SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF

FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 OF

THE SECURITIES EXCHANGE Act of 1934

For the month of November 2014

ORIX

Corporation

(Translation of Registrant’s Name into English)

World Trade Center Bldg., 2-4-1 Hamamatsu-cho, Minato-Ku,

Tokyo, JAPAN

(Address of Principal Executive Offices)

(Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F x Form

40-F ¨

(Indicate by check mark whether the

registrant by furnishing the information contained in this form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.)

Yes ¨ No x

Table of Documents Filed

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

ORIX Corporation |

|

|

|

| Date: November 26, 2014 |

|

By |

|

/s/ Haruyuki Urata |

|

|

|

|

Haruyuki Urata |

|

|

|

|

Director |

|

|

|

|

Deputy President and Chief Financial Officer |

|

|

|

|

ORIX Corporation |

|

|

|

|

|

November 26, 2014 |

FOR IMMEDIATE RELEASE

Contact Information:

ORIX Corporation

Corporate Planning Department

Tel: +81-3-3435-3121

Fax:

+81-3-3435-3154

URL: www.orix.co.jp/grp/en/

Announcement of Third-Party Allotment of Treasury Stock Based on Stock Compensation Plan

TOKYO, Japan – November 26, 2014 – ORIX Corporation (the “Company”), a leading integrated financial services group, announced

that it has decided to dispose of treasury stock through a third-party allotment (the “Disposal”) in accordance with the stock compensation plan for the directors and executive officers of the Company and group executives on

November 25, 2014. The details follow below.

| 1. |

Overview of the Disposal |

|

|

|

|

|

| (1) |

|

Disposal date |

|

December 11, 2014 |

|

|

|

| (2) |

|

Number of shares to be disposed of |

|

428,800 shares |

|

|

|

| (3) |

|

Disposal amount |

|

1,659 yen per share |

|

|

|

| (4) |

|

Total disposal amount |

|

711,379,200 yen |

|

|

|

| (5) |

|

Subscription or disposal method

(Allottee) |

|

By third-party allotment (Yoshihiko Miyauchi,

all shares to be disposed of) |

| 2. |

Purpose of, and Reasons for the Disposal |

The Company has adopted a stock compensation plan for the directors

and executive officers of the Company and the executives of the Company’s group companies.

The Disposal is being conducted for the purpose of

granting the Company’s shares as stock compensation to Yoshihiko Miyauchi, with his retirement as Director, Representative Executive Officer, and Chairman and Chief Executive Officer as of June 24, 2014.

| * |

Under this stock compensation plan, the directors and executive officers of the Company and the executives of the Company’s group companies are granted points annually while in office based on the standard set

forth by the Compensation Committee and, on and after their resignation, are provided with an amount of compensation equal to the accumulated number of points multiplied by the market share price. By using such compensation, the resigned directors

and executives are obliged to purchase shares from the Company at the market share price. |

| 3. |

Amount, Use, and Anticipated Time of Use of Funds Raised |

| |

(1) |

Amount of funds raised |

|

|

|

|

|

| (i) |

|

Aggregate amount to be paid |

|

711,379,200 yen |

|

|

|

| (ii) |

|

Estimated costs of disposal |

|

5,000,000 yen |

|

|

|

| (iii) |

|

Estimated net proceeds |

|

706,379,200 yen |

| * |

The estimated disposal costs above consist of the estimated cost of documentation, etc. |

| |

(2) |

Specific use and anticipated time of use of funds raised |

As described in 2. above, the

Disposal is based on the stock compensation plan for the directors and executive officers of the Company and the executives of the Company’s group companies; therefore, fundraising is not the main purpose of the Disposal. Also, since the

allottee will pay for the treasury stock using the funds that he is provided with in advance by the Company in accordance with the stock compensation plan, no funds will be raised externally.

| 4. |

Perspective on Reasons for Use of Funds |

No funds will be raised externally because the treasury stock will be

paid for using the funds that the Company provides in advance in accordance with the stock compensation plan. The Company considers that it is reasonable that all of the funds raised by the Disposal will be allocated to working capital, as it will

contribute to the Company’s business operations.

| 5. |

Reasonableness of Disposal Terms |

| |

(1) |

Basis and details for calculating the amount to be paid |

The amount to be paid per share was

determined to be 1,659 yen, which represents a 7.55% premium against the closing price for the regular trading of common shares of the Company (the “Closing Price”) on the Tokyo Stock Exchange (the “TSE”) as of the

date of the decision of the Representative Executive Officer regarding the Disposal (November 25, 2014).

