Use these links to rapidly review the document

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

|

|

|

| Filed by the Registrant ý |

Filed by a Party other than the Registrant o |

Check the appropriate box: |

| o |

|

Preliminary Proxy Statement |

| o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ý |

|

Definitive Proxy Statement |

| o |

|

Definitive Additional Materials |

| o |

|

Soliciting Material under §240.14a-12 |

|

|

|

|

|

|

| Jones Lang LaSalle Incorporated |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

| ý |

|

No fee required. |

| o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

|

(1) |

|

Title of each class of securities to which transaction applies: |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

(2) |

|

Aggregate number of securities to which transaction applies: |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

(3) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

(4) |

|

Proposed maximum aggregate value of transaction: |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

(5) |

|

Total fee paid: |

| |

|

|

|

|

|

|

|

|

|

|

| o |

|

Fee paid previously with preliminary materials. |

| o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement

number, or the Form or Schedule and the date of its filing. |

| |

|

(1) |

|

Amount Previously Paid: |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

(2) |

|

Form, Schedule or Registration Statement No.: |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

(3) |

|

Filing Party: |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

(4) |

|

Date Filed: |

| |

|

|

|

|

|

|

|

|

|

|

Table of Contents

Table of Contents

|

|

|

|

|

|

|

|

|

To Our

Shareholders |

April 17,

2015

Dear

Shareholder:

We

would like to notify you that the 2015 Annual Meeting of Shareholders of Jones Lang LaSalle Incorporated will take place on Friday, May 29, 2015, beginning at 1:00 p.m.,

local time, at the JLL office located at One Post Office Square, 26th Floor, Boston, Massachusetts

02109.

At

this year's meeting, we will vote on the election of 11 directors and the ratification of the election of

KPMG LLP as our independent registered public accounting firm. We will also conduct a non-binding advisory vote to approve the

compensation of the Company's named executive officers.

There

are three pending changes on the Board this year. Kate S. Lavelle, who has served on our Board since 2013, has decided not to stand for

re-election at this year's Annual Meeting in order to devote additional time to a new business venture. We appreciate her valued service on our Board and wish her well in her future endeavors. All of

the other current directors are standing for re-election.

We

are very pleased that each of Samuel A. Di Piazza, Jr. and Ann Marie Petach has been

nominated to stand for

election at the 2015 Annual Meeting. Each of them has served in senior leadership positions at some of the largest and most sophisticated global business organizations and we feel fortunate to have

individuals of their caliber as new nominees.

Mr. Di Piazza

retired as Global Chief Executive Officer of PricewaterhouseCoopers International Ltd., concluding a 36-year career at the world's largest professional services firm. He

then served as Vice Chairman of the Institutional Clients Group and Member of the Senior Strategic Advisory Group at Citigroup, Inc.

Ms. Petach

most recently served in several senior positions with BlackRock, Inc., the world's largest investment management firm, including as its Chief Financial Officer. Before that,

she had a 23-year career with Ford Motor Company culminating in her serving as its Treasurer.

Your vote is very important to us. This year, we are again voluntarily furnishing proxy materials to our shareholders on the Internet rather than mailing printed

copies to each shareholder. This serves our sustainability goals and also saves us significant postage, printing, and processing costs. Whether or not you plan to attend the Annual Meeting, please

cast your vote, as instructed in the Notice of Internet Availability of Proxy Materials, over the Internet or by telephone, as promptly as possible. You may also request a paper proxy card to submit

your vote by mail if you prefer. If you attend the Annual Meeting, you may vote your shares in person even if you have previously given your proxy.

We

anticipate that we will mail the Notice of Internet Availability of Proxy Materials to our shareholders on or about April 17, 2015. The proxy materials we are furnishing on the Internet

include our 2014 Annual Report, which includes our Annual Report on Form 10-K for the year ended December 31, 2014.

We

appreciate your continued interest in JLL.

|

|

|

Sheila A. Penrose

Chairman of the Board of Directors |

|

Colin Dyer

Chief Executive Officer and President |

Table of Contents

|

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

AND PROXY STATEMENT |

|

|

|

When:

Friday, May 29, 2015

1:00 p.m. |

|

Where:

JLL Boston Office

One Post Office Square, 26th Floor

Boston, Massachusetts 02109 |

Items of Business

The Annual Meeting will have the following purposes:

- 1.

- To elect eleven Directors to serve one-year terms until the 2016 Annual Meeting of Shareholders and until their successors are

elected and qualify;

- 2.

- To approve, by non-binding vote, executive compensation (say-on-pay);

and

- 3.

- To ratify the appointment of KPMG LLP as our independent registered public accounting firm for the year ending

December 31, 2015.

Record Date March 23, 2015

The Board of Directors has fixed the close of business on Monday, March 23, 2015 as the record date for determining the

shareholders entitled to receive notice of, and to vote at, the Annual Meeting. We will permit only shareholders, or persons holding proxies from shareholders, to attend the Annual Meeting.

|

|

|

| |

|

By Order of the Board of Directors |

|

|

Mark J. Ohringer

Corporate Secretary |

April 17,

2015

YOUR VOTE IS VERY IMPORTANT. ANY SHAREHOLDER MAY ATTEND THE ANNUAL MEETING IN PERSON. IN ORDER FOR US TO HAVE THE QUORUM NECESSARY TO CONDUCT THE ANNUAL MEETING, WE ASK THAT

SHAREHOLDERS WHO DO NOT INTEND TO BE PRESENT AT THE ANNUAL MEETING IN PERSON GIVE THEIR PROXY OVER THE INTERNET OR BY TELEPHONE. IF YOU PREFER, YOU MAY ALSO REQUEST A PAPER PROXY CARD TO SUBMIT YOUR

VOTE BY MAIL. YOU MAY REVOKE ANY PROXY IN THE MANNER DESCRIBED IN THE ACCOMPANYING PROXY STATEMENT AT ANY TIME BEFORE IT HAS BEEN VOTED AT THE ANNUAL MEETING.

Table of Contents

To

assist your consideration of the proposals to be acted upon at our 2015 Annual Meeting, we highlight below the important information you will find in this Proxy

Statement. This summary does not contain all information you should consider, and you should carefully read the entire Proxy Statement and Annual Report on Form 10-K before you vote.

Financial and Operational Highlights

In 2014, JLL delivered historically-high revenues and profits by continuing to execute on its Strategy 2020, which includes the

following overall objectives:

We

believe we remain well-positioned to take advantage of the opportunities in a consolidating industry and to navigate successfully the dynamic markets in which we compete worldwide.

Among

its financial and operational highlights for 2014, JLL:

- •

- Recognized record fee revenue of $4.7 billion, an 18% increase over 2013 and

29% over 2012.

- •

- Generated adjusted net income of $393 million, 37% higher than 2013 and 60%

higher than 2012.

- •

- Maintained our investment-grade balance sheet throughout the year and continued to

realize benefits from low interest expense. The firm reduced total net debt to $163 million from $437 million last year. This is the third consecutive year that the firm has reduced debt

by more than $100 million while continuing to invest in the business and increase our dividend. In February 2015, the firm amended and expanded its long-term bank credit facility. We increased

the size of the facility to $2.0 billion and extended its maturity to February 2020. The Company's strong balance sheet continues to serve as a competitive differentiator.

- •

- Raised our investment grade credit rating with Standard & Poor's Ratings

Services (S&P) to BBB, which is now consistent with the rating we previously had from Moody's Investors Service, Inc.

- •

- Generated $105.3 million of incentive fees as the result of positive

performance for clients of LaSalle Investment Management, which also achieved a capital raise during the year of $8.9 billion from investors. LaSalle had $53.6 billion of assets under

management at December 31, 2014, up from $47.6 billion at the end of the prior year.

