Illinois State-Workers Pension Board Switches to Funds That Track Market

September 16 2016 - 3:30PM

Dow Jones News

The board overseeing 401(k)-style benefits for 52,000 Illinois

state workers has terminated all money managers who try to handpick

winners, a major embrace of low-cost funds that instead mimic the

markets.

The Illinois State Board of Investment, in a 7-to-1 vote on

Thursday, jettisoned mutual funds sold by T. Rowe Price Group Inc.,

Fidelity Investments, Invesco Inc. and four others.

The pullback means roughly $2.8 billion of Illinois

state-employee retirement assets—representing roughly two-thirds of

the $4 billion fund—would now be in the hands of Vanguard Group and

Northern Trust.

The shift would dramatically reduce outside management fees paid

plan-wide, dropping from more than $10 million annually to $1

million, Marc Levine, the board's chairman, said in an interview.

On a per-participant basis, it equates to fees being shaved to

about one-fourth of the previously paid total.

The decision came down to plan participants being provided too

many choices and a struggle to justify the extra fees due to mixed

performance, Mr. Levine said. "Excellence and complexity is not the

same thing," he said. "More choices are worse than fewer

choices."

The 52,000 workers primarily have a traditional defined-benefit

pension, but they can supplement that with an employer-provided,

tax deductible 401(k)-style plan. Those who opt for 401(k)-style

savings make additional tax-deductible contributions from their

paychecks.

The Illinois plan's abandonment of higher-charging, so-called

"active" managers comes amid a broader debate unfolding among big

investors: whether Wall Street firms can consistently outperform a

simple index fund that costs virtually nothing.

The shift means Illinois state workers, legislators and

judges—those participating in the 401(k)-style fund—would choose

from between seven categories of investments rather than 16. All

the holdovers will be so-called "passive" funds that strive to

imitate, not outsmart, the markets.

"We're taking all that complexity out," Mr. Levine said.

The Illinois State Board of Investment oversees a traditional

pension benefit for about 120,000 current and retired workers,

including the 52,000 who opt for the supplemental 401k-style

benefit. The strategy for the broader $16 billion plan is also to

try to drive down external-management fees and simplify, according

to Mr. Levine.

In March, Mr. Levine asked one hedge-fund executive point-blank:

"Why do I need you?" In recent months, the Illinois plan has

slashed 65 of its 80 hedge-fund managers.

Other U.S. retirement systems also offer workers optional

supplemental 401(k) plans to pair with a traditional defined

benefit pension. U.S. pension plans collectively have $470.9

billion in 401(k)-style assets, according to the Federal

Reserve.

The nation's largest U.S. public pension, the California Public

Employees' Retirement System, manages such a $1.9 billion so-called

defined-contribution plan in addition to the $283.9 billion

traditional pension, according to a September report by the

Pensions & Investments trade publication and consultant Willis

Towers Watson.

The fifth-largest U.S. pension, the Florida State Board of

Administration, has $8.6 billion placed in a 401k-style plan versus

$139.2 billion for a traditional pension.

Write to Timothy W. Martin at timothy.martin@wsj.com

(END) Dow Jones Newswires

September 16, 2016 15:15 ET (19:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

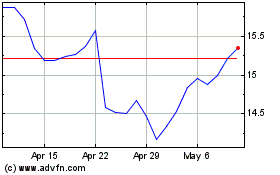

Invesco (NYSE:IVZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

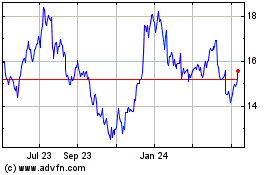

Invesco (NYSE:IVZ)

Historical Stock Chart

From Apr 2023 to Apr 2024