UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For 6 April, 2015

Commission File Number 1-14642

ING Groep

N.V.

Bijlmerplein 888

1102

MG Amsterdam

The Netherlands

Indicate by

check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T rule 101(b)(7): ¨

THIS REPORT ON FORM 6-K (EXCEPT FOR THE ISSUER RATINGS AND

EXPECTED SECURITIES RATINGS SPECIFIED ON PAGES 1 AND 16 OF THE INVESTOR PRESENTATION CONTAINED IN EXHIBIT 99.1 HERETO) SHALL BE DEEMED TO BE INCORPORATED BY REFERENCE IN THE REGISTRATION STATEMENT ON FORM F-3 (FILE NO. 333- 202880) OF ING GROEP N.V.

AND TO BE A PART THEREOF FROM THE DATE ON WHICH THIS REPORT IS FURNISHED, TO THE EXTENT NOT SUPERSEDED BY DOCUMENTS OR REPORTS SUBSEQUENTLY FILED OR FURNISHED.

This Report contains the following:

|

|

|

| Exhibit

No. |

|

|

|

|

99.1

|

|

Investor Presentation in connection with Perpetual Additional Tier 1 Contingent Convertible Capital Securities (April 2015) |

|

|

99.2

|

|

Update to certain legal proceeding disclosures in ING Groep N.V.’s annual report on Form 20-F for the year ended December 31, 2014 filed with the U.S. Securities and Exchange Commission on March 19, 2015 (the “2014 Form

20-F”) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

ING Groep N.V. |

|

|

(Registrant) |

|

|

| By: |

|

/s/ J.D. Wolvius |

| Name: Title: |

|

J.D. Wolvius Head of Capital

Management |

|

|

| By: |

|

/s/ N.R. Tambach |

| Name: Title: |

|

N.R. Tambach Group Controller |

Dated: 3 April, 2015

Exhibit 99.1

ING Group

Inaugural AT1 Roadshow

April 2015 www.ing.com

Executive summary

ING Group

ING Group restructuring and re-positioning as a Bank is virtually complete

FY14 phased-in CET1 ratio of 13.5%

ING Bank

ING Bank is the leading Retail and

Commercial Bank in the Benelux

We have organically built leading direct banks in Germany, Austria, Spain,

Italy, France and Australia….

…and strong positions in growth countries in Europe and Asia,

supported by a Commercial Bank active in 40 countries

The Bank is highly profitable with a healthy underlying

full year 2014 ROE of 9.9% (non-GAAP)*

NPLs remained well contained during the recent financial crisis

Ample liquidity with a full year 2014 buffer of EUR 183 billion liquid assets on a EUR 829 billion balance

sheet

AT1 transaction summary

Issuer: ING Groep N.V.

Structure: CRD IV / CRR

compliant Additional Tier 1 securities

Currency: USD (SEC registered)

Rationale: general corporate purposes and to further strengthen the regulatory capital base

Tranche: perpNC[ ] and perpNC[ ]

Loss absorption: variable equity conversion

7.0%

phased-in CET1 ratio trigger at ING Groep N.V. on a consolidated basis

Subject to Dutch Bail-In power

Expected ratings of AT1 securities

Ba2 by Moody’s and BB by Fitch

Buffer to

conversion trigger is EUR 21 billion as of 31 December 2014**

EUR 36 billion distributable items as of

31 December 2014

Except as otherwise indicated, all figures included in this document are presented on

the basis of International Financial Reporting Standards (“IFRS”) as adopted by the European Union (“IFRS-EU”). For more information on how IFRS-EU differs from IFRS as issued by the International Accounting Standards Board

(“IFRS-IASB”), see p. F-15 of our Annual Report on Form 20-F for the year ended 31 December 2014 (“2014 20-F”)

* FY 2014 ROE on an IFRS-EU basis w as 7.5%

**

Buffer to conversion trigger compared to the FY14 phased-in CET1 ratio adjusted for the sale of Voya and NN Group shares in 1Q15 (details on page 20). For a reconciliation of adjusted FY14 CET1 ratios to FY14 CET1 ratios see page 4

1

ING Group

2

ING Group – monetisation of NN Group still to be completed

ING Group plans to divest remaining Insurance stake before year-end 2016

Full divestment NN Group deadline—End 2016

NN Group 45% 55%

Voya Financial 100%

Insurance Asia 100%

Sold To be sold

Dutch State fully repaid in 2014 (in EUR bln)

3.5

Premiums and coupons

10.0 10.0 Nominal

Received Paid

Restructuring virtually completed

Dutch State has been completely repaid

Bank

divestments completed in 2013

Resolved sales of Asian Insurance activities in 2013 and US Insurance activities

in 2015

NN Group to be de-consolidated in 2015 and completely divested before year-end 2016

Behavioural constraints lifted at the earlier of NN Group deconsolidation or the end of 4Q15

Going forward, ING Group will consist of Banking operations only

3

ING Group phased-in CET1 in excess of ING Bank

Phased-in Common equity Tier 1 capital* (in EUR bln)

13.5% 13.9%

1.3

40.5 41.8

13.0% 11.2%

2.1

-5.0

38.8

33.3

Group CET1 FY14 Change due to sale FY14

phased-in Financial Group FY14 phased-in Bank CET1 FY14

of Voya and NN CET1 ratio Institutions

shareholders’ CET1 ratio

Group shares in adjusted for the deductions** equity*** adjusted for full

1Q15 sale of Voya and divestment of NN

NN Group shares Group shares

in 1Q15

All capital ratios are non-GAAP metrics,

except for unadjusted phased-in CET1 capital and CET1 ratio

* For a presentation of fully-loaded CET1 capital

and risk-weighted assets compared to phased-in CET1 capital and risk-weighted assets, see p. F-223 of the 2014 20-F

