5)% | | 3% |

| | | | | | |

n.m. - not meaningful

| | | | | | |

|

| | | | | | | | | | |

LaSalle Investment Management Revenue ($ in millions, “LC” = local currency) | Nine Months Ended September 30, | | % Change in USD | | % Change in LC |

2015 |

| 2014 |

| | |

| | | | | | |

Advisory Fees | $ | 181.3 |

| $ | 176.8 |

| | 3% | | 11% |

Transaction Fees & Other | 19.5 |

| 19.8 |

| | (2)% | | 7% |

Incentive Fees | 99.3 |

| 79.5 |

| | 25% | | 38% |

Operating Revenue | $ | 300.1 |

| $ | 276.1 |

| | 9% | | 18% |

| | | | | | |

Equity Earnings | 57.6 |

| 40.4 |

| | 43% | | 44% |

Total Segment Revenue | $ | 357.7 |

| $ | 316.5 |

| | 13% | | 21% |

| | | | | | |

n.m. - not meaningful | | | | | | |

LaSalle Investment Management Performance Highlights:

| |

• | Total segment revenue was $155 million for the quarter, compared with $162 million last year. This included advisory fee growth of 7 percent, $69 million of incentive fees and $21 million of equity earnings. |

| |

• | Incentive fees and equity earnings were notable for the quarter, despite a tough 2014 comparable. Incentive fees were driven by the sale of assets as LaSalle realized gains from legacy investments, whereas equity earnings were primarily valuation driven. |

| |

• | Operating expenses were $92 million for the quarter, compared with $95 million last year. Operating income was $63 million for the quarter, compared with $68 million last year. |

| |

• | Adjusted EBITDA was $63 million for the quarter, compared with $68 million last year. Adjusted EBITDA margin was 40.9 percent, compared with 42.0 percent in 2014. Year-to-date Adjusted EBITDA was $130 million, up from $108 million in 2014. Year-to-date Adjusted EBITDA margin was 36.3 percent, compared to 34.0 percent in 2014. |

| |

• | Capital raise was $838 million for the quarter and $3.8 billion year-to-date. |

| |

• | Assets under management were $57.2 billion as of September 30, 2015, up from $56.0 billion as of June 30, 2015. The net increase in assets under management resulted from $2.5 billion of acquisitions and takeovers, $1.7 billion of dispositions and withdrawals, $0.7 billion of net valuation decreases and $1.1 billion of net foreign currency increases. |

JLL Reports Third-Quarter 2015 Results - Page 12

About JLL

JLL (NYSE: JLL) is a professional services and investment management firm offering specialized real estate services to clients seeking increased value by owning, occupying and investing in real estate. A Fortune 500 company with annual fee revenue of $4.7 billion and gross revenue of $5.4 billion, JLL has more than 230 corporate offices, operates in more than 80 countries and has a global workforce of approximately 58,000. On behalf of its clients, the firm provides management and real estate outsourcing services for a property portfolio of 3.4 billion square feet, or 316 million square meters, and completed $118 billion in sales, acquisitions and finance transactions in 2014. Its investment management business, LaSalle Investment Management, has $57.2 billion of real estate assets under management. JLL is the brand name, and a registered trademark, of Jones Lang LaSalle Incorporated. For further information, visit www.jll.com.

200 East Randolph Drive Chicago Illinois 60601 │ 30 Warwick Street London W1B 5NH │ 9 Raffles Place #39-00 Republic Plaza Singapore 048619

Cautionary Note Regarding Forward-Looking Statements

Statements in this news release regarding, among other things, future financial results and performance, achievements, plans and objectives and dividend payments may be considered forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors which may cause actual results, performance, achievements, plans and objectives and dividend payments of JLL to be materially different from those expressed or implied by such forward-looking statements. For additional information concerning risks, uncertainties and other factors that could cause actual results to differ materially from those anticipated in forward-looking statements, and risks to JLL’s business in general, please refer to those factors discussed under “Business,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Quantitative and Qualitative Disclosures about Market Risk,” and elsewhere in JLL’s Annual Report on Form 10-K for the year ended December 31, 2014, on Form 10-Q for the quarters ended March 31, 2015 and June 30, 2015, and in other reports filed with the Securities and Exchange Commission. There can be no assurance that future dividends will be declared since the actual declaration of future dividends, and the establishment of record and payment dates, remains subject to final determination by the Company’s Board of Directors. Any forward-looking statements speak only as of the date of this release, and except to the extent required by applicable securities laws, JLL expressly disclaims any obligation or undertaking to publicly update or revise any forward-looking statements contained herein to reflect any change in JLL’s expectations or results, or any change in events.

JLL Reports Third-Quarter 2015 Results - Page 13

Conference Call

Management will conduct a conference call with shareholders, analysts and investment professionals on Wednesday, October 28, 2015 at 9:00 a.m. EDT.

If you would like to participate in the teleconference, please dial into one of the following phone numbers five to ten minutes before the start time (the passcode will also be required):

|

| | |

∙ | U.S. callers: | +1 844 231 9804 |

∙ | International callers: | +1 402 858 7998 |

∙ | Passcode: | 49805888 |

Webcast

We are also offering a live webcast. Follow these steps to participate:

| |

1. | You must have a minimum 14.4 Kbps Internet connection |

| |

2. | Log on to http://www.visualwebcaster.com/event.asp?id=102889 |

| |

3. | Download free Windows Media Player software: (link located under registration form) |

| |

4. | If you experience problems listening, please call the Webcast Hotline +1 800 744 9473 and provide your Event ID (102889). |

Supplemental Information

Supplemental information regarding the third-quarter 2015 earnings call has been posted to the Investor Relations section of the company's website: www.jll.com.

Conference Call Replay

Available: 12:00 p.m. EDT Wednesday, October 28, 2015 through 11:59 p.m. EST Saturday, November 28, 2015 at the following numbers:

|

| | | |

∙ | U.S. callers: | +1 855 859 2056 | or + 1 800 585 8367 |

∙ | International callers: | +1 404 537 3406 | |

∙ | Passcode: | 49805888 | |

Web Audio Replay

An audio replay will be available. Information and the link can be found on the company’s website: www.jll.com.

If you have any questions, please contact JLL’s Investor Relations department at: JLLInvestorRelations@am.jll.com.

