Current Report Filing (8-k)

August 13 2015 - 4:46PM

Edgar (US Regulatory)

United States

Securities and Exchange Commission

Washington, D.C. 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 13, 2015

Jones Lang LaSalle Incorporated

(Exact name of registrant as specified in its charter)

|

| | | | |

Maryland | | 001-13145 | | 36-4150422 |

(State or other jurisdiction | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

of incorporation or organization) | | | | |

|

| | |

200 East Randolph Drive, Chicago, IL | | 60601 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: 312-782-5800

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): |

| |

[ ] | Written communications pursuant to Rule 425 under Securities Act (17 CFR 230.425) |

[ ] | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

[ ] | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

[ ] | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 7.01 Regulation FD Disclosure

Additional information regarding the registrant's proposed acquisition of Oak Grove Commercial Mortgage, LLC is attached hereto as Exhibit 99.1. The registrant undertakes no obligation to update this information, including any forward-looking statements, to reflect subsequently occurring events or circumstances.

The information in this Current Report, including the exhibits, shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing. This information will not be deemed an admission as to the materiality of any information contained herein that is required to be disclosed solely by Regulation FD.

Item 8.01 Other Events

In a press release issued on August 13, 2015, Jones Lang LaSalle Investments, LLC and Jones Lang LaSalle Operations, L.L.C., each wholly-owned indirect subsidiaries of Jones Lang LaSalle Incorporated (collectively, “JLL”), announced that JLL entered into an Agreement and Plan of Merger with Oak Grove Commercial Mortgage, LLC, a Delaware limited liability company (“Oak Grove”) and certain affiliates of Oak Grove. A summary description of such agreement is provided below and in the copy of the press release which is attached hereto as Exhibit 99.2 and is incorporated by reference.

The acquisition of Oak Grove brings greater full-service mortgage lending and mortgage banking capabilities to JLL. Oak Grove's Fannie Mae, Freddie Mac and HUD/GNMA capabilities will expand JLL’s market-rate, affordable, seniors housing and healthcare financial expertise, and complement its multifamily sales and equity services.

The consideration payable at closing is equal to $175 million, from which Oak Grove will retire outstanding indebtedness (excluding warehouse loans/lines) and redeem its preferred unit holders. Oak Grove has the potential to earn future payments based on a five-year earn-out structure tied to performance of the combined platform. The expected total consideration payable pursuant to the Agreement and Plan of Merger is approximately $260 million.

We anticipate the transaction will close by year end subject to a number of standard approvals and conditions, including the expiration or termination of the applicable waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended.

Cautionary Note Regarding Forward-Looking Statements

Statements in this communication regarding, among other things, future financial results and performance, achievements, plans and objectives may be considered forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors which may cause actual results, performance, achievements, plans and objectives of JLL to be materially different from those expressed or implied by such forward-looking statements. For additional information concerning risks, uncertainties and other factors that could cause actual results to differ materially from those anticipated in forward-looking statements, and risks to JLL’s business in general, please refer to those factors discussed under “Business,” “Risk Factors,”

“Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Quantitative and Qualitative Disclosures about Market Risk,” and elsewhere in JLL’s Annual Report on Form 10-K for the year ended December 31, 2014, in each of the Quarterly Reports on Form 10-Q for the quarters ended March 31, 2015 and June 30, 2015, and in other reports filed with the Securities and Exchange Commission. Any forward-looking statements speak only as of the date of this presentation, and except to the extent required by applicable securities laws, JLL expressly disclaims any obligation or undertaking to publicly update or revise any forward-looking statements contained herein to reflect any change in JLL’s expectations or results, or any change in events.