** Reversal of deduction from CET1 capital of investment in remaining shares of NN Group as non-consolidated financial institutions

*** Adjustments to reflect full divestment of NN Group stake. NN Group full divestment impact is calculated based on

figures disclosed for 4Q14 with the share price of EUR 24.84

Strong adjusted Group capital ratios

Sales of Voya and NN Group shares in 1Q15 added EUR 1.3 billion of phased-in Common equity Tier 1

FY14 phased-in CET1 ratio adjusted for the sale of Voya and NN Group shares in 1Q15 increased to 13.9%

ING Group’s FY14 phased-in CET1 ratio adjusted for full divestment of NN Group shares would be 13.0%

The excess capital of FY14 phased-in CET1 ratio adjusted for full divestment of NN Group shares over Bank CET1 capital

FY14 is ~ EUR 5.5 billion***

Over time, with the realisation of the complete divestment of our Insurance

operations, ING Group and ING Bank’s capital base and ratios are expected to converge

4

ING Group fully-loaded CET1 to increase from year-end 2014

Fully-loaded Common equity Tier 1 capital (non-GAAP*, in EUR bln)

10.5%

11.5%

3.0

31.5

34.4

Group CET1 FY14 Change due to sale FY14 fully-loaded

of Voya and NN

CET1 ratio

Group shares in

adjusted for the

1Q15

sale of Voya and

NN Group shares

in 1Q15

13.2% 11.4%

9.8

-5.0

39.2

33.7

Financial Group FY14 fully-loaded Bank CET1 FY14

Institutions shareholders’ CET1 ratio

deductions** equity*** adjusted for full

divestment of NN

Group shares

All capital ratios are non-GAAP

metrics, except for unadjusted phased-in CET1 capital and CET1 ratio

* For a presentation of fully-loaded CET1

capital and risk-weighted assets compared to phased-in CET1 capital and risk-weighted assets, see p. F-223 of the 2014 20-F

** Reversal of deduction from CET1 capital of investment in remaining shares of NN Group as non-consolidated financial institutions

*** Adjustments to reflect full divestment of NN Group stake. NN Group full divestment impact is calculated based on

figures disclosed for 4Q14 with the share price of EUR 24.84

Strong adjusted Group capital ratios

Sales of Voya and NN Group shares in 1Q15 added EUR 3.0 billion of fully-loaded common equity Tier 1

FY14 fully-loaded CET1 ratio adjusted for the sale of Voya and NN Group shares in 1Q15 increased to 11.5%

ING Group’s FY14 fully-loaded CET1 ratio adjusted for full divestment of NN Group shares would be 13.2%

The excess capital of FY14 fully-loaded CET1 ratio adjusted for full divestment of NN Group shares over Bank CET1 capital

FY14 is ~ EUR 5.5 billion***

Over time, with the realisation of the complete divestment of our Insurance

operations, ING Group and ING Bank’s capital base and ratios are expected to converge

5

ING Group consists primarily of Banking assets

Parent company balance sheet ING Group (in EUR bln, as at 31 December 2014)

Assets Liabilities

—ING Bank 38.1 Equity 50.4

- NN Group

(68%) 13.5 Anchor investors 0.7

- Other 0.1 Grandfathered Tier 1 instruments 6.6

Other subordinated loans 0.8

Investments in Group companies 51.7 Subordinated loans 8.1

—Debenture loans 5.4

- Receivables from

Group companies 11.6—Amounts owed to Group companies 0.1

- Other receivables, prepayments, accruals

0.6—Other amounts owed and accrued liabilities 1.4

- Available-for-sale equity investments Voya

1.6—Derivatives from Group companies 0.1

Other assets 13.8 Other liabilities 7.0

Total assets 65.5 Total liabilities and equity 65.5

Following the monetisation of Insurance activities, cash buffers are expected to increase

On-lent receivables from Group companies expected to be repaid

6

ING Bank

7

ING Bank has a growing and well diversified income base

Underlying income excluding Credit Value Adjustments/Debt Value Adjustments*

(non-GAAP, in EUR bln)

0.7

15.0

15.2

15.6

1.1 1.2 Other income (excl. CVA/DVA), investment

2.3 income and Corporate line interest results***

2.2 2.2

3.3 3.5 Commission income

3.7

Interest result Commercial Banking

8.5 9.1

8.0

Interest result Retail Banking

2012 2013 2014

ING Bank has steadily increased

income

Supported by strong NIM

development

Income is well diversified

in terms of geography and business

Geographic income distribution**

11%

Netherlands

35%

Belgium

22%

Germany

Rest of Europe

11%

Outside Europe

21%

Net Interest Margin (in bps)

151 132 142

2012 2013 2014

* CVA/DVA w as EUR -0.6 bln in 2012; EUR 0.1 bln in 2013; EUR -0.3 bln in 2014

** Excluding region Other (e.g. Corporate Line, RED and REIM)

*** Other income (excl. CVA/DVA), investment income and Corporate line interest results is a non-GAAP measure and is

adjusted from the equivalent IFRS-EU measure, for more information refer to p.1, paragraph 6 from the 2014 20-F

8

ING is disciplined on cost control

Expenses have

been relatively flat… (non-GAAP, in EUR bln)