- •

- Completed ten acquisitions that expanded our capabilities in key regional markets

including Spain, Portugal, France, Sweden, England, and Malaysia, as well as in the United States.

- •

- Provided capital markets services for $118 billion of

client transactions.

- •

- Completed 33,500 transactions for landlord and tenant clients,

representing 662 million square feet of space.

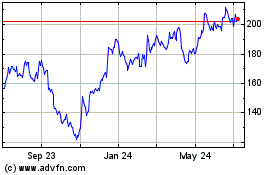

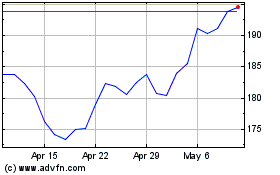

Stock and Dividend Performance

For the calendar year ended December 31, 2014, the price of a share of our Common Stock increased

47.25%. We paid total dividends of $0.48 per share, up from $0.44 the previous year.

|

Proxy Statement Summary

|

S-1

|

Table of Contents

Industry Recognition

During 2014, we continued to win numerous awards that reflected the quality of the services we provide to our clients, the integrity

of our people, and our desirability as a place to work, including:

|

|

|

|

|

|

|

|

|

|

|

|

2014 Awards |

|

|

|

|

• One of America's Best Managed Companies by Forbes

• For the seventh consecutive year, one of the World's Most Ethical

Companies by the Ethisphere Institute • For the sixth consecutive year, one of the Global Outsourcing 100 — by the International Association of Outsourcing

Professionals • Perfect Score on the Human Rights Campaign Foundation's 2015 Corporate Equality Index, a U.S. benchmarking survey on corporate policies and practices related to LGBT workplace equality

• Listed on the 2020 Honor Roll by the 2020 Women on Boards

• One of the Top Ten Most Innovative Law Departments by

InsideCounsel • Best in Class — Real Estate Interactive Media Award for Cities Research Center • Best of the

Best — Top Diversity Employer and Top Supplier Diversity Program by Black EOE Journal |

|

|

|

• Best Places to Work in Money Management by Pensions & Investments

• Best Property Consultancy in each of China, Hong Kong, Japan, Philippines,

Singapore, Indonesia and India as part of multiple other awards at the International Property Awards for Asia Pacific • Investment Agency Team of the Year at the UK Property Awards • 2014 Energy Star Sustained Excellence Award from the U.S. Environmental Protection Agency • Best Performing Property Brand by the Managing Partners' Forum Awards for Management

Excellence • Real Estate Investment Management Firm of the Year in Germany by International Fund Awards • Best Performing

Fund in Pan-European Property Fund Index by IPD European Property Investment Awards • One of the Best Places to Work by a number of local

publications |

|

|

Financial Performance

The following table presents key financial data for each of the last three fiscal years, all as of each year end.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

($ in thousands, except share data)

|

|

|

|

2012

|

|

|

|

2013

|

|

|

|

2014

|

|

|

|

|

|

Gross revenue |

|

|

|

|

$3,932,830 |

|

|

|

|

$4,461,591 |

|

|

|

|

$5,429,603 |

|

|

|

|

|

Total operating expenses |

|

|

|

|

3,643,427 |

|

|

|

|

4,092,772 |

|

|

|

|

4,963,939 |

|

|

|

|

|

Operating income |

|

|

|

|

289,403 |

|

|

|

|

368,819 |

|

|

|

|

465,664 |

|

|

|

|

|

Net income available to common shareholders |

|

|

|

|

207,556 |

|

|

|

|

269,456 |

|

|

|

|

385,749 |

|

|

|

|

|

Diluted earnings per common share |

|

|

|

|

4.63 |

|

|

|

|

5.98 |

|

|

|

|

8.52 |

|

|

|

|

|

EBITDA (1) |

|

|

|

|

390,783 |

|

|

|

|

476,119 |

|

|

|

|

605,995 |

|

|

|

|

|

Total Assets |

|

|

|

|

4,351,499 |

|

|

|

|

4,597,353 |

|

|

|

|

5,075,336 |

|

|

|

|

|

Total Net Debt (2) |

|

|

|

|

537,507 |

|

|

|

|

437,032 |

|

|

|

|

163,000 |

|

|

|

|

|

Total Liabilities |

|

|

|

|

2,392,243 |

|

|

|

|

2,406,544 |

|

|

|

|

2,652,767 |

|

|

|

|

|

Total Shareholders' Equity |

|

|

|

|

1,951,183 |

|

|

|

|

2,179,669 |

|

|

|

|

2,386,797 |

|

|

|

|

|

Cash Dividends Paid |

|

|

|

|

18,219 |

|

|

|

|

20,026 |

|

|

|

|

21,885 |

|

|

The above information is qualified in its entirety by the more detailed and complete information in our Annual Report on

Form 10-K for the year ended December 31, 2014.

(1) EBITDA represents earnings before interest expense, net of interest income, income taxes, depreciation

and amortization. Although EBITDA is a non-GAAP financial measure, EBITDA is used extensively by management and is useful to investors and

|

Proxy Statement Summary

|

S-2

|

Table of Contents

lenders as one of the primary metrics for evaluating debt, to sustain potential future increases in debt and to satisfy capital requirements. EBITDA also is used in the calculations of certain

covenants related to the Company's long-term bank credit facility. However, EBITDA should not be considered as an alternative either to net income available to common shareholders or net cash by

operating activities, both of which are determined in accordance with U.S. generally accepted accounting principles ("U.S. GAAP"). A reconciliation of our EBITDA to net income and net cash

provided by operating activities is contained in Item 6, Selected Financial Data, in our Annual Report on Form 10-K for the year ended December 31, 2014.

(2) Net debt is calculated by adding total debt and deferred business acquisition obligations, less cash.

Corporate Governance

Our mission as an organization is to deliver exceptional strategic, fully-integrated services, best practices, and innovative

solutions for real estate owners, occupiers, investors, and developers worldwide. In order to achieve our mission, we realize we must establish and maintain an enterprise that will sustain itself over

the long-term

for the benefit of all of its stakeholders—clients, shareholders, employees, suppliers, and communities, among others. Accordingly, we have committed ourselves to effective corporate

governance that reflects best practices and the highest level of business ethics. To that end, and as the result of our shareholder engagement efforts, over the past years we have adopted the

following significant corporate governance policies and practices:

|

|

|

|

|

|

|

|

|

|

|

|

Corporate Governance Policies and Practices |

|

|

|

|

• Significant Majority of Independent Directors • Separate Non-Executive Chairman of the Board and Chief Executive Officer Roles • Highly Diverse Board (as to gender,

ethnicity and experience) • Annual Election of All Directors • Annual Shareholder "Say-on-Pay" Vote for Executive Compensation • Majority Voting for Directors

• Independent Directors Meet Without Management Present at Each In-Person Meeting • Company Code of Business Ethics Applicable to Directors • Right of Shareholders Owning 30%

of Outstanding Shares to Call a Special Meeting of Shareholders for any Purpose • Annual Evaluation of Board Effectiveness by Senior Management • Annual Board and Committee

Self-Evaluation • Stewardship Compensation Program for Directors, with No Separate Meeting Fees |

|

|

|

• Two-Thirds of Board Stewardship Compensation is in Company Shares • No Perquisites to Board Members • Minimum Shareholding Requirement

for Directors • Policy Against Pledging and Hedging Company Stock •

Board Orientation / Education Program

• Corporate Compliance Program • Disclosure Committee for Financial

Reporting • Required Approval by the Nominating and Governance Committee for any Related Party Transactions

• Company Makes Negligible Political Contributions • Regular Succession Planning for

Both Management and Board • Directors Not "Over-Boarded" • Significant engagement with employees, senior management and clients at Board meetings, which take place across our major offices globally

• Increasingly sophisticated integrated reporting and corporate sustainability reporting |

|

|

|

Proxy Statement Summary

|

S-3

|

Table of Contents

Objectives of Executive Compensation

The principal objectives of the Compensation Committee of our Board of Directors are to (1) align the compensation of each

member of the Global Executive Board, our senior-most management group, with the Company's short-term and long-term performance, (2) provide incentives for driving and meeting the Company's

strategic goals, and (3) help attract and retain the leaders who will be crucial to the Company's long-term success and ultimate sustainability.