Item 9.01 Financial Statements and Exhibits

|

| | |

Exhibit Number | | Description |

99.1 | | Investor Presentation relating to Acquisition of Oak Grove Commercial Mortgage, LLC |

99.2 | | Press Release dated August 13, 2015 |

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| |

Dated: August 13, 2015 | Jones Lang LaSalle Incorporated |

| | |

| By: /s/ Christie B. Kelly |

| Name: Christie B. Kelly |

| Title: Executive Vice President and Chief Financial Officer |

EXHIBIT INDEX

|

| | |

Exhibit No. | | Description |

99.1 | | Investor Presentation relating to Acquisition of Oak Grove Commercial Mortgage, LLC |

99.2 | | Press Release dated August 13, 2015 |

August 2015 Investor Presentation JLL to acquire Oak Grove Capital Working together to create value in the world of real estate 58,000 employees, 230 offices, 80 countries, 1 global brand

Statements in this presentation regarding, among other things, future financial results and performance, achievements, plans and objectives may be considered forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements involve known and unknown risks, uncertainties and other factors which may cause actual results, performance, achievements, plans and objectives of JLL to be materially different from those expressed or implied by such forward-looking statements. For additional information concerning risks, uncertainties and other factors that could cause actual results to differ materially from those anticipated in forward-looking statements, and risks to JLL’s business in general, please refer to those factors discussed under “Business,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” “Quantitative and Qualitative Disclosures about Market Risk,” and elsewhere in JLL’s Annual Report on Form 10-K for the year ended December 31, 2014, in each of the Quarterly Reports on Form 10-Q for the quarters ended March 31, 2015 and June 30, 2015, and in other reports filed with the Securities and Exchange Commission. Any forward- looking statements speak only as of the date of this presentation, and except to the extent required by applicable securities laws, JLL expressly disclaims any obligation or undertaking to publicly update or revise any forward-looking statements contained herein to reflect any change in JLL’s expectations or results, or any change in events. © 2015 Jones Lang LaSalle IP, Inc. All rights reserved. No part of this publication may be reproduced by any means, whether graphically, electronically, mechanically or otherwise howsoever, including without limitation photocopying and recording on magnetic tape, or included in any information store and/or retrieval system without prior written permission of Jones Lang LaSalle IP, Inc. Cautionary note regarding forward-looking statements 2

Driving to Strategy 2020 JLL’s strategy for continued success • Balance top-line growth, platform investments and productivity to maximize profit and total shareholder return • Leverage global position and industry consolidation to invest strategically and grow market share • Continue improving operating capabilities today and for our future • Maintain financial strength and flexibility to respond to opportunities and challenges • Strategy 2020 o Pursue business and operational strategies to sustain long-term performance o Invest in work streams to accelerate G5 strategies Build our local and regional Markets business Strengthen our winning positions in Corporate Solutions Capture the leading share of global capital flows for real estate investments Grow LaSalle Investment Management’s leadership position G1 G2 G3 G4 G5 Connections: Differentiate and Sustain 3

How we earn fees Leasing Broker transactions between tenants & landlords Driven by economic growth and corporate confidence Capital Markets & Hotels Real estate investment sales, financing arrangements, capital raising and investment advice Driven by investor allocations to real estate and market liquidity Property & Facility Management Management & outsourcing of properties & portfolios Driven by value enhancement for investors and corporate occupiers Project & Development Services Design & management of real estate projects Driven by capital expenditure and expansion decisions Advisory & Other Workplace strategy, valuation, consulting, advisory and sustainability Driven by best practices in workplace productivity LaSalle Investment Management Real estate investment management Driven by investment performance and capital raising MULTIFAMILY RETAIL HOTEL JLL has expertise in these real-estate asset categories INDUSTRIAL OFFICE 4

Oak Grove Capital • Leading provider of debt financing for market-rate, affordable and healthcare-related multifamily housing • Full-service platform for Fannie Mae, Freddie Mac & HUD/GNMA JLL Capital Markets • Full-service global provider of capital solutions for real estate investors and occupiers • Global access to thousands of foreign and domestic investors • Freddie Mac Program Plus® Seller/Servicer Companies today: $775M Loans in 2014 as a Freddie Mac Program Plus® Seller/Servicer $4.5B Total U.S. multifamily financing in 2014 $4B U.S. multifamily sales transactions in 2014 30+ Geographies covered throughout U.S. $1.4B 2014 Agency volume Top 3 Debt financing providers for affordable housing by both Fannie Mae and Freddie Mac in each of last 4 years 120 Employees 2014 Excellence in Asset Management Winner ~ Fannie Mae 5