Expenses adjusted and redundancy provisions

8.7 8.6 8.6 8.6

2011 2012 2013 2014

Costs have remained flat

despite higher regulatory costs, higher pension costs, inflation and net investments in future growth

.and we

will continue to remain disciplined on costs

In 2014, we have taken additional steps in digital banking, which

include IT investments primarily in 2015/16 (smaller investments in 2017), but this is expected to result in further efficiency gains thereafter

In addition, we will continue to selectively invest in our businesses for future growth

Cost savings (in EUR mln)

Target cost Target cost

Cost savings savings savings

Announced achieved by 2017 by 2018

Retail Banking

2011-13 354 480 480

NL 2014 195 260

ING Bank

Belgium 2012 105 160 160

Commercial 2012 203 315 315

Banking 2014 25 40

Total Bank 662 1,175 1,255

9

ING Bank has a low risk profile

ING Bank

additions to loan loss provisions (in bps of average RWA* / in EUR bln)

76 74 83

50 48 55

36

2.3 2.1 2.3

3 3 1.4 1.3 1.6

1.1

-

0.1 0.1 -

-

2006 2007 2008 2009 2010 2011 2012 2013 2014

Lending portfolio December 2014

12% Netherlands

39%

Belgium

17%

Germany

Rest of Europe

15% Outside Europe

17%

* Orange line being bps of average RWA

** Includes off -balance sheet positions

Credit

outstandings** December 2014

Residential mortgages

11% 3% Business lending

Benelux

17% Other retail lending

49%

9% Industry lending

11%

General lending &

transaction services

Other

ING Bank has a well diversified and collateralised loan book with a strong focus on own originated mortgages 69% of the

portfolio is retail based Commercial Bank showed solid results throughout the cycle

10

ING has generated significant amounts of capital

Strong increase in ING Bank CT1/CET1 capital ratios

Basel II Basel III – fully-loaded(non-GAAP)*

11.4%

9.6% 10.0%

7.8%

2009 2011 2013 2014

Limited impact Comprehensive

Assessment on phased-in CET1 (FY13, in %)

10.4% 11.4%

0.3% 1.4% 8.7%

8.4%

Comprehensive Asset Quality Review Stress

Test After CA Peer group Peer group—after CA

Assessment (CA)(AQR)

starting point

• ING Bank reported only one small loss since 2006

Capital generation driven by bank profitability, revaluation reserves and capital release through book gains on divestments ING comfortably passed the Comprehensive Assessment

(“CA”)

Total impact CET1 ratio of -172 bps -29 bps AQR

-143 bps Stress test

This compares favourably to -300 bps on average for all participating banks in the EBA CA (the peer group)

Source: European Banking Authority comprehensive assessment 2014

* Basel III phased-in CET1 ratio as of 31 December 2014 w as 11.2%. For a presentation of fully-loaded CET1 ratio compared to phased-in CET1 ratio, see p. F-223 of the 2014 20-F

11

ING Bank capital structure is strong

Common

equity Tier 1 ratio (fully-loaded) 31 December 2014 (non-GAAP)

11.4% 3.0% >10%

2.5%

4.5%

31/12/2014 Minimum CET1 Capital conservation

Systemic risk buffer CET1 ambition + buffers

requirement buffer

Leverage in line with ~4% target (non-GAAP, EUR bln)*

39 38

6

Additional Tier 1

34 Fully-loaded CET1

Leverage ambition

4.1% 4.0%

Total liabilities (31 December 2014, in %)

Customer deposits FV liabilities

Banks Equity

Professional funding Other liabilities

* The leverage exposure of 4.1% at the end of 2014 is calculated using the published IFRS-EU balance sheet, in w hich

notional cash pooling activities are netted, plus off-balance-sheet commitments In January 2015, the EC formally adopted the Delegated Act for the leverage ratio. The adjusted leverage ratio of ING Bank, taking into account the combined impact of

grossing up the notional cash pool activities and the alignment w ith the Delegated Act, is 3.6%. The leverage ratio is a CRD IV measure that w ill become effective in 2018 and is not yet implemented in Dutch law and regulations; accordingly, it is

a non-GAAP measure

12

ING has flexibility to comply with expected TLAC requirements*

Possible TLAC requirements (year-end 2014, fully loaded, in %)

CET1 Management Buffer

CET1 SRB 3.0%

CET1 Capital Conservation Buffer 2.5%

TLAC eligible instruments 8%

T2 ~2.0%

AT1 ~1.5%

CET1 Pillar 1 4.5%

Minimum total requirement

21.5%

Minimum Total Loss Absorbing Capacity 16%

Assumed TLAC Requirements

Additional TLAC 5%**

T2 3.2%

AT 1 1.9%*

CET 1 11.4%

ING Bank

The Financial Stability Board’s TLAC proposals

TLAC proposals not yet final.

Finalisation expected in November 2015

Assuming

TLAC requirements at 21.5% (including buffers), ING is well placed to meet requirements

TLAC versus funding

needs

ING Bank has EUR 66 billion of long-term professional funding maturing until the end of 2019

Given the amount of long-term debt maturing, ING has ample flexibility to comply with expected TLAC requirements including

the allowance of 2.5% for senior debt

Grandfathered loans will be replaced by CRD IV compliant hybrids in the

coming years. TLAC proposals are still subject to change.