###

|

| | | | | | | | | | | | | | | |

JONES LANG LASALLE INCORPORATED |

Consolidated Statements of Operations |

For the Three and Nine Months Ended September 30, 2015 and 2014 |

(in thousands, except share data) |

(Unaudited) |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| |

| 2015 | | 2014 | | 2015 | | 2014 |

| | | | | | | |

Revenue | $ | 1,501,267 |

| | $ | 1,365,975 |

| | $ | 4,078,254 |

| | $ | 3,680,622 |

|

| | | | | | | |

Operating expenses: | | | | | | | |

Compensation and benefits | 896,080 |

| | 828,241 |

| | 2,459,056 |

| | 2,226,804 |

|

Operating, administrative and other | 440,119 |

| | 388,290 |

| | 1,245,443 |

| | 1,141,376 |

|

Depreciation and amortization | 26,643 |

| | 22,023 |

| | 77,060 |

| | 67,214 |

|

Restructuring and acquisition charges 4 | 18,108 |

| | (37 | ) | | 20,757 |

| | 41,379 |

|

Total operating expenses | 1,380,950 |

| | 1,238,517 |

| | 3,802,316 |

| | 3,476,773 |

|

| | | | | | | |

Operating income 1 | 120,317 |

| | 127,458 |

| | 275,938 |

| | 203,849 |

|

| | | | | | | |

Interest expense, net of interest income | (6,774 | ) | | (7,361 | ) | | (20,369 | ) | | (21,661 | ) |

Equity earnings from real estate ventures | 25,362 |

| | 19,552 |

| | 63,873 |

| | 40,945 |

|

| | | | | | | |

Income before income taxes and noncontrolling interest 4 | 138,905 |

| | 139,649 |

| | 319,442 |

| | 223,133 |

|

Provision for income taxes 4 | 25,720 |

| | 34,912 |

| | 71,576 |

| | 29,889 |

|

Net income 4 | 113,185 |

| | 104,737 |

| | 247,866 |

| | 193,244 |

|

| | | | | | | |

Net income attributable to noncontrolling interest | 2,776 |

| | 453 |

| | 5,252 |

| | 1,116 |

|

Net income attributable to the Company | $ | 110,409 |

| | $ | 104,284 |

| | $ | 242,614 |

| | $ | 192,128 |

|

| | | | | | | |

Dividends on unvested common stock, net of tax benefit | — |

| | — |

| | 163 |

| | 176 |

|

Net income attributable to common shareholders | $ | 110,409 |

| | $ | 104,284 |

| | $ | 242,451 |

| | $ | 191,952 |

|

| | | | | | | |

Basic earnings per common share | $ | 2.45 |

| | $ | 2.33 |

| | $ | 5.40 |

| | $ | 4.30 |

|

| | | | | | | |

Basic weighted average shares outstanding | 45,001,309 |

| | 44,809,133 |

| | 44,905,217 |

| | 44,637,429 |

|

| | | | | | | |

Diluted earnings per common share 2 | $ | 2.43 |

| | $ | 2.30 |

| | $ | 5.34 |

| | $ | 4.24 |

|

| | | | | | | |

Diluted weighted average shares outstanding | 45,452,959 |

| | 45,290,595 |

| | 45,394,517 |

| | 45,241,766 |

|

| | | | | | | |

EBITDA 3 | $ | 172,322 |

| | $ | 169,033 |

| | $ | 416,871 |

| | $ | 312,008 |

|

| | | | | | | |

Please reference attached financial statement notes. | | | | | | |

|

| | | | | | | | | | | | | | | |

JONES LANG LASALLE INCORPORATED |

Segment Operating Results |

For the Three and Nine Months Ended September 30, 2015 and 2014 |

(in thousands) |

(Unaudited) |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

|

| 2015 | | 2014 | | 2015 | | 2014 |

REAL ESTATE SERVICES | | | | | | | |

| | | | | | | |

AMERICAS | | | | | | | |

Revenue: | | | | | | | |

Operating revenue | $ | 639,405 |

| | $ | 582,387 |

| | $ | 1,791,071 |

| | $ | 1,573,552 |

|

Equity earnings (losses) | 4,450 |

| | (756 | ) | | 5,366 |

| | 446 |

|

Total segment revenue | 643,855 |

| | 581,631 |

| | 1,796,437 |

| | 1,573,998 |

|

Gross contract costs 1 | (52,150 | ) | | (60,601 | ) | | (158,047 | ) | | (152,863 | ) |

Total segment fee revenue | 591,705 |

| | 521,030 |

| | 1,638,390 |

| | 1,421,135 |

|

| | | | | | | |

Operating expenses: | | | | | | | |

Compensation, operating and administrative expenses | 566,668 |

| | 521,987 |

| | 1,606,929 |

| | 1,423,746 |

|

Depreciation and amortization | 15,638 |

| | 11,658 |

| | 46,511 |

| | 38,500 |

|

Total segment operating expenses | 582,306 |

| | 533,645 |

| | 1,653,440 |

| | 1,462,246 |

|

Gross contract costs 1 | (52,150 | ) | | (60,601 | ) | | (158,047 | ) | | (152,863 | ) |

Total fee-based segment operating expenses | 530,156 |

| | 473,044 |

| | 1,495,393 |

| | 1,309,383 |

|

| | | | | | | |

Operating income | $ | 61,549 |

| | $ | 47,986 |

| | $ | 142,997 |

| | $ | 111,752 |

|

| | | | | | | |

Adjusted EBITDA | $ | 77,187 |

| | $ | 59,644 |

| | $ | 189,508 |

| | $ | 150,252 |

|

| | | | | | | |

EMEA | | | | | | | |

Revenue: | | | | | | | |

Operating revenue | $ | 447,037 |

| | $ | 368,564 |

| | $ | 1,189,070 |

| | $ | 1,076,088 |

|

Equity earnings | 8 |

| | 13 |

| | 752 |

| | 14 |

|

Total segment revenue | 447,045 |

| | 368,577 |

| | 1,189,822 |

| | 1,076,102 |

|

Gross contract costs 1 | (114,125 | ) | | (70,403 | ) | | (276,047 | ) | | (234,929 | ) |

Total segment fee revenue | 332,920 |

| | 298,174 |

| | 913,775 |

| | 841,173 |

|

| | | | | | | |

Operating expenses: | | | | | | | |

Compensation, operating and administrative expenses | 413,838 |

| | 345,893 |

| | 1,116,030 |

| | 1,022,599 |

|

Depreciation and amortization | 6,800 |

| | 6,355 |

| | 18,099 |

| | 17,303 |

|

Total segment operating expenses | 420,638 |

| | 352,248 |

| | 1,134,129 |

| | 1,039,902 |

|

Gross contract costs 1 | (114,125 | ) | | (70,403 | ) | | (276,047 | ) | | (234,929 | ) |