We

compensate the members of our Global Executive Board using the following principal elements:

|

|

|

|

|

|

|

|

|

|

|

|

Element |

|

|

|

Type |

|

|

|

|

|

Annual Cash and Equity |

|

|

|

Base salary, paid in cash |

|

|

|

|

|

|

|

|

Annual incentives based on short-term performance, paid in cash and restricted stock with time vesting |

|

|

|

|

|

Long-Term

Incentive Compensation |

|

|

|

Long-term incentive plans based on performance over multi-year periods, paid in cash and restricted stock with time vesting and hold-post vesting requirement |

|

|

|

|

|

|

|

|

CEO performance incentive and retention plan |

|

|

|

|

|

Retirement |

|

|

|

Same as for employees generally (401(k) match in the U.S. and standard plans in other countries) |

|

|

We

do not provide any significant perquisites. Our Board of Directors has decided that restricted stock grants made to our senior executives in 2013 and beyond under our long-term incentive

compensation plans will have a "double trigger" in the case of a change of control (namely the executive's employment must be terminated after the change of control in order for the restricted stock

to vest on an accelerated basis).

Shareholder Voting Matters

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Voting Proposal

|

|

|

|

Board Voting Recommendation

|

|

|

|

|

|

Proposal 1: |

|

|

|

Election of Eleven Directors |

|

|

|

FOR each nominee listed below |

|

|

|

|

|

Proposal 2: |

|

|

|

Non-Binding "Say-on-Pay" Vote Approving Executive Compensation |

|

|

|

FOR |

|

|

|

|

|

Proposal 3: |

|

|

|

Ratification of Appointment of Independent Registered Public Accounting Firm |

|

|

|

FOR |

|

|

|

Proxy Statement Summary

|

S-4

|

Table of Contents

Director Nominees for Election at the 2015 Annual Meeting

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

|

|

Age

|

|

|

|

Director

Since

|

|

|

|

Position

|

|

|

|

Independent

|

|

|

|

Audit

Committee

|

|

|

|

Compensation

Committee

|

|

|

|

Nominating

and

Governance

Committee

|

|

|

|

Other

Current

Public

Boards (1)

|

|

|

|

|

|

Current Directors Who Are Nominees Standing for Re-Election |

|

|

|

|

|

Hugo Bagué |

|

|

|

54 |

|

|

|

2011 |

|

|

|

Group Executive, Organisational Resources, Rio Tinto plc |

|

|

|

Yes |

|

|

|

— |

|

|

|

Yes |

|

|

|

Yes |

|

|

|

— |

|

|

|

|

|

Colin Dyer |

|

|

|

62 |

|

|

|

2004 |

|

|

|

Chief Executive Officer and President, JLL |

|

|

|

No |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

Dame DeAnne Julius |

|

|

|

66 |

|

|

|

2008 |

|

|

|

Retired Chairman, Royal Institute of International Affairs |

|

|

|

Yes |

|

|

|

Yes |

|

|

|

Yes |

|

|

|

Yes |

|

|

|

1 |

|

|

|

|

|

Ming Lu |

|

|

|

56 |

|

|

|

2009 |

|

|

|

Partner, KKR & Co., L.P. |

|

|

|

Yes |

|

|

|

— |

|

|

|

Chairman |

|

|

|

Yes |

|

|

|

— |

|

|

|

|

|

Martin H. Nesbitt |

|

|

|

52 |

|

|

|

2011 |

|

|

|

Co-Chief Executive Officer, The Vistria Group, LLC |

|

|

|

Yes |

|

|

|

Yes |

|

|

|

— |

|

|

|

Yes |

|

|

|

1 |

|

|

|

|

|

Sheila A. Penrose |

|

|

|

69 |

|

|

|

2002; Chairman Since 2005 |

|

|

|

Chairman of the Board, JLL |

|

|

|

Yes |

|

|

|

Yes |

|

|

|

Yes |

|

|

|

Chairman |

|

|

|

1 |

|

|

|

|

|

Shailesh Rao |

|

|

|

43 |

|

|

|

2013 |

|

|

|

Vice President for Asia Pacific, Latin America and Emerging Markets, Twitter, Inc. |

|

|

|

Yes |

|

|

|

— |

|

|

|

Yes |

|

|

|

Yes |

|

|

|

— |

|

|

|

|

|

David B. Rickard |

|

|

|

68 |

|

|

|

2007 |

|

|

|

Retired Chief Financial Officer and Chief Administrative Officer, CVS Caremark Corporation |

|

|

|

Yes |

|

|

|

Chairman; Audit Committee Financial Expert |

|

|

|

— |

|

|

|

Yes |

|

|

|

2 |

|

|

|

|

|

Roger T. Staubach |

|

|

|

73 |

|

|

|

2008 |

|

|

|

Executive Chairman, JLL Americas |

|

|

|

No |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

Nominees for First-Time Election |

|

|

|

|

|

Samuel A. Di Piazza, Jr. |

|

|

|

64 |

|

|

|

First Time Nominee |

|

|

|

Retired Global Chief Executive Officer, Pricewaterhouse

Coopers International Ltd. |

|

|

|

Yes |

|

|

|

To be determined by the Board, if elected |

|

|

|

To be determined by the Board, if elected |

|

|

|

Yes, if elected, as all Independent Directors serve on this committee |

|

|

|

2 |

|

|

|

|

|

Ann Marie Petach |

|

|

|

54 |

|

|

|

First Time Nominee |

|

|

|

Retired Chief Financial Officer, BlackRock, Inc., and Treasurer, Ford Motor Company |

|

|

|

Yes |

|

|

|

To be determined by the Board, if elected |

|

|

|

To be determined by the Board, if elected |

|

|

|

Yes, if elected, as all Independent Directors serve on this committee |

|

|

|

— |

|

|

- (1)

- Reflects

only boards of directors of other publicly-traded entities. Additional information about other board service is described in the Proxy Statement

under "Directors and Corporate Officers — Biographical Information; Composition of the Board of Directors."

|

Proxy Statement Summary

|

S-5

|

Table of Contents

|

Proxy Statement

|

|

Table of Contents

|

QUESTIONS AND ANSWERS ABOUT THE

PROXY MATERIALS AND OUR ANNUAL MEETING |

Q: Why am I receiving these materials?

- A:

- The

Board of Directors (the Board) of Jones Lang LaSalle Incorporated, a Maryland corporation

(JLL, which may sometimes be referred to as the Company or as we, us or our), is providing these proxy materials to

you in connection with our 2015 Annual Meeting of Shareholders (including any adjournments or postponements, the Annual Meeting). The Annual Meeting

will take place at 1:00 p.m. local time, on Friday, May 29, 2015, at the JLL office located in Boston, Massachusetts. We first released this proxy statement

(Proxy Statement) to our shareholders on or about April 17, 2015.

- As

one of our shareholders, you are invited to attend the Annual Meeting. You are also entitled to vote on each of the matters we describe in

this Proxy Statement.

