Current Report Filing (8-k)

March 11 2015 - 8:03AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 10, 2015

Invesco Ltd.

(Exact name of registrant as specified in its charter)

|

| | | | |

| | | | |

Bermuda | | 001-13908 | | 98-0557567 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

|

| | | | | | |

| | | | | | |

1555 Peachtree Street, NE, Atlanta, Georgia | | | | | | 30309 |

(Address of principal executive offices) | | | | | | (Zip Code) |

Registrants telephone number, including area code: (404) 892-0896

n/a

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

|

| |

Item 7.01 | Regulation FD Disclosure. |

On March 10, 2015, Invesco Ltd. issued a press release announcing its preliminary assets under management for the month ended February 28, 2015. A copy of that press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

|

| |

Item 9.01 | Financial Statements and Exhibits. |

|

| | |

| | |

Exhibit No. | | Description |

99.1 | | Press Release, dated March 10, 2015, issued by Invesco Ltd. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | | |

| Invesco Ltd. | |

| | | |

| By: | /s/ Loren M. Starr | |

| | Loren M. Starr | |

| | Senior Managing Director and Chief Financial Officer | |

Date: March 11, 2015

Exhibit Index

|

| | |

| | |

Exhibit No. | | Description |

99.1 | | Press Release, dated March 10, 2015, issued by Invesco Ltd. |

|

| | |

| | Press Release For immediate release |

Invesco Ltd. Announces February 28, 2015

Assets Under Management

Invesco Relations Contact: Jordan Krugman 404-439-4605

Media Relations Contact: Bill Hensel 404-479-2886

Atlanta, March 10, 2015 --- Invesco Ltd. (NYSE: IVZ) today reported preliminary month-end assets under management (AUM) of $809.4 billion, an increase of 2.9% month over month. The increase was driven by favorable market returns, net long-term inflows, and favorable foreign exchange. FX increased AUM by $3.0 billion during the month. During the month, passive alternative AUM included a $0.7 billion reduction representing 32 exchange traded notes (ETNs). These ETNs did not transfer over as part of the agreement with Deutsche Bank to transition the investment management of the PowerShares DB suite of commodity exchange traded funds (ETFs) to Invesco. Preliminary average total AUM for the quarter through February 28 were $792.5 billion, and preliminary average active AUM for the quarter through February 28 were $650.8 billion.

|

| | | | | | | | | | | | |

Total Assets Under Management |

(in billions) | | Total | | Equity | | Fixed Income | | Balanced | | Money Market | | Alternatives |

| | | | | | | | | | | | |

February 28, 2015(a) | | $809.4 | | $397.5 | | $183.8 | | $51.0 | | $77.3(b) | | $99.8 |

January 31, 2015 | | $786.5 | | $376.5 | | $182.5 | | $49.5 | | $77.0 | | $101.0 |

December 31, 2014

| | $792.4 | | $384.4 | | $181.6 | | $50.6 | | $76.5 | | $99.3 |

November 30, 2014

| | $804.0 | | $395.0 | | $181.9 | | $51.6 | | $76.8 | | $98.7 |

Active (c) |

(in billions) | | Total | | Equity | | Fixed Income | | Balanced | | Money Market | | Alternatives |

| | | | | | | | | | | | |

February 28, 2015(a) | | $664.3 | | $306.2 | | $141.4 | | $51.0 | | $77.3(b) | | $88.4 |

January 31, 2015 | | $647.7 | | $291.7 | | $140.4 | | $49.5 | | $77.0 | | $89.1 |

December 31, 2014 | | $651.0 | | $296.2 | | $140.5 | | $50.6 | | $76.5 | | $87.2 |

November 30, 2014 | | $656.0 | | $301.6 | | $140.0 | | $51.6 | | $76.8 | | $86.0 |

Passive (c) |

(in billions) | | Total | | Equity | | Fixed Income | | Balanced | | Money Market | | Alternatives |

| | | | | | | | | | | | |

February 28, 2015(a) | | $145.1 | | $91.3 | | $42.4 | | $— | | $— | | $11.4 |

January 31, 2015 | | $138.8 | | $84.8 | | $42.1 | | $— | | $— | | $11.9 |

December 31, 2014 | | $141.4 | | $88.2 | | $41.1 | | $— | | $— | | $12.1 |

November 30, 2014 | | $148.0 | | $93.4 | | $41.9 | | $— | | $— | | $12.7 |

|

| |

(a) | Preliminary - subject to adjustment. |

(b) | Preliminary - ending money market AUM include $73.3 billion in institutional money market AUM and $4.0 billion in retail money market AUM. |

(c) | Passive AUM include ETF’s, UIT’s, non-fee earning leverage, foreign exchange overlays and other passive mandates. Active AUM are total AUM less passive AUM. |

About Invesco Ltd.

Invesco Ltd. is a leading independent global investment management firm, dedicated to helping investors worldwide achieve their financial objectives. By delivering the combined power of our distinctive investment management capabilities, Invesco provides a wide range of investment strategies and vehicles to our clients around the world. Operating in more than 20 countries, the firm is listed on the New York Stock Exchange under the symbol IVZ. Additional information is available at www.invesco.com.

###

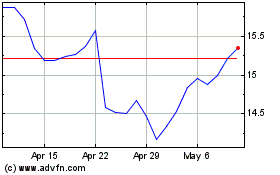

Invesco (NYSE:IVZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

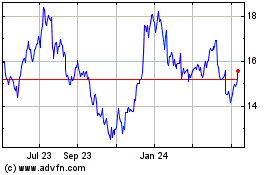

Invesco (NYSE:IVZ)

Historical Stock Chart

From Apr 2023 to Apr 2024