Total fee-based segment operating expenses | 306,513 |

| | 281,845 |

| | 858,082 |

| | 804,973 |

|

| | | | | | | |

Operating income | $ | 26,407 |

| | $ | 16,329 |

| | $ | 55,693 |

| | $ | 36,200 |

|

| | | | | | | |

Adjusted EBITDA | $ | 33,207 |

| | $ | 22,684 |

| | $ | 73,792 |

| | $ | 53,503 |

|

|

| | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| |

| 2015 | | 2014 | | 2015 | | 2014 |

ASIA PACIFIC | | | | | | | |

Revenue: | | | | | | | |

Operating revenue | $ | 280,651 |

| | $ | 272,708 |

| | $ | 797,974 |

| | $ | 754,890 |

|

Equity earnings | 193 |

| | 198 |

| | 215 |

| | 119 |

|

Total segment revenue | 280,844 |

| | 272,906 |

| | 798,189 |

| | 755,009 |

|

Gross contract costs 1 | (47,697 | ) | | (54,419 | ) | | (145,955 | ) | | (148,483 | ) |

Total segment fee revenue | 233,147 |

| | 218,487 |

| | 652,234 |

| | 606,526 |

|

| | | | | | | |

Operating expenses: | | | | | | | |

Compensation, operating and administrative expenses | 264,261 |

| | 254,352 |

| | 753,763 |

| | 713,111 |

|

Depreciation and amortization | 3,657 |

| | 3,444 |

| | 10,878 |

| | 9,869 |

|

Total segment operating expenses | 267,918 |

| | 257,796 |

| | 764,641 |

| | 722,980 |

|

Gross contract costs 1 | (47,697 | ) | | (54,419 | ) | | (145,955 | ) | | (148,483 | ) |

Total fee-based segment operating expenses | 220,221 |

| | 203,377 |

| | 618,686 |

| | 574,497 |

|

| | | | | | | |

Operating income | $ | 12,926 |

| | $ | 15,110 |

| | $ | 33,548 |

| | $ | 32,029 |

|

| | | | | | | |

Adjusted EBITDA | $ | 16,583 |

| | $ | 16,338 |

| | $ | 44,426 |

| | $ | 39,682 |

|

| | | | | | | |

LASALLE INVESTMENT MANAGEMENT | | | | | | | |

Revenue: | | | | | | | |

Operating revenue | $ | 134,174 |

| | $ | 142,316 |

| | $ | 300,139 |

| | $ | 276,092 |

|

Equity earnings | 20,711 |

| | 20,097 |

| | 57,540 |

| | 40,366 |

|

Total segment revenue | 154,885 |

| | 162,413 |

| | 357,679 |

| | 316,458 |

|

| | | | | | | |

Operating expenses: | | | | | | | |

Compensation, operating and administrative expenses | 91,432 |

| | 94,299 |

| | 227,777 |

| | 208,724 |

|

Depreciation and amortization | 548 |

| | 566 |

| | 1,572 |

| | 1,542 |

|

Total segment operating expenses | 91,980 |

| | 94,865 |

| | 229,349 |

| | 210,266 |

|

| | | | | | | |

Operating income | $ | 62,905 |

| | $ | 67,548 |

| | $ | 128,330 |

| | $ | 106,192 |

|

| | | | | | | |

Adjusted EBITDA | $ | 63,453 |

| | $ | 68,114 |

| | $ | 129,902 |

| | $ | 107,734 |

|

| | | | | | | |

| | | | | | | |

SEGMENT RECONCILING ITEMS | | | | | | | |

Total segment revenue | $ | 1,526,629 |

| | $ | 1,385,527 |

| | $ | 4,142,127 |

| | $ | 3,721,567 |

|

Reclassification of equity earnings | 25,362 |

| | 19,552 |

| | 63,873 |

| | 40,945 |

|

Total revenue | $ | 1,501,267 |

| | $ | 1,365,975 |

| | $ | 4,078,254 |

| | $ | 3,680,622 |

|

| | | | | | | |

Total operating expenses before restructuring and acquisition charges | 1,362,842 |

