Tesco Sells 41 Stores In GBP950 Million Sale And Leaseback Deal

July 07 2010 - 12:48PM

Dow Jones News

Tesco PLC (TSCO.LN), the world's fourth-biggest retailer by

sales, said Wednesday that it has sold 41 stores in a sale and

leaseback deal that will generate some GBP950 million as part of

its continuing program to extract more value from its vast U.K.

property portfolio.

The transaction is structured as a joint venture with the

supermarket operator's pension fund trustees, and is the fourth

such deal by Tesco in 18 months.

Last year it sold and leased back 12 stores and two distribution

centers in a GBP458 million joint venture deal with Tesco Pension

Trustees Ltd; it sold and leased back 13 properties worth GBP605

million to various other investors including the Universities

Superannuation Scheme, Prupim, the property-investment arm of U.K.

insurer Prudential PLC (PUK), LaSalle Investment Management, a unit

of Jones Lang LaSalle Inc. (JLL), and Canada Life Assurance; and in

October it completed a GBP514 million sale and leaseback deal

involving 15 stores and two distribution units with an unidentified

U.K. pension fund.

In line with its deal in October the transaction is being

primarily funded by fixed rate notes issued by Tesco Property

Finance 3 PLC.

-By Marietta Cauchi, Dow Jones Newswires; +44 207 842 9241;

marietta.cauchi@dowjones.com

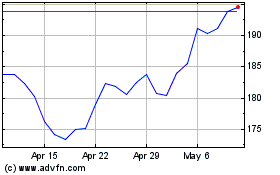

Jones Lang LaSalle (NYSE:JLL)

Historical Stock Chart

From Mar 2024 to Apr 2024

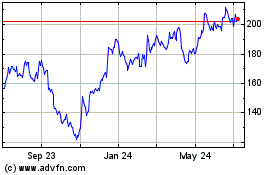

Jones Lang LaSalle (NYSE:JLL)

Historical Stock Chart

From Apr 2023 to Apr 2024