UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the

Registrant x

Filed by a party other than the

Registrant ¨

Check the appropriate box:

|

|

|

| ¨ |

|

Preliminary Proxy Statement |

|

|

| ¨ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

| x |

|

Definitive Proxy Statement |

|

|

| ¨ |

|

Definitive Additional Materials |

|

|

| ¨ |

|

Soliciting Material Pursuant to §240.14a-12 |

IDEX Corporation

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than The Registrant)

Payment of Filing Fee (Check the appropriate box):

|

|

|

|

|

|

|

| x |

|

No fee required. |

|

|

| ¨ |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|

|

|

|

|

(1) |

|

Title of each class of securities to which transaction applies:

|

|

|

(2) |

|

Aggregate number of securities to which transaction applies:

|

|

|

(3) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee

is calculated and state how it was determined):

|

|

|

(4) |

|

Proposed maximum aggregate value of transaction:

|

|

|

(5) |

|

Total fee paid:

|

|

|

| ¨ |

|

Fee paid previously with preliminary materials. |

|

|

| ¨ |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the

previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

|

|

|

(1) |

|

Amount Previously Paid:

|

|

|

(2) |

|

Form, Schedule or Registration Statement No.:

|

|

|

(3) |

|

Filing Party:

|

|

|

(4) |

|

Date Filed:

|

1925 West Field Court, Suite 200

Lake Forest, IL 60045

March 5, 2015

Dear Stockholder:

You are cordially invited to attend the Annual Meeting of Stockholders of

IDEX Corporation (the Company) which will be held on Wednesday, April 8, 2015, at 9:00 a.m. Central Time, at the Lincolnshire Marriott Resort, 10 Marriott Drive, Lincolnshire, Illinois 60069.

Details of the business to be conducted at the Annual Meeting are given in the attached Notice of Annual Meeting and Proxy Statement. Included with

the Proxy Statement is a copy of the Company’s 2014 Annual Report. We encourage you to read the Annual Report. It includes information on the Company’s operations, markets, products and services, as well as the Company’s audited

financial statements.

Whether or not you attend the Annual Meeting, it is important that your shares be represented and voted.

Therefore, we urge you to sign, date, and promptly return the accompanying proxy card in the enclosed envelope. Alternatively, you can vote over the telephone or the Internet as described on the proxy card. If you decide to attend the Annual

Meeting, you will be able to vote in person, even if you have previously submitted your proxy card, or voted by telephone or over the Internet.

On behalf of the Board of Directors, I would like to express our appreciation for your continued interest in the affairs of the Company. We look forward to seeing you at the Annual Meeting.

Sincerely,

ANDREW K. SILVERNAIL

Chairman of the Board, President and

Chief Executive Officer

IDEX CORPORATION

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

APRIL 8, 2015

To the Stockholders:

The Annual Meeting of Stockholders of IDEX Corporation (the Company) will be held on Wednesday, April 8, 2015, at 9:00 a.m. Central

Time, at the Lincolnshire Marriott Resort, 10 Marriott Drive, Lincolnshire, Illinois 60069, for the following purposes:

| |

1. |

To elect two directors, each for a term of three years. |

| |

2. |

To vote on a non-binding resolution to approve the compensation of the Company’s named executive officers. |

| |

3. |

To approve the Second Amended and Restated IDEX Corporation Incentive Award Plan. |

| |

4. |

To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for 2015. |

| |

5. |

To transact such other business as may properly come before the Annual Meeting. |

The Board of Directors fixed the close of business on February 10, 2015, as the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting.

You may obtain directions to the location of the Annual Meeting by visiting our website at www.idexcorp.com.

By Order of the Board of Directors

FRANK J. NOTARO

Senior Vice President, General Counsel

and Secretary

March 5, 2015

Lake Forest, Illinois

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON APRIL 8, 2015

The Proxy Statement and 2014 Annual Report of IDEX Corporation are available at:

http://phx.corporate-ir.net/phoenix.zhtml?c=83305&p=irol-reportsAnnual

PROXY STATEMENT

IDEX Corporation (the

Company or IDEX) has prepared this Proxy Statement in connection with the solicitation by the Company’s Board of Directors of proxies for the Annual Meeting of Stockholders to be held on Wednesday, April 8, 2015, at

9:00 a.m. Central Time, at the Lincolnshire Marriott Resort, 10 Marriott Drive, Lincolnshire, Illinois 60069 (the Annual Meeting). The Company commenced distribution of this Proxy Statement and the accompanying materials on March 5,

2015.

The Company will bear the costs of preparing and mailing this Proxy Statement and other costs of the proxy solicitation made by

the Board of Directors. Certain of the Company’s officers and employees may solicit the submission of proxies authorizing the voting of shares in accordance with the Board of Directors’ recommendations, but no additional remuneration will

be paid by the Company for the solicitation of those proxies. These solicitations may be made by personal interview, telephone, email or facsimile transmission. The Company has made arrangements with brokerage firms and other record holders of its

Common Stock for the forwarding of proxy solicitation materials to the beneficial owners of that stock. The Company will reimburse those brokerage firms and others for their reasonable out-of-pocket expenses in connection with this work. In

addition, the Company has engaged Morrow & Co., LLC, 470 West Ave., Stamford, Connecticut to assist in proxy solicitation and collection at a cost of $6,500, plus out-of-pocket expenses.

1

VOTING AT THE MEETING

The record of stockholders entitled to notice of, and to vote at, the Annual Meeting was taken as of the close of business on February 10, 2015, and each stockholder will be entitled to vote at the Annual

Meeting any shares of Common Stock held of record on that date. 78,298,528 shares of Common Stock were outstanding at the close of business on February 10, 2015. Each share entitles its holder of record to one vote on each matter upon

which votes are taken at the Annual Meeting. No other securities are entitled to be voted at the Annual Meeting.

A quorum of

stockholders is necessary to take action at the Annual Meeting. A majority of outstanding shares of Common Stock present in person or represented by proxy will constitute a quorum. The Company will appoint election inspectors to determine whether or

not a quorum is present, and to tabulate votes cast by proxy or in person. Under certain circumstances, a broker or other nominee may have discretionary authority to vote shares of Common Stock if instructions have not been received from the

beneficial owner or other person entitled to vote. The election inspectors will treat directions to withhold authority, abstentions and broker non-votes (which occur when a broker or other nominee holding shares for a beneficial owner does not vote

on a particular proposal because such broker or other nominee does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner) as present and entitled to vote for purposes of determining

the presence of a quorum for the transaction of business at the Annual Meeting. The following sets forth the voting procedures for each proposal at the Annual Meeting:

Proposal 1 — Election of Directors. Directors are elected by a plurality of the votes cast at the Annual Meeting; provided however, that the Company’s Corporate Governance Guidelines

provide for a “plurality plus” standard with respect to the election of directors, under which any nominee who receives a greater number of withhold votes than affirmative votes in an uncontested election is required to submit an offer of

resignation for consideration by the Nominating and Corporate Governance Committee of the Board of Directors, as more fully described under Proposal 1 — Election of Directors. Abstentions and broker non-votes will have no effect on the election

of directors.

Proposal 2 — Advisory Vote on Executive Compensation. Approval of the compensation of the Company’s

named executive officers will require the affirmative vote of a majority of shares present in person or represented by proxy and entitled to vote on the matter. Abstentions will have the effect of a vote against approval and broker non-votes will

have no effect on the vote.

Proposal 3 — Approval of the Second Amended and Restated IDEX Corporation Incentive Award Plan.