| | 1,238,554 |

| | 3,781,559 |

| | 3,435,394 |

|

Operating income before restructuring and acquisition charges | $ | 138,425 |

| | $ | 127,421 |

| | $ | 296,695 |

| | $ | 245,228 |

|

| | | | | | | |

Restructuring and acquisition charges 4 | 18,108 |

| | (37 | ) | | 20,757 |

| | 41,379 |

|

Operating income after restructuring and acquisition charges | $ | 120,317 |

| | $ | 127,458 |

| | $ | 275,938 |

| | $ | 203,849 |

|

| | | | | | | |

Total adjusted EBITDA | $ | 190,430 |

| | $ | 166,780 |

| | $ | 437,628 |

| | $ | 351,171 |

|

Restructuring and acquisition charges 4 | 18,108 |

| | (2,253 | ) | | 20,757 |

| | 39,163 |

|

Total EBITDA | $ | 172,322 |

| | $ | 169,033 |

| | $ | 416,871 |

| | $ | 312,008 |

|

| | | | | |

Please reference attached financial statement notes. | | | | | |

|

| | | | | | | | | | | | | | |

JONES LANG LASALLE INCORPORATED | | |

Consolidated Balance Sheets | | |

September 30, 2015, December 31, 2014 and September 30, 2014 | | |

(in thousands) | | |

| | | | (Unaudited) | | | | (Unaudited) |

| | | | September 30, | | December 31, | | September 30, |

| | | | 2015 | | 2014 | | 2014 |

ASSETS | | | | | | |

Current assets: | | | | | | |

| Cash and cash equivalents | | $ | 193,499 |

| | $ | 250,413 |

| | $ | 162,568 |

|

| Trade receivables, net of allowances | | 1,407,440 |

| | 1,375,035 |

| | 1,216,322 |

|

| Notes and other receivables | | 222,270 |

| | 181,377 |

| | 193,324 |

|

| Warehouse receivables | | 41,274 |

| | 83,312 |

| | 185,797 |

|

| Prepaid expenses | | 90,065 |

| | 64,963 |

| | 84,484 |

|

| Deferred tax assets, net | | 129,869 |

| | 135,251 |

| | 122,353 |

|

| Other | | 9,980 |

| | 27,825 |

| | 29,399 |

|

| | Total current assets | | 2,094,397 |

| | 2,118,176 |

| | 1,994,247 |

|

| | | | | | | | |

Property and equipment, net of accumulated depreciation | | 377,832 |

| | 368,361 |

| | 344,765 |

|

Goodwill, with indefinite useful lives | | 1,999,623 |

| | 1,907,924 |

| | 1,910,990 |

|

Identified intangibles, net of accumulated amortization | | 43,384 |

| | 38,841 |

| | 40,443 |

|

Investments in real estate ventures | | 311,814 |

| | 297,142 |

| | 290,674 |

|

Long-term receivables | | 110,044 |

| | 85,749 |

| | 94,170 |

|

Deferred tax assets, net | | 104,670 |

| | 90,897 |

| | 64,832 |

|

Deferred compensation plans | | 128,910 |

| | 111,234 |

| | 108,484 |

|

Other | | 64,352 |

| | 57,012 |

| | 86,181 |

|

| | Total assets | | $ | 5,235,026 |

| | $ | 5,075,336 |

| | $ | 4,934,786 |

|

| | | | | | | | |

LIABILITIES AND EQUITY | | | | |

Current liabilities: | | | | |

| Accounts payable and accrued liabilities | | $ | 636,824 |

| | $ | 630,037 |

| | $ | 518,704 |

|

| Accrued compensation | | 790,977 |

| | 990,678 |

| | 665,556 |

|

| Short-term borrowings | | 30,504 |

| | 19,623 |

| | 43,292 |

|

| Deferred tax liabilities, net | | 16,554 |

| | 16,554 |

| | 11,606 |

|

| Deferred income | | 143,913 |

| | 104,565 |

| | 119,963 |

|

| Deferred business acquisition obligations | | 48,616 |

| | 49,259 |

| | 46,462 |

|

| Warehouse facility | | 41,274 |

| | 83,312 |

| | 185,797 |

|

| Minority shareholder redemption liability | | — |

| | 11,158 |

| | 10,909 |

|

| Other | | 153,109 |

| | 141,825 |

| | 157,987 |

|

| | Total current liabilities | | 1,861,771 |

| | 2,047,011 |

| | 1,760,276 |

|

| | | | | | | | |

Noncurrent liabilities: | | | | | | |

| Credit facility | | 235,005 |

| | — |

| | 250,000 |

|

| Long-term senior notes | | 275,000 |

| | 275,000 |

| | 275,000 |

|

| Deferred tax liabilities, net | | 17,723 |

| | 17,082 |

| | 18,029 |

|

| Deferred compensation | | 142,551 |

| | 125,857 |

| | 114,576 |

|

| Deferred business acquisition obligations | | 37,975 |

| | 68,848 |

| | 65,937 |

|

| Minority shareholder redemption liability | | — |

| | — |

| | — |

|

| Other | | 130,301 |

| | 118,969 |

| | 94,111 |

|

| | Total liabilities | | 2,700,326 |

| | 2,652,767 |

| | 2,577,929 |

|

|

| | | | | | | | | | | | | | |

| | | | (Unaudited) | | | | (Unaudited) |

| | | | September 30, | | December 31, | | September 30, |

| | | | 2015 | | 2014 | | 2014 |

Redeemable noncontrolling interest | | 8,917 |

| | 13,449 |

| | 13,638 |

|

| | | | | | | | |

Company shareholders' equity: | | | | | | |

| Common stock, $.01 par value per share,100,000,000 shares authorized; 45,033,713, 44,828,779, and 44,817,758 shares issued and outstanding as of September 30, 2015, December 31, 2014 and September 30, 2014, respectively | | 450 |

| | 448 |

| | 448 |

|

| Additional paid-in capital | | 980,698 |

| | 961,850 |

| | 957,374 |

|

| Retained earnings | | 1,861,427 |

| | 1,631,145 |

| | 1,448,602 |

|

| Shares held in trust | | (6,328 | ) | | (6,407 | ) | | (6,407 | ) |

| Accumulated other comprehensive income (loss) | | (329,747 | ) | | (200,239 | ) | | (76,839 | ) |

| | Total Company shareholders' equity | | 2,506,500 |

| | 2,386,797 |

| | 2,323,178 |

|

| | | | | | | | |

| Noncontrolling interest | | 19,283 |

| | 22,323 |

| | 20,041 |

|

| | Total equity | | 2,525,783 |

| | 2,409,120 |

| | 2,343,219 |

|

| | | | | | | | |

| | Total liabilities and equity | | $ | 5,235,026 |

| | $ | 5,075,336 |

| | $ | 4,934,786 |

|

| | | | | | | | |

Please reference attached financial statement notes. | | | | | | |

JONES LANG LASALLE INCORPORATED

Summarized Consolidated Statements of Cash Flows

For the Nine Months Ended September 30, 2015 and 2014

(in thousands)

|

| | | | | | | |

| Nine Months Ended |

| September 30, |

| 2015 | | 2014 |

| | | |

Cash (used in) provided by operating activities | $ | (18,245 | ) | | $ | 42,356 |

|

| | | |

Cash used in investing activities | (184,464 | ) | | (111,503 | ) |

| | | |

Cash provided by financing activities | 160,243 |

| | 82,769 |

|

| | | |

Effect of currency exchange rate changes on cash and cash equivalents | (14,448 | ) | | (3,780 | ) |

| | | |

Net (decrease) increase in cash and cash equivalents | $ | (56,914 | ) | | $ | 9,842 |

|

| | | |

Cash and cash equivalents, beginning of period | 250,413 |

| | 152,726 |

|

| | | |

Cash and cash equivalents, end of period | $ | 193,499 |

| | $ | 162,568 |

|

| | | |

Please reference attached financial statement notes. | | | |

JONES LANG LASALLE INCORPORATED

Financial Statement Notes

1. Consistent with U.S. GAAP (“GAAP”), gross contract vendor and subcontractor costs (“gross contract costs”) which are managed on certain client assignments in the Property & Facility Management and Project & Development Services business lines are presented on a gross basis in both revenue and operating expenses. Gross contract costs are excluded from revenue and operating expenses in determining “fee revenue” and “fee-based operating expenses,” respectively. Excluding these costs from revenue and operating expenses more accurately reflects how the firm manages its expense base and its operating margins.