Such amount to be paid per share

was determined in accordance with the method for calculating the disposal amount per share as the average Closing Price (rounded upwards to the nearest yen) on the TSE for the 30 trading days commencing 45 days preceding, and not including, the day

on which the terms of the disposal of treasury stock to the relevant directors and executive officers are determined (such day, the “Determination Date”); provided, however, that if the above amount is less than either the Closing

Price on the Determination Date or that on the date on which the relevant directors and executive officers retire, then the disposal amount per share shall be the highest of the three prices. The Company considers that this calculation method is

reasonable because arbitrariness can be excluded with this method, which is based on the market price immediately before the date of the decision of the amount to be paid, and set the highest of more than one price, comparing the market prices at

specific dates and the average market prices in specific periods.

In addition, the amount to be paid per share for the Disposal

represents, respectively, a 8.43% premium against 1,530 yen (rounded upwards to the nearest yen), the average of the Closing Prices on the TSE for the one-month period preceding the Determination Date (from October 26, 2014, to

November 25, 2014) ; a 10.82% premium against 1,497 yen (rounded upwards to the nearest yen), the average of the Closing Prices on the TSE for the three-month period preceding the Determination Date (from August 26, 2014, to

November 25, 2014); and a 6.14% premium against 1,563 yen (rounded upwards to the nearest yen), the average of the Closing Prices on the TSE for the six-month period preceding the Determination Date (from May 26, 2014, to November 25,

2014). Taking into consideration this data, the Representative Executive Officer has determined that such amount to be paid per share is reasonable and does not fall within a specially favorable price.

| |

(2) |

Reasons for the judgment that the number of shares to be issued and level of dilution of shares are reasonable |

The total number of treasury stock to be disposed of through the Disposal is 428,800 shares (number of voting rights: 4,288), and the ratio to

the total number of issued and outstanding shares of the Company as of September 30, 2014 (not including treasury stock of the Company) is 0.03% (ratio in voting rights: 0.03%) (rounded down to the second decimal place).

The Disposal is based on the stock compensation plan for the directors and executive officers of

the Company and the executives of the Company’s group companies. The Company considers that the dilution caused by the Disposal is within a reasonable extent and that there will only be a minor impact on the trading market, taking into

consideration the fact that the Compensation Committee of the Company duly decided the amount of such compensation and the method for calculation of the number of shares to be allotted, and the amount to be paid exceeds the price judged to

appropriately reflect the value of the shares of the Company as described in (1) above, and the dilution ratio of the Disposal to the total number of issued and outstanding shares (not including treasury stock of the Company) is 0.03%.

| 6. |

Reasons for Selecting Allottee and other related matters |

| |

(1) |

Overview of the allottee |

|

|

|

|

|

| (i) |

|

Name |

|

Yoshihiko Miyauchi |

|

|

|

| (ii) |

|

Address |

|

Shinagawa-ku, Tokyo (Japan) |

|

|

|

| (iii) |

|

Title |

|

Senior Chairman (ex- Director, Representative

Executive Officer, and Chairman and Chief Executive Officer (retired in June 24, 2014)) |

|

|

|

| (iv) |

|

Relationship between the Company and the allottee |

|

As of September 30, 2014, Mr. Miyauchi holds 393,800 shares of common stock of the Company. Further, he retired as Director, Representative Executive Officer, and Chairman and Chief Executive Officer of the Company on

June 24, 2014, and took office as Senior Chairman on the same day. Other than the above mentioned matters, there is no capital, personal or business relationship between the Company and Mr. Miyauchi (including his relatives, companies, etc. of

which a majority stake is owned by Mr. Miyauchi and/or his relatives, and the subsidiaries of the companies, etc. of which a majority stake is owned by Mr. Miyauchi and/or his relatives), which shall be described herein. In addition, the affiliates

and affiliate companies of the Company do not have any special capital, personal or business relationship with Mr. Miyauchi or his affiliates and affiliate companies. |

| * |

Mr. Yoshihiko Miyauchi, the allottee, joined the Company in April 1964, was appointed as the Representative Director, President and Chief Executive Officer of the Company in December 1980, the Representative