- A

proxy is the legal designation you give to another person to vote the shares of stock you own. If you designate someone as your proxy in a

written document, that document is called a proxy card. We have designated two of our officers as proxies for our Annual Meeting: Colin Dyer and Mark J. Ohringer. We are asking you to designate

each of them separately as a proxy to vote your shares on your behalf.

Q: Why is JLL making these materials available over the Internet rather than mailing them?

- A:

- Under

the "Notice and Access Rule" that the United States Securities and Exchange Commission (the SEC) has

adopted, we may furnish proxy materials to our shareholders on the Internet rather than mailing printed copies of those materials to each shareholder. This helps us meet our sustainability goals and

it will save significant postage, printing and processing costs. If you received a Notice Regarding the Availability of Proxy Materials (Notice of Internet

Availability) by mail, you will not receive a printed copy of our proxy materials unless you specifically request one. Instead, the Notice of Internet Availability will

instruct you about how to (1) access and review our proxy materials on the Internet and (2) access your proxy card to vote on the Internet or by telephone.

- We

anticipate that we will mail the Notice of Internet Availability to our shareholders on or about April 17, 2015.

Q: How can I have printed copies of the proxy materials mailed to me?

- A:

- If

you received a Notice of Internet Availability by mail and you would prefer to receive a printed copy of our proxy materials, including a paper proxy

card, please follow the instructions included in the Notice of Internet Availability.

Q: What information does this Proxy Statement contain?

- A:

- The

information in this Proxy Statement relates to (1) the proposals on which our shareholders will vote at the Annual Meeting and (2) the

voting process. It includes the information about JLL that we are required to disclose as the basis for your decision about how to vote on each proposal.

Q: What other information are you furnishing with this Proxy Statement?

- A:

- Our

2014 Annual Report, which includes our annual report on Form 10-K for the year ended December 31, 2014, has been made available on the

Internet to all shareholders entitled to vote at the Annual Meeting and who received the Notice of Internet Availability. You may also view our 2014 Annual Report and this Proxy Statement at www.jll.com

in the "Investor Relations" section.

|

Proxy Statement

|

Page

|

1

|

Table of Contents

- You

may obtain a paper copy of our 2014 Annual Report and this Proxy Statement without charge by writing the JLL Investor Relations Department

at the address of our principal executive office, 200 East Randolph Drive, Chicago, Illinois 60601, or by calling +1.312.228.2430.

Q: What items of business will be voted on at the Annual Meeting?

- A:

- The

three items of business scheduled to be voted on at the Annual Meeting are:

- •

- Proposal 1: The

election of eleven Directors to serve one-year terms until the 2016 Annual Meeting of Shareholders;

- •

- Proposal 2:

Approval, by non-binding advisory vote, of executive compensation (say-on-pay); and

- •

- Proposal 3:

Ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2015.

Q: How does the Board recommend that I vote?

- A:

- Our

Board recommends that you vote your shares as follows:

- •

- FOR each of the eleven nominees to the Board;

- •

- FOR the non-binding advisory say-on-pay vote approving executive compensation; and

- •

- FOR the ratification of the appointment of KPMG LLP as our independent

registered public accounting firm for 2015.

Q: What shares may I vote?

- A:

- Only

shareholders of record of JLL's Common Stock (NYSE: JLL), $0.01 par value per share (the Common Stock), at the close of business on Monday,

March 23, 2015 (the Record Date), are entitled

to notice of, and to vote at, the Annual Meeting. Each share of Common Stock is entitled to one vote on all matters voted upon by shareholders and is entitled to vote for as many persons as there are

Directors to be elected. Based on the information we have received from Computershare, our transfer agent and stock registrar, there were 44,859,342 voting shares of Common Stock outstanding on the

Record Date. The shares of our Common Stock are held in approximately 358 registered accounts. According to Broadridge Investor Communications, those registered accounts represent approximately 52,337

beneficial owners (which we believe includes the number of individual holders in certain reported mutual funds that hold our shares).

Q: What is the difference between holding shares as a shareholder of record and as a beneficial owner?

- A:

- Most

JLL shareholders hold their shares through a broker or other nominee rather than directly in their own names. There are some distinctions between

(1) shares you hold of record in your own name and (2) those you own beneficially through a broker or nominee, as follows:

- Shareholder of Record

- If

your shares are registered directly in your name with JLL's stock registrar, Computershare, then with respect to those shares we consider you

to be the shareholder of record. As a shareholder of record, you have the right to grant your voting proxy directly to the Company or to vote in person at the Annual Meeting.

- Beneficial Owner

- If

you hold shares in a brokerage account or by a trustee or another nominee, then we consider you to be the beneficial owner of shares held "in

street name," and we are furnishing these proxy materials to you through your broker, trustee, or nominee. As the beneficial owner, you have the right to direct your broker, trustee or nominee how to

vote and we are also inviting you to attend the Annual Meeting.

|

Proxy Statement

|

Page

|

2

|

Table of Contents

- Since

a beneficial owner is not the shareholder of record, you may not vote these shares in person at the Annual Meeting unless you obtain a

"legal proxy" from the broker, trustee, or nominee that holds your shares, giving you the right to vote the shares at the Annual Meeting. Your broker, trustee, or nominee has enclosed or provided

instructions to you on how to vote your shares.

Q: How can I attend the Annual Meeting?

- A:

- You

are entitled to attend the Annual Meeting only if you were a JLL shareholder as of the close of business on Monday, March 23, 2015 or you hold a

valid proxy for the Annual Meeting. You should be prepared to present a photo identification for admittance. In addition, if you are a shareholder of record, we will verify your name against the list

of shareholders of record on the Record Date prior to admitting you to the Annual Meeting. If you are not a shareholder of record but hold shares through a broker, trustee or nominee (in street name),

you should provide proof of beneficial ownership on the Record Date, such as your most recent account statement prior to March 23, 2015, a copy of the voting instruction card furnished to you,

or other similar evidence of ownership. If you do not provide photo identification or comply with the other procedures outlined above upon request, we will not admit you to the Annual Meeting.

Q: How can I vote my shares in person at the Annual Meeting?

- A:

- You

may vote in person at the Annual Meeting those shares you hold in your name as the shareholder of record. You may vote in person at the Annual Meeting

shares you hold beneficially in street name only if you obtain a legal proxy from the broker, trustee, or nominee that holds your shares, giving you the right to vote the shares. Even if you plan to

attend the Annual Meeting, we recommend that you also submit your proxy or voting instructions as described below so that your vote will be counted if you later decide not to attend the Annual

Meeting.

Q: How can I vote my shares without attending the Annual Meeting?

- A:

- Whether

you hold shares directly as the shareholder of record or beneficially in street name, you may direct how your shares are voted without attending the

Annual Meeting. Shareholders may deliver their proxies either:

- •

- Electronically over the Internet at www.proxyvote.com;

- •

- By telephone (please see your proxy card for instructions); or

- •

- By requesting, completing and submitting a properly signed paper proxy card as outlined in the Notice of Internet Availability.

Q: May I change my vote or revoke my proxy?

- A:

- You

may change your vote at any time prior to the vote at the Annual Meeting. If you are the shareholder of record, you may change your vote

by:

- •

- Granting a new proxy bearing a later date (which automatically revokes the earlier proxy);

- •

- Providing a written notice of revocation prior to your shares being voted; or

- •

- Attending the Annual Meeting and voting in person.

- A

written notice of revocation must be sent to our Corporate Secretary at the address of our principal executive office, which we provide above.

Attendance at the Annual Meeting will not cause your previously granted proxy to be revoked unless you specifically so request. For shares you hold beneficially in street name, you may change your

vote (1) by submitting new voting instructions to your broker, trustee or nominee or (2) if you have obtained a legal proxy from your broker, trustee or nominee giving you the right to

vote your shares, by attending the Annual Meeting and voting in person.

|

Proxy Statement

|

Page

|

3

|

Table of Contents

Q: Who can help answer my questions?