Approval of the Second Amended and Restated IDEX Corporation Incentive Award Plan will require the affirmative vote of a majority of shares cast on the matter. Abstentions will have the effect of a vote against approval and broker non-votes will

have no effect on the vote.

Proposal 4 — Ratification of Auditors. Approval of ratification of the auditors will

require the affirmative vote of a majority of shares present in person or represented by proxy and entitled to vote on the matter. Abstentions will have the effect of a vote against approval and broker non-votes will have no effect on the vote.

The Company requests that you mark the accompanying proxy card to indicate your votes, sign and date it, and return it to the Company in

the enclosed envelope, or vote by telephone or over the Internet as described on the proxy card. If you vote by telephone or over the Internet, you should not mail your proxy card. If your completed proxy card or telephone or Internet voting

instructions are received prior to the Annual Meeting, your shares will be voted in accordance with your voting instructions. If you sign and return your proxy card but do not give voting instructions, your shares will be voted FOR the election of

the Company’s nominees as directors, FOR approval of the compensation of the Company’s named executive officers, FOR approval of the Second Amended and Restated IDEX Corporation Incentive Award Plan, FOR approval of the ratification of the

appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for 2015, and in the discretion of the proxy holders as to any other business which may properly come before the Annual Meeting. Any

proxy solicited hereby may be revoked by the person or persons giving it at any time before it has been exercised at the Annual Meeting by giving notice of revocation to the Company in writing prior to the Annual Meeting. If you decide to attend the

Annual Meeting, you will be able to vote in person, even if you have previously submitted your proxy card, or voted by telephone or over the Internet. The Company requests that all such written notices of revocation be addressed to Frank J. Notaro,

Senior Vice President, General Counsel and Secretary, IDEX Corporation, 1925 West Field Court, Suite 200, Lake Forest, IL 60045.

2

PROPOSAL 1 — ELECTION OF DIRECTORS

The Company’s Restated Certificate of Incorporation, as amended, provides for a three-class Board, with one class being elected each year

for a term of three years. The Board of Directors currently consists of nine members, three of whom are Class II directors whose terms will expire at this year’s Annual Meeting, three of whom are Class III directors whose terms will

expire at the Annual Meeting to be held in 2016, and three of whom are Class I directors whose terms will expire at the Annual Meeting to be held in 2017. Mr. Bell, a Class I director, will retire and resign from the Board on the date of the

Annual Meeting. Mr. Tokarz, a Class II director, will not stand for election this year.

The Board of Directors has nominated two

individuals for election as Class II directors to serve for a three-year term expiring at the Annual Meeting to be held in 2018, or upon the election and qualification of their successors. The nominees of the Board of Directors are William M.

Cook and Cynthia J. Warner, each of whom is currently serving as a director of the Company. The nominees and the directors serving in Class III and Class I whose terms expire in future years and who will serve or continue to serve after

the Annual Meeting are listed below with brief statements setting forth their present principal occupations and other information, including any directorships in other public companies, and their particular experiences, qualifications, attributes

and skills that lead to the conclusion they should serve as a director.

If for any reason any of the nominees are unavailable to serve,

proxies solicited hereby may be voted for a substitute. The Board, however, expects the nominees to be available.

Under the

Company’s Corporate Governance Guidelines, any director nominee who receives a greater number of withhold votes than affirmative votes in an uncontested election is required to submit an offer of resignation for consideration by the Nominating

and Corporate Governance Committee of the Board of Directors within 90 days from the date of election. The Nominating and Corporate Governance Committee must then consider all of the relevant facts and circumstances and recommend to the Board of

Directors the action to be taken with respect to the offer of resignation.

3

The Company’s Board of Directors Recommends a Vote FOR

the Nominees in Class II Identified Below.

Nominees for Election

Class II: Nominees for Three-Year Term

|

|

|

| WILLIAM M. COOK |

|

Director since April 2008 |

| Chairman, President and Chief Executive Officer |

|

Age 61 |

| Donaldson Company, Inc. |

|

|

Mr. Cook has served as Chairman, President and Chief Executive Officer of Donaldson Company, Inc. since prior

to 2009. Effective as of April 1, 2015, Mr. Cook will retire as the President and Chief Executive Officer of Donaldson Company, Inc., but will continue to serve as its Chairman of the Board. Mr. Cook is a director of Donaldson Company

and Valspar Corporation.

Mr. Cook’s strong business and organizational leadership skills and his relevant experience in

technological industries led to the conclusion that he should serve on the Board of Directors. Mr. Cook is a 34-year veteran of Donaldson Company, a technology-driven global company that manufactures filtration systems designed to remove

contaminants from air and liquids. Throughout his career at Donaldson Company, Mr. Cook has served in several senior executive positions, and was elected as a director in 2004. Mr. Cook received a bachelor of science degree in business

administration and a master of business administration degree from Virginia Polytechnic Institute and State University.

Mr. Cook is

a member of the Audit Committee of the Board of Directors. Effective immediately following the Annual Meeting, Mr. Cook will become Lead Director of the Board of Directors.

|

|

|

| CYNTHIA J. WARNER |

|

Director since February 2013 |

| Executive Vice President, Strategy and Business Development |

|

Age 56 |

| Tesoro Companies, Inc. |

|

|

Ms. Warner has been Executive Vice President, Strategy and Business Development for Tesoro Companies, Inc.

since October 2014. From 2012 to 2014, Ms. Warner was Chairman and Chief Executive Officer of Sapphire Energy, Inc. From 2009 to 2011, Ms. Warner was Chairman and President of Sapphire Energy. Prior to 2009, Ms. Warner was Group Vice

President, Global Refining, BP plc.

Ms. Warner’s operating leadership skills, international experience and extensive

experience in the energy, refining and transportation industries led to the conclusion that she should serve on the Board of Directors. During her 25 years at BP and Amoco, Inc., Ms. Warner gained significant knowledge of the global energy

industry and served in numerous leadership roles, including overseeing BP’s Global Refining business and its Health Safety Security Environment, with a consistent record of success in coordinating the operations of thousands of employees across

BP’s global facilities. In her role as Chief Executive Officer of Sapphire Energy, an alternative energy venture, Ms. Warner had oversight responsibility for the raising of substantial investment capital and the successful completion of a

new demonstration facility for the company. Ms. Warner received a bachelor of engineering degree in chemical engineering from Vanderbilt University and a masters of business administration degree from Illinois Institute of Technology.

Ms. Warner is a member of the Compensation Committee and Nominating and Corporate Governance Committee of the Board of Directors.

4

Other Incumbent Directors

Class III: Three-Year Term Expires in 2016

|

|

|

| ERNEST J. MROZEK |

|

Director since July 2010 |

| Retired Vice Chairman and Chief Financial Officer |

|

Age 61 |

| The ServiceMaster Company |

|

|

Mr. Mrozek served as Vice Chairman and Chief Financial Officer of The ServiceMaster Company until his

retirement in March 2008. Mr. Mrozek is a director of G&K Services, Inc.

Mr. Mrozek’s strategic and operating

leadership skills, his extensive experience and expertise in the business services industry and his financial reporting expertise led to the conclusion that he should serve on the Board of Directors. Through over 20 years of executive

experience in various senior positions in general management, operations and finance at ServiceMaster, a residential and commercial service company, Mr. Mrozek developed extensive knowledge of the business services industry and gained valuable

financial expertise and experience in mergers and acquisitions. Prior to joining ServiceMaster in 1987, Mr. Mrozek spent 12 years in public accounting with Arthur Andersen & Co. Mr. Mrozek has also acquired substantial

experience in corporate governance as a director on the boards of several public and private companies. Mr. Mrozek received a bachelor of science degree in accountancy with honors from the University of Illinois and is a certified public

accountant.