Senior debt as a percentage of RWAs of 2.5% may be

allowable for bail-in purposes

13

Ambition 2017

ING Bank

Fully-loaded CET1 (CRD IV)*

Leverage**

C/I***

RoE**** (IFRS-EU equity)

Group dividend pay-out

2013 10.0% 3.9% 56.2% 9.0%

2014 11.4% 4.1% 55.1% 9.9%

40% of

4Q Group net profit

Ambition 2017

>10% ~4% 50-53% 10-13%

40% of annual Group net

profit

Guidance

We will aim to maintain a comfortable buffer above the minimum 10% to absorb regulatory changes and potential volatility

Aim to reach 50-53% cost/income ratio in 2016. Over time, improve further towards the lower-end of the range

Target dividend pay-out ³40% of ING Group’s annual net profit

Interim and final dividend; final may be increased with additional capital return

* 2013 is pro-forma for CRD IV (non-GAAP)

** Non-GAAP. The leverage exposure of 4.1% at the end of 2014 is calculated using the published IFRS-EU balance sheet, in which notional cash pooling activities are netted, plus

off-balance-sheet commitments.

In January 2015, the EC formally adopted the Delegated Act for the leverage

ratio. The pro-forma leverage ratio of ING Bank, taking into account the combined impact of grossing up the notional cash pool activities and the alignment with the Delegated Act, is 3.6%.

*** Non-GAAP. On an underlying basis, excluding CVA/DVA and redundancy costs **** Non-GAAP. On an underlying basis

14

Additional Tier 1 Issue

15

Summary terms ING AT1 issue

Issuer • ING

Groep N.V. (“Issuer”)

Issuer rating • A3 by Moody’s/A by Fitch/A- by S&P

Instrument • US$[ ]m Perpetual Additional Tier 1 Contingent Convertible Capital Securities (“Capital

Securities”)

Tranche • US$ perpetual NC[ ] and US$ perpetual NC[ ]

Loss Absorption mechanism • Full equity conversion upon occurrence of a Trigger Event, with a floor at US$9

Expected securities ratings • Ba2 by Moody’s and BB by Fitch

Ranking • Unsecured and subordinated

Currency • US$

Denomination/offering •

Denominations of US$200,000 and integral multiples of US$1,000 in excess thereof up to and including US$399,000

Coupon • [ ]% and [ ]%, semi-annually payable in arrear, reset at applicable First Call Date and every fifth

anniversary thereafter

Coupon cancellation • At the Issuer’s discretion. Mandatory cancellation upon

insufficient Distributable Items or if payment exceeds Maximum Distributable Amount

Issuer call • On or

after the applicable First Call Date and on any five-year anniversary thereof

Early Redemption Events •

Regulatory Event and Tax Event

Trigger Event for Principal Loss

Absorption • Phased-in CET1 Ratio of ING Groep N.V. has fallen below 7.0 per cent on a consolidated basis

Equity conversion • Equity conversion upon occurrence of a Trigger Event

• Application has been made to list the Capital Securities on the Global Exchange Market of the Irish Stock Exchange

and the Capital Securities will be

Listing & Governing Law governed by, and construed in accordance

with the laws of New York, except for subordination provisions and waiver of set-off provisions which shall be

governed by the laws of The Netherlands

Bail-in Power Acknowledgment • Investors acknowledge and agree to be bound by the exercise of the Dutch bail-in power by the relevant resolution authority in respect of the Capital

Securities

Risk Factors • Investors should read the risk factors in the preliminary prospectus supplement dated on or about April 6, 2015 relating to the Capital Securities and in the

2014 20-F

16

ING Group capital position ahead of regulatory requirements

ING Group’s FY14 CET1 ratios net of deductions adjusted for ING Group capital requirements Insurance sales of Voya and NN Group shares in 1Q15 (non-GAAP)

Current regulatory CET1 guidance level

13.5% 16.6% 16.6%

2.7% 3.1%

2.0% 2.0%

1.5% 10.5%

3.0%

13.9%

2.5% 11.5%

4.5%

ING Group’s current FY14 phased-in CET1 ratio of 13.9%, adjusted for the sale of Voya and NN Group shares in 1Q15, is

well in excess of 10.5% which we understand is expected to be the regulatory guidance level for the Group The FY14 fully-loaded CET1 ratio adjusted for full divestment of our remaining NN Group shares would be 13.2% We have not considered any other

potential regulatory buffers until further clarification from regulators

Future general regulatory FY14

phased-in CET1 ratio FY14 fully-loaded CET1

requirements plus AT1 and adjusted for the sale of ratio adjusted

for the sale

T2 Voya and NN Group of Voya and NN Group

shares in 1Q15 shares in 1Q15

CET1 Capital Conservation Buffer (CCB)

Systemic

Buffer Requirement (SIB) Additional Tier 1

Tier 2

Systemic Buffer Requirement and Capital Conservation Buffer need to be met by CET1

17

Distributable items amply cover coupon payments

ING Group—distributable items

AT1 distributions may only be paid out of distributable items

ING Group currently has EUR 36.2 billion of distributable items

As a multiple of FY14 coupon payments on Tier 1 capital, ING Group’s distributable items are 80x

No coupons on Tier 1 instruments were missed

During the financial crisis, ING stopped paying dividends on common shares in 2009

Coupon payments on Tier 1 instruments continued throughout the crisis

Distributions to shareholders in general will be subject to 15% Dutch dividend withholding tax

ING Group available distributable items (CRR/CRD IV)

ING Group (in EUR bln) 2014 2013

Share premium 16.0 16.0

Other reserves 21.6 23.3

Share of associate reserve 11.9 7.1

Non-distributable -13.7 -12.3

Total 35.8 34.1

Interest expenses on own fund instruments 0.5 0.6

Distributable items 36.2 34.7

18

Ample buffer to Maximum Distributable Amount (MDA)