- A:

- If

you have any questions about the Annual Meeting or how to vote or revoke your proxy, please contact Broadridge Investor Communications at +1.631.254.7400.

- If

you need additional copies of this Proxy Statement or voting materials, please contact Broadridge Investor Communications at the number above

or the JLL Investor Relations team at +1.312.228.2430.

Q: How many shares must be present or represented to conduct business at the Annual Meeting?

- A:

- The

quorum requirement for holding the Annual Meeting and transacting business is that holders of a majority of shares of our Common Stock that are issued

and outstanding and are entitled to vote must be present in person or represented by proxy.

Q: What is the voting requirement to approve each of the proposals?

- A:

- The

Company has established a majority-vote standard for the election of Directors. Accordingly, in order to be elected, each Director must receive at least

a majority of the votes cast for him or her by holders of Common Stock entitled to vote at the Annual Meeting. There is no cumulative voting for Directors.

- Although

the advisory vote on executive compensation is non-binding, our Board will review the result of the vote and, consistent with our

philosophy of shareholder engagement, will take it into account in making a determination concerning executive compensation in the future.

- The

affirmative vote of a majority of the total number of votes cast by holders of Common Stock entitled to vote at the Annual Meeting will be

necessary to (1) approve executive compensation through a non-binding advisory say-on-pay vote and (2) ratify the appointment of KPMG LLP as our independent registered public

accounting firm for 2015.

Q: How are votes counted?

- A:

- For

the purpose of determining whether a quorum is present at the Annual Meeting, we will count shares of Common Stock represented in person or by properly

executed proxy. We will treat shares which abstain from voting as to a particular matter and broker non-votes (defined below) as shares that are present at the Annual Meeting for purposes of

determining whether a quorum exists, but we will not count them as votes cast on such matter.

- Accordingly,

abstentions and broker non-votes will have no effect in determining whether Director nominees have received the requisite number of

affirmative votes.

- Abstentions

and broker non-votes will also have no effect on (1) the voting with respect to the approval of the non-binding vote on

executive compensation or (2) the ratification of the appointment of KPMG LLP.

- Brokers

holding shares of stock for beneficial owners have the authority to vote on certain "routine" matters, in their discretion, in the event

they have not received instructions from the beneficial owners. However, when a proposal is not a "routine" matter and a broker has not received voting instructions from the beneficial owner of the

shares with respect to that proposal, the broker may not vote the shares for that proposal.

- A

"broker non-vote" occurs when a broker holding shares for a beneficial owner signs and returns a proxy with respect to those shares of stock

held in a fiduciary capacity, but does not vote on a particular matter because the broker does not have discretionary voting power with respect to that matter and has not received instructions from

the beneficial owner.

|

Proxy Statement

|

Page

|

4

|

Table of Contents

Q: What happens if I sign but do not give specific voting instructions on my proxy?

- A:

- If

you hold shares in your own name and you submit a proxy without giving specific voting instructions, the proxy holders will vote your shares in the manner

recommended by our Board on all matters presented in this Proxy Statement.

- If

you hold shares through a broker, trustee or other nominee and do not provide your broker with specific voting instructions, under the rules

that govern brokers in such circumstances, your broker will not have the authority to exercise discretion to vote your shares with respect to

Proposal 1 (election of Directors) or Proposal 2 (say-on-pay), but will have the authority to exercise discretion to vote your shares with

respect to Proposal 3 (ratification of KPMG LLP).

Q: What happens if a Director does not receive a majority of the votes cast for him or her?

- A:

- Under

our By-Laws, if a Director does not receive the vote of at least the majority of the votes cast, that Director will promptly tender his or her

resignation to the Board. Our Nominating and Governance Committee will then make a recommendation to the Board as to whether to accept or reject the tendered resignation, or whether other action

should be taken. The Board is required to take action with respect to the resignation, and publicly disclose its rationale, within 90 days from the date of the certification of the election

results. If a resignation is not accepted by the Board, the Director will continue to serve until the next Annual Meeting and until his or her successor is duly elected, or his or her earlier

resignation or removal. We provide additional details about our majority voting procedures under "Corporate Governance Principles and Board Matters" below.

Q: What should I do if I receive more than one set of voting materials?

- A:

- There

are circumstances under which you may receive more than one Notice of Internet Availability. For example, if you hold your shares in more than one

brokerage account, you may receive a separate voting instruction card for each brokerage account in which you hold shares. If you are a shareholder of record and your shares are registered in more

than one name, you will receive more than one Notice. Please vote each different proxy you receive, since each one represents different shares that you own.

Q: Where can I find the voting results of the Annual Meeting?

- A:

- We

intend to announce preliminary voting results at the Annual Meeting and then disclose the final results in a Form 8-K filing with the SEC within

four business days after the date of the Annual Meeting.

Q: What is the deadline to propose actions for consideration at next year's Annual Meeting of Shareholders or to

nominate individuals to serve as Directors?

- A:

- Shareholder

proposals intended to be presented at the 2016 Annual Meeting and included in JLL's Proxy Statement and form of proxy relating to that Annual

Meeting pursuant to Rule 14a-8 under the Securities and Exchange Act of 1934 (as amended, the Exchange Act) must be received by JLL at our

principal executive office by December 18, 2015.

- Our

By-Laws require that proposals of shareholders made outside of Rule 14a-8 under the Exchange Act must be submitted to our Corporate

Secretary at our principal executive office not later than February 29, 2016 and not earlier than January 30, 2016. In addition, any shareholder intending to nominate a candidate for

election to the Board at the 2016 Annual Meeting must give timely written notice to our Corporate Secretary at our principal executive office not later than February 29, 2016 and not earlier

than January 30, 2016.

- Shareholders

may, subject to and in accordance with our By-Laws, recommend director candidates for consideration by the Nominating and

Governance Committee. The recommendation must be delivered to our Corporate Secretary, who will forward the recommendation to the Nominating and Governance Committee for consideration.

|

Proxy Statement

|

Page

|

5

|

Table of Contents

|

|

DIRECTORS AND CORPORATE OFFICERS |

Biographical Information; Composition of the Board of Directors

We provide below biographical summaries for each of:

- •

- Our eight current Non-Executive Directors;

- •

- Our two current Directors who are also Corporate Officers;

- •

- Two first-time nominees for election as Non-Executive Directors; and

- •

- Our additional Corporate Officers.

Director Qualifications

In the case of each Director who is a nominee for election at the 2015 Annual Meeting, we also provide below under "Three Proposals To Be Voted Upon

At The Annual Meeting—Proposal 1" a separate Qualifications Statement indicating those specific qualifications, attributes and skills that support his or her membership on our Board

of Directors.

Current Board Composition and Nominees for Election

Our Board currently consists of the following ten members:

|

|

|

|

|

|

|

|

|

| |

|

Hugo Bagué |

|

Kate S. Lavelle |

|

Shailesh Rao |

|

|

| |

|

Colin Dyer |

|

Ming Lu |

|

David B. Rickard |

|

|

| |

|

Dame DeAnne Julius |

|

Martin H. Nesbitt |

|

Roger T. Staubach |

|

|

| |

|

|

|

Sheila A. Penrose |

|

|

|

|

All

of the above Directors served for all of 2014 and through the date of this Proxy Statement. All of the above Directors are also nominees for election except for Ms. Lavelle, who has decided

not to stand for re-election at the Annual Meeting in order to devote time to a new business venture. In addition, based on the recommendation of the Nominating and Governance Committee, the Board has

nominated the following individuals for first-time election at the 2015 Annual Meeting:

Samuel A. Di Piazza, Jr.