Mr. Mrozek is Chairman of the Audit Committee of the Board of Directors.

|

|

|

| DAVID C. PARRY |

|

Director since December 2012 |

| Vice Chairman |

|

Age 61 |

| Illinois Tool Works Inc. |

|

|

Mr. Parry has served as Vice Chairman of Illinois Tool Works Inc. (ITW) since 2010. From prior to 2009 until

2010, Mr. Parry was Executive Vice President of ITW with responsibility for the Polymers and Fluids Group.

Mr. Parry’s

strategic and operating leadership skills and global commercial perspective gained from over 30 years of international business leadership experience, his significant acquisition experience and his extensive expertise in the industrial products

manufacturing industry led to the conclusion that he should serve on the Board of Directors. During 18 years of executive and management experience in various senior management positions at ITW, a multinational manufacturer of a diversified range of

industrial products and equipment, Mr. Parry has successfully grown the operations and profitability of multiple business units and helped ITW complete numerous acquisitions. Prior to joining ITW in 1994, Mr. Parry spent 17 years in

various executive and management positions at Imperial Chemical Industries, which at the time was one of the largest chemical producers in the world. Mr. Parry received a bachelor of science degree in chemistry, a master of science degree in

chemistry and a Ph.D. in polymer chemistry from Victoria University of Manchester, Manchester, England.

Mr. Parry is a member of

the Audit Committee of the Board of Directors. Effective immediately following the Annual Meeting, Mr. Parry will become Chairman of the Nominating and Corporate Governance Committee and a member of the Compensation Committee, and will cease to

be a member of the Audit Committee, of the Board of Directors.

5

|

|

|

| LIVINGSTON L. SATTERTHWAITE |

|

Director since April 2011 |

| President |

|

Age 54 |

| Cummins Power Generation Division |

|

|

Mr. Satterthwaite has served as President of Cummins Power Generation, a unit of Cummins, Inc., since June

2008.

Mr. Satterthwaite’s business leadership and sales skills, international experience and extensive experience in

industrial manufacturing led to the conclusion that he should serve on the Board of Directors. Since joining Cummins in 1988, Mr. Satterthwaite has held various positions at Cummins Power Generation and other divisions of Cummins, including 14

years in managerial and sales positions in the United Kingdom and Singapore. Prior to joining Cummins, Mr. Satterthwaite spent four years at Schlumberger Limited, an oilfield services provider, as a General Field Engineer.

Mr. Satterthwaite received a bachelor of science degree in civil engineering from Cornell University and a masters in business administration degree from Stanford University.

Mr. Satterthwaite is a member, and effective immediately following the Annual Meeting will become Chairman, of the Compensation Committee of

the Board of Directors.

Class I: Three-Year Term Expires in 2017

|

|

|

| GREGORY F. MILZCIK |

|

Director since April 2008 |

| Retired President and Chief Executive Officer |

|

Age 55 |

| Barnes Group Inc. |

|

|

Mr. Milzcik served as President and Chief Executive Officer of Barnes Group Inc. from prior to 2009 until his

retirement in 2013. Mr. Milzcik is a director of Kulicke & Soffa Industries Inc.

Mr. Milzcik’s business

leadership skills, his relevant experience in industrial manufacturing, his corporate governance and executive compensation training and his extensive technical and management education led to the conclusion that he should serve on the Board of

Directors. Through his executive experience at Barnes Group, Mr. Milzcik obtained a unique understanding of the industrial manufacturing business environment and gained exposure to and familiarity with IDEX’s customer base. In addition,

Mr. Milzcik gained experience with international commerce, government contracting, complex project management, intellectual property management and industry cyclicality, which enrich his perspective as a director of the Company.

Mr. Milzcik has acquired substantial training in corporate governance and executive compensation through his executive experience, board memberships and attendance at the Harvard Directors College, Stanford Directors College and ODX/Columbia

Director Education Program, and has been named a Board Leadership Fellow by the National Association of Corporate Directors. Mr. Milzcik received a bachelor of science degree in applied science and technology from Thomas Edison State College, a

master’s degree in management and administration from Cambridge College, a certificate of graduate studies in administration and management from Harvard University and a doctorate from Case Western Reserve University, with research focusing on

management systems in cyclical markets. Mr. Milzcik is a Certified Manufacturing Engineer through the Society of Manufacturing Engineers, and has an FAA Airframe and Power Plant License.

Mr. Milzcik is a member of the Audit Committee of the Board of Directors.

6

|

|

|

| ANDREW K. SILVERNAIL |

|

Director since August 2011 |

| Chairman, President and Chief Executive Officer |

|

Age 44 |

| IDEX Corporation |

|

|

Mr. Silvernail was appointed Chairman of the Board effective January 1, 2012. Mr. Silvernail has

served as President and Chief Executive Officer and a director of the Company since August 10, 2011. Prior to his appointment as President and Chief Executive Officer, Mr. Silvernail served since January 2011 as Vice President Group

Executive of the Company’s Health & Science Technologies, Global Dispensing and Fire & Safety/Diversified Products business segments. From February 2010 to December 2010, Mr. Silvernail was Vice President Group

Executive of the Company’s Health & Sciences Technologies and Global Dispensing business segments. Mr. Silvernail joined IDEX in January 2009 as Vice President Group Executive of Health & Science Technologies.

Mr. Silvernail is a director of Stryker Corporation.

Mr. Silvernail’s relevant experience with engineering and technology

industries in general, together with his extensive management experience led to the conclusion that he should serve on the Board of Directors. Mr. Silvernail received his bachelor of science degree in government from Dartmouth College and his

masters of business administration degree from Harvard University.

7

CORPORATE GOVERNANCE

Information Regarding the Board of Directors and Committees

The Board of Directors has the

ultimate authority for the management of the Company’s business. The Corporate Governance Guidelines, the charters of the Board committees, the Code of Business Conduct and Ethics, and the Standards for Director Independence, provide the

framework for the governance of the Company. The Corporate Governance Guidelines address matters such as composition, election of directors, size and retirement age for the Board, Board membership criteria, the role and responsibilities of the

Board, director compensation, share ownership guidelines, and the frequency of Board meetings (including meetings to be held without the presence of management). The Code of Business Conduct and Ethics sets forth the guiding principles of business

ethics and certain legal requirements applicable to all of the Company’s employees and directors. Copies of the current Corporate Governance Guidelines, the charters of the Board committees, the Code of Business Conduct and Ethics, and the

Standards for Director Independence are available under the Investor Relations links on the Company’s website at www.idexcorp.com.

The Board selects the Company’s executive officers, delegates responsibilities for the conduct of the Company’s operations to those

officers, and monitors their performance. Without limiting the generality of the foregoing, the Board of Directors oversees an annual assessment of enterprise risk exposure, and the management of such risk, conducted by the Company’s

executives. When assessing enterprise risk, the Board focuses on the achievement of organizational objectives, including strategic objectives, to improve long-term performance and enhance stockholder value. Direct oversight allows the Board to

assess management’s inclination for risk, to determine what constitutes an appropriate level of risk for the Company and to discuss with management the means by which to control risk. In addition, while the Board of Directors has the ultimate

oversight responsibility for the risk management process, the Audit Committee focuses on financial risk management and exposure, and legal compliance. The Audit Committee receives an annual risk assessment report from the Company’s internal

auditors and reviews and discusses the Company’s financial risk exposures and the steps management has taken to monitor, control and report those exposures.