Adjusted operating income excludes the impact of restructuring and acquisition charges. “Adjusted operating income margin” is calculated by dividing adjusted operating income by fee revenue. Below are reconciliations of revenue and operating expenses to fee revenue and fee-based operating expenses, as well as adjusted operating income margin calculations, for the three and nine months ended September 30, 2015 and 2014.

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | September 30, |

($ in millions) | | 2015 | | 2014 | | 2015 | | 2014 |

| | | | | | | | |

Revenue | | $ | 1,501.3 |

| | $ | 1,366.0 |

| | $ | 4,078.2 |

| | $ | 3,680.6 |

|

Gross contract costs | | (214.0 | ) | | (185.4 | ) | | (580.0 | ) | | (536.3 | ) |

Fee revenue | | $ | 1,287.3 |

| | $ | 1,180.6 |

| | $ | 3,498.2 |

| | $ | 3,144.3 |

|

| | | | | | | | |

Operating expenses | | $ | 1,381.0 |

| | $ | 1,238.5 |

| | $ | 3,802.3 |

| | $ | 3,476.8 |

|

Gross contract costs | | (214.0 | ) | | (185.4 | ) | | (580.0 | ) | | (536.3 | ) |

Fee-based operating expenses | | $ | 1,167.0 |

| | $ | 1,053.1 |

| | $ | 3,222.3 |

| | $ | 2,940.5 |

|

| | | | | | | | |

Operating income | | $ | 120.3 |

| | $ | 127.5 |

| | $ | 275.9 |

| | $ | 203.8 |

|

| | | | | | | | |

Add: | | | | | | | | |

Restructuring and acquisition charges* | | 18.1 |

| | (2.2 | ) | | 20.8 |

| | 39.2 |

|

Adjusted operating income | | $ | 138.4 |

| | $ | 125.3 |

| | $ | 296.7 |

| | $ | 243.0 |

|

| | | | | | | | |

Adjusted operating income margin | | 10.8 | % | | 10.6 | % | | 8.5 | % | | 7.7 | % |

*See note 4 for more information on restructuring and acquisition charges

2. Net restructuring and acquisition charges are excluded from GAAP net income attributable to common shareholders to arrive at adjusted net income for the three and nine months ended September 30, 2015 and 2014. Adjusted net income in the table below for the three and nine months ended September 30, 2014 no longer incorporates an adjustment to exclude the net intangible amortization related to the 2011 King Sturge acquisition; such amounts were $0.5 million and $1.6 million of amortization expense for the three and nine months ended September 30, 2014, respectively. There was no comparable activity during the three and nine months ended September 30, 2015.

Below are reconciliations of GAAP net income attributable to common shareholders to adjusted net income and calculations of earnings per share for each net income total:

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | September 30, |

($ in millions, except per share data) | | 2015 | | 2014 | | 2015 | | 2014 |

| | | | | | | | |

GAAP net income attributable to common shareholders | | $ | 110.4 |

| | $ | 104.3 |

| | $ | 242.5 |

| | $ | 192.0 |

|

Shares (in 000s) | | 45,453 |

| | 45,291 |

| | 45,395 |

| | 45,242 |

|

GAAP diluted earnings per share | | $ | 2.43 |

| | $ | 2.30 |

| | $ | 5.34 |

| | $ | 4.24 |

|

| | | | | | | | |

GAAP net income attributable to common shareholders | | $ | 110.4 |

| | $ | 104.3 |

| | $ | 242.5 |

| | $ | 192.0 |

|

Restructuring and acquisition charges, net* | | 4.0 |

| | (1.6 | ) | | 6.0 |

| | 3.5 |

|

Adjusted net income | | $ | 114.4 |

| | $ | 102.7 |

| | $ | 248.5 |

| | $ | 195.5 |

|

| | | | | | | | |

Shares (in 000s) | | 45,453 |

| | 45,291 |

| | 45,395 |

| | 45,242 |

|

| | | | | | | | |

Adjusted diluted earnings per share | | $ | 2.52 |

| | $ | 2.27 |

| | $ | 5.47 |

| | $ | 4.32 |

|

*See note 4 for more information on restructuring and acquisition charges

3. Adjusted EBITDA represents earnings before interest expense net of interest income, income taxes, depreciation and amortization, adjusted for restructuring and acquisition charges. Although adjusted EBITDA and EBITDA are non-GAAP financial measures, they are used extensively by management and are useful to investors and lenders as metrics for evaluating operating performance and liquidity. EBITDA is used in the calculations of certain covenants related to the firm’s revolving credit facility. However, adjusted EBITDA and EBITDA should not be considered as an alternative to net income determined in accordance with GAAP. Because adjusted EBITDA and EBITDA are not calculated under GAAP, the firm’s adjusted EBITDA and EBITDA may not be comparable to similarly titled measures used by other companies.

Below is a reconciliation of net income to EBITDA and adjusted EBITDA:

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | September 30, |

($ in millions) | | 2015 | | 2014 | | 2015 | | 2014 |

| | | | | | | | |

GAAP net income | | $ | 113.2 |

| | $ | 104.7 |

| | $ | 247.9 |

| | $ | 193.2 |

|

Add: | | | | | | | | |

Interest expense, net of interest income | | 6.8 |

| | 7.4 |

| | 20.4 |

| | 21.7 |

|

Provision for (benefit from) income taxes | | 25.7 |

| | 34.9 |

| | 71.5 |

| | 29.9 |

|

Depreciation and amortization | | 26.6 |

| | 22.0 |

| | 77.1 |

| | 67.2 |

|

| | |

| | |

| | |

| | |

|

EBITDA | | $ | 172.3 |

| | $ | 169.0 |

| | $ | 416.9 |

| | $ | 312.0 |

|

Add: | | | | | | | | |

Restructuring and acquisition charges | | 18.1 |

| | (2.2 | ) | | 20.8 |

| | 39.2 |

|

Adjusted EBITDA | | $ | 190.4 |

| | $ | 166.8 |

| | $ | 437.7 |

| | $ | 351.2 |

|

4. Restructuring and acquisition charges are excluded from segment operating results, although they are included for consolidated reporting. For purposes of segment operating results, the allocation of restructuring and acquisition charges to the segments has been determined not to be meaningful to investors, so the performance of segment results has been evaluated without allocation of these charges.

Restructuring and acquisition charges presented in the Financial Statement Notes for the three and nine months ended September 30, 2014 includes a pre-tax benefit of $2.2 million associated with acquisition-related activity that

was presented within Operating, administrative and other expenses in the consolidated statements of operations for the quarter and reclassified for full-year 2014 reporting comparability.