A powerful combination Strategic Fit Cultural Fit • Consistent with JLL’s 2020 strategic plan • Disciplined around strategic fit, culture, financial alignment and returns • Expands JLL’s Capital Markets platform; moves JLL toward being a U.S. multifamily market leader • Adds full service Fannie Mae, Freddie Mac and HUD/GNMA platform, while expanding JLL’s expertise in the affordable, seniors housing and healthcare sectors • Combined platform provides ability to scale and expand in lending segments while maintaining discipline and credit quality • Cultural fit characterized by client focus and collaboration • Well respected firm with shared values to join JLL Combined U.S. presence Existing JLL Location New/Expanded JLL multifamily presence through merger • Our goals: 1. Maintain a strong culture of credit, risk and operational excellence 2. Become the multifamily provider of choice for our clients 3. Be one of the best partners for the U.S. multifamily finance agencies with an aligned mission 6

Financial alignment Valuation Overview • Consideration payable at closing of $175M, from which Oak Grove Capital will retire outstanding indebtedness (excluding warehouse loans/lines) and redeem its preferred unit holders • Oak Grove Capital has the potential to earn additional consideration over a five-year earn-out structure tied to performance • Expected total purchase price of $260M • EBITDA multiple within historic range of larger JLL acquisitions Financial Contributions • Expected to be EPS accretive in calendar year 2016 • Planned high revenue growth; margins consistent with existing Capital Markets business • Approximately $14B combined loan servicing portfolio to provide JLL with annuity revenue and profit stream • High-quality portfolio and performance with expanded scope • Provides cross-selling opportunities to JLL’s platform and facilitates platform expansion Funding and Leverage • To be funded in cash drawing from JLL’s existing $2.0B revolving credit facility • Cash funding at closing expected to be $180M including expenses • Expected closing by year-end subject to standard closing conditions and approvals • Transaction does not change JLL’s strategic, long-term leverage profile of less than 2.0X 7

News Release – continued – JLL to Acquire U.S. Multifamily Finance Provider Oak Grove Capital Broadens capital markets capabilities to include full Fannie Mae, Freddie Mac and HUD/GNMA lending services CHICAGO, Aug. 13, 2015— JLL (NYSE:JLL) today announced it is acquiring Oak Grove Commercial Mortgage, LLC, which does business as Oak Grove Capital, to continue its focus on growing a full-service capital markets capability in the Americas. As one of the nation’s longest standing providers of debt financing for multifamily and seniors housing real estate, Oak Grove brings greater full-service mortgage lending and mortgage banking capabilities to JLL. Its Fannie Mae, Freddie Mac and HUD/GNMA capabilities will expand JLL’s market-rate, affordable and seniors housing and healthcare financing expertise, and complement its multifamily sales and equity services. The acquisition of Oak Grove is expected to close by year end, subject to standard closing conditions and approvals. --------------------------------------------------------------------------------------------------------------------------------------------------------- Transaction Highlights: • Creates a full-service capability in the multifamily and seniors housing lending industry that will drive further growth for JLL’s Capital Markets business • Margin accretive to JLL; provides profitable annuity revenue through a combined $14 billion loan servicing portfolio • Complementary ethical, collaborative, client-oriented cultures including high standards of credit and financial discipline ---------------------------------------------------------------------------------------------------------------------------------------------------------- “The multifamily sales and financing market represents a substantive portion of all capital markets activity in the United States. To provide our clients the best-in-class expertise they’ve come to expect from JLL, we’re broadening our capabilities in this important space,” said Greg O’Brien, CEO, Americas for JLL. “Oak Grove has built a superior reputation and is widely recognized as a leader in credit analysis, underwriting and risk management, as well as asset management and loan servicing. Its complementary culture and deep client relationships will blend seamlessly as we partner together to create a focused approach in the multifamily sector.” Led by David Williams, Kevin Filter, Brian Kelleher and Brian Ranallo, St. Paul, Minnesota-based Oak Grove: - Is one of the longest standing multifamily and seniors housing lending providers. - Has a full-service platform for Fannie Mae, Freddie Mac and HUD/GNMA multifamily finance agencies, as well as CMBS, life and specialty finance companies.