Director, Chairman and Chief Executive Officer of the Company in April 2000, and the Director, Representative Executive Officer, and Chairman and Chief Executive Officer of the Company in June 2003, respectively, and resigned from the last office at

the end of the annual shareholders meeting held on June 24, 2014. He currently serves as the Senior Chairman of the Company. In light of his position and career above, the Company judges that he is not a member of antisocial forces and does not

have any relationship with antisocial forces, and accordingly submitted a confirmation letter to that effect to the TSE. |

| |

(2) |

Reasons for selecting the allottee |

With respect to the reasons for selecting the allottee,

please see 2. above.

| |

(3) |

Allottee’s policy on holding shares |

The Company has confirmed that the allottee intends

to hold the disposed shares of the Company for the medium-and-long term.

The Company will obtain a confirmation letter by which it is

agreed that, if the allottee transfers all or a part of such shares within two years after the disposal date, such allottee will report the details of the transfer to the Company in writing, the Company will report the substance of such report to

the TSE and such allottee will consent to the substance of such report being made available for public inspection.

| |

(4) |

Confirmed facts regarding the existence of assets necessary for payment by the allottee |

Since

the allottee will pay for the treasury stock using the funds that he is provided with in advance by the Company, the Company considers that there will be no problem with respect to the funds required for the payment of the Disposal.

| 7. |

Major Shareholders and Shareholding Ratio after the Disposal |

|

|

|

|

|

|

|

|

|

|

|

| Before the Disposal

(as of September 30, 2014) |

|

|

After the Disposal |

|

| Japan Trustee Services Bank, Ltd. (Trust Account) |

|

|

8.12 |

% |

|

Japan Trustee Services Bank, Ltd. (Trust Account) |

|

|

8.12 |

% |

|

|

|

|

| JP Morgan Chase Bank 380055

(Standing proxy: Mizuho Bank, Ltd., Settlement & Clearing Services Division) |

|

|

6.16 |

% |

|

JP Morgan Chase Bank 380055

(Standing proxy: Mizuho Bank, Ltd., Settlement & Clearing Services Division) |

|

|

6.16 |

% |

|

|

|

|

| The Master Trust Bank of Japan, Ltd. (Trust Account) |

|

|

5.98 |

% |

|

The Master Trust Bank of Japan, Ltd. (Trust Account) |

|

|

5.98 |

% |

|

|

|

|

| The Chase Manhattan Bank 385036

(Standing proxy: Mizuho Bank, Ltd., Settlement & Clearing Services Division) |

|

|

2.87 |

% |

|

The Chase Manhattan Bank 385036

(Standing proxy: Mizuho Bank, Ltd., Settlement & Clearing Services Division) |

|

|

2.87 |

% |

|

|

|

|

| State Street Bank and Trust Company

(Standing proxy: The Hongkong and Shanghai Banking Corporation Limited, Tokyo Branch) |

|

|

2.17 |

% |

|

State Street Bank and Trust Company

(Standing proxy: The Hongkong and Shanghai Banking Corporation Limited, Tokyo Branch) |