CET1 buffer requirements (in %)

EUR 28.2 bln** Current level ING Group’s FY14 phased-in CET1 EUR 11.7 bln*

9.4% ratio adjusted for Insurances sales of Voya and NN 3.9%

group shares in 1Q15 of 13.9%

3.0%

2.3%

1.5%

0.8% 1.9% 2.5%

1.3%

0.6%

4.5% 4.5% 4.5% 4.5% 4.5%

2015 2016 2017 2018 2019

CET1 CET1—Capital Conservation Buffer CET1—Systemic Buffer Requirement

Headroom above MDA restriction levels

MDA

restrictions will apply if ING Group breaches the Combined Buffer Requirements (CBR)

CBR is phased-in from

2016 and to be completed by 2019

The current expected buffer to the 2019 MDA restriction level is EUR 12

billion*

The Group CET1 ratio is not expected to fall below the level for ING Bank post Insurance divestments

Therefore a strong buffer to MDA will remain in place as the Bank is managed to a CET1 > 10% plus a

comfortable buffer to absorb regulatory changes and potential volatility

* The buffer to MDA in 2019 is

calculated by subtracting 2019 combined CET1 requirements of 10% from the phased-in CET1 ratio adjusted for Insurances sales of Voya and NN group shares in 1Q15 of 13.9%, multiplied by phased-in RWA adjusted for Insurances sales of Voya and NN group

shares in 1Q15 of EUR 300.3 bln. If the regulator w ere to require certain pillar 2 requirements to be added to the CBR for MDA purposes, the buffer to MDA could be smaller

** The buffer to MDA in 2015 is calculated by subtracting 2015 CET1 requirements of 4.5% from the phased-in CET1 ratio adjusted for Insurances sales of Voya and NN group shares in 1Q15 of

13.9%, multiplied by phased-in RWA adjusted for Insurances sales of Voya and NN group shares in 1Q15 of EUR 300.3 bln

19

ING Group’s current buffer to conversion trigger is ~ EUR 21 billion

FY14 CET1 ratios including adjustments (non-GAAP, in EUR bln)

13.9% 13.0% 11.5%

Trigger

(7%)

21

18

14

21 21 21

FY14 phased-in CET1 ratio adjusted for

Insurances sales FY14 phased-in CET1 ratio adjusted for full divestment of FY14 fully-loaded CET1 ratio adjusted for Insurance sales of Voya and NN Group shares in 1Q15 Voya and NN Group shares of Voya and NN Group shares in 1Q15

7% capital Buffer to trigger

Buffer to conversion trigger

The ING Group

phased-in capital buffer of EUR 21 bln is high

This equals six times the annual Bank risk costs under EBA

adverse stress test 2014

In February 2015, ING announced its intention to reinstate dividend payments

Dividend policy

Our intention is to pay a minimum of 40% of ING Group’s annual net profits by way of dividend, with effect from 2015

Furthermore, at the end of each financial year, the Board will recommend whether to return additional capital to

shareholders dependent on financial, strategic and regulatory considerations

20

Important legal information

PRESENTATION OF

FINANCIAL INFORMATION

IFRS-EU

Unless otherwise indicated, all figures included in this document are presented on the basis of International Financial Reporting Standards (“IFRS”) as adopted by the European

Union (“IFRS-EU”). IFRS-EU differs from IFRS as issued by the International Accounting Standards Board (“IFRS-IASB”) as used in ING’s Annual Report on Form 20-F for the fiscal year ended December 31, 2014 (“2014

Form 20-F”). For more information on how IFRS-EU differs from IFRS-IASB, see page 3 of the 2014 Form 20-F and page F-15 of our consolidated financial statements in the 2014 Form 20-F. For a reconciliation of IFRS-EU and IFRS-IASB, see page F-15

of our consolidated financial statements in the 2014 Form 20-F.

Certain Non-GAAP Financial Measures

This document includes certain non-GAAP financial measures which are not measures of financial performance

under IFRS-IASB or IFRS-EU. ING believes these non-GAAP financial measures will enhance potential investors’ understanding of ING’s regulatory capital position, leverage position and/or financial performance, including:

Fully-loaded CET1 ratio: This ratio is calculated based on CRD IV on a fully-loaded (that is, fully phased-in) basis as it

will be in effect on 1 January 2019. For a presentation of fully-loaded CET1 capital and risk weighted assets compared to phased-in CET1 capital and risk weighted assets, see page F-223 of the 2014 Form 20-F.

Adjusted phased-in CET1 ratio and adjusted fully-loaded CET1 ratio: These ratios are calculated based on CRD IV on an

adjusted basis to reflect a full divestment by ING of its remaining equity ownership of Voya and NN Group. For a reconciliation of these adjustments to phased-in CET1 ratio and to fully-loaded CET1 ratio, see slides 4 and 5, respectively, of this

document.

Leverage ratio: The leverage ratio is a CRD IV measure that will become effective in 2018 and is not

yet implemented in Dutch law and regulations.

Underlying metrics, including underlying return on equity (ROE),

underlying income and underlying cost:income ratio: ING evaluates the results of its banking segments using a financial performance measure called underlying result. Underlying result was previously defined as result under IFRS-EU (continuing and

discontinuing operations) excluding the impact of divestments, special items and total net result from discontinued operations. As of 30 September 2014, ING Group’s ‘Underlying result’ was adjusted in order to better reflect the

performance of the Total banking business. Therefore, the remaining legacy insurance activities (included in ‘Insurance Other’ in its profit and loss account) as well as the intercompany eliminations between ING Bank and NN Group are no

longer included as part of ING Group’s underlying result. Special items include items of income or expense that are significant and arise from events or transactions that are distinct from the ordinary operating activities. Disclosures on

comparative periods also reflect the impact of current period’s divestments. For more information and for a reconciliation of underlying net result to the net result (presented in accordance with IFRS-IASB), see page 58 of our 2014 Form 20-F.