JLL To Acquire U.S. Multifamily Finance Provider Oak Grove Capital - Provides loan origination, underwriting, asset management and loan servicing. - Is routinely recognized by Fannie Mae and Freddie Mac as one of the top affordable and seniors housing lenders including, most recently, the 2014 Excellence in Asset Management award from Fannie Mae. - Will expand its ability to meet client needs by leveraging access to JLL’s client base, broad finance platform, and multifamily investment sales experts. Once the acquisition is complete, all 120 Oak Grove employees from across the country will join JLL. Given their deep history in the multifamily finance sector, the Oak Grove leadership team will take an active role in shaping and leading JLL’s multifamily business in partnership with their new colleagues. Together, JLL and Oak Grove have more than $4 billion in annual originations and $14 billion in loan servicing plus the ability to scale across the United States and expand in critical lending segments while maintaining discipline and credit quality. “We are one of the few companies in the country to have deep, longstanding relationships with all of the multifamily finance agencies. Joining JLL’s broader platform will allow us to bring those affiliations to the next level while retaining the entrepreneurial spirit and hands-on execution our clients have long appreciated,” said Williams, CEO of Oak Grove. “JLL has grown its mortgage production team significantly over the last five years and we intend to contribute further to that momentum as we work together to better serve the needs of our collective clients in the apartment and seniors housing sectors.” JLL Capital Markets is a full-service global provider of capital solutions for real estate investors and occupiers. The firm’s in-depth local market and global investor knowledge delivers the best-in-class solutions for clients — whether a sale, financing, repositioning, advisory or recapitalization execution. In 2014 alone, JLL Capital Markets completed $118 billion in investment sale and debt and equity transactions globally. The firm’s Capital Markets team comprises more than 1,700 specialists, operating all over the globe. For more news, please visit The Investor, an online and mobile app news source providing real-time commercial real estate news to asset buyers and sellers around the world. For more news, videos and research resources on JLL, please visit the firm’s U.S. media center Web page: http://bit.ly/18P2tkv. About JLL JLL (NYSE: JLL) is a professional services and investment management firm offering specialized real estate services to clients seeking increased value by owning, occupying and investing in real estate. A Fortune 500 company with annual fee revenue of $4.7 billion and gross revenue of $5.4 billion, JLL has more than 230 corporate offices, operates in 80 countries and has a global workforce of approximately 58,000. On behalf of its clients, the firm provides management and real estate outsourcing services for a property portfolio of 3.4 billion square feet, or 316 million square meters, and completed $118 billion in sales, acquisitions and finance transactions in 2014. Its investment management business, LaSalle Investment Management, has $56.0 billion of real estate assets under

JLL To Acquire U.S. Multifamily Finance Provider Oak Grove Capital management. JLL is the brand name, and a registered trademark, of Jones Lang LaSalle Incorporated. For further information, visit www.jll.com. Contact: Heather Filkins Gayle Kantro Phone: +1 312 228 2137 +1 312 228 2795 Email: Heather.Filkins@am.jll.com Gayle.Kantro@am.jll.com ###

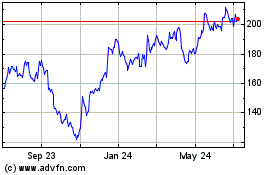

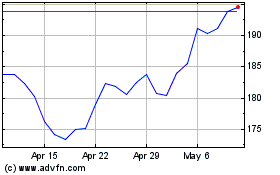

Jones Lang LaSalle (NYSE:JLL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Jones Lang LaSalle (NYSE:JLL)

Historical Stock Chart

From Apr 2023 to Apr 2024