The Company’s By-laws permit the Board to select its Chairman in the manner it determines to be most appropriate. The Corporate Governance Guidelines provide that, if the Chairman of the Board is not the Chief

Executive Officer, and is an independent director, there shall be no Lead Director. If the Chairman of the Board is the Chief Executive Officer or is not an independent director, the independent directors shall elect an independent Lead Director. In

connection with Mr. Silvernail’s appointment as Chairman, the Board appointed Michael T. Tokarz as Lead Director. Mr. Tokarz, a Class II director, is not standing for election this year. Effective immediately following the Annual

Meeting, William M. Cook will serve as Lead Director. The responsibilities of the Lead Director include:

| |

• |

|

Coordinating the activities of the independent directors; |

| |

• |

|

Reviewing the Board meeting agendas and providing the Chairman with input on the agendas; |

| |

• |

|

Preparing the agendas for executive session of the independent directors and chairing those sessions; |

| |

• |

|

Facilitating communications between the Chairman and other members of the Board; and |

| |

• |

|

Coordinating the performance evaluation of the Chief Executive Officer. |

The independent non-management directors of the Board meet separately as a group at every regularly scheduled Board meeting. The Lead Director

generally presides at these non-management executive sessions. During 2014, the Board held six meetings.

The Board believes that its

current leadership structure provides independent board leadership and engagement while deriving the benefit of having the CEO also serve as Chairman of the Board. The Chief Executive Officer, as the individual with primary responsibility for

managing the Company’s

8

day-to-day operations, is best positioned to chair regular Board meetings and to oversee discussion on business and strategic issues. Coupled with the existence of a Lead Director and regular

executive sessions of the non-management directors, this structure provides independent oversight, including risk oversight, while facilitating the exercise of the Board’s responsibilities.

The Board has adopted standards for determining whether a director is independent. These standards are based upon the listing standards of the New

York Stock Exchange and applicable laws and regulations, and are available on the Company’s website as described above. The Board also reviewed commercial relationships between the Company and organizations with which directors were affiliated

by service as an executive officer. The relationships with these organizations involved the Company’s sale or purchase of products or services in the ordinary course of business that were made on arm’s-length terms and other circumstances

that did not affect the relevant directors’ independence under applicable law and NYSE listing standards. The Board has affirmatively determined, based on these standards and after considering the relationship described immediately above, that

the following directors, two of whom are standing for election to the Board, are independent: Messrs. Cook, Milzcik, Mrozek, Parry and Satterthwaite, and Ms. Warner. The Board has also determined that Mr. Silvernail is not independent.

Mr. Silvernail is the Chairman of the Board, President and Chief Executive Officer of the Company. The Board has also determined that all Board standing committees are composed entirely of independent directors.

Important functions of the Board are performed by committees comprised of members of the Board. Subject to applicable provisions of the

Company’s By-laws and based on the recommendations of the Nominating and Corporate Governance Committee, the Board as a whole appoints the members of each committee each year at its first meeting. The Board may, at any time, appoint or remove

committee members or change the authority or responsibility delegated to any committee, subject to applicable law and NYSE listing standards. There are three standing committees of the Board: the Nominating and Corporate Governance Committee, the

Audit Committee, and the Compensation Committee. Each committee has a written charter that is available on the Company’s website as described above.

The Nominating and Corporate Governance Committee’s primary purpose and responsibilities are to: develop and recommend to the Board corporate governance principles and a code of business conduct and ethics;

develop and recommend criteria for selecting new directors; identify individuals qualified to become directors consistent with criteria approved by the Board, and recommend to the Board such individuals as nominees to the Board for its approval;

make recommendations to the Board regarding any director who submits an offer of resignation by reason of the plurality plus voting standard under the Company’s Corporate Governance Guidelines; screen and recommend to the Board individuals

qualified to become Chief Executive Officer and any other senior officer whom the committee may wish to approve; and oversee evaluations of the Board, individual Board members and Board committees. The members of the Nominating and Corporate

Governance Committee are Messrs. Bell and Tokarz, and Ms. Warner. Mr. Bell, a Class I director, will retire and resign from the Board effective immediately following the Annual Meeting. Mr. Tokarz, a Class II director, is

not standing for election this year. Effective immediately following the Annual Meeting, Messrs. Parry and Satterthwaite will become members of the Nominating and Corporate Governance Committee. During 2014, the Nominating and Corporate Governance

Committee held three meetings.

It is the policy of the Nominating and Corporate Governance Committee to consider nominees for the Board

recommended by the Company’s stockholders in accordance with the procedures described under “STOCKHOLDER PROPOSALS AND DIRECTOR NOMINATIONS FOR 2015 ANNUAL MEETING” below. Stockholder nominees who are nominated in accordance with

these procedures will be given the same consideration as nominees for director from other sources.

9

The Nominating and Corporate Governance Committee selects nominees for the Board who demonstrate the

following qualities:

Experience (in one or more of the following):

| |

• |

|

high-level leadership experience in business or administrative activities; |

| |

• |

|

specialized expertise in the industries in which the Company competes; |

| |

• |

|

breadth of knowledge about issues affecting the Company; and |

| |

• |

|

ability and willingness to contribute special competencies to Board activities. |

Personal attributes:

| |

• |

|

loyalty to the Company and concern for its success and welfare, and willingness to apply sound independent business judgment; |

| |

• |

|

awareness of a director’s vital part in the Company’s good corporate citizenship and corporate image; |

| |

• |

|

time available for meetings and consultation on Company matters; and |

| |

• |

|

willingness to assume fiduciary responsibilities. |

Qualified candidates for membership on the Board are identified and considered based on the qualities described above, without regard to race, color, religion, sex, ancestry, national origin or disability. In the

past, the Company has engaged executive search firms to help identify and facilitate the screening and interviewing of director candidates. After conducting an initial evaluation of a candidate, the Nominating and Corporate Governance Committee will

interview that candidate if it believes the candidate suitable to be a director. The Committee may also ask the candidate to meet with other members of the Board. If the Committee believes a candidate would be a valuable addition to the Board, it

will recommend to the full Board appointment or election of that candidate. Annually, the Nominating and Corporate Governance Committee reviews the qualifications and backgrounds of the directors, as well as the overall composition of the Board, and

recommends to the full Board the slate of directors for nomination for election at the annual meeting of stockholders.

The Audit

Committee’s primary duties and responsibilities are to: monitor the integrity of the Company’s financial reporting process and systems of internal control regarding finance, accounting and legal compliance; monitor the independence and

performance of the Company’s independent registered public accounting firm and monitor the performance of the Company’s internal audit and compliance functions; hire and fire the Company’s independent registered public accounting firm

and approve any audit and non-audit work performed by the independent registered public accounting firm; provide an avenue of communication among the independent registered public accounting firm, management and the Board; prepare the audit

committee report that Securities and Exchange Commission (SEC) rules require to be included in the Company’s annual proxy statement; and administer the Company’s Related Person Transactions Policy (see “Transactions With Related

Persons” below). The members of the Audit Committee are Messrs. Cook, Milzcik, Mrozek and Parry. Effective immediately following the Annual Meeting, Mr. Parry will cease to be a member of the Audit Committee. The Board has determined

that each of Messrs. Cook, Milzcik and Mrozek is an “audit committee financial expert,” as defined by SEC rules. During 2014, the Audit Committee held 10 meetings.