21

Important legal information

MARKETING

RESTRICTIONS

The Capital Securities described in this document are complex financial instruments and are not a

suitable or appropriate investment for all investors. In some jurisdictions, regulatory authorities have adopted or published laws, regulations or guidance with respect to the offer or sale of securities such as the Capital Securities to retail

investors.

In particular, in August 2014, the UK Financial Conduct Authority (the “FCA”) published

the Temporary Marketing Restriction (Contingent Convertible Securities) Instrument 2014 (as amended or replaced from time to time, the “TMR”) which took effect on October 1, 2014. Under the rules set out in the TMR (as amended or

replaced from time to time, the “TMR Rules”) certain contingent write-down or convertible securities, such as the Capital Securities, must not be sold to retail clients in the European Economic Area (“EEA”), and nothing may be

done that would or might result in the buying of such securities or the holding of a beneficial interest in such securities by a retail client in the EEA (in each case within the meaning of the TMR Rules), other than in accordance with the limited

exemptions set out in the TMR Rules.

Certain of the underwriters (or their affiliates) are subject to, and

required to comply with, the TMR Rules. By purchasing, or making or accepting an offer to purchase any Capital Securities from ING and/or the underwriters, you represent, warrant, agree with and undertake to ING and each of the underwriters that

(1) you are not a retail client in the EEA (as defined in the TMR Rules), (2) whether or not you are subject to the TMR Rules, you will not sell or offer the Capital Securities to retail clients in the EEA or do anything (including the

distribution of this document) that would or might result in the buying of the Capital Securities or the holding of a beneficial interest in the Capital Securities by a retail client in the EEA (in each case within the meaning of the TMR Rules),

other than (i) in relation to any sale or offer to sell the Capital Securities to a retail client in or resident in the United Kingdom, in any other circumstances that do not and will not give rise to a contravention of the TMR Rules by any

person and/or (ii) in relation to any sale or offer to sell the Capital Securities to a retail client in any EEA member state other than the United Kingdom, where (a) you have conducted an assessment and concluded that the relevant retail

client understands the risks of an investment in the Capital Securities and is able to bear the potential losses involved in an investment in the Capital Securities and (b) you have at all times acted in relation to such sale or offer in

compliance with the Markets in Financial Instruments Directive (2004/39/EC) (“MiFID”) to the extent it applies to you or, to the extent MiFID does not apply to you in a manner which would be in compliance with MiFID if it were to

apply to you; and (3) you will at all times comply with all applicable local laws, regulations and regulatory guidance (whether inside or outside the EEA) relating to sales of instruments such as the Capital Securities, including any such laws,

regulations and regulatory guidance relating to determining the appropriateness and/or suitability of an investment in the Capital Securities by investors in any relevant jurisdiction.

Where acting as agent on behalf of a disclosed or undisclosed client when purchasing, or making or accepting an offer to

purchase, any Capital Securities from ING and/or the underwriters the foregoing representations, warranties, agreements and undertakings will be given by and be binding upon both the agent and its underlying client.

For the avoidance of doubt, the restrictions described above do not affect the distribution of the Capital Securities in

jurisdictions outside of the EEA, including in the United States, provided that any distribution complies with the TMR Rules.

Any document relating to an offering of the Capital Securities will be prepared on the basis that any offer of the Capital Securities in any member state of the EEA which has implemented

Directive 2003/71/EC, as amended (including by Directive 2010/73/EU) (the “Prospectus Directive”), will be made pursuant to an exemption under the Prospectus Directive, as implemented in that member state, from the requirement to publish a

prospectus for offers of the Capital Securities.

22

Important legal information

NOTICES TO INVESTORS

Forward Looking Statements

Certain of the statements contained in this document are statements of future expectations and other forward-looking statements. These expectations are based on management’s current

views and assumptions and involve known and unknown risks and uncertainties. Actual results, performance or developments may differ materially from those expressed or implied by these forward looking statements, including factors that are outside

ING’s control. These factors include, but are not limited to: (i) changes in general economic conditions, in particular economic conditions in ING’s core markets; (ii) changes in performance of financial markets, including

developing markets; (iii) consequences of a potential (partial) break-up of the euro; (iv) the implementation of ING’s restructuring plan to separate banking and insurance operations; (v) changes in the availability of, and costs

associated with, sources of liquidity such as interbank funding, as well as conditions in the credit markets generally, including changes in borrower and counterparty creditworthiness; (vi) the frequency and severity of insured loss events;

changes affecting mortality and morbidity levels and trends; (vii) changes affecting persistency levels; (viii) changes affecting interest rate levels; (ix) changes affecting currency exchange rates; (x) changes in investor,

customer and policyholder behavior; (xi) changes in general competitive factors; (xii) changes in laws and regulations; (xiii) changes in the policies of governments and/or regulatory authorities; (xiv) conclusions with regard to

purchase accounting assumptions and methodologies; (xv) changes in ownership that could affect the future availability to us of net operating loss, net capital and built-in loss carry forwards; (xvi) changes in credit ratings;

(xvi) ING’s ability to achieve projected operational synergies or to successfully implement the Ambition 2017 program; and (xv) the other risks and uncertainties detailed in “Item 3. Key Information—Risk Factors” in the

2014 Form 20-F. Any forward-looking statements made by or on behalf of ING speak only as of the date they are made, and ING assumes no obligation to publicly update or revise any forward looking statements, whether as a result of new information or

for any other reason. You should, however, consult any additional disclosures that ING may make in any documents which it publishes and/or files with the U.S. Securities and Exchange Commission (“SEC”).