Restructuring and acquisition charges of $18 million in the quarter ended September 30, 2015 include $13 million related to the write-off of an indemnification asset which arose from prior period acquisition activity. This write-off is offset by the recognition of a tax benefit of an equal amount in the provision for income taxes, and therefore has no impact on net income.

|

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | September 30, |

($ in millions) | | GAAP | Adjusting Item | Adjusted | | GAAP | Adjusting Item | Adjusted |

| | | | | | | | |

Income before income taxes and noncontrolling interest | | $ | 138.9 |

| $ | 12.8 |

| $ | 151.7 |

| | $ | 319.4 |

| $ | 12.8 |

| $ | 332.2 |

|

Provision for income taxes | | 25.7 |

| 12.8 |

| 38.5 |

| | 71.5 |

| 12.8 |

| 84.3 |

|

Net Income | | $ | 113.2 |

| | $ | 113.2 |

| | $ | 247.9 |

| | $ | 247.9 |

|

| | | | | | | | |

Excluding the impact of this item, the adjusted provision for income taxes for the three months ended September 30, 2015 of $38.5 reflects a 25.4 percent effective tax rate on adjusted income before taxes of $151.7 million.

5. Each geographic region offers the firm’s full range of Real Estate Services businesses consisting primarily of tenant representation and agency leasing; capital markets; property management and facilities management; project and development services; and advisory, consulting and valuations services. LaSalle Investment Management provides investment management services to institutional investors and high-net-worth individuals.

6. The consolidated statements of cash flows are presented in summarized form. For complete consolidated statements of cash flows, please refer to the firm’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2015, to be filed with the Securities and Exchange Commission shortly.

7. EMEA refers to Europe, Middle East and Africa. MENA refers to Middle East and North Africa. Greater China includes China, Hong Kong, Macau and Taiwan. Southeast Asia refers to Singapore, Indonesia, Philippines, Thailand and Vietnam. The BRIC countries include Brazil, Russia, India and China.

8. Certain prior year amounts have been reclassified to conform to the current presentation.

|

| |

Contact: | Christie B. Kelly |

Title: | Global Chief Financial Officer |

Phone: | +1 312 228 2316 |

Supplemental Information Earnings Call Third-Quarter 2015

Capital Markets(1) (in USD) Americas -4% 10% 10-15% EMEA(2) 2% -4% -5-10% Asia Pacific 1% 2% Flat Total -1% 3% 5% Leasing (in square meters) Americas (U.S. only) 2% —% 0-5% EMEA (Europe only) 29% 11% 5-10% Asia Pacific (select markets) 27% 33% 25% Total 12% 7% 5-10% Investment Volumes Remain Strong; Outlook Steady Q3 2015 Market Volume & Outlook Actual Forecast Q3 2015 v. Q3 2014 Q3 YTD 2015 v. Q3 YTD 2014 FY 2015 v. FY 2014 Leasing Volumes Improving; Momentum Building 1) Market volume data presented in U.S. dollar and excludes multi-family assets. 2) Q3 2015 actual volumes are up 22% compared to Q3 2014 in euro terms, up 2% in US Dollar terms. JLL Research volume projections for full-year 2015 are up 9% in euro terms compared to 2014 and a decline of 9% in US Dollar terms. Source: JLL Research, October 2015 JLL Research 2 Market Volumes Actual Forecast Q3 2015 v. Q3 2014 Q3 YTD 2015 v. Q3 YTD 2014 FY 2015 v. FY 2014 Gross Absorption

Multi-Regional Thales Group Harris Corporation Nokia Matthews International Americas Brookdale Senior Living National Science Foundation, Alexandria VAInova Health System 111 West 57th Street, New York Glen Star, Dallas The Lexington, Nashville RFR, New York Constitution Plaza, Hartford EMEA Aon Trivago, Dusseldorf Retail Portfolio, Ireland Eurpoean Investment Bank, BrusselsLeone Portfolio, Netherlands Front Office, France Damco Czech Republic Adidas Group, Moscow Asia Pacific IBM Hongjia Tower, Shanghai Telstra, Australia Hyundai Motor Finance, Beijing IAG, Australia Growthpoint Properties, Canberra InterContinental Hong Kong GIC, Australia Selected Business Wins and Expansions 3

Rental Values Capital Values + 20-30% Madrid + 10-20% Hong Kong London*, Tokyo, Frankfurt, Sydney, Paris*, Boston, Chicago, Los Angeles, New York*, San Francisco, Shanghai + 5-10% Sydney, London*, Shanghai, Boston, Chicago, Milan, Toronto, Washington DC, Stockholm, Los Angeles, San Francisco, Tokyo, Madrid, Toronto, Beijing Beijing, New York* + 0-5% Dubai, Washington DC, Mexico City, Stockholm, Brussels, Seoul, Hong Kong, Dubai, Mexico City,Frankfurt, Seoul, Brussels, Milan Stockholm - 0-5% Sao Paulo, Mumbai, Paris* Mumbai, Singapore - 5-10% Sao Paulo - 10-20% Singapore, Moscow - 20-30% Moscow Prime Offices – Projected Changes in Values, 2015 4 NOTES: *New York – Midtown, London – West End, Paris - CBD. Nominal rates in local currency. Source: JLL Research, October 2015

Note: Equity earnings of $25.4M and $63.9M in Q3 2015 and YTD 2015, respectively, are included in segment results, however, excluded from Consolidated totals. Year-over-year increases shown fee-based have been calculated using fee revenue, which excludes gross contract costs. Consolidated Fee - $1,287 Gross - $1,501 LaSalle $155 EMEA Fee - $333 Gross - $447 Q3 2015 Revenue Q3 2015 performance ($ in millions) Americas Fee - $592 Gross - $644 Asia Pac Fee - $233 Gross - $281 5 Consolidated Fee - $3,498 Gross - $4,078 LaSalle $358 EMEA Fee - $914 Gross - $1,190 YTD 2015 Americas Fee - $1,638 Gross - $1,796 Asia Pac Fee - $652 Gross - $798 Q3 2015 YTD 2015 YOY % Growth, Fee Revenue Basis LC USD Segment LC USD 16% 14% Americas 17% 15% 25% 12% EMEA 24% 9% 20% 7% Asia Pacific 18% 8% 3% (5%) LaSalle 21% 13% 17% 9% Consolidated 20% 11% 19% 10% Consolidated Gross Revenue 20% 11%