Ann Marie Petach

Changes During 2014 in Corporate Officer Positions

Gregory P. O'Brien was named the Chief Executive Officer of our Americas business effective

January 16, 2014, having previously served as the Chief Executive Officer for our Americas Markets Solutions business. Colin Dyer, our Global Chief Executive Officer, had served as the Chief

Executive Officer for our Americas business on an interim basis during 2013 and until January 16, 2014.

Allan Frazier was appointed our Global Head of Data and Information Management and Chief Data Officer effective January 1, 2014. He was

previously with HSBC Holdings plc.

Parikshat Suri was appointed our Global Internal Audit Director effective September 1, 2014, moving from the role of Chief Financial Officer for

JLL India to succeed James C. "Corey" Lewis, who was named Global Account Lead for a major client account.

|

Proxy Statement

|

Page

|

6

|

Table of Contents

Current Non-Executive Directors Standing for Re-Election

Hugo

Bagué Mr. Bagué, 54, has been a Director of JLL since March 2011. He is a nominee standing for election to our

Board at the 2015 Annual Meeting. Since 2007, Mr. Bagué has been a Group Executive for Rio Tinto Organisational Resources with overall responsibility currently for Human

Resources, Health, Safety, Environment and Communities, External Affairs, Media Relations, Corporate Communications, Procurement, Information Systems and Technology, Shared Services, and Group

Property. Headquartered in the United Kingdom, Rio Tinto plc is a leading international mining and metals group that employs 60,000 people worldwide in over forty countries.

Mr. Bagué was previously the global vice president of Human Resources for the Technology Solutions Group of Hewlett Packard Corporation, based in Palo Alto, California. Prior to

that he worked for Compaq Computer, Nortel Networks and Abbott Laboratories, based out of Switzerland, France, and Germany, respectively. He received a degree in linguistics and post graduate

qualifications in Human Resources and Marketing from the University of Ghent in Belgium.

Dame DeAnne Julius Dame DeAnne, 66, has

been a Director of JLL since November 2008. She is a nominee standing for election to our Board at the 2015 Annual Meeting. Dame DeAnne was the Chairman of the Royal Institute of International

Affairs, also known as Chatham House, from 2003 through 2012. Founded in 1920 and based in London, Chatham House is a world-leading source of independent analysis, informed debate and influential

ideas on how to build a prosperous and secure world. From 1997 to 2001, Dame DeAnne served as a founding member of the Monetary Policy Committee of the Bank of England. Prior to that, she held a

number of positions in the private sector, including Chief Economist at each of British Airways PLC and Royal Dutch Shell PLC, and was Chairman of the British Airways Pension Investment

Management. She has also served as a senior economic advisor at the World Bank and a consultant to the International Monetary Fund. Dame DeAnne currently serves as an independent non-executive member

of each of the board of directors at Roche Holding AG, a global healthcare and pharmaceutical firm, and the governing body of the University College London where she also serves as Chairman. She

previously served as a non-executive member of the board of directors of BP PLC, one of the world's largest energy companies, and the board of partners of Deloitte UK, a firm providing audit,

consulting, financial advisory, risk management, and tax services. Dame DeAnne has a B.S. in Economics from Iowa State University and a Ph.D. in Economics from the University of California. In January

2013, Dame DeAnne was knighted by The Queen of the United Kingdom for her services to international relations.

Ming Lu Mr. Lu, 56, has been a

Director of JLL since May 2009. He is a nominee standing for election to our Board at the 2015 Annual Meeting. Mr. Lu joined KKR Asia Limited in 2006 and since 2007 he has been a Partner with

KKR & Co., L.P., a leading global alternative asset manager sponsoring and managing funds that make investments in private equity, fixed income and other assets in North America, Europe, Asia,

and the Middle East. In connection with his KKR position, Mr. Lu is a member of the board of directors of four of KKR's portfolio of companies, including MMI Group, a precision engineering

company based in Singapore that provides components to the hard disc, oil and gas and aerospace industries; Masan Consumer Corporation, a leading branded consumer goods company in Vietnam; Weststar

Aviation Service Sdn Bhd, a helicopter transportation service provider to offshore oil and gas companies, and Goodpack Limited, a leader in steel intermediate bulk containers, a multi-modal, reusable

metal box system that provides packaging, transportation and storage for global core industries. Prior to joining KKR, Mr. Lu was a Partner at CCMP Capital Asia Pte Ltd (formerly

JP Morgan Partners Asia Pte Ltd), a leading private equity fund focusing on investments in Asia, from 1999 to 2006. Before that, he held senior positions at Lucas Varity, a leading global

automotive component supplier, Kraft Foods International, Inc. and CITIC, the largest direct investment firm in China. Mr. Lu received a B.A. in economics from Wuhan University of Hydro

Electrical Engineering in China and an M.B.A. from the University of Leuven in Belgium.

Martin H.

Nesbitt Mr. Nesbitt, 52, has been a Director of JLL since March 2011. He is a nominee standing for election to our Board at the 2015 Annual

Meeting. In January 2013, Mr. Nesbitt became the Co-Chief Executive Officer of The Vistria Group, LLC, a private-equity investment firm. From 2000 until then, Mr. Nesbitt served as

President and CEO of PRG Parking Management (known as The Parking Spot), a Chicago-based owner and operator of off-airport parking facilities that he conceived and co-founded in August 2000. Prior to

launching The Parking Spot, he was an officer of the Pritzker Realty Group, L.P., the real estate group for Pritzker family interests. Before that, Mr. Nesbitt was a Vice President and

Investment Manager at LaSalle Partners, one of the predecessor corporations to JLL. He is a member of the board of directors of Norfolk Southern Corporation, one of the premier rail transportation

companies in the United States. Mr. Nesbitt is also a Trustee of Chicago's Museum of Contemporary Art. He is the Treasurer for Organizing for America, the successor organization to Obama for

America, a project of the Democratic National Committee, and is also the Chairman of the Barack Obama Foundation, the foundation created in January 2014 to establish the Barack Obama

|

Proxy Statement

|

Page

|

7

|

Table of Contents

Presidential

Library and Museum, among other things. He has previously been a member of the board of directors of the Pebblebrook Hotel Trust, a real estate investment trust and a member of The

University of Chicago Laboratory School Board. Mr. Nesbitt has an M.B.A. from the University of Chicago and both a Bachelor's degree and an honorary doctorate degree from Albion College,

Albion, Michigan.

Sheila A.

Penrose Ms. Penrose, 69, has been a Director of JLL since May 2002 and has been the Chairman of the Board since January 1, 2005. She is a

nominee standing for election to our Board at the 2015 Annual Meeting. Ms. Penrose served as an Executive Advisor to The Boston Consulting Group from January 2001 to December 2007. In September

2000, Ms. Penrose retired from Northern Trust Corporation, a bank holding company and a global provider of personal and institutional financial services, after more than 23 years of

service. While at Northern Trust, Ms. Penrose served as President of Corporate and Institutional Services and as a member of the Management Committee. Ms. Penrose is a member of the

board of directors of McDonald's Corporation, the world's leading foodservice retailer, and Entrust Datacard Group, a supplier of systems for secure identity and secure transaction solutions.

Ms. Penrose

previously served on the board of directors of eFunds Corporation, a provider of integrated information and payment solutions, and Nalco Chemical Corp., a specialty chemicals provider.