Additional risks and factors are identified in our filings with the SEC, including in the 2014 Form 20-F and in the

preliminary prospectus supplement relating to the Capital Securities dated on or about April

6, 2015 (the

“Preliminary Prospectus Supplement”), which are or will become available on the SEC’s website at http://www.sec.gov.

Risks Associated with the Capital Securities

Investing in the Capital Securities described in this document and in the Preliminary Prospectus Supplement involves

significant risks. You should reach your own investment decision only after consultation with your own financial and legal advisers about risks associated with an investment in the Capital Securities and the suitability of investing in the Capital

Securities in light of the particular characteristics and terms of the Capital Securities and of your particular financial circumstances. As part of making an investment decision, you should make sure you thoroughly understand the Capital

Securities’ terms, including (1) the provisions governing automatic conversion of the Capital Securities into ordinary shares of ING (including, in particular, the circumstances under which such conversion may occur), (2) the

agreement by you to be bound by the exercise of any Dutch Bail-In Power, (3) that interest is due and payable only at the sole discretion of ING and, in some circumstances, shall not be paid, and any such interest not paid shall be cancelled,

(4) that there is no scheduled repayment date for the principal of the Capital Securities, and (5) that the Capital Securities are not redeemable at the option or election of holders. You should also carefully consider the risk factors and

the other information contained in the Preliminary Prospectus Supplement, the accompanying prospectus, the 2014 Form 20-F, and the other information included and incorporated by reference in the Preliminary Prospectus Supplement and the accompanying

prospectus before deciding to invest in the Capital Securities.

23

Important legal information

NOTICES TO INVESTORS

(continued)

Notice to U.S. Persons

This document has been produced by ING solely for use at presentations held in connection with the offering of the Capital Securities, and may not be reproduced or redistributed, in whole

or in part, to any other persons. ING has filed a registration statement (including a prospectus) with the SEC on Form F-3 (File No. 333-202880) and has filed, or will file, the Preliminary Prospectus Supplement with the SEC for the offering of

the Capital Securities to which this document relates. Before you invest, you should read the prospectus in that registration statement, the Preliminary Prospectus Supplement relating to the offering of the Capital Securities (when filed) and other

documents that ING may file with the SEC for more complete information about ING and this offering. You may get these documents for free by searching the SEC online database (EDGAR®) at www.sec.gov. Alternatively, you may obtain a copy of the

prospectus and Preliminary Prospectus Supplement from ING Financial Markets LLC by calling toll-free at +1 (877) 446 4930

Notice to Persons in The Netherlands

The Capital

Securities may only be offered in The Netherlands to qualified investors as defined in the Dutch Financial Markets Supervision Act (Wet op het financieel toezicht).

Notice to Persons in the United Kingdom

This

document is for distribution only to persons who (i) have professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended, the

“Financial Promotion Order”), (ii) are persons falling within Article 49(2)(a) to (d) (“high net worth companies, unincorporated associations etc.”) of the Financial Promotion Order, (iii) are outside the United

Kingdom, or (iv) are persons to whom an invitation or inducement to engage in investment activity (within the meaning of Section 21 of the UK Financial Services and Markets Act 2000 (“FSMA”)) in connection with the issue or sale

of any securities may otherwise lawfully be communicated or caused to be communicated (all such persons together being referred to as “relevant persons”). This document is directed only at relevant persons and must not be acted on or

relied on by persons who are not relevant persons. Any investment or investment activity to which this document relates is available only to relevant persons and will be engaged in only with relevant persons.

Notice to Persons in Hong Kong

The Capital Securities may not be offered or sold in Hong Kong by means of any document other than (i) in circumstances which do not constitute an offer to the public within the

meaning of the Companies Ordinance (Cap.32, Laws of Hong Kong) or (ii) to “professional investors” within the meaning of the Securities and Futures Ordinance (Cap.571, The Laws of Hong Kong) and any rules made thereunder or

(iii) in other circumstances which do not result in the document being a “prospectus” within the meaning of the Companies Ordinance, and no advertisement, invitation or document relating to the Capital Securities may be issued or may

be in the possession of any person for the purpose of issue (in each case whether in Hong Kong or elsewhere), which is directed at, or the contents of which are likely to be accessed or read by, the public in Hong Kong (except if permitted to do so

under the laws of Hong Kong) other than with respect to Securities which are or are intended to be disposed of only to persons outside Hong Kong or only to “professional investors” within the meaning of the Securities and Futures Ordinance

and any rules made thereunder.

24

Important legal information

NOTICES TO INVESTORS

(continued)

Notice to Persons in Singapore

This document has not been registered as a prospectus with the Monetary Authority of Singapore. Accordingly, this document

and any other document or material in connection with the offer or sale, or invitation for subscription or purchase, of the Capital Securities may not be circulated or distributed, nor may the Capital Securities be offered or sold, or be made the

subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore other than (i) to an institutional investor under Section 274 of the Securities and Futures Act (Chapter 289) (the

“SFA”), (ii) to a relevant person, or any person pursuant to Section 275(1A), and in accordance with the conditions, specified in Section 275 of the SFA or (iii) otherwise pursuant to, and in accordance with the

conditions of, any other applicable provision of the SFA.