Note: Segment and Consolidated Real Estate Services (“RES”) operating revenue exclude Equity earnings (losses). Fee revenue presentation of Property & Facility Management, Project & Development Services and Total RES Operating Revenue excludes gross contract costs. Q3 2015 Real Estate Services revenue ($ in millions; % change in local currency over Q3 2014) Americas EMEA Asia Pacific Total RES Leasing $296.9 17% $72.4 23% $48.5 19% $417.8 19% Capital Markets & Hotels $74.9 5% $110.3 35% $38.5 48% $223.7 26% Property & Facility Management Fee $117.5 16% $53.8 3% $99.4 18% $270.7 14% Gross Revenue $168.0 8% $75.0 3% $135.3 18% $378.3 10% Project & Development Services - Fee $63.4 15% $40.7 27% $21.8 26% $125.9 21% Gross Revenue $65.1 18% $133.6 83% $33.6 -6% $232.3 43% Advisory, Consulting & Other $34.5 17% $55.7 35% $24.8 -3% $115.0 19% Total RES Operating Fee Revenue $587.2 16% $332.9 25% $233.0 20% $1,153.1 17% Total Gross Revenue $639.4 14% $447.0 37% $280.7 15% $1,367.1 19% 6

Note: Segment and Consolidated Real Estate Services (“RES”) operating revenue exclude Equity earnings (losses). Fee revenue presentation of Property & Facility Management, Project & Development Services and Total RES Operating Revenue excludes gross contract costs. YTD 2015 Real Estate Services revenue ($ in millions; % change in local currency over YTD 2014) Americas EMEA Asia Pacific Total RES Leasing $790.7 15% $185.9 14% $127.2 14% $1,103.8 14% Capital Markets & Hotels $226.2 32% $298.7 42% $99.0 37% $623.9 38% Property & Facility Management Fee $345.2 13% $156.4 4% $289.2 15% $790.8 12% Gross Revenue $499.3 13% $219.6 1% $396.9 13% $1,115.8 10% Project & Development Services - Fee $176.5 19% $111.3 30% $60.7 31% $348.5 25% Gross Revenue $180.4 20% $324.1 48% $99.0 14% $603.5 33% Advisory, Consulting & Other $94.4 13% $160.8 26% $75.9 9% $331.1 18% Total RES Operating Fee Revenue $1,633.0 17% $913.1 24% $652.0 18% $3,198.1 19% Total Gross Revenue $1,791.0 17% $1,189.1 27% $798.0 16% $3,778.1 20% 7

• Successful capital raising with $838 million for the quarter, $3.8 billion raised year-to-date • Assets Under Management reach $57 billion, up from $50 billion a year ago • Equity earnings of $20 million in the quarter from net valuation increases and investment dispositions • Significant incentive fees of $69 million realized in favorable market conditions in the quarter • Stable platform based upon annuity like advisory fees driven by core assets Separate Accounts $32.7 Commingled Funds $11.6 Public Securities $12.9 Q3 & Year-to-date 2015 Highlights Q3 2015 AUM = $57 Billion ($ in billions) Note: AUM data reported on a one-quarter lag. Public Securities $12.9 Continental Europe $3.8 8

•Investment grade ratings; Baa2 (Stable) BBB+ (Stable) ◦ Low debt cost: year-to-date net interest expense of $20.4 million versus $21.7 million in 2014 • M&A Activity ◦ 15 acquisitions executed or announced in 2015, 25 acquisitions since the beginning of 2014 ◦ Ample capacity on $2 billion bank credit facility ◦ Disciplined underwriting remains a focus ▪ Strategic fit, culture alignment and financially accretive • Q3 YTD Capital Spending Consistent with Capital Allocation Strategy ◦ M&A (1) $103 million ◦ Capital Expenditures (2) $ 85 million ◦ Co-Investment (3) $ 1 million Balance Sheet $ millions Q3 2015 Q4 2014 Q3 2014 Cash and Cash Equivalents $ 193 $ 250 $ 163 Short Term Borrowings 31 20 43 Credit Facility 235 — 250 Net Bank Debt $ 73 $ (230) $ 130 Long Term Senior Notes 275 275 275 Deferred Business Acquisition Obligations 87 118 112 Total Net Debt $ 435 $ 163 $ 517 Balance Sheet Highlights Strong balance sheet 9 (1) Includes upfront payments made at close plus deferred acquisition payments and earn outs paid during the period for transactions closed in prior periods (2) Excludes investments in joint venture entities, capitalized leases and tenant improvement allowances that are required to be consolidated under U.S. GAAP (3) Includes capital contributions of $40.8M partially offset by distributions of $39.7M

Appendix 10

Prime Offices – Capital Value Clock, Q3 2014 v Q3 2015 Based on notional capital values for Grade A space in CBD or equivalent. US positions relate to the overall market Source: JLL Research, October 2015 Americas EMEA Asia Pacific The Jones Lang LaSalle Property Clocks SM 11

Prime Offices – Rental Clock, Q3 2014 v Q3 2015 Based on rents for Grade A space in CBD or equivalent. US positions relate to the overall market Source: JLL Research, October 2015 Americas EMEA Asia Pacific The Jones Lang LaSalle Property Clocks SM 12

Refer to page 18 for Reconciliation of GAAP Net Income to Adjusted EBITDA for the three and nine months ended September 30, 2015, for details relative to these Adjusted EBITDA calculations. Segment Adjusted EBITDA is calculated by adding the segment’s depreciation and amortization to its reported operating income, which excludes restructuring and acquisition charges. Consolidated Adjusted EBITDA is the sum of the Adjusted EBITDA of the four segments. Consolidated $190 Q3 2015 Adjusted EBITDA Q3 2015 performance ($ in millions) Asia Pac $17 EMEA $33 LaSalle $63 13 Consolidated $438 YTD 2015 Asia Pac $44 EMEA $74 LaSalle $130 Q3 (USD) Adj. EBITDA Margin, Fee Revenue YTD (USD) 2015 2014 Segment 2015 2014 13.0% 11.5% Americas 11.6% 10.6% 10.0% 7.6% EMEA 8.1% 6.4% 7.1% 6.4% Asia Pacific 6.8% 6.2% 40.9% 42.0% LaSalle 36.3% 34.0% 14.8% 13.9% Consolidated 12.5% 11.1% Americas $77 Americas $190

