RED Continues Strong Relationship with National Church Residences with a MAP & Lean Closing for Independent & Assisted Living...

October 27 2016 - 12:32PM

Business Wire

Working together to build better communities, RED

Mortgage Capital, the mortgage banking arm of RED Capital

Group, LLC, and National Church Residences coordinated a MAP and

Lean closing for a refinance and renovation of Portage Trail

Village, a property in Cuyahoga Falls, Ohio.

This Smart News Release features multimedia.

View the full release here:

http://www.businesswire.com/news/home/20161027006345/en/

Portage Trail Village (Photo: Business

Wire)

Portage Trail is a 13 story, 183 unit HUD Section 202 apartment

community with occupancy restricted to heads of household age 62+

or handicapped. The property was acquired by National Church

Residences in 1991 and is 100% Section 8 subsidized.

National Church Residences is a strong believer in helping

seniors age in place – allowing for transition to assisted living

when and if the time requires it for its residents. With that idea

in mind, under the Assisted Living Conversion Program (ALCP)

through HUD, renovations were done in 2009 to convert the first six

floors of the building to Assisted Living (AL) units. Floors 7-13

of the building maintained the Independent Living (IL) status.

The $3.1M FHA MAP Financing, paired with a $1.06M FHA Lean

Financing provides for rehabilitation of the building. The process

was a unique coordination requiring the building to be divided into

two separate condominium facilities. The rehab for the AL units was

funded through the Lean program and the IL units were funded under

the MAP program. In addition, National Church Residences was able

to leverage additional equity from Low Income Housing Tax Credits

(LIHTC) and a $1M subordinate loan from the Ohio Housing Finance

Agency.

“National Church Residences is thrilled to partner with

RED on the rehab of Portage Trail. Their expertise was

extraordinarily valuable,” stated Matt Rule, Senior Vice President

of Development for National Church Residence. “We are especially

excited that the Portage Trail campus will continue to allow our

senior residents to have the option to age in place in independent

units and, if appropriate, allow them to transition to assisted

living units without ever leaving behind their community of friends

or the building.”

“We firmly believe in helping our partners build better

communities and work hard to find creative ways to help them

succeed. This was a unique opportunity for RED to utilize our

experience in both the Affordable Housing and Seniors Housing to

complete the transaction for our friends at National Church

Residences,” states Tracy Peters, Senior Managing Director for

RED. “It is always a privilege to work with National Church

Residences, and we look forward to working with them for years to

come.”

To learn more about RED and the Affordable Housing team click

here.

About RED CAPITAL GROUP, LLC

Recognized for its industry expertise, innovative and

comprehensive structures, and consistently high rankings, RED

Capital Group, LLC has provided over $72 billion of integrated debt

and equity capital since 1990 to the seniors housing and health

care, multifamily, affordable, and student housing industries

through three operating companies.

RED Mortgage Capital, LLC is the nation’s #1 FHA/HUD MAP and

Lean Lender by loan count in HUD FY2015 as well as a leading Fannie

Mae DUS® and a Freddie Mac small balance lender with a mortgage

servicing portfolio near $16 billion. RED Capital Markets, LLC

(MEMBER FINRA/SIPC) is a leader in the distribution of Fannie Mae

and Ginnie Mae Project MBS, and provides structuring, underwriting,

placement, and advisory services for tax-exempt and taxable housing

and health care bonds. RED Capital Partners, LLC provides

proprietary debt and equity solutions, and asset management in a

range of forms, including subordinated gap and bridge loans. RED

Capital Group, LLC is a wholly-owned subsidiary of ORIX USA

Corporation. Visit www.redcapitalgroup.com.

About ORIX USA Corporation

ORIX USA provides innovative capital solutions that clients need

to propel their business to the next level. Based in Dallas, ORIX

USA has a team of more than 600 employees spanning nearly 20

offices across the U.S. and Brazil. ORIX USA and its family of

companies offer investment capital and asset management services to

clients in the corporate, real estate, municipal and energy

sectors, while holding $6 billion of assets and managing an

additional $29 billion, approximately. Its parent company, ORIX

Corporation, is a Tokyo-based, publicly owned international

financial services company with operations in 37 countries and

regions worldwide. ORIX Corporation is listed on the Tokyo (8591)

and New York Stock Exchanges (IX). For more information on ORIX

USA, visit www.orix.com.

DUS® is a registered trademark of Fannie

Mae

View source

version on businesswire.com: http://www.businesswire.com/news/home/20161027006345/en/

RED Capital Group, LLCLisalynne Quinn, +1 469-385-1434Director

of Marketingllquinn@redcapitalgroup.com

Orix (NYSE:IX)

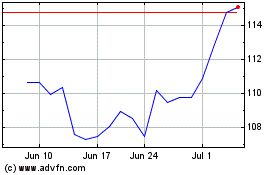

Historical Stock Chart

From Mar 2024 to Apr 2024

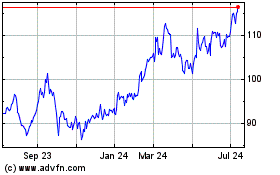

Orix (NYSE:IX)

Historical Stock Chart

From Apr 2023 to Apr 2024