The Compensation Committee’s primary duties and responsibilities are to: establish the Company’s compensation philosophy and structure the

Company’s compensation programs to be consistent with that philosophy; establish the compensation of the Chief Executive Officer and other senior officers; develop and recommend to the Board compensation for the directors; and prepare the

10

compensation committee report the rules of the SEC require to be included in the Company’s annual proxy statement. The members of the Compensation Committee are Messrs. Bell,

Satterthwaite and Tokarz, and Ms. Warner. Mr. Bell, Class I director, will retire and resign from the Board effective immediately following the Annual Meeting. Mr. Tokarz, a Class II director, is not standing for election this year.

Effective immediately following the Annual Meeting, Mr. Parry will become a member of the Compensation Committee. During 2014, the Compensation Committee held four meetings.

To assist the Compensation Committee in discharging its responsibilities, the Compensation Committee retained Towers Watson to act as an outside

consultant. Towers Watson is engaged by, and reports directly to, the Compensation Committee. The Compensation Committee has reviewed the nature of the relationship between itself and Towers Watson, including all personal and business relationships

between the committee members, Towers Watson and the individual compensation consultants who provide advice to the Compensation Committee. Based on its review, the Compensation Committee did not identify any actual or potential conflicts of interest

in Towers Watson’s engagement as an independent consultant. Towers Watson works with the Compensation Committee and management to structure the Company’s compensation programs and evaluate the competitiveness of its executive compensation

levels. Towers Watson’s primary areas of assistance to the Compensation Committee are:

| |

• |

|

Analyzing market compensation data for all executive positions; |

| |

• |

|

Advising on the structure of the Company’s compensation programs; |

| |

• |

|

Advising on the terms of equity awards; |

| |

• |

|

Assessing the relationship between named executive officer compensation and Company financial performance; |

| |

• |

|

Reviewing the risk associated with the Company’s compensation programs; and |

| |

• |

|

Reviewing materials to be used in the Company’s proxy statement. |

Towers Watson periodically provides the Compensation Committee and management market data on a variety of compensation-related topics. The Compensation Committee authorized Towers Watson to interact with the

Company’s management, as needed, on behalf of the Compensation Committee, to obtain or confirm information.

During 2014, each

director attended more than 75% of the aggregate number of meetings of the Board and of committees of the Board of which he or she was a member. The Company encourages its directors to attend the annual meeting of stockholders but has no formal

policy with respect to that attendance. All of the directors attended the 2014 Annual Meeting of Stockholders.

Compensation Committee Interlocks and

Insider Participation

During 2014, Messrs. Bell, Milzcik, Satterthwaite and Tokarz, and Ms. Warner served as the members

of the Compensation Committee. Neither Mr. Bell, Mr. Milzcik, Mr. Satterthwaite, Mr. Tokarz, nor Ms. Warner (i) was an officer or employee of the Company or any of its subsidiaries during 2014, (ii) was formerly an

officer of the Company or any of its subsidiaries, or (iii) had any relationship requiring disclosure by the Company under Item 404 of Regulation S-K under the Securities Act of 1933, as amended. There were no relationships between

the Company’s executive officers and the members of the Compensation Committee that require disclosure under Item 407(e)(4) of Regulation S-K.

Transactions with Related Persons

The Board has adopted a written Related Person Transactions

Policy regarding the review, approval and ratification of transactions with related persons. All related person transactions are

11

approved by the Audit Committee. If the transaction involves a related person who is a director or immediate family member of a director, that director will not be included in the deliberations

regarding approval. In approving the transaction, the Audit Committee must determine that the transaction is fair and reasonable to the Company.

Compensation of Directors

The objectives of

our director compensation program are to attract highly-qualified individuals to serve on our Board of Directors and align our directors’ interests with the interests of our stockholders. The Compensation Committee reviews the program at least

annually to ensure that it continues to meet these objectives.

The Company believes that to attract and retain qualified directors, pay

levels should be targeted at the 50th percentile (or median) of pay levels for directors at comparable companies. From time to time, the Compensation Committee, with the assistance of Towers Watson, evaluates the competitiveness of director

compensation. The primary reference point for the determination of market pay is the peer group of companies used to benchmark the Company’s executive compensation. For further details on this topic, refer to “Market Benchmarking”

under “Compensation Process and Oversight” in the Compensation Discussion and Analysis below. Market composite data derived from pay surveys available to Towers Watson and to the Company is also used.

Our director compensation for 2014 was based on the following:

|

|

|

|

|

| Annual Retainer and Meeting Fees |

|

$ |

75,000 |

|

| Committee Chair Retainer |

|

|

|

|

| Audit Committee |

|

$ |

15,000 |

|

| Compensation Committee |

|

$ |

10,000 |

|

| Nominating and Corporate Governance Committee |

|

$ |

8,000 |

|

| Lead Director Fees |

|

|

|

|

| Annual Retainer |

|

$ |

15,000 |

|

| Annual Equity Grant |

|

$ |

15,000 |

|

| Restricted Stock |

|

|

100% of Value |

|

| Value of Equity Grants Upon Initial Election to the Board |

|

|

Pro-rated annual grant |

|

| Restricted Stock |

|

|

100% of Value |

|

| Value of Annual Equity Grants |

|

$ |

110,000 |

|

| Restricted Stock |

|

|

100% of Value |

|

Equity grants upon initial election to the Board are made on the date of appointment. Annual equity grants are made

on the first regularly scheduled meeting of the Board held each year. All grants are structured to provide 100% of the expected value in the form of restricted stock awards, and are made under the IDEX Corporation Incentive Award Plan (Incentive

Award Plan). The restricted stock vests in full on the earliest of the third anniversary of the grant, retirement, failure of the director to be re-elected to the Board, or a change in control of the Company. The restricted stock is non-transferable

until the recipient is no longer serving as a director, and is subject to forfeiture if the director terminates service as a director for reasons other than death, disability, retirement, or failure to be re-elected to the Board. Prior to 2014,

director equity grants were structured to provide approximately 50% of the expected value in the form of stock options and 50% of the expected value in the form of restricted stock awards. The Board transitioned the form of award to 100% restricted

stock in 2014. Beginning in 2015, directors will have the ability to defer payment of all or a portion of their annual equity grant.

12

Under the Company’s Directors Deferred Compensation Plan, directors are permitted to defer their

cash compensation as of the date their compensation would otherwise be payable. In general, directors must make elections to defer fees payable during a calendar year by the end of the preceding calendar year. Newly elected directors have up to 30

days to elect to defer future fees. All amounts deferred are recorded in a memorandum account for each director and are credited or debited with earnings or losses as if such amounts had been invested in an interest-bearing account or certain mutual

funds, at the option of the director. The deferred compensation credited to the interest-bearing account is adjusted on at least a quarterly basis with hypothetical earnings equal to the lesser of the Barclays Capital Long Term Bond AAA —

Corporate Bond Index as of the first business day in November of the calendar year preceding the year for which the earnings are to be credited or 120% of the long-term applicable federal rate (AFR) as of the first business day in November. In

accordance with SEC rules, no earnings on deferred compensation are shown in the Director Compensation table below because no “above market” rates were earned on deferred amounts in 2014. Directors must elect irrevocably to receive the

deferred funds either in a lump sum or in equal annual installments of up to 10 years, and to begin receiving distributions either at termination of Board service or at a future specified date. If a director should die before all amounts credited

under the Directors Deferred Compensation Plan have been paid, the unpaid balance in the participating director’s account will be paid to the director’s beneficiary. The memorandum accounts are not funded, and the right to receive future

payments of amounts recorded in these accounts is an unsecured claim against the Company’s general assets.

