Current Report Filing (8-k)

March 10 2015 - 6:02AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 9, 2015

INTERNATIONAL GAME TECHNOLOGY

(Exact Name of Registrant as Specified in its Charter)

|

Nevada |

|

001-10684 |

|

88-0173041 |

|

(State or Other Jurisdiction |

|

(Commission |

|

(I.R.S. Employer |

|

of Incorporation) |

|

File Number) |

|

Identification No.) |

6355 South Buffalo Drive

Las Vegas, Nevada 89113

(Address of Principal Executive Offices) (Zip Code)

(702) 669-7777

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

o Written communications pursuant to Rule 425 under the Securities Act (17 CFR 240.425)

o Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

o Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

o Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Item 5.04 Temporary Suspension of Trading Under Registrant’s Employee Benefit Plans.

As previously reported, on July 15, 2014, International Game Technology (“IGT”) entered into an Agreement and Plan of Merger (as amended by Amendment No. 1 thereto, the “Merger Agreement”) with GTECH S.p.A. (“GTECH”), GTECH Corporation (solely with respect to Section 5.02(a) and Article VIII), International Game Technology PLC (formerly known as Georgia Worldwide Limited and Georgia Worldwide PLC) (“Holdco”) and Georgia Worldwide Corporation. The transactions contemplated by the Merger Agreement (the “Transactions”) remain subject to U.K. court approval and other customary closing conditions set forth in the Merger Agreement, and are currently expected to close the week of April 5, 2015.

On March 9, 2015, the trustee of the IGT 401(k) Savings Plan (the “Plan”) notified IGT that, in connection with the closing of the Transactions, it intends to temporarily suspend certain transactions activity in or involving the IGT Company Stock Fund (the “Stock Fund”) under the Plan (each such period of temporary suspension, a “blackout period”). These blackout periods enable the trustee of the Plan to convert shares of IGT common stock held in the Stock Fund at the closing of the Transactions into a combination of cash and Holdco ordinary shares upon completion of the Transactions, in accordance with the terms and conditions of the Merger Agreement. During the blackout periods, participants will be unable to direct or diversify investments pertaining to, or obtain loans or distributions with respect to, their individual account balances held in the Stock Fund.

Based on the expected timing for the closing of the Transactions, the following blackout periods will apply:

· the restriction on distributions of in-kind shares of IGT common stock from the Stock Fund is expected to begin at 4:00pm Eastern Time on March 23, 2015 and end the week of April 12, 2015;

· the restriction on exchanges in or out, and on loans or distributions from, individual account balances invested in the Stock Fund is expected to begin the week of April 5, 2015 and end the week of April 12, 2015.

During the blackout periods and for a period of two years after the ending date of the blackout periods, a stockholder or other interested person may obtain, without charge, the actual beginning and ending dates of the blackout periods by sending a written request to International Game Technology, 6355 South Buffalo Drive; Las Vegas, Nevada 89113.

On March 9, 2015, IGT gave notice of the blackout periods to its directors and executive officers. Pursuant to Section 306(a) of Sarbanes-Oxley Act of 2002 and Regulation BTR promulgated under the Securities Exchange Act of 1934, as amended (“Regulation BTR”), IGT’s directors and executive officers are prohibited from directly or indirectly purchasing, selling or otherwise acquiring or transferring any shares of IGT common stock or other equity securities of IGT (including pursuant to options to acquire common stock and other derivative securities) during the blackout periods described above, subject to limited exceptions under Regulation BTR. This trading restriction bars directors and executive officers from trading within the Stock Fund as well as trading outside the Stock Fund. The description of the notice contained herein does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the notice, a copy of which is filed herewith as Exhibit 99.1 and is hereby incorporated by reference herein.

Any questions concerning the blackout period or the transactions affected by the blackout period should be addressed to the General Counsel at 702-669-7777 or by mail at International Game Technology, 6355 South Buffalo Drive, Las Vegas, Nevada 89113.

Cautionary Statement Regarding Forward Looking Statements

This Current Report on Form 8-K contains forward-looking statements (including within the meaning of the Private Securities Litigation Reform Act of 1995) concerning IGT, GTECH, Holdco, the proposed transactions and other matters. These statements may discuss goals, intentions and expectations as to future plans, trends, events, or otherwise, based on current beliefs of the management of IGT and GTECH as well as assumptions made by, and information currently available to, such management. These forward-looking statements are subject to various risks and uncertainties, many of which are outside the parties’ control. Therefore, you should not place undue reliance on such statements. Factors that could cause actual results to differ materially from those in the forward-looking statements include the possibility that the transaction will not close, including by any failure to satisfy any closing conditions to the proposed transactions or a termination of the Merger Agreement and other risks and uncertainties described in IGT’s Annual Report on Form 10-K, as amended, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other documents filed by IGT, GTECH and Holdco from time to time with the Securities and Exchange Commission. Except as required under applicable law, IGT does not assume any obligation to update these forward-looking statements.

