ING to Cut 7,000 Jobs in Cost-Savings Drive

October 03 2016 - 3:50AM

Dow Jones News

AMSTERDAM—ING Groep NV on Monday became the latest European

lender to announce a new round of layoffs and restructuring as it

seeks to slash costs and invest in digital services.

The Netherlands' largest bank by assets said it would scrap

around 7,000 jobs in the next couple of years in an attempt to

reduce annual costs by €900 million ($1.01 billion) by 2021. The

cuts represent around 13% of the bank's global workforce and will

primarily affect employees in Belgium and the Netherlands, ING

said.

The plans were unveiled as part of a wider overhaul in which ING

aims to converge its banking operations in Europe toward one

digital platform. It said it would invest €800 million to improve

its digital services.

The measures came along with new financial targets for 2020 that

were more cautious than the previous ones.

ING reiterated its target of achieving a core capital ratio of

more than 12.5% and a leverage ratio of more than 4%. But it said

it would not update its target for a return on equity, a key

measure of profitability, due to "continuing regulatory

uncertainty." The bank currently targets a return of 10% to

13%.

Write to Maarten van Tartwijk at maarten.vantartwijk@wsj.com

(END) Dow Jones Newswires

October 03, 2016 03:35 ET (07:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

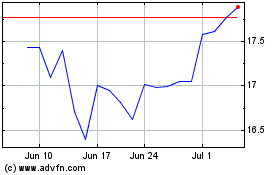

ING Groep NV (NYSE:ING)

Historical Stock Chart

From Mar 2024 to Apr 2024

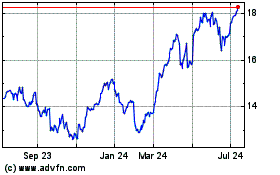

ING Groep NV (NYSE:ING)

Historical Stock Chart

From Apr 2023 to Apr 2024