Non-management directors

are subject to stock ownership guidelines. Non-management directors must comply with the guidelines within five years of their initial election to the Board. The guidelines dictate that all non-management directors must purchase or acquire shares of

the Company’s Common Stock having an aggregate value at the time of purchase or acquisition equal to five times the annual retainer in effect upon their election to the Board. As of December 31, 2014, all directors were either in

compliance with the ownership guidelines or were proceeding towards meeting the ownership guidelines within the applicable five-year period.

The following table summarizes the total compensation earned in 2014 for the Company’s directors. Mr. Silvernail receives no additional compensation for his service as a director.

2014 Director Compensation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Name |

|

Fees Earned

or Paid in

Cash |

|

|

Stock

Awards(1)(2) |

|

|

All Other

Compensation(3) |

|

|

Total |

|

| Bradley J. Bell |

|

$ |

83,000 |

|

|

$ |

110,000 |

|

|

$ |

10,000 |

|

|

$ |

203,000 |

|

| William M. Cook |

|

|

75,000 |

|

|

|

110,000 |

|

|

|

10,000 |

|

|

|

195,000 |

|

| Gregory F. Milzcik |

|

|

75,000 |

|

|

|

110.000 |

|

|

|

10,000 |

|

|

|

195,000 |

|

| Ernest J. Mrozek |

|

|

90.000 |

|

|

|

110,000 |

|

|

|

10,000 |

|

|

|

210,000 |

|

| David C. Parry |

|

|

75,000 |

|

|

|

110,000 |

|

|

|

|

|

|

|

185,000 |

|

| Livingston L. Satterthwaite |

|

|

75,000 |

|

|

|

110,000 |

|

|

|

8,101 |

|

|

|

193,101 |

|

| Michael T. Tokarz |

|

|

100,000 |

|

|

|

125.000 |

|

|

|

10,000 |

|

|

|

235,000 |

|

| Cynthia J. Warner |

|

|

75,000 |

|

|

|

110,000 |

|

|

|

|

|

|

|

185,000 |

|

| (1) |

Reflects the aggregate grant date fair value in accordance with FASB ASC Topic 718 using the assumptions set forth in the footnotes to financial statements in the Company’s

Annual Report on Form 10-K for the year ended December 31, 2014, assuming no forfeitures. |

| (2) |

The following table provides information on the restricted stock and stock option awards held by the Company’s non-management directors and the value of those awards as of

December 31, 2014. All outstanding awards are in or exercisable for shares of the Company’s Common Stock. |