2

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit |

|

|

|

Number |

|

Description |

|

|

|

|

|

99.1 |

|

Notice of Blackout Period to Directors and Executive Officers of International Game Technology, dated March 9, 2015. |

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

INTERNATIONAL GAME TECHNOLOGY |

|

|

|

|

|

|

|

|

|

|

By: |

/s/ Paul C. Gracey, Jr. |

|

Date: March 9, 2015 |

|

Paul C. Gracey, Jr. |

|

|

|

General Counsel and Secretary |

4

Exhibit 99.1

NOTICE OF BLACKOUT PERIOD

To: Directors and Executive Officers of International Game Technology

Re: Notice of Imposition of Blackout Period Pursuant to Section 306(a) of the Sarbanes-Oxley Act of 2002

Date: March 9, 2015

As you know, on July 15, 2014, International Game Technology (“IGT”) entered into an Agreement and Plan of Merger (as amended by Amendment No. 1 thereto, the “Merger Agreement”) with GTECH S.p.A. (“GTECH”), under which GTECH will merge into a holding company, International Game Technology PLC (formerly known as Georgia Worldwide Limited and Georgia Worldwide PLC) (“Holdco”), and IGT will become a wholly owned subsidiary of Holdco, subject to the terms and conditions of the Merger Agreement. The transactions contemplated by the Merger Agreement (the “Transactions”) remain subject to U.K. court approval and other customary closing conditions set forth in the Merger Agreement, and are currently expected to close the week of April 5, 2015.

As a result of the Transactions, the trustee of the IGT 401(k) Savings Plan (the “Plan”) notified IGT that, in connection with the closing of the Transactions, it intends to temporarily suspend certain transactions activity in or involving the IGT Company Stock Fund (the “Stock Fund”) under the Plan (each such period of temporary suspension, a “blackout period”). These blackout periods enable the trustee of the Plan to convert shares of IGT common stock held in the Stock Fund at the closing of the Transactions into a combination of cash and Holdco ordinary shares upon completion of the Transactions, in accordance with the terms and conditions of the Merger Agreement. During the blackout periods, participants will be unable to direct or diversify investments pertaining to, or obtain loans or distributions with respect to, their individual account balances held in the Stock Fund.

Based on the expected timing for the closing of the Transactions, the following blackout periods will apply:

· the restriction on distributions of in-kind shares of IGT common stock from the Stock Fund is expected to begin at 4:00pm Eastern Time on March 23, 2015 and end the week of April 12, 2015;

· the restriction on exchanges in or out, and on loans or distributions from, individual account balances invested in the Stock Fund is expected to begin the week of April 5, 2015 and end the week of April 12, 2015.

During the blackout periods, a director or executive officer may obtain, without charge, information as to whether the blackout period has begun or ended by contacting the General Counsel at 702-669-7777.

Pursuant to Section 306(a) of Sarbanes-Oxley Act of 2002 and Regulation BTR promulgated under the Securities Exchange Act of 1934, as amended (“Regulation BTR”), this notice is to inform you, as directors and executive officers of IGT, that commencing on April 5, 2015, you are prohibited from directly or indirectly purchasing, selling or otherwise acquiring or transferring any shares of IGT common stock or other equity securities of IGT, including pursuant to options to acquire common stock and other derivative securities, during the blackout periods described above. Securities acquired outside of an individual’s service as a director or executive officer (such as shares acquired when the person was an employee but not yet an executive officer) are not covered. However, if you hold both covered shares and non-covered shares, any shares that you sell will be presumed to come first from the covered shares unless you can identify the source of the sold shares and show that you use the same identification for all related purposes (such as tax reporting and disclosure requirements).

Given the complexity of these rules, you are urged to avoid any discretionary change in your beneficial ownership of IGT equity securities during the blackout periods. Even if you think an exception applies to you, we ask that you not trade ANY IGT security or derivative during the blackout periods, unless you have advance written permission from IGT’s General Counsel. Please note that Regulation BTR does not apply to any sale or other disposition of equity securities in connection with a merger, acquisition, divestiture, or similar transaction occurring by operation of law. Accordingly, Regulation BTR does not apply to the treatment of your IGT equity securities provided for in the Merger Agreement in the merger transaction by which IGT will become a subsidiary of Holdco.

If you have any questions concerning this notice, the blackout period or the transactions affected by the blackout period, please contact the General Counsel at 702-669-7777 or by mail at International Game Technology, 6355 South Buffalo Drive; Las Vegas, Nevada 89113.

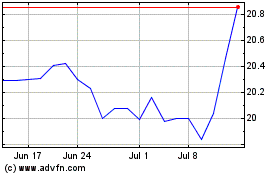

International Game Techn... (NYSE:IGT)

Historical Stock Chart

From Mar 2024 to Apr 2024

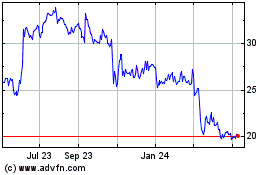

International Game Techn... (NYSE:IGT)

Historical Stock Chart

From Apr 2023 to Apr 2024