|

|

2.17 |

% |

|

|

|

|

| Japan Trustee Services Bank, Ltd. (Trust Account 9) |

|

|

1.88 |

% |

|

Japan Trustee Services Bank, Ltd. (Trust Account 9) |

|

|

1.88 |

% |

|

|

|

|

| State Street Bank and Trust Company 505225

(Standing proxy: Mizuho Bank, Ltd., Settlement & Clearing Services Division) |

|

|

1.73 |

% |

|

State Street Bank and Trust Company 505225

(Standing proxy: Mizuho Bank, Ltd., Settlement & Clearing Services Division) |

|

|

1.73 |

% |

|

|

|

|

| The Chase Manhattan Bank, N.A. London Secs Lending Omnibus Account

(Standing proxy: Mizuho Bank, Ltd., Settlement & Clearing Services Division) |

|

|

1.67 |

% |

|

The Chase Manhattan Bank, N.A. London Secs Lending Omnibus Account

(Standing proxy: Mizuho Bank, Ltd., Settlement & Clearing Services Division) |

|

|

1.67 |

% |

|

|

|

|

| The Bank of NY Mellon SA/NV 10

(Standing proxy: The Bank of Tokyo-Mitsubishi UFJ, Ltd.) |

|

|

1.47 |

% |

|

The Bank of NY Mellon SA/NV 10

(Standing proxy: The Bank of Tokyo-Mitsubishi UFJ, Ltd.) |

|

|

1.47 |

% |

|

|

|

|

| CITI Bank, N.A. –N.Y, AS DEPOSITARY BANK FOR DEPOSITARY SHARE HOLDERS

(Standing proxy: Citibank Japan Ltd.) |

|

|

1.33 |

% |

|

CITI Bank, N.A. –N.Y, AS DEPOSITARY BANK FOR DEPOSITARY SHARE HOLDERS

(Standing proxy: Citibank Japan Ltd.) |

|

|

1.33 |

% |

| * |

The figures above are based on the shareholder registry as of September 30, 2014. Since the Company cannot exhaustively identify the number of shares related to trust businesses held bytrust banks and other

institutions, the figures above are based on the number of shares held in the name of nominees recorded in the shareholder registry. |

The Disposal will not affect the Company’s net income target for this fiscal year.

| 9. |

Matters relating to Procedures based on the Company’s Code of Conduct |

The Disposal does not require an

opinion being acquired from an independent third party or require any procedures to confirm the intent of shareholders, which are provided for under Article 432 of the Securities Listing Regulations of the TSE, because (i) the dilution ratio is

less than 25%, and (ii) it does not involve a change in controlling shareholders.

| 10. |

Business Results and Status of Equity Finance for the Latest Three Years |

| |

(1) |

Business results for the latest three years (consolidated basis) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(Yen) |

|

| |

|

Fiscal year

ended March 31,

2012 |

|

|

Fiscal year

ended March 31,

2013 |

|

|

Fiscal year

ended March 31,

2014 |

|

| Consolidated sales* |

|

|

964,779 million |

|

|

|

1,055,764 million |

|

|

|

1,341,651 million |

|

| Consolidated operating income |

|

|

122,215 million |

|

|

|

150,853 million |

|

|

|

200,978 million |

|

| Consolidated net income* |

|

|

83,509 million |

|

|

|

111,909 million |

|

|

|

186,794 million |

|

| Consolidated net income per share* |

|

|

77.68 |

|

|

|

102.87 |

|

|

|

147.30 |

|

| Dividend per share* |

|

|

9 |

|

|

|

13 |

|

|

|

23 |

|

| Consolidated net assets per share* |

|

|

1,284.15 |

|

|

|

1,345.63 |

|

|

|

1,465.31 |

|

| * |

Since the Company prepares its consolidated financial statements in accordance with the US GAAP, these figures respectively show “Total Revenue,” “Net income attributable to the Company’s

shareholders,” “Net income attributable to the Company’s shareholders per share,” and “the Company’s shareholders’ equity per share.” In addition, on April 1, 2013, the Company implemented a 10-for-1

stock split of common shares held by shareholders registered on the Company’s register of shareholders as of March 31, 2013. Accordingly, the number of issued shares was adjusted retrospectively to reflect the stock split for all periods

presented. |

| |

(2) |

Status of the number of issued shares and the number of potential shares (as of September 30, 2014) |

|

|

|

|

|

|

|

|

|

| |

|

Number of shares |

|

|

Ratio to number of

issued shares |

|

| Number of issued shares |

|

|

1,323,639,628 |

|

|

|

100 |

% |

| Number of potential shares at the current conversion price (exercise price) |

|

|

8,218,070 |

|

|

|

0.62 |

% |

| Number of potential shares at the minimum conversion price (exercise price) |

|

|

— |

|

|

|

— |

|

| Number of potential shares at the maximum conversion price (exercise price) |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(Yen) |

|

| Years ended March 31 |

|

2012 |

|

|

2013 |

|

|

2014 |

|

| Opening Price |

|

|

789 |

|

|

|

802 |

|

|

|

1,173 |

|

| High Price |

|

|

864 |

|

|

|

1,257 |

|

|

|

1,920 |

|

| Low Price |

|

|

548 |

|

|

|

637 |

|

|

|

1,127 |

|

| Closing Price |

|

|

790 |

|

|

|

1,191 |

|

|

|

1,453 |

|

| * |

On April 1, 2013, the Company implemented a 10-for-1 stock split of common shares held by shareholders registered on the Company’s register of shareholders as of March 31, 2013. Accordingly, the stock