13

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Option Awards |

|

|

Stock Awards |

|

| |

|

Number of Securities

Underlying

Unexercised

Options |

|

|

Option

Exercise

Price |

|

|

Option

Expiration

Date |

|

|

Number of

Shares or

Units of

Stock that

Have Not

Vested(b) |

|

|

Market Value

of Shares or

Units

of Stock that

Have Not

Vested(c) |

|

| Name |

|

Exercisable(a) |

|

|

Unexercisable(a) |

|

|

|

|

|

| Bradley J. Bell |

|

|

6,750 |

|

|

|

0 |

|

|

$ |

25.70 |

|

|

|

02/02/2015 |

|

|

|

3,360 |

|

|

$ |

261,542 |

|

|

|

|

3,375 |

|

|

|

0 |

|

|

|

30.67 |

|

|

|

02/02/2016 |

|

|

|

|

|

|

|

|

|

|

|

|

3,375 |

|

|

|

0 |

|

|

|

33.99 |

|

|

|

02/12/2017 |

|

|

|

|

|

|

|

|

|

|

|

|

2,250 |

|

|

|

0 |

|

|

|

30.85 |

|

|

|

02/20/2018 |

|

|

|

|

|

|

|

|

|

|

|

|

2,250 |

|

|

|

0 |

|

|

|

19.98 |

|

|

|

02/24/2019 |

|

|

|

|

|

|

|

|

|

|

|

|

4,080 |

|

|

|

0 |

|

|

|

30.82 |

|

|

|

02/23/2020 |

|

|

|

|

|

|

|

|

|

|

|

|

3,190 |

|

|

|

0 |

|

|

|

40.89 |

|

|

|

02/22/2021 |

|

|

|

|

|

|

|

|

|

|

|

|

3,530 |

|

|

|

0 |

|

|

|

42.86 |

|

|

|

02/21/2022 |

|

|

|

|

|

|

|

|

|

|

|

|

3,075 |

|

|

|

0 |

|

|

|

50.45 |

|

|

|

02/15/2023 |

|

|

|

|

|

|

|

|

|

| William M. Cook |

|

|

3,375 |

|

|

|

0 |

|

|

|

32.95 |

|

|

|

04/08/2018 |

|

|

|

3,360 |

|

|

|

261,542 |

|

|

|

|

2,250 |

|

|

|

0 |

|

|

|

19.98 |

|

|

|

02/24/2019 |

|

|

|

|

|

|

|

|

|

|

|

|

4,080 |

|

|

|

0 |

|

|

|

30.82 |

|

|

|

02/23/2020 |

|

|

|

|

|

|

|

|

|

|

|

|

3,190 |

|

|

|

0 |

|

|

|

40.89 |

|

|

|

02/22/2021 |

|

|

|

|

|

|

|

|

|

|

|

|

3,530 |

|

|

|

0 |

|

|

|

42.86 |

|

|

|

02/21/2022 |

|

|

|

|

|

|

|

|

|

|

|

|

3,075 |

|

|

|

0 |

|

|

|

50.45 |

|

|

|

02/15/2023 |

|

|

|

|

|

|

|

|

|

| Gregory F. Milzcik |

|

|

3,375 |

|

|

|

0 |

|

|

|

32.95 |

|

|

|

04/08/2018 |

|

|

|

3,360 |

|

|

|

261,542 |

|

|

|

|

2,250 |

|

|

|

0 |

|

|

|

19.98 |

|

|

|

02/24/2019 |

|

|

|

|

|

|

|

|

|

|

|

|

4,080 |

|

|

|

0 |

|

|

|

30.82 |

|

|

|

02/23/2020 |

|

|

|

|

|

|

|

|

|

|

|

|

3,190 |

|

|

|

0 |

|

|

|

40.89 |

|

|

|

02/22/2021 |

|

|

|

|

|

|

|

|

|

|

|

|

3,530 |

|

|

|

0 |

|

|

|

42.86 |

|

|

|

02/21/2022 |

|

|

|

|

|

|

|

|

|

|

|

|

3,075 |

|

|

|

0 |

|

|

|

50.45 |

|

|

|

02/15/2023 |

|

|

|

|

|

|

|

|

|

| Ernest J. Mrozek |

|

|

6,650 |

|

|

|

0 |

|

|

|

28.20 |

|

|

|

07/01/2020 |

|

|

|

3,360 |

|

|

|

261,542 |

|

|

|

|

3,190 |

|

|

|

0 |

|

|

|

40.89 |

|

|

|

02/22/2021 |

|

|

|

|

|

|

|

|

|

|

|

|

3,530 |

|

|

|

0 |

|

|

|

42.86 |

|

|

|

02/21/2022 |

|

|

|

|

|

|

|

|

|

|

|

|

3,075 |

|

|

|

0 |

|

|

|

50.45 |

|

|

|

02/15/2023 |

|

|

|

|

|

|

|

|

|

| David C. Parry |

|

|

4,930 |

|

|

|

0 |

|

|

|

45.08 |

|

|

|

12/06/2022 |

|

|

|

3,775 |

|

|

|

293,846 |

|

|

|

|

3,075 |

|

|

|

0 |

|

|

|

50.45 |

|

|

|

02/15/2023 |

|

|

|

|

|

|

|

|

|

| Livingston L. Satterthwaite |

|

|

4,800 |

|

|

|

0 |

|

|

|

45.16 |

|

|

|

04/05/2021 |

|

|

|

3,360 |

|

|

|

261,542 |

|

|

|

|

3,530 |

|

|

|

0 |

|

|

|

42.86 |

|

|

|

02/21/2022 |

|

|

|

|

|

|

|

|

|

|

|

|

3,075 |

|

|

|

0 |

|

|

|

50.45 |

|

|

|

02/15/2023 |

|

|

|

|

|

|

|

|

|

| Michael T. Tokarz |

|

|

6,750 |

|

|

|

0 |

|

|

|

25.70 |

|

|

|

02/02/2015 |

|

|

|

3,885 |

|

|

|

302,408 |

|

|

|

|

3,375 |

|

|

|

0 |

|

|

|

30.67 |

|

|

|

02/02/2016 |

|

|

|

|

|

|

|

|

|

|

|

|

3,375 |

|

|

|

0 |

|

|

|

33.99 |

|

|

|

02/12/2017 |

|

|

|

|

|

|

|

|

|

|

|

|

2,250 |

|

|

|

0 |

|

|

|

30.85 |

|

|

|

02/20/2018 |

|

|

|

|

|

|

|

|

|

|

|

|

2,250 |

|

|

|

0 |

|

|

|

19.98 |

|

|

|

02/24/2019 |

|

|

|

|

|

|

|

|

|

|

|

|

4,080 |

|

|

|

0 |

|

|

|

30.82 |

|

|

|

02/23/2020 |

|

|

|

|

|

|

|

|

|

|

|

|

3,190 |

|

|

|

0 |

|

|

|

40.89 |

|

|

|

02/22/2021 |

|

|

|

|

|

|

|

|

|

|

|

|

4,160 |

|

|

|

0 |

|

|

|

42.86 |

|

|

|

02/21/2022 |

|

|

|

|

|

|

|

|

|

|

|

|

3,620 |

|

|

|

0 |

|

|

|

50.45 |

|

|

|

02/15/2023 |

|

|

|

|

|

|

|

|

|

| Cynthia J. Warner |

|

|

4,610 |

|

|

|

0 |

|

|

|

50.45 |

|

|

|

02/15/2023 |

|

|

|

2,780 |

|

|

|

216,395 |

|

| |

(a) |

All options expire on the 10th anniversary of the grant date. Options granted prior to 2006 (with expiration dates prior to 2016) vested 100% on the second anniversary of

the grant date. Options granted during and after 2006 (with expiration dates during and after 2016) vested 100% on the first anniversary of the grant date. All options vest 100% upon a change in control of the Company. |

| |

(b) |

See footnote 1 to table under “SECURITY OWNERSHIP” below for vesting provisions. |

| |

(c) |

Determined based upon the closing price of the Company’s Common Stock on December 31, 2014. |

| (3) |

Reflects matching gifts of up to $10,000 per year directed to Internal Revenue Code 501(c)(3) tax-exempt, non-profit organizations under the IDEX Corporation Matching Gift

Program. |

14

Communications with the Board of Directors

Stockholders and other interested parties may contact the Board, the non-management directors as a group or any of the individual directors,

including the Lead Director, by writing to Frank J. Notaro, Senior Vice President, General Counsel and Secretary, IDEX Corporation, 1925 West Field Court, Suite 200, Lake Forest, Illinois 60045. Inquiries sent by mail will be reviewed,

sorted and summarized by Mr. Notaro before they are forwarded to any director.

15

SECURITY OWNERSHIP

The following table furnishes information as of February 10, 2015, except as otherwise noted, with respect to shares of the Company’s Common Stock beneficially owned by (i) each director and nominee

for director, (ii) each officer named in the Summary Compensation Table, (iii) directors, nominees and executive officers of the Company as a group, and (iv) any person who is known by the Company to be a beneficial owner of more than

five percent of the outstanding shares of Common Stock. Except as indicated by the notes to the following table, the holders listed below have sole voting power and investment power over the shares beneficially held by them. Under SEC rules, the

number of shares shown as beneficially owned includes shares of Common Stock subject to options that are exercisable currently or will be exercisable within 60 days of February 10, 2015. Shares of Common Stock subject to options that are

exercisable within 60 days of February 10, 2015, are considered to be outstanding for the purpose of determining the percentage of the shares held by a holder, but not for the purpose of computing the percentage held by others. An *

indicates ownership of less than one percent of the outstanding Common Stock. For purposes of the following table, the address for each of the directors, nominees and executive officers of the Company is c/o 1925 West Field Court, Suite 200,

Lake Forest, Illinois 60045.

|

|

|

|

|

|

|

|

|

| Name and Address of Beneficial Owner |

|

Shares

Beneficially

Owned |

|

|

Percent of

Class |

|

| Directors and Nominees (other than Named Executive Officers): |

|

|

|

|

|

|

|

|

| Bradley J. Bell(1) |

|

|

68,876 |

|

|

|

* |

|

| William M. Cook(1) |

|

|

28,690 |

|

|

|

* |

|

| Gregory F. Milzcik(1) |

|

|

26,690 |

|

|

|

* |

|

| Ernest J. Mrozek(1) |

|

|

21,725 |

|

|

|

* |

|

| David C. Parry(1) |

|

|

11,780 |

|

|

|

* |

|

| Livingston L. Satterthwaite(1) |

|

|

16,102 |

|

|

|

* |

|

| Michael T. Tokarz(1) |

|

|

361,051 |

|

|

|

* |

|

| Cynthia J. Warner(1) |

|

|

7,390 |

|

|

|

* |

|

| Named Executive Officers: |

|

|

|

|

|

|

|

|

| Andrew K. Silvernail(2)(3) |

|

|

212,738 |

|

|

|

* |

|

| Heath A. Mitts(2)(3) |

|

|

127,752 |

|

|

|

* |

|

| Eric D. Ashleman(2)(3) |

|

|

54,422 |

|

|

|

* |

|

| Brett E. Finley(2)(3) |

|

|

40,398 |

|

|

|

* |

|

| Frank J. Notaro(2)(3) |

|

|

55,033 |

|

|

|

* |

|

| Directors, Nominees and All Executive Officers as a Group: (16 persons)(4) |

|

|

1,199,426 |

|

|

|

1.5 |

|

| Other Beneficial Owners: |

|

|

|

|

|

|

|

|

| T. Rowe Price Associates, Inc.(5) |

|

|

9,913,639 |

|

|

|

12.4 |

|

| 100 East Pratt Street Baltimore, Maryland 21202 |

|

|

|

|

|

|

|

|

| BlackRock Inc.(6) |

|

|

5,048,883 |

|

|

|

6.4 |

|

| 40 East 52nd Street New York, New York 10022 |

|

|

|

|

|

|

|

|

| The Vanguard Group(7) |

|

|

4,906,114 |

|

|

|

6.2 |

|

| 100 Vanguard Blvd. Malvern, Pennsylvania 19355 |

|

|

|

|

|

|

|

|

| (1) |

Includes 25,125, 19,500, 19,500, 16,445, 8,005, 11,405, 26,300 and 4,610 shares under exercisable options for Messrs. Bell, Cook, Milzcik, Mrozek,

Parry, Satterthwaite and Tokarz, and Ms. Warner, respectively. Includes 1,000 shares of restricted stock issued to each of Messrs. Bell, Cook, Milzcik, Mrozek and Satterthwaite on February 21, 2012, which vest on February 21, 2015;