Ms. Penrose serves on both the steering committee of the Community of Chairmen and the advisory board of the Gender Parity initiative of the World Economic Forum, on the board of the Chicago

Council on Global Affairs, and as a founding member of the US 30% Club. Ms. Penrose received a Bachelor's degree from the University of Birmingham in England and a Master's degree from the

London School of Economics. She also attended the Executive Program of the Stanford Graduate School of Business. In 2010, Ms. Penrose was inducted into the Chicago Business Hall of Fame and in

2014 was named a finalist for Chairman of the Year by NYSE Governance Services.

Shailesh Rao Mr. Rao, 43, has

been a Director of JLL since September 2013. He is a nominee standing for election to our Board at the 2015 Annual Meeting. Mr. Rao is the Vice President for Asia Pacific, Latin America and

Emerging Markets at Twitter, Inc., the global on-line social networking service. Before joining Twitter in April 2012, Mr. Rao served for seven years in a number of roles, including Managing

Director for India, at Google Inc., the global technology company focused on search, operating systems and platforms. Mr. Rao earned the prestigious Google Founder's Award for his role

in the development of Google Maps and Google Earth. He also played a leadership role in the growth of Google's YouTube business globally as Vice President for the YouTube and Display businesses across

Asia Pacific. Mr. Rao has dual undergraduate degrees in Economics and History from the University of Pennsylvania and an M.B.A. from the Kellogg School of Management.

David B.

Rickard Mr. Rickard, 68, has been a Director of JLL since July 2007. He is a nominee standing for election to our Board at the 2015 Annual

Meeting. In December 2009, Mr. Rickard retired from his position as the Executive Vice President, Chief Financial Officer and Chief Administrative Officer of CVS Caremark Corporation, the

leading provider of prescriptions and related healthcare services in the United States and the operator of over 6,000 CVS pharmacy stores. Prior to joining CVS Caremark in 1999, Mr. Rickard had

been the Senior Vice President and Chief Financial Officer for RJR Nabisco Holdings Corporation. He is currently a member of the board of directors, and Chairman of the audit committee, of each of

Harris Corporation, an international communications and information technology company, and Dollar General Corporation, one of America's largest retailers with over 11,000 stores. Mr. Rickard

has an A.B. from Cornell University and an M.B.A. from Harvard Business School. In 2011, Mr. Rickard was inducted into the Financial Executives International CFO Hall of Fame.

Nominees Who are Not Currently Non-Executive Directors

Samuel A. Di Piazza,

Jr. Mr. Di Piazza, 64, is a nominee standing for first-time election to our Board at the 2015 Annual Meeting. Mr. Di Piazza

retired as Global Chief Executive Office of PricewaterhouseCoopers International Ltd. in September 2009 after eight years of leading the largest professional services firm in the world. Over his

thirty-six year career at PwC, he led the US Firm as Chairman and Senior Partner, the Americas Tax Practice and was a member of the Global Leadership Team. After retiring from PwC,

Mr. Di Piazza joined Citigroup, Inc., where he served as Vice Chairman of the Global Corporate and Investment Bank from 2011 until February 2014. He currently serves as the Chair

of the Board of Trustees of Mayo Clinic. Mr. Di Piazza serves on the Board of Directors of DirecTV, Inc. as well as ProAssurance, Inc., both NYSE-listed companies. He is a member of the

Executive Committee of St. Patrick's Cathedral

in New York City and The Inner City Scholarship Fund of New York City. He is a Trustee of the USA Foundation Board of the World Economic Forum and a member of the Executive Committee of

the National September 11th Memorial and Museum. Mr. Di Piazza has served as a Trustee of the International Financial Reporting Standards Foundation, and is

|

Proxy Statement

|

Page

|

8

|

Table of Contents

past

Chairman of the Geneva-based World Business Council on Sustainable Development, The Conference Board, Inc., Junior Achievement Worldwide and the Financial Accounting Foundation, the oversight

body of the FASB. Mr. Di Piazza received a B.S. in accounting from the University of Alabama and an M.S. from the University of Houston. Mr. Di Piazza is the co-author of Building Public Trust: The Future

of Corporate Reporting.

Ann Marie Petach Ms. Petach, 54,

is a nominee standing for first-time election to our Board at the 2015 Annual Meeting. From 2007 until 2014, Ms. Petach was a senior leader at BlackRock, Inc., the world's largest

investment management firm managing over $4.6 trillion of assets on behalf of governments, companies, foundations, and millions of individuals globally. Most recently, Ms. Petach was the

co-head of US Client Solutions and prior to that she was the Chief Financial Officer of BlackRock. Prior to joining BlackRock in 2007, Ms. Petach was Vice President, Treasurer at Ford Motor

Company, where she worked for the firm in the US, Europe and South America over a period of 23 years. Ms. Petach is currently a member of the board of directors of certain of BlackRock's

affiliated companies and she is a trustee, secretary and treasurer of the Financial Accounting Foundation. Ms. Petach earned a B.A. degree in business and Spanish from Muhlenberg College in

1982 and a MSIA degree from Carnegie Mellon University in 1984.

The

Nominating and Governance Committee identified Mr. Di Piazza and Ms. Petach as candidates for nomination through a third-party search firm.

Current Directors Who Are Also Corporate Officers

Colin Dyer Mr. Dyer, 62, has

been the President and Chief Executive Officer, and a Director, of JLL since August 2004. He is a nominee standing for election to our Board at the 2015 Annual Meeting. Mr. Dyer is currently

the Chairman of our Global Executive Board. From September 2000 to August 2004, he was the founding Chief Executive Officer of the WorldWide Retail Exchange, an Internet-based business-to-business

exchange whose members include more than 40 of the world's leading retailers and manufacturers. From 1996 until September 2000, Mr. Dyer was Chief Executive Officer of Courtaulds Textiles plc,

an international clothing and fabric company, having served in various management positions with that firm since 1982. From 1978 until 1982, he was a client manager at McKinsey & Company, an

international consulting firm. He also previously served on the board of directors, and was the chairman of the audit committee, of Northern Foods plc, a major food supplier to the British retail

sector. He is a

member of The Chicago Club and the Royal Institution of Chartered Surveyors. Mr. Dyer is also on the Board of Directors of The Executives' Club of Chicago. Mr. Dyer holds a BSc degree

from Imperial College in London and an M.B.A. from INSEAD in Fontainebleau, France.

Roger T.

Staubach Mr. Staubach, 73, has been the Executive Chairman, Americas, and a Director, of JLL since July 2008. He is a nominee standing for

election to our Board at the 2015 Annual Meeting. Mr. Staubach founded The Staubach Company in 1977 and served as its Chairman and Chief Executive Officer until June 2007, when he became its

Executive Chairman. The Staubach Company merged with JLL in July 2008. A 1965 graduate of the United States Naval Academy with a B.S. degree in Engineering, Mr. Staubach served for four years

as a Navy officer. He then joined the Dallas Cowboys professional football team as its Quarterback, from which he retired in March 1980. Mr. Staubach was also the Chairman of the Host Committee

for Super Bowl XLV, which was held in North Texas at the beginning of 2011. He has received numerous honors for his leadership in business, civic, philanthropic and athletic activities, including the

2006 Congressional Medal of Honor "Patriot Award," the Pro Football Hall of Fame, the Heisman Trophy and the 2007 Horatio Alger Award. He has also been inducted into the Texas Business Hall of Fame

and named a "Distinguished Graduate" by the United States Naval Academy.

Additional Corporate Officers

Charles J.