prices above were adjusted retrospectively to reflect the stock split for all periods presented. |

| |

(ii) |

Over the last six months |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

(Yen) |

|

| |

|

May |

|

|

June |

|

|

July |

|

|

August |

|

|

September |

|

|

October |

|

| Opening Price |

|

|

1,491 |

|

|

|

1,634 |

|

|

|

1,682 |

|

|

|

1,659.5 |

|

|

|

1,570 |

|

|

|

1,510 |

|

| High Price |

|

|

1,649 |

|

|

|

1,686 |

|

|

|

1,728 |

|

|

|

1,682 |

|

|

|

1,634.5 |

|

|

|

1,540.5 |

|

| Low Price |

|

|

1,487 |

|

|

|

1,595 |

|

|

|

1,571 |

|

|

|

1,500 |

|

|

|

1,505 |

|

|

|

1,295.5 |

|

| Closing Price |

|

|

1,614 |

|

|

|

1,679 |

|

|

|

1,693.5 |

|

|

|

1,570 |

|

|

|

1,513 |

|

|

|

1,508.5 |

|

| |

(iii) |

Stock price on the business day immediately prior to the date of the decision on the Disposal |

|

|

|

|

|

| |

|

(Yen) |

|

| |

|

November 21, 2014 |

|

| Opening Price |

|

|

1,530.5 |

|

| High Price |

|

|

1,547.5 |

|

| Low Price |

|

|

1,524 |

|

| Closing Price |

|

|

1,540.5 |

|

| |

(4) |

Status of equity finance for the last three years |

Disposal of Treasury Stock through

Third-Party Allotment

|

|

|

| Payment date |

|

July 18, 2013 |

| Total disposal amount |

|

19,408,448,400 yen |

| The disposal price per share |

|

1,396 yen |

| Number of issued shares before the disposal |

|

1,221,433,050 shares |

| Number of shares disposed of |

|

13,902,900 shares |

| Number of issued shares after the disposal |

|

1,221,433,050 shares |

| Allottee |

|

Coöperatieve Centrale Raiffeisen-Boerenleenbank B.A. (Rabobank) |

| Initial use of funds at the disposal |

|

Not applicable because the payment was made by contribution in kind. |

| Anticipated time of use of funds raised at the disposal |

|

Same as above |

| Usage of funds at the current date |

|

Same as above |

About ORIX

ORIX Corporation (TSE: 8591; NYSE: IX) is a financial services group which provides innovative products and services to its customers by constantly pursuing

new businesses. Established in 1964, from its start in the leasing business, ORIX has advanced into neighboring fields and at present has expanded into lending, investment, life insurance, banking, asset management, automobile related, real estate

and environment and energy related businesses. Since entering Hong Kong in 1971, ORIX has spread its businesses globally by establishing locations in 35 countries and regions across the world. ORIX celebrates its 50th anniversary in 2014 and moving forward it aims to contribute to society while continuing to capture new business opportunities and sustain growth by promoting acceleration of its corporate strategy

“Finance + Services.” For more details, please visit our website: http://www.orix.co.jp/grp/en/

These documents may contain forward-looking

statements about expected future events and financial results that involve risks and uncertainties. Such statements are based on our current expectations and are subject to uncertainties and risks that could cause actual results to differ materially

from those described in the forward-looking statements. Factors that could cause such a difference include, but are not limited to, those described under “Risk Factors” in the Company’s annual report on Form 20-F filed with the United

States Securities and Exchange Commission and under “4. Risk Factors” of the “Summary of Consolidated Financial Results” of the “Consolidated Financial Results April 1, 2013 – March 31, 2014.”

-End-

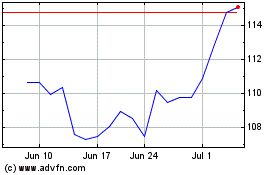

Orix (NYSE:IX)

Historical Stock Chart

From Mar 2024 to Apr 2024

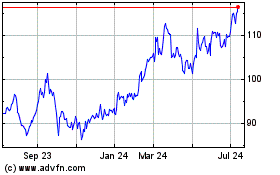

Orix (NYSE:IX)

Historical Stock Chart

From Apr 2023 to Apr 2024