ING Profit Jumps as Lending Grows -- Update

August 03 2016 - 7:22AM

Dow Jones News

By Maarten van Tartwijk

AMSTERDAM-- ING Groep NV on Wednesday said its second-quarter

net profit soared as the Dutch bank expanded its loan book and kept

margins stable despite pressure from record low interest rates.

The Amsterdam-based bank, the Netherlands' largest lender by

assets, said net profit was EUR1.3 billion ($1.46 billion) in the

three months to the end of June, up from EUR358 million in the same

period a year earlier. Underlying net profit, which excludes asset

disposals, rose 27% to EUR1.4 billion, beating market

expectations.

The bank's shares rose 8% following the results.

ING said its latest results were lifted by the strong growth of

its loan book, which expanded by EUR14.8 billion in the quarter, as

well as improved performance at its financial-markets division and

a drop in loan-loss provisions.

The bank' underlying interest margin, the difference between the

rate at which it borrows and lends, remained relatively stable

despite ultralow interest rates. It was 1.50% compared with 1.43%

last year and 1.51% in the previous quarter, and ING said it

expects it to stay at these levels in the coming quarters.

European bank shares have been hit hard in recent months, in

part because of concerns that historically low interest rates and

more stringent regulations will eat into their profitability. ING's

shares have fallen more than 20% since the start of 2016 and by

around 40% in the past year.

ING, one of Europe's largest savings banks, with EUR452 billion

in retail client deposits, has been able to protect margins by

slashing rates on savings accounts and charging fees on large

corporate deposits. The bank has also shifted its focus from

mortgages to higher-yielding consumer and business loans.

Chief Executive Ralph Hamers said cost-savings and customer

growth also contributed to the strong performance. "Our goal to

restructure, invest and focus on digital services is paying off,"

he said. "The only way to counter [low rates] is to have a sound

business."

Overall, net interest income was EUR3.3 billion, representing a

5.3% increase from last year and a 0.6% rise from the previous

quarter.

The results were further boosted by a EUR200 million gain on the

sale of its stake in Visa Europe, offsetting a EUR137 million

provision linked to a scandal in the Netherlands involving

mis-selling of interest-rate derivatives.

ING said it would declare an interim dividend of EUR0.24 a

share, unchanged from the previous year.

Write to Maarten van Tartwijk at maarten.vantartwijk@wsj.com

(END) Dow Jones Newswires

August 03, 2016 07:07 ET (11:07 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

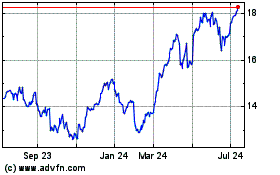

ING Groep NV (NYSE:ING)

Historical Stock Chart

From Mar 2024 to Apr 2024

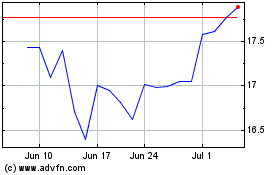

ING Groep NV (NYSE:ING)

Historical Stock Chart

From Apr 2023 to Apr 2024