1,170 shares of restricted stock issued to Mr. Tokarz on February 21, 2012, which vest on February 21, 2015; 1,415 shares of restricted stock issued to Mr. Parry on December 6, 2012, which vest on December 6, 2015; 845

shares of restricted stock issued to each of Messrs. Cook, |

16

| |

Milzcik, Mrozek, Parry and Satterthwaite on February 15, 2013, which vest on February 15, 2016; 1,265 shares of restricted stock issued to Ms. Warner on February 15, 2013,

which vest on February 15, 2016; and 1,515 shares of restricted stock issued to each of Messrs. Cook, Milzcik, Mrozek, Parry and Satterthwaite and Ms. Warner on February 13, 2014, which vest on February 13, 2017. Also includes

845 shares and 995 shares of restricted stock issued to Messrs. Bell and Tokarz, respectively, on February 15, 2013, and 1,515 shares and 1,720 shares of restricted stock issued to Messrs. Bell and Tokarz, respectively, on February 13,

2014, which vest on April 8, 2015. The restricted shares held by Messrs. Cook, Milzcik, Mrozek, Parry, and Satterthwaite, and Ms. Warner may vest earlier than the dates indicated above upon a change in control of the Company,

retirement, or failure to be re-elected to the Board. All shares of restricted stock are eligible for dividends. |

| (2) |

Includes 125,942, 89,987, 27,734, 12,886 and 45,663 shares under exercisable options for Messrs. Silvernail, Mitts, Ashleman, Finley and Notaro, respectively.

|

| (3) |

Includes shares of restricted stock awarded by the Company as follows: |

Mr. Silvernail was awarded 18,670 shares of restricted stock under the Incentive Award Plan on February 21, 2012, which vest on February 21, 2015; 18,505 shares of restricted stock under the

Incentive Award Plan on February 15, 2013, which vest on February 15, 2016; and 9,320 shares of restricted stock under the Incentive Award Plan on February 13, 2014, which vest on February 13, 2017; provided he is employed by the

Company on such vesting dates.

Mr. Mitts was awarded 5,840 shares of restricted stock under the Incentive Award Plan on

February 21, 2012, which vest on February 21, 2015; 4,560 shares of restricted stock under the Incentive Award Plan on February 15, 2013, which vest on February 15, 2016; and 2,225 shares of restricted stock under the Incentive

Award Plan on February 13, 2014, which vest on February 13, 2017; provided he is employed by the Company on such vesting dates.

Mr. Ashleman was awarded 4,090 shares of restricted stock under the Incentive Award Plan on February 21, 2012, which vest on

February 21, 2015; 1,725 shares of restricted stock under the Incentive Award Plan on February 15, 2013, which vest on February 15, 2016; 9,915 shares of restricted stock under the Incentive Award Plan on February 15, 2013, which

vest 50% on February 15, 2016 and 50% on February 15, 2017; and 1,895 shares of restricted stock under the Incentive Award Plan on February 13, 2014, which vest on February 13, 2017; provided he is employed by the Company on such

vesting dates.

Mr. Finley was awarded 2,950 shares of restricted stock under the Incentive Award Plan on February 21, 2012,

which vest on February 21, 2015; 1,725 shares of restricted stock under the Incentive Award Plan on February 15, 2013, which vest on February 15, 2016; 9,915 shares of restricted stock under the Incentive Award Plan on

February 15, 2013, which vest 50% on February 15, 2016 and 50% on February 15, 2017; and 1,345 shares of restricted stock under the Incentive Award Plan on February 13, 2014, which vest on February 13, 2017; provided he is

employed by the Company on such vesting dates.

Mr. Notaro was awarded 5,840 shares of restricted stock under the Incentive Award

Plan on February 21, 2012, which vest on February 21, 2015; 2,600 shares of restricted stock under the Incentive Award Plan on February 15, 2013, which vest on February 15, 2016; and 930 shares of restricted stock under the

Incentive Award Plan on February 13, 2014, which vest on February 13, 2017; provided he is employed by the Company on such vesting dates.

The restricted shares held by Messrs. Silvernail, Mitts, Ashleman, Finley and Notaro may vest earlier than the dates indicated above upon a change in control of the Company and certain other events. See

“Outstanding Equity Awards at 2014 Fiscal Year End” under “EXECUTIVE COMPENSATION.”

All shares of restricted stock

are eligible for dividends.

| (4) |

Includes 551,045 shares under options that are exercisable currently or will be exercisable within 60 days of February 10, 2015, and 147,195 unvested shares of

restricted stock. |

17

| (5) |

Based solely on information in Schedule 13G, as of December 31, 2014, filed by T. Rowe Price Associates, Inc. (Price Associates) with respect to Common Stock owned by

Price Associates and certain other entities which Price Associates directly or indirectly controls or for which Price Associates is an investment advisor on a discretionary basis. |

| (6) |

Based solely on information in Schedule 13G, as of December 31, 2014, filed by BlackRock Inc. (BlackRock) with respect to Common Stock owned by BlackRock and certain

other entities which BlackRock directly or indirectly controls or for which BlackRock is an investment advisor on a discretionary basis. |

| (7) |

Based solely on information in Schedule 13G, as of December 31, 2014, filed by Vanguard Group (Vanguard) with respect to Common Stock owned by Vanguard and certain

other entities which Vanguard directly or indirectly controls or for which Vanguard is an investment advisor on a discretionary basis. |

18

EXECUTIVE COMPENSATION

Risk Assessment

The Compensation Committee periodically reviews the potential risks arising

from our compensation policies, practices and programs to determine whether any potential risks are material to the Company. In approving the 2014 compensation program design, the Compensation Committee engaged in discussions with its independent

compensation consultant and management regarding any potential risks and concluded that the Company’s compensation policies and practices are designed with the appropriate balance of risk and reward in relation to the Company’s overall

business strategy, do not incentivize employees, including executive officers, to take unnecessary or excessive risks, and that any risks arising from the Company’s policies and practices are not reasonably likely to have a material adverse

effect on the Company. In this review, the Compensation Committee considered the attributes of the Company’s policies and practices, including:

| |

• |

|

The mix of fixed and variable compensation opportunities; |

| |

• |

|

The balance between annual cash and long-term, stock-based performance opportunities; |

| |

• |

|

Multiple performance factors tied to key measures of short-term and long-term performance that motivate sustained performance and are based on quantitative

measures; |

| |

• |

|

Caps on the maximum payout for cash incentives; |

| |

• |

|

Stock ownership requirements for executives that encourage a long-term focus on performance; |

| |

• |

|

An insider trading policy that prohibits hedging and pledging; |

| |

• |

|

A clawback policy that applies to performance-based compensation, including stock-based awards, for directors and officers; and |

| |

• |

|

Oversight by an independent compensation committee. |

Compensation Committee Report

The Compensation Committee has reviewed the following

Compensation Discussion and Analysis and discussed its contents with management. Based on this review and discussion, the Compensation Committee recommended to the Board that the Compensation Discussion and Analysis be included in this Proxy

Statement.

Michael T. Tokarz, Chairman

Bradley J. Bell

Livingston L. Satterthwaite

Cynthia J. Warner

19

Compensation Discussion and Analysis

Executive Summary

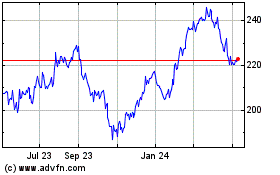

2014 saw a continuation of the positive momentum that we experienced in

2013. We focused on increasing shareholder value by focusing on improving organic growth, driven through core product and business line strategies, and productivity gains, while maintaining a disciplined approach to acquisitions, dividends and share

repurchases. The following are 2014 financial highlights: