ING's Profit Beats Expectations -- Update

February 04 2016 - 4:29AM

Dow Jones News

By Maarten van Tartwijk

Dutch bank ING Groep NV Thursday posted a higher-than-expected

rise in fourth-quarter earnings, but hinted at a more cautious

dividend policy in light of new capital requirements.

ING said underlying pretax profit, which excludes special items

and divestments, was EUR1.2 billion ($1.3 billion) in the last

three months of 2015, a 54% rise compared with the same period last

year.

The bank said it would propose a final dividend of EUR0.41 a

share.

Shares in ING jumped more than 6.5% in Amsterdam in early

trading, even as the dividend came in slightly below

expectations.

ING's dividend was in focus as it faces new capital requirements

from the Dutch banking regulator. The Dutch central bank requires

large lenders to build up a so-called systemic risk buffer in the

coming years as a potential safeguard against future taxpayer

bailouts. As a result, ING must have a common-equity Tier 1 ratio,

a measure of core capital, of at least 12.5% by 2019.

Many analysts had already slashed their dividend forecasts in

recent weeks on concerns that the new requirements would force ING

to take a more prudent approach on payouts, despite its large pile

of excess capital.

Chief Executive Ralph Hamers said ING seeks to have a capital

position in excess of the requirements and that the bank aims to

"pay a progressive dividend over time." The bank has previously

promised a dividend ratio of at least 40% of net profit.

The results come as ING is in the final stages of divesting its

insurance business, which is part of a wider strategic overhaul

implemented after the bank received a government bailout during the

financial crisis. Last year, ING sold its remaining shares in U.S.

insurer Voya Financial Inc. and it still has stake of around 14% in

Dutch insurer NN Group NV.

ING reported a net profit of EUR819 million, a 30% drop compared

with last year when the results still included the income of its

insurance businesses. The latest results benefited from a strong

performance of ING's retail and wholesale divisions, which both

reported a rise in income, while loan-loss provisions fell.

Write to Maarten van Tartwijk at maarten.vantartwijk@wsj.com

(END) Dow Jones Newswires

February 04, 2016 04:14 ET (09:14 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

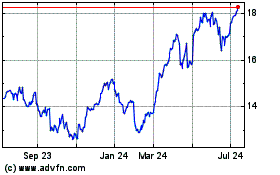

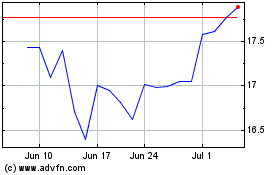

ING Groep NV (NYSE:ING)

Historical Stock Chart

From Mar 2024 to Apr 2024

ING Groep NV (NYSE:ING)

Historical Stock Chart

From Apr 2023 to Apr 2024