Doyle Dr. Doyle, 55, has been the Chief Marketing and Communications Officer of JLL since September 2007. From January 2005 until he joined JLL,

he was the Global Head of Business Development and Marketing with Clifford Chance, an international law firm. From February 1997 to January 2005, he held a range of global marketing and communications

positions with Accenture, a business consulting, technology and outsourcing firm, the last of which was as the global marketing and communications director for its largest business division. He also

previously held senior marketing and business development positions with British Telecom, a network and telecommunications services firm, Fujitsu, a technology and information services firm, and

started his career with the UK's nuclear research agency (UKAEA), where he was a business strategist. Dr. Doyle graduated from Glasgow University, where he also received a

|

Proxy Statement

|

Page

|

9

|

Table of Contents

master's

degree in History and English, and he also holds a doctorate in Modern History from Oxford University. Dr. Doyle is the author of the Oxford Dictionary of

Marketing.

Mark K. Engel Mr. Engel,

42, has been the Global Controller of JLL since August 2008. From April 2007 to August 2008, he served as our Assistant Global Controller and from November 2004 through March 2007 he was our Director

of External Financial Reporting. Prior to that, Mr. Engel served as Controller of the Principal Investments Management business of JPMorgan Chase & Co., Vice President of Accounting

Policy at Bank One Corporation and also held various positions within the audit practice of Deloitte & Touche. Mr. Engel received a B.B.A. in Accountancy from the University of Notre

Dame. He is a Certified Public Accountant (inactive).

Allan Frazier Mr. Frazier, 62,

has been Executive Vice President, Global Head of Data and Information Management and Chief Data Officer of JLL since January 2014. Prior to joining JLL, from March 2003 to January 2014,

Mr. Frazier served in roles of increasing responsibility and ending as Executive Vice President and Global Head of Data and Information Management for HSBC Holdings plc, the global banking

organization, and before then at other major financial institutions for which he developed and managed data management teams in most major markets across the Americas, Asia Pacific, and Europe/Middle

East. Mr. Frazier has a Bachelor's degree in Quantitative Geography from The University of California at Berkeley and a Master's degree in Economic Geography from San Francisco State

University.

Alastair Hughes Mr. Hughes, 49,

has been Chief Executive Officer for our Asia Pacific business segment since January 2009. He is a member of our Global Executive Board. He was previously the Chief Executive Officer for our Europe,

Middle East and Africa operating segment from November 2005. From 2000 to 2005, Mr. Hughes was the Managing Director of our English business. He joined Jones Lang Wootton, one of the

predecessor entities to JLL, in September 1988 and held positions of increasing responsibilities within our Management Services, Fund Management, and Capital Markets businesses. Mr. Hughes

graduated in Economics from Heriot Watt University in Edinburgh and has a Diploma in Land Economy from Aberdeen University. He is also a member of the Royal Institute of Chartered Surveyors.

Jeff A.

Jacobson Mr. Jacobson, 53, has been Chief Executive Officer of LaSalle Investment Management, JLL's investment management business segment, since

January 2007. He is a member of our Global Executive Board. From 2000 through 2006, he was Regional Chief Executive Officer of LaSalle Investment Management's European operations. From 1998 to 2000,

Mr. Jacobson was a Managing Director of Security Capital Group Incorporated. During the period between 1986 and 1998, he served in positions of increasing responsibilities with LaSalle

Partners, one of the predecessor corporations to JLL. Mr. Jacobson graduated from Stanford University, where he received an A.B. in Economics and an A.M. from its Food Research

Institute.

James S.

Jasionowski Mr. Jasionowski, 56, has been Executive Vice President, Chief Tax Officer of JLL since January 2007. He was Executive Vice President,

Director of Tax, from April 2002 to December 2006. From October 2001 to March 2002, he served as Managing Director within the Structured Finance Group of General Electric Capital Corporation. He also

served as Executive Vice President and Director of Tax of Heller Financial, Inc., a commercial finance company, from September 1997 through December 2001, and as Vice President and Tax Counsel of

Heller Financial from May 1993 through August 1997. Prior to that, he held a variety of positions within the tax practice of KPMG from August 1985 through May 1993, ending as Senior Manager, Tax. He

held a variety of positions with Jewel Companies, Inc., from June 1981 through July 1985. Mr. Jasionowski has a B.S. in Accountancy from Northern Illinois University, where he was also a

University Scholar, and a J.D. from IIT Chicago Kent College of Law.

David A.

Johnson Mr. Johnson, 52, has been Executive Vice President, Global Chief Information Officer of JLL since November 2004. He served as the Chief

Information Officer for the Americas business segment of JLL from 1999 to 2004. He joined LaSalle Partners, the predecessor firm to JLL, as Head of Technology for the Management Services Group in

September 1997. Prior to joining LaSalle Partners, Mr. Johnson served as a practice lead for the Real Estate Operations and Systems Group for PricewaterhouseCoopers in Chicago and

New York from 1993 to 1997 and was Manager of Portfolio Performance and Head of Technology for Dreyfus Realty Advisors in New York City from 1990 to 1993. Before joining Dreyfus, he held

a variety of positions in the commercial banking industry. Mr. Johnson received a Bachelor's degree in mathematics and economics from Ithaca College and an M.B.A. in Finance and Economics from

Pace University.

|

Proxy Statement

|

Page

|

10

|

Table of Contents

Christie B.

Kelly Ms. Kelly, 53, has been Executive Vice President and Chief Financial Officer of JLL since July 2013. She is a member of our Global

Executive Board. Before joining JLL, from 2009 she served as the Chief Financial Officer of Duke Realty Corporation, a leading U.S. real estate investment trust (REIT) specializing in the ownership,

management and development of bulk industrial facilities, medical office properties and suburban office buildings. Prior to joining Duke Realty, Ms. Kelly served as Senior Vice President of the

Global Real Estate Group at Lehman Brothers, the investment banking firm, from 2007 to 2009. Before that, she was employed by General Electric Company from 1983 to 2007 and served in numerous finance

and operational financial management positions in the United States, Europe and Asia that included responsibility for mergers and acquisitions, process improvements, internal audit, and enterprise

risk management. She is a member of the board of directors of Kite Realty and was previously a member of the board of directors of the National Bank of Indianapolis. Ms. Kelly is on the board

of trustees of the Butler University Business School. Ms. Kelly has a B.A. in Economics from Bucknell University. She has been recognized as one of the Women of Influence by the Indianapolis Business

Journal.

Patricia Maxson Dr. Maxson, 56,

has been Executive Vice President, Chief Human Resources Officer of JLL since March 2012. From December 2007 until she joined JLL, she served as Vice President, Human Resources for Merck Research Labs

at Merck & Co., Inc. From 1988 to 2007, Dr. Maxson held a variety of positions at Rohm and Haas Co., a specialty chemical company, initially as a chemist in the research organization and

moving into human resources in 1999. Immediately prior to joining Merck, she served as the Rohm and Haas Human Resources Director for Europe. Dr. Maxson has a B.S. in Chemistry from Michigan

State University, a Ph.D. in Chemistry from the University of California, Berkeley, and an M.A. in Clinical Psychology from The Fielding Graduate Institute.

Gregory P.

O'Brien Mr. O'Brien, 52, has been the Chief Executive Officer for our Americas business segment since January 2014. He is a member of our Global

Executive Board. Mr. O'Brien was previously the Chief Executive Officer of our Americas Markets Solutions business and prior to that the Chief Executive Officer of our Americas Brokerage

business. He was the Chief Executive Officer of The Staubach Company prior to its merger with JLL in 2008. Mr. O'Brien earned an M.B.A. from Harvard Business School after graduating from Tufts

University with a B.S. in Electrical Engineering.

Mark J.

Ohringer Mr. Ohringer, 56, has been Executive Vice President, Global General Counsel and Corporate Secretary of JLL since April 2003. From April

2002 through March 2003, he served as Senior Vice President, General Counsel and Secretary of Kemper Insurance Group, Inc., an insurance holding company. Prior to that, Mr. Ohringer served as