ADR Report: Shares Higher As Greece Approves Austerity Measures

February 13 2012 - 5:10PM

Dow Jones News

International companies trading in New York closed higher

Monday, in line with the broader market, following the Greek

parliament's approval of austerity measures required in order for

the country to receive a second bailout package from its European

partners and the International Monteary Fund.

The Bank of New York index of ADRs climbed 1.2% to 131.45 as

European stocks rallied, with financial companies trading mostly

higher.

Lloyds Banking Group PLC (LYG, LLOY.LN) added 2.8% to $2.19, UBS

AG (UBS, UBSN.VX) rose 2% to $14.18 and ING Groep NV (ING, INGA.AE)

was lifted 2.3% to $8.74.

The European index gained 1.2% to 120.47.

Wausau Paper Corp. (WPP) struck an agreement with its largest

shareholder, activist hedge fund Starboard Value LP, to nominate

two directors supported by Starboard to its board. Starboard Value

has been angling for change at the paper products company, in which

it holds a roughly 10% stake, according to FactSet Research. The

hedge fund last month sent a letter to Wausau urging it to expand

its strategic review to include a potential sale of its paper

segment or the entire company. Shares of Wausau Paper gained 3.2%

to $9.78.

Offsetting those gains were Societe Generale SA (SCGLY, GLE.FR)

and BNP Paribas SA (BNPQY, BNP.FR), which ended down 1.7% at $5.96

and 0.7% at $22.76, respectively. They fell after it was confirmed

that the French regulator lifted the ban on short selling of some

French financial companies. The ban was first imposed in

August.

The Asian index ended up 1.3% at 128.33.

Advanced Semiconductor Engineering (ASX, 2311.TW) shares added

1.5% to $4.86 as HSBC raised its stock-investment rating on the

company to overweight form neutral and upped its price target.

Fubon also raised its price target citing Advanced Semiconductor's

better-than-expected first-quarter revenue guidance.

Taiwan Semiconductor Manufacturing Co. Ltd. (TSM, 2330.TW) also

rose 2% to $14.11.

The Latin American index rose 1.5% to 381.15 and the emerging

markets index added 1.4% to 314.08.

An increase in international oil prices boosted shares of

petroleum companies. Brazilian energy giant Petroleo Brasileiro SA

(PBR, PETR4.BR), or Petrobras, gained 1.9% to $30.14.

Companhia Energetica de Minas Gerais (CIG, CMIG4.BR), Brazil's

third-biggest electric utility, signed an agreement Monday to

supply steelmaker Gerdau SA (GGB, GGBR4.BR) with power through

2021. Shares of Cemig, as the generator and distributor is known,

climbed 1.1% to $22. It said it will supply power for Gerdau's

facilities in southeastern and southern Brazil.

Argentine real-estate development group Inversiones y

Representaciones SA (IRS, IRSA.BA) posted a profit of 127 million

pesos ($30 million) during the second quarter accounting period

ending Dec. 31, up 11.4% on the year, the company reported Monday.

IRSA's shares jumped 1.4% to $10.62 as its profit was up sharply

from the gain it posted during the first quarter.

-By Corrie Driebusch, Dow Jones Newswires; 212-416-2143;

corrie.driebusch@dowjones.com

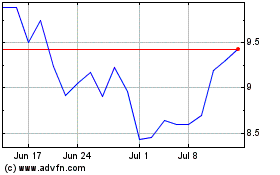

IRSA Inversiones and Rep... (NYSE:IRS)

Historical Stock Chart

From Mar 2024 to Apr 2024

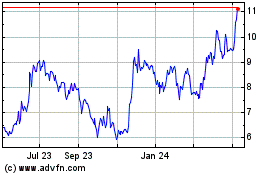

IRSA Inversiones and Rep... (NYSE:IRS)

Historical Stock Chart

From Apr 2023 to Apr 2024