UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of the

Securities Exchange Act of 1934

June 12, 2015

Date of Report (Date of earliest event reported)

INTERNATIONAL

FLAVORS & FRAGRANCES INC.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| NEW YORK |

|

1-4858 |

|

13-1432060 |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

521 WEST 57th STREET

NEW YORK, NEW YORK 10019

(Address of Principal Executive Offices) (Zip Code)

(212) 765-5500

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01. |

Regulation FD Disclosure. |

On June 12, 2015, International Flavors &

Fragrances Inc. (the “Company”) issued a press release announcing that it had made a binding offer to purchase Lucas Meyer Cosmetics. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

On June 12, 2015, the Company made a binding offer for the

acquisition of Lucas Meyer Cosmetics, a business of Unipex Group. Lucas Meyer Cosmetics develops, manufactures and markets ingredients for the cosmetic and personal care industry. Lucas Meyer Cosmetics offers proprietary active ingredients,

functional ingredients and delivery systems which address health and wellness macro-trends in the beauty industry in both the developed and emerging markets. Under the terms of the offer, which includes exclusivity protection, the Company will pay

approximately 283 million Euros and will fund the acquisition from existing resources. The binding offer was made in order to consult with a French works council of the seller prior to entering into a definitive agreement.

| Item 9.01. |

Financial Statements and Exhibits. |

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press release dated June 12, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

INTERNATIONAL FLAVORS & FRAGRANCES INC. |

|

|

|

|

| Date: June 12, 2015 |

|

|

|

By: |

|

/s/ Richard A. O’Leary |

|

|

|

|

Name: |

|

Richard A. O’Leary |

|

|

|

|

Title: |

|

Interim Chief Financial Officer, Vice President and Controller |

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

Description |

|

|

| 99.1 |

|

Press release dated June 12, 2015. |

Exhibit 99.1

IFF to Expand into Cosmetics Ingredients

Makes Binding Offer for the Acquisition of Lucas Meyer Cosmetics

NEW YORK – June 12, 2015 – International Flavors & Fragrances Inc. (NYSE:IFF), a leading global creator of flavors and

fragrances for consumer products, today announced that it has made a binding offer for the acquisition of Lucas Meyer Cosmetics, a business of Unipex Group. The transaction is structured as a binding offer in order to allow the seller to consult

with its French works council prior to entering into the final purchase agreement. The acquisition is expected to close in the third quarter of 2015 and is subject to exclusivity protection.

Lucas Meyer Cosmetics, headquartered in Quebec City, Canada, with operations in France and Australia, develops, manufactures and markets innovative

ingredients for the cosmetics and personal care industry. The Company offers proprietary active ingredients, functional ingredients and delivery systems that address health and wellness macro-trends in the beauty industry in both the developed and

emerging markets.

“The addition of Lucas Meyer Cosmetics to the IFF portfolio aligns well with our strategic growth initiative to strengthen and

expand our portfolio,” said IFF Chairman and CEO Andreas Fibig. “The Company has a successful track record of delivering double-digit compounded annual sales growth since 2011 in a very attractive industry. We believe they will be an

excellent complement to our existing portfolio and will strengthen our ability to achieve our Vision 2020 goals of accelerated growth and increased differentiation.”

“This acquisition would combine our fragrance expertise, global commercial network, leadership in natural ingredients, and unique R&D pipeline with

Lucas Meyer Cosmetics’ research and cosmetics ingredients innovation,” added Nicolas Mirzayantz, Group President Fragrances. “This will strengthen our product offerings and enable IFF to be one of our customers’ partners of

choice in the very attractive skin care and hair care segment. We’re looking forward to welcoming Lucas Meyer Cosmetics’ employees to IFF.”

“We believe IFF is the preferred partner for Lucas Meyer Cosmetics’ future development while preserving the continuity of the world-class,

innovative and market-driven cosmetic ingredient expertise built over the years by our dedicated and loyal employees,” said Antonio Lara, Vice President and General Manager of Lucas Meyer Cosmetics.

Under the terms of the offer, IFF will pay approximately €283 million. The transaction, which will be funded from existing resources, is expected to add

revenues of approximately €40 million on an annualized basis.

Morgan Stanley & Co. is acting as financial advisor to IFF, and Cleary Gottlieb Steen &

Hamilton LLP is acting as legal advisor.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E

of the Securities Exchange Act of 1934, as amended, including IFF’s expectations and beliefs (i) that its binding offer will be accepted, (ii) regarding the timing of the closing of the acquisition; (iii) that the acquisition, if

consummated, will accelerate IFF’s growth and increase its differentiation, (iv) regarding the impact of the acquisition, if consummated, on IFF’s future financial and operational results including its future product offerings and

(v) regarding the future growth of the cosmetics and personal care industry and statements containing the words such as “anticipate,” “approximate,” “believe,” “plan,” “estimate,”

“expect,” “project,” “could,” “should,” “will,” “intend,” “may” and other similar expressions. Such forward-looking statements are inherently uncertain, and stockholders and other

potential investors must recognize that actual results may differ materially from IFF’s expectations as a result of a variety of factors, including, without limitation, the risks discussed below and those set forth in IFF’s Annual Report

on Form 10-K and its other filings with the Securities and Exchange Commission.

These statements involve risks and uncertainties related to IFF’s

acquisition of Lucas Meyer Cosmetics include, but are not limited to, (i) whether Lucas Meyer Cosmetics will accept the offer and execute a binding purchase agreement, (ii) the ability and willingness of both parties to satisfy the

conditions precedent and to close the transaction in the expected timeframe, (iii) the inability to obtain, or delays in obtaining, cost savings and synergies from the acquisition, (iv) costs and difficulties related to the integration of

Lucas Meyer Cosmetics with IFF businesses and operations, (v) unexpected costs or liabilities, resulting from the acquisitions, (vi) the inability to retain key personnel, (vi) potential adverse reactions, changes to business

relationships or competitive responses resulting from the acquisition, (vii) the ability of IFF to recognize the anticipated financial and operational benefits of the acquisition and (viii) other macroeconomic factors that could impact the

growth of the cosmetics and personal care industry.

IFF disclaims any obligation to update any such factors or to announce publicly the results of any

revisions to any of the forward-looking statements to reflect future events or developments.

About IFF

International Flavors & Fragrances Inc. (NYSE: IFF) is a leading global creator of flavors and fragrances used in a wide variety of consumer products.

Consumers experience these unique scents and tastes in fine fragrances and beauty care, detergents and household goods, as well as beverages, sweet goods and food products. IFF leverages its competitive advantages of consumer insight, research and

development, creative expertise and customer intimacy to provide customers with innovative and differentiated product offerings. A member of the S&P 500 Index, IFF has more than 6,200 employees working in 32 countries worldwide. For more

information, please visit our website at www.iff.com; follow us on Twitter and LinkedIn.

Contacts:

International Flavors & Fragrances Inc.

Michael

DeVeau

VP, Global Corporate Communications & Investor Relations

Michael.DeVeau@iff.com

212-708-7164

Denise Gillen

Manager, Fragrances Communications

Denise.Gillen@iff.com

212-515-7308

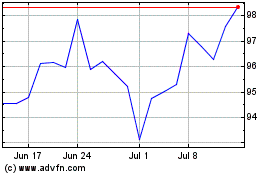

International Flavors an... (NYSE:IFF)

Historical Stock Chart

From Mar 2024 to Apr 2024

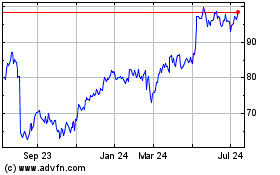

International Flavors an... (NYSE:IFF)

Historical Stock Chart

From Apr 2023 to Apr 2024