Chinese Exports Post Biggest Decline Since 2009

January 13 2016 - 12:20AM

Dow Jones News

By Mark Magnier

BEIJING--Chinese exports declined for the year, marking their

worst performance since 2009, as weak demand continued to weigh on

the world's second-largest economy.

Exports, however, fell less than expected in December thanks to

a favorable comparison with year-earlier figures. The improved

monthly results don't signal a major recovery this year despite a

weaker yuan, economists said.

"In the next few months, the comparative price effect will fade

out and export growth will recover," ING Group economist Tim Condon

said. "But it's not going to be as strong as in 2013 or 2014."

According to the General Administration of Customs, China's

exports fell 1.4% in December in dollar terms from a year earlier,

after a drop of 6.8% in November. This was a more modest decline

than the 8.0% fall forecast by 15 economists surveyed by The Wall

Street Journal. In yuan terms, exports rose last month. Imports

last month fell 7.6% from a year earlier, compared with an 8.7%

decline in November.

The country's trade surplus widened to $60.1 billion in December

from $54.1 billion in November. Last year's weak Chinese exports

and even weaker imports led to a record $594.5 billion annual trade

surplus, compared with $382.5 billion in 2014, the agency said, as

full-year exports fell 2.8% and imports fell 14.1%.

Despite the decline in exports last year, the Asian giant

managed to increase its share of global trade.

"China's declining exports in 2015 were mainly due to sluggish

external demand on the back of slowing global economic recovery

since the financial crisis," Customs spokesman Huang Songping told

reporters Wednesday. "But China's export performance is better than

other major economies in the world."

Few economists see a huge export turnaround ahead, however, with

exports no longer as important for China as they used to be.

December's improved outbound data may reflect a one-time boost as

companies rushed to meet year-end orders. While business sentiment

in Germany picked up recently, confidence surveys in the U.S. have

weakened. And on the import side, domestic demand and global

commodity prices remain weak.

"Demand may not be a big driver," said Standard Chartered Bank

economist Ding Shuang.

Rong Zhaoxia, a saleswoman with Jiangmen, Guangdong-based

Bonanza Metalware Ltd., which sells stainless steel kitchenware to

Europe and Australia, said the company's export shipments fell in

2015 from 2014 levels, with the decline accelerating in the fourth

quarter. Despite tougher conditions, the company doesn't expect to

lay off any of its 200 or so workers, she said, although it may

lose some through attrition.

"The world economy is not good, and both Europe and Australia

are declining," she said. "Our contracts dropped in number terms

and our sales in 2015 declined over 2014."

Mr. Huang of the customs agency said Beijing will keep a close

eye on the yuan's movement. China has seen a significant

depreciation in the yuan in recent weeks as the central bank

introduces more flexibility into the currency trading system,

leading to a 1.5% depreciation over the past week--its sharpest

weekly decline since August. A depreciating currency tends to makes

exports less expensive when purchased overseas.

Shipping companies said the weaker yuan should spur outbound

trade flows. "Chinese exporters often tell us that with rising

costs in China, it is a battle to stay competitive

internationally," said Tim Smith, North Asia chief representative

with shipping company Maersk Group Ltd. "Export trade performance

was relatively weak in 2016, and anything that gives exports a

boost is welcome."

Ms. Rong said the yuan's recent slide isn't a huge factor for

her company, which generally fixes prices months in advance,

although it should provide more modest opportunity for discounting

moving forward. She said she expects the yuan to depreciate to

around 6.9 yuan to the dollar this year--it is currently trading

around 6.57--adding that she hopes the downward slide is gradual

since volatility tends to hurt their business.

While the International Monetary Fund recently said that China's

currency was fairly valued, China's large annual surplus could

become a U.S. political issue this year, particularly if Republican

presidential candidate Donald Trump does well, economists said.

"He's already lashed out and said we're losing everything to

China," said ING's Mr. Condon. "If he's the Republican presidential

candidate, I suspect there will be more saber rattling on

that."

Grace Zhu and Liyan Qi contributed to this article.

Write to Mark Magnier at mark.magnier@wsj.com

(END) Dow Jones Newswires

January 13, 2016 00:05 ET (05:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

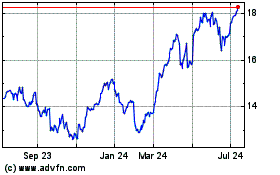

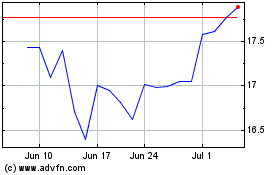

ING Groep NV (NYSE:ING)

Historical Stock Chart

From Mar 2024 to Apr 2024

ING Groep NV (NYSE:ING)

Historical Stock Chart

From Apr 2023 to Apr 2024