Where the Capital Securities are subscribed or

purchased under Section 275 of the Securities and Futures Act by a relevant person which is:

(a) a

corporation (which is not an accredited investor (as defined in Section 4A of the Securities and Futures Act)) the sole business of which is to hold investments and the entire share capital of which is owned by one or more individuals, each of

whom is an accredited investor; or

(b) a trust (where the trustee is not an accredited investor) whose sole

purpose is to hold investments and each beneficiary of the trust is an individual who is an accredited investor, then

“securities” (as defined in Section 239(1) of the Securities and Futures Act) of that corporation or the beneficiaries’ rights and interest (howsoever described) in

that trust shall not be transferrable for six months after that corporation or that trust has acquired the Capital Securities pursuant to an offer made under Section 275 of the Securities and Futures Act except:

(i) to an institutional investor under Section 274 of the SFA or to a relevant person defined in Section 275(2)

of the Securities and Futures Act, or to any person arising from an offer referred to in Section 275(1A) or Section 276(4)(i)(B) of the Securities and Futures Act;

(ii) where no consideration is or will be given for the transfer;

(iii) where the transfer is by operation of law;

(iv) as specified in Section 276(7) of the Securities and Futures Act; or

(v) as specified in Regulation 32 of the Securities and Futures (Offers of Investments) (Shares and Debentures)

Regulations 2005 of Singapore.

25

Important legal information

NOTICES TO INVESTORS

(continued)

Notice to Persons in Japan

The Capital Securities have not been and will not be registered under the Financial Instruments and Exchange Law of Japan

(Law No. 25 of 1919, as amended) (the “FIEL”) and, accordingly, will not be offered or sold, directly or indirectly, in Japan or to, or for the benefit of, any resident of Japan (which term as used herein means any person resident in

Japan, including any corporation or other entity organized under the laws of Japan), or to others for re-offering or resale, directly or indirectly, in Japan or to, or for the benefit of, a resident of Japan, except pursuant to an exemption from the

registration requirements of, and otherwise in compliance with, the FIEL and any other applicable laws, regulations and ministerial guidelines of Japan promulgated by relevant Japanese governmental or regulatory authorities in effect at the relevant

time.

Notice to Persons in Switzerland

This document, as well as any other material relating to the Capital Securities, including the Preliminary Prospectus

Supplement, which are the subject of the offering contemplated by this document, do not constitute an issue prospectus pursuant to Articles 652a and/or 1156 of the Swiss Code of Obligations. The Capital Securities will not be listed on the SIX Swiss

Exchange and, therefore, the documents relating to the Capital Securities, including, but not limited to, this document and the Preliminary Prospectus Supplement, do not claim to comply with the disclosure standards of the listing rules of the SIX

Swiss Exchange and corresponding prospectus schemes annexed to the listing rules of the SIX Swiss Exchange. The Capital Securities are being offered in Switzerland by way of a private placement, i.e. to a small number of selected investors only,

without any public offer and only to investors who do not purchase the Capital Securities with the intention to distribute them to the public. The investors will be individually approached by ING from time to time. This document and the Preliminary

Prospectus Supplement as well as any other material relating to the Capital Securities is personal and confidential and does not constitute an offer to any other person. This document may only be used by those investors to whom it has been handed

out in connection with the offering described herein and may neither directly nor indirectly be distributed or made available to other persons without the express consent of ING. It may not be used in connection with any other offer and shall in

particular not be copied and/or distributed to the public in (or from) Switzerland.

Notice to Persons in

Taiwan

The Securities cannot be offered, distributed, sold or resold to the public in Taiwan unless prior

approval from, or effective registration with, the Republic of China government authorities has been obtained pursuant to the applicable laws or a private placement exemption is available under the applicable securities laws.

Other Jurisdictions Outside the United States

No action may be taken in any jurisdiction other than the United States that would permit a public offering of the Capital Securities or the possession, circulation or distribution of this

document or the Preliminary Prospectus Supplement in any jurisdiction where action for that purpose is required. Accordingly, the Capital Securities may not be offered or sold, directly or indirectly, and neither this document, the Preliminary

Prospectus Supplement nor any other offering material or advertisements in connection with the Capital Securities may be distributed or published in or from any country or jurisdiction, except under circumstances that will result in compliance with

any applicable rules and regulations of any such country or jurisdiction.

26

Exhibit 99.2

Update to certain legal proceeding disclosures in ING Groep N.V.’s 2014 Form 20-F

In connection with the status of the purported class litigation alleging violations of the federal securities laws with respect to disclosures made in

connection with the 2007 and 2008 offerings of ING’s Perpetual Hybrid Capital Securities (as described in Item 8 (Financial information – Legal Proceedings, Consolidated Statements and Other Financial Information) of the 2014 Form

20-F), the U.S. Supreme Court on March 30, 2015 vacated the judgment of the Second Circuit and remanded the case back to the Second Circuit.

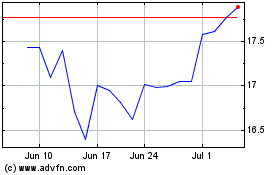

ING Groep NV (NYSE:ING)

Historical Stock Chart

From Mar 2024 to Apr 2024

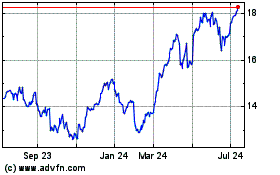

ING Groep NV (NYSE:ING)

Historical Stock Chart

From Apr 2023 to Apr 2024