Note: Segment and Consolidated Real Estate Services (“RES”) operating revenue exclude Equity earnings (losses). Fee revenue presentation of Property & Facility Management, Project & Development Services and Total RES Operating Revenue excludes gross contract costs. Q3 2015 Real Estate Services revenue ($ in millions; % change in USD over Q3 2014) Americas EMEA Asia Pacific Total RES Leasing $296.9 16% $72.4 9% $48.5 7% $417.8 14% Capital Markets & Hotels $74.9 4% $110.3 21% $38.5 29% $223.7 16% Property & Facility Management Fee $117.5 11% $53.8 -9% $99.4 5% $270.7 4% Gross Revenue $168.0 1% $75.0 -8% $135.3 6% $378.3 1% Project & Development Services - Fee $63.4 11% $40.7 14% $21.8 11% $125.9 12% Gross Revenue $65.1 14% $133.6 60% $33.6 -17% $232.3 28% Advisory, Consulting & Other $34.5 15% $55.7 21% $24.8 -14% $115.0 9% Total RES Operating Fee Revenue $587.2 13% $332.9 12% $233.0 7% $1,153.1 11% Total Gross Revenue $639.4 11% $447.0 21% $280.7 3% $1,367.1 12% 14

Note: Segment and Consolidated Real Estate Services (“RES”) operating revenue exclude Equity earnings (losses). Fee revenue presentation of Property & Facility Management, Project & Development Services and Total RES Operating Revenue excludes gross contract costs. YTD 2015 Real Estate Services revenue ($ in millions; % change in USD over YTD 2014) Americas EMEA Asia Pacific Total RES Leasing $790.7 14% $185.9 -1% $127.2 5% $1,103.8 10% Capital Markets & Hotels $226.2 31% $298.7 25% $99.0 22% $623.9 27% Property & Facility Management Fee $345.2 9% $156.4 -9% $289.2 5% $790.8 4% Gross Revenue $499.3 7% $219.6 -11% $396.9 5% $1,115.8 2% Project & Development Services - Fee $176.5 15% $111.3 13% $60.7 19% $348.5 15% Gross Revenue $180.4 17% $324.1 26% $99.0 3% $603.5 19% Advisory, Consulting & Other $94.4 11% $160.8 11% $75.9 -1% $331.1 8% Total RES Operating Fee Revenue $1,633.0 15% $913.1 9% $652.0 8% $3,198.1 12% Total Gross Revenue $1,791.0 14% $1,189.1 11% $798.0 6% $3,778.1 11% 15

• Reimbursable vendor, subcontractor and out-of-pocket costs reported as revenue and expense in JLL financial statements have been increasing steadily • Gross accounting requirements increase revenue and costs without corresponding profit • Business managed on a fee revenue basis to focus on margin expansion in the base business Revenue 1 Gross contract costs Fee revenue 1 Operating expenses Gross contract costs Fee-based operating expenses Operating income Restructuring and acquisition charges 2 Adjusted operating income Adjusted operating income margin Fee Revenue / Expense Reconciliation ($ in millions) 1) Consolidated revenue and fee revenue exclude equity earnings (losses). 2) Restructuring and acquisition charges are excluded from adjusted operating income margin. See Financial Statement Notes to the Q3 2015 earnings release for additional information. 2015 2014 2015 2014 Three Months Ended September 30 Nine Months Ended September 30 $ 1,501.3 $ 1,366.0 $ 4,078.2 $ 3,680.6 214.0 185.4 580.0 536.3 $ 1,287.3 $ 1,180.6 $ 3,498.2 $ 3,144.3 $ 1,381.0 $ 1,238.5 $ 3,802.3 $ 3,476.8 214.0 185.4 580.0 536.3 $ 1,167.0 $ 1,053.1 $ 3,222.3 $ 2,940.5 $ 120.3 $ 127.5 $ 275.9 $ 203.8 18.1 (2.2) 20.8 39.2 $ 138.4 $ 125.3 $ 296.7 $ 243.0 10.8% 10.6% 8.5% 7.7% 16

Reconciliation of GAAP Net Income to Adjusted Net Income and Earnings per Share ($ in millions) GAAP net income attributable to common shareholders Shares (in 000s) GAAP diluted earnings per share GAAP net income attributable to common shareholders Restructuring and acquisition charges, net 1 Adjusted net income Shares (in 000s) Adjusted diluted earnings per share 2015 2014 2015 2014 Three Months Ended September 30 Nine Months Ended September 30 $ 110.4 $ 104.3 $ 242.5 $ 192.0 45,453 45,291 45,395 45,242 $ 2.43 $ 2.30 $ 5.34 $ 4.24 $ 110.4 $ 104.3 $ 242.5 $ 192.0 4.0 (1.6) 6.0 3.5 $ 114.4 $ 102.7 $ 248.5 $ 195.5 45,453 45,291 45,395 45,242 $ 2.52 $ 2.27 $ 5.47 $ 4.32 17 1) Restructuring and acquisition charges are excluded from adjusted net income margin. See Financial Statement Notes to the Q3 2015 earnings release for additional information.

Reconciliation of GAAP Net Income to Adjusted EBITDA ($ in millions) GAAP net income Interest expense, net of interest income Provision for (benefit from) income taxes Depreciation and amortization EBITDA Restructuring and acquisition charges 1 Adjusted EBITDA 1) Restructuring and acquisition charges are excluded from adjusted EBITDA margin. See Financial Statement Notes to the Q3 2015 earnings release for additional information. JLL is the brand name, and a registered trademark, of Jones Lang LaSalle Incorporated. 2015 2014 2015 2014 Three Months Ended September 30 Nine Months Ended September 30 $ 113.2 $ 104.7 $ 247.9 $ 193.2 6.8 7.4 20.4 21.7 25.7 34.9 71.6 29.9 26.6 22.0 77.1 67.2 $ 172.3 $ 169.0 $ 417.0 $ 312.0 18.1 (2.2) 20.8 39.2 $ 190.4 $ 166.8 $ 437.8 $ 351.2 18

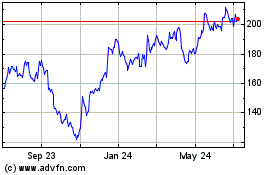

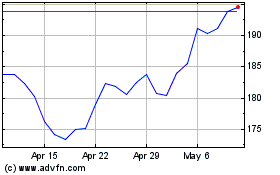

Jones Lang LaSalle (NYSE:JLL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Jones Lang LaSalle (NYSE:JLL)

Historical Stock Chart

From Apr 2023 to Apr 2024