BlackRock Buys U.K. Garden Centers in Hunt for Yield

September 07 2015 - 6:18AM

Dow Jones News

By Art Patnaude

BlackRock Inc., the world's largest asset manager, is

cultivating a group of U.K. garden centers, a fresh signal that

investors are digging deeper into the property sector in their hunt

for yield.

BlackRock Real Estate, the firm's property arm, on Monday bought

a portfolio of eight garden centers around the U.K. for GBP112.5

million ($171.1 million) from U.S. property investor LaSalle

Investment Management.

The portfolio adds to a growing pool of alternative investments

for BlackRock, which owns doctors' offices and student housing in

the U.K., as well as parking garages, cinemas and gas stations

elsewhere.

"This is our first foray into garden centers," said Geoffrey

Shaw, portfolio manager at BlackRock. "Our real estate platform has

been going through a significant transformation," he said, noting

growth in areas such as real estate debt, publicly-listed property

firms and infrastructure.

Alternative real-estate assets like garden centers, which in the

U.K. typically offer food and giftware in addition to horticulture,

are increasingly on the radar of global investors. The Canada

Pension Plan Investment Board in March spent GBP1.1 billion on a

student housing portfolio. Brookfield Property Partners LP in June

bought Center Parcs, which operates five family-oriented vacation

resorts in the U.K., from Blackstone Group LP.

Low interest rates around the world have made traditional

commercial property--such as offices, shops, or

warehouses--increasingly attractive to investors compared with

other assets such as bonds.

As rising demand pushes up prices, investors are turning to

alternative properties. In the U.K., deal volume for alternative

property sectors hit GBP8.7 billion in the first half of 2015, up

from GBP4.7 billion in the same period the year before, according

to agent JLL.

Garden centers, along with marinas, are a further step from the

norm, said Alan Plumb, head of leisure and trade-related property

at agent Savills. Before the financial crisis and advent of

extremely low interest rates, "investors might have thought some of

these sectors were too small," Mr. Plumb said. "Now they're

starting to look at them."

BlackRock, which manages over $21 billion of real estate equity

and debt, bought the group of garden centers primarily for their

rental income, Mr. Shaw said. Six of the assets are let to Wyevale

Garden Centers, the largest garden-center operator in the U.K.,

owned by private-equity firm Terra Firma Capital Partners Ltd.

"We're looking to find income at a time when fixed-income isn't

yielding that much," Mr. Shaw said.

Many of Blackrock's clients, like pension funds, require steady

streams of consistent income. The garden centers in the portfolio

have an average unexpired lease term of 29 years. The net initial

yield on the portfolio is 5.25%, an attractive return compared with

the 2.5% that 30-year U.K. government bonds currently offer.

LaSalle assembled the portfolio about a decade ago for the

LaSalle Garden Center Fund, which produced a total return of 8.5%.

LaSalle was obliged to sell the portfolio at the end of the fund's

tenure.

"The returns have been so good," said Alan Tripp, head of U.K.

at LaSalle, which manages $56 billion of property assets. "We held

on right until the end."

LaSalle is a large investor in health care and student housing,

Mr. Tripp said. "The main attraction of the [alternative real

estate] sector is the income. There's a move toward this, but when

you're stepping into alternatives you have to know what you're

getting into," he said.

In Britain, a nation obsessed with homes and gardens, garden

centers are ripe for investment for three main reasons, Mr. Shaw at

BlackRock said. They attract an older age group, a growing section

of the U.K. population; shoppers tend to be homeowners, a category

of the population that tends to be more affluent; and the cafes and

restaurants act as leisure destinations, making garden centers more

than just a straight retail offering.

Write to Art Patnaude at art.patnaude@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 07, 2015 06:03 ET (10:03 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

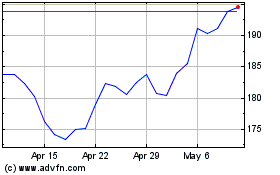

Jones Lang LaSalle (NYSE:JLL)

Historical Stock Chart

From Mar 2024 to Apr 2024

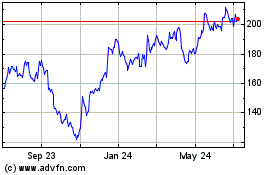

Jones Lang LaSalle (NYSE:JLL)

Historical Stock Chart

From Apr 2